What are the 2 types of insurance?

Contents

- 1 What are the 2 types of insurance?

- 2 What does ot mean in auto insurance?

- 3 Which insurance is best for car third party or comprehensive?

- 4 What are 4 main types of coverage and insurance?

There are two main types of insurance: This may interest you : What is basic car insurance called?.

- Life Insurance.

- General Insurance.

What are two types of life insurance? There are two main types of life insurance – term and lifetime insurance. All life is sometimes called permanent life insurance, and it includes small parts, which include the old life, the world life, the different life and the different world life.

What does ot mean in auto insurance?

OT – Another Party or Someone. To see also : Which type of insurance is best for car?. OTC – Out of Contacts. OV – One Car.

What terms are used in insurance? Here are some basic terms for life insurance: Insured – the person (s) covered by the insurance policy. Premiums â € “Monthly or annual fees you have to pay to get insurance coverage. Face Amountâ € “The dollar amount would be paid by the insurer on the death of the Insurance.

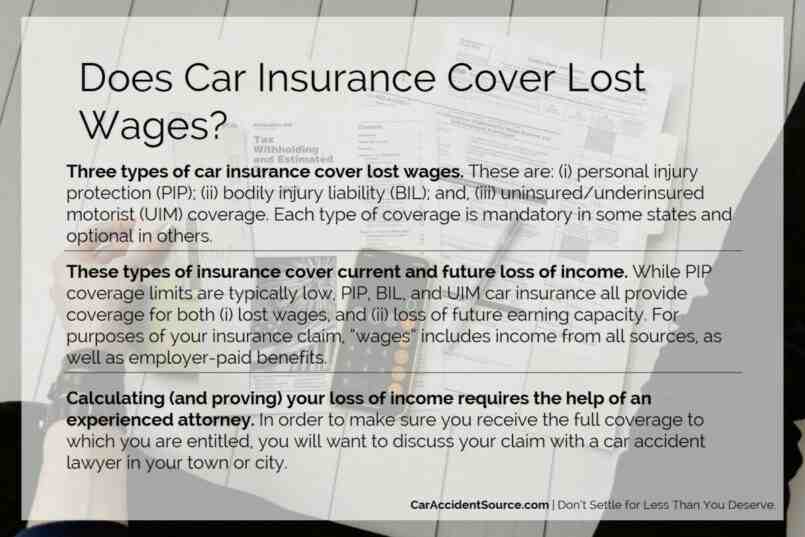

What are the 3 types of car insurance?

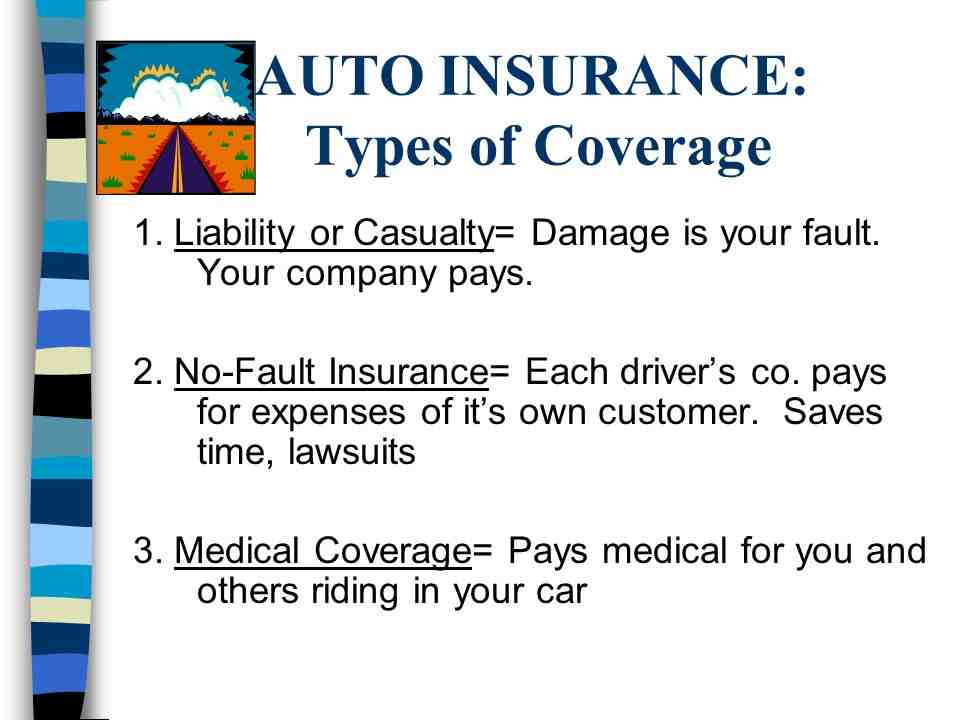

The three types of car insurance offered worldwide are comprehensive, comprehensive, and collision-free. Drivers may purchase other types of auto insurance coverage, such as personal injury protection and an uninsured / underinsured driver, but they are not available everywhere.

What are the different types of car insurance coverage?

The six most common forms of auto insurance coverage are: auto accident closure, uninsured and uninsured drivers closure, full closure, collision closure, medical insurance coverage and personal injury protection. Depending on where you live, some of these covers are mandatory and some are optional.

What type of car insurance is the most important?

Currently, there is a group of different types of car insurance. Most important is the case, full and collision coverage.

What does me stand for in auto insurance?

Body injury liability covers other personal injuries or death that are caused by the insured. A home injury lawsuit that covers insurance or car insurance damages another person’s property.

What does me mean in insurance?

Physical Injury: Injury, disease, disease or death caused by a motor vehicle accident. Bodily Injury Liability Coverage: Protects your assets in the event of an accident when other people are injured or killed. C.

What does ot mean in insurance?

OT – Another Party or Someone. OTC – Out of Contacts.

What does 100k 300k 100k mean?

You must have up to 100,000 / 300,000 / 100,000 to split the closing limit. That means: $ 100,000 to cover each person in a car accident, $ 300,000 to cover completely for a car accident injury. $ 100,000 compensation for property damage to third-party vehicles.

What does it mean for insurance to cover?

insurance provided by an insurance company if it agrees to pay a premium if something happens, for example if someone is injured, if equipment is lost or damaged: When applying for building and interior insurance cover, make sure you provide more. about the place as much as possible.

What does terms mean in insurance?

Term insurance is a form of life insurance that provides coverage for a certain period of time or a fixed “term” of years. If the insured dies at the time specified in the time law and applicable law, the death penalty will be paid.

Which insurance is best for car third party or comprehensive?

| Third-Party Insurance | |

|---|---|

| Premium Price | Cheap than the full insurance and rates predicted by IRDAI. |

| Which one should you buy? | If you are driving an old car or you are driving your car a little too much the best option to go is a third-party cover and pay lower premiums. |

What is the best third or most complete rule? Therefore, if the car is new and expensive, a full cover is the best option. Coverage: Third-party insurance covers third-party vehicle damage, personal injury accident, as well as third party property damage. Some companies charge additional fees for third-party closure.

Which type of insurance is best for car?

What is better Car Insurance? Taking full car insurance cover is always recommended as it provides complete protection not only for someone else’s car as third-party car insurance, but also for itself damaging to your car, as well as any harm to the driver’s owner.

What is the most important type of car insurance?

Most importantly it should be part of your state’s responsibility and closure for home damage.

What are the 3 types of car insurance?

The three types of car insurance offered worldwide are comprehensive, comprehensive, and collision-free. Drivers may purchase other types of auto insurance coverage, such as personal injury protection and an uninsured / underinsured driver, but they are not available everywhere.

Which insurance cover is best for car?

Enough is enough This is the highest level of insurance you can have. It covers you, your car and any others involved in an accident. It includes all the cap on third party fire and theft, but it also protects you as the driver and can compensate for your car damage.

What are 4 main types of coverage and insurance?

The Bottom Line. Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you should have. Always check with your employer first for help.

What are the five main types of insurance? Home or property insurance, life insurance, disability insurance, health insurance, and five types of car insurance should be available to everyone.

What is a type of insurance coverage?

Insurance coverage refers to the amount of risk or liability that is covered to an individual or organization through insurance activities. Common types of insurance coverage include auto insurance, life insurance and homeowners insurance.

How many types of insurance coverages are there?

The six most common forms of auto insurance coverage are: auto accident closure, uninsured and uninsured drivers closure, full closure, collision closure, medical insurance coverage and personal injury protection. Depending on where you live, some of these covers are mandatory and some are optional.

What are the 3 types of insurance?

Then we take a closer look at three basic types of insurance: property, liability, and life.