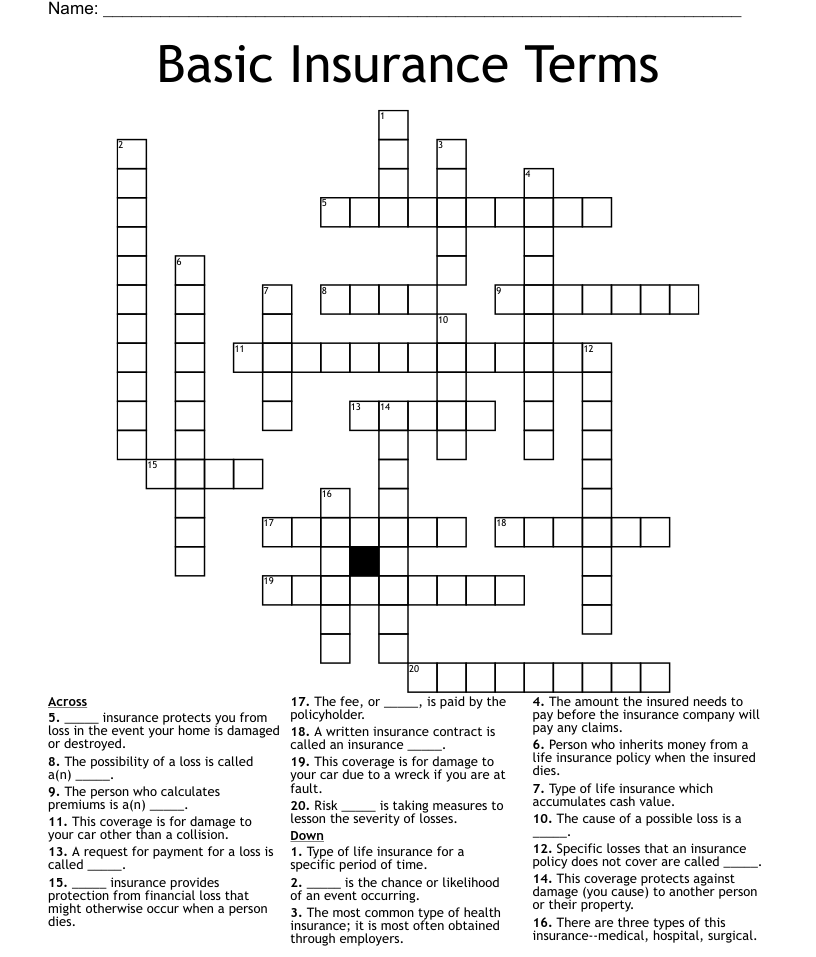

There are 7 types of insurance; Life or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee insurance.

What is a non standard auto?

Contents

- 1 What is a non standard auto?

- 2 What’s the minimum insurance you need?

- 3 What is all perils coverage auto?

- 4 When a property owner wishes to convey her property to a new owner she will generally use a?

Non-standard car insurance is intended for vehicle owners who have a bad driving experience or an accident history. On the same subject : Which type of insurance is best for car?. Non-standard car insurance is usually more expensive for a car owner than a traditional insurance policy, as the insurance company has a higher risk that they may have to pay out as a result of an accident.

What does a non-standard car mean? Non-standard car insurance – insurance for drivers with poor driving experience who may have been refused by insurers offering standard forms of car insurance.

What the difference in a standard and non-standard auto insurance?

Standard car insurance is available for lower risk drivers. It is easiest to find, as it is usually offered by all major insurers and regional insurers. This may interest you : What are the 3 types of car insurance?. Non-standard insurance is provided to drivers who are considered by insurers to be high risk. It is usually more expensive and not as widely available as regular insurance.

What does non-standard insurance mean?

Non-standard car insurance refers to high-risk insurance coverage, which is the most expensive level. It is reserved for managers who are too risky for insurance companies to cover at their normal price. Insurers usually divide their insurance coverage into three: preferred, standard and non-standard.

What does Standard mean in insurance?

Standard form or Standard policy – a form of insurance policy that is intended for use by many different insurers and has exactly the same provisions, regardless of the insurer that issued the policy.

What is standard car insurance?

Ordinary car insurance refers to the most basic car insurance offered to drivers who belong to a medium risk profile. Ordinary insurance is usually the cheapest car insurance for a driver.

What standard insurance means?

A standard insurance policy offers standard insurance cover for drivers that are considered by insurance companies to be low risk.

What is the difference between standard and non standard health insurance?

The difference between the “standard packages” offered by different companies is the network of providers, the composition of the medicines and the premium. “Non-standard plans” sometimes include additional services such as dental care and vision care for adults. Each health plan contracts with certain doctors and hospitals.

What is the difference between basic and standard insurance?

There are some services that are not part of the basic service but are standard, and Standard allows you to leave the network, while Basic does not cover domestic non-PPO providers, except for emergency services.

What is a standard insurance?

Ordinary car insurance is the basic or lowest level of insurance coverage available from an insurance provider. Regulations in most states require the driver to take out liability insurance and determine the exact dollar value of the insurance cover required.

Is progressive standard or nonstandard?

Most insurance companies, including Geico and Progressive, offer non-standard car insurance policies. Other companies, such as The General and Safe Auto, specialize in offering non-standard insurance policies to high-risk drivers.

Which is classified as non-standard by insurance companies?

Solution (by the Examveda team) Insurance companies classify the diet card as non-standard.

Is Progressive Insurance considered high risk?

Progressive insures high-risk drivers. Progressive was one of the first car insurance companies to specialize in high-risk driver insurance and remains a major insurer of high-risk drivers.

What is a non-standard insurance?

Non-standard car insurance refers to high-risk insurance coverage, which is the most expensive level. It is reserved for managers who are too risky for insurance companies to cover at their normal price. Insurers usually divide their insurance coverage into three: preferred, standard and non-standard.

What’s the minimum insurance you need?

Explanation: The minimum insurance required by law is third party insurance. This covers your liability to those involved in the collision, but not for damaging your vehicle. The third party’s basic insurance also does not cover theft or fire.

What is the minimum insurance? Here are the minimum liability insurance requirements (according to §11580.1b of the California Insurance Code): $ 15,000 for personal injury / death. $ 30,000 for more than one injury / death. $ 5,000 for property damage.

What is the lowest level of car insurance?

Liability insurance is usually the cheapest level of car insurance, as it only covers injuries and damage to another vehicle if you are at fault. Cheap liability insurance is best suited for drivers with a paid vehicle who has enough savings to cover medical and other expenses.

What are the 3 types of car insurance?

The three types of universally offered car insurance are liability, comprehensive and collision insurance. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured / underinsured drivers, but these are not available in all states.

How much cheaper is liability vs full coverage?

How much is liability cheaper than full insurance? Liability insurance is on average 64% cheaper than full insurance. According to WalletHub’s 2021 data, car liability insurance costs an average of $ 720 per year, while full-cost car insurance costs an average of $ 1997 per year.

What is the lowest form of car insurance?

Liability – This level of insurance coverage is the minimum you can have if you are a legally insured driver. It is your responsibility to protect you, the driver, if you are responsible for an accident or if you are held liable even if it was not technically caused.

What is the minimum insurance requirement in UK?

Third party insurance is the legal minimum. This means that you are protected in the event of an accident that causes damage or injury to another person, vehicle, animal or property. It does not cover other costs, such as repairing your own vehicle. You may want to use an insurance broker.

What do I need to insure my car UK?

What documents are required to obtain car insurance in the UK?

- your full name (as it appears on your driving license)

- your date of birth.

- you permanent, home address.

- your office.

- your email address.

- registration of the car you want to drive.

- your driving license number.

Which of the insurance is mandatory?

Third party liability (TPL) car insurance is compulsory in India. The TPL policy protects you from the legal consequences of an accident you cause.

Is insurance mandatory in the UK?

Is car insurance compulsory in the UK? Yes, there is a legal requirement in the UK for motor vehicles on public roads to be insured. Therefore, car insurance must be taken out to drive a car legally. Third party insurance is the minimum required by law.

What is the most basic insurance you must have?

Most states require liability insurance for personal injury and property damage. Some states also require drivers to purchase additional types of insurance, such as personal injury protection (PIP) or uninsured / underinsured driver (UM / UIM) insurance.

What are the 7 basic types of insurance coverage needed?

Here are the seven most common types of insurance that everyone needs – or at least must consider.

- Health insurance. …

- Life insurance. …

- Invalidity insurance. …

- Long – term care insurance. …

- Homeowners and tenants insurance. …

- Liability insurance. …

- Car insurance. …

- Protect yourself.

What is basic insurance coverage?

Basic car insurance is a policy that only covers liability insurance. This helps to cover any damage that you may cause to other people and their property. This may include medical bills, repairs or replacements, and legal consequences. Almost every state has minimum basic car insurance limits for its drivers.

What is the most important insurance a driver can have?

The most important cover must be your country’s minimum liability and property damage insurance. More than anything else, you need car insurance to drive legally. Driving without it may result in the loss of your driving license and a fine.

What is all perils coverage auto?

Coverage – All hazards: Optional coverage that covers all causes of damage except those explicitly mentioned in your policy. All-risk insurance also covers loss or damage if your car is stolen or damaged by an extra driver or someone in your household.

What are the 3 hazard categories? Keys to take with you

- The hazard is a potential side effect.

- The danger makes this event more likely.

- Dangers fall into three classifications: physical, moral, and moral.

Is all perils the same as comprehensive?

All threats are a combination of collision and comprehensiveness. The only difference is that it combines two types of insurance coverage into one policy.

What does all perils mean in insurance?

“Open risks”, sometimes referred to as “all risks”, are a type of insurance cover. This means that your insurance company will cover you for everything that happens to your business, unless specifically excluded from your policy.

What is the difference between named perils and comprehensive?

If you have a policy on these hazards, ask which damages are covered and which are not. If you have a comprehensive policy, ask what losses are excluded from the insurance.

What means all perils deductible?

The AOP deductible – or the deductible for all other risks – is the amount you must pay out of your own pocket before your home insurance takes effect and covers the insurance loss.

What does all peril mean in insurance?

The danger, as indicated in the insurance policy, is the cause of the loss, such as fire or theft. Coverage can be provided on the basis of “all hazards” or “these hazards”. These hazard policies list exactly what is covered by the policy, while open hazard (or all hazard) policies list what is excluded.

What does $500 All peril mean?

If your policy has all your home insurance, it means that anything that happens as a result of a dangerous situation or disaster is generally covered. An example is a fire that causes pipes to burst.

Does all perils include flood?

Therefore, an insured person who experiences damage or damage caused by a flood cannot file a claim for damage with his or her insurer, as the flood is not mentioned as a threat in the insurance cover. … The insurance contract for all risks shall cover all risks of the insured, except those which are specifically excluded from the list.

What does all peril mean in insurance?

The danger, as indicated in the insurance policy, is the cause of the loss, such as fire or theft. Coverage can be provided on the basis of “all hazards” or “these hazards”. These hazard policies list exactly what is covered by the policy, while open hazard (or all hazard) policies list what is excluded.

What is covered under all perils?

Car insurance for all hazards includes theft, fires, falling items and more. Collision protection even covers some hazards that are not covered by typical home insurance, such as earthquakes and flood damage.

What does 1% All peril mean?

If your policy has all your home insurance, it means that anything that happens as a result of a dangerous situation or disaster is generally covered.

Does all perils include flood?

Therefore, an insured person who experiences damage or damage caused by a flood cannot file a claim for damage with his or her insurer, as the flood is not mentioned as a threat in the insurance cover. … The insurance contract for all risks shall cover all risks of the insured, except those which are specifically excluded from the list.

When a property owner wishes to convey her property to a new owner she will generally use a?

A waiver may be one of the easiest ways to transfer property to a new owner. In other words, the owner of the property (also known as the donor) can offer this type of deed and transfer the interests of the whole property to the beneficiary or beneficiary.

What are the five elements of contract law? The five requirements for entering into a valid contract are offer, acceptance, remuneration, jurisdiction and legal will.

What are the terms used in contract?

Contract terms are defined as terms, warranties or vague terms. It may be specified in the contract, arising from its nature or prescribed by law.

What are legal terms in a contract?

The terms and conditions are part of ensuring that the parties understand their contractual rights and obligations. The parties will draft them into a legal agreement, also known as a legal agreement, in accordance with local, state and federal contract laws. These set important limits that all contractors must adhere to.

What are the 4 basics of a contract?

For a contract to be valid, it must have four main elements: agreement, capacity, discretion and intent. Keep these elements in mind so that your contracts are always protected.

What are the 4 essential elements a contract needs in order to be legal?

Before entering into a written contract, there must be certain essential elements, including: the details of the parties, the purpose of the contract, a detailed description of the rights and obligations of each party (eg money, products or services) in return for what they are. ..