What is a decent credit score?

Is 707 a Good credit score to buy a house?

Contents

- 1 Is 707 a Good credit score to buy a house?

- 2 What can I get with a 606 credit score?

- 3 What is the average credit score of a 20 year old?

- 4 Is 900 a good credit score?

Regular loans are usually better for those with a credit score of 700 or more. (Overall, credit rating requirements are 620 and above. This may interest you : What is the difference between full coverage and liability?.) Regular mortgage benefits include: Buy a home for as little as 3%.

What can I get with a 606 credit score?

| Type of loan | Is it worth it? |

|---|---|

| Favorite Store Credit Card | YES |

| Airline / Hotel credit card | NO |

| Best Credit Levels | NO |

| Car Loans with 0% Preliminary Rate | NO |

Are their comments free of charge? Unre moyen mfe shub obtenir sa cote de free work is the application of the office bureaus. This may interest you : Car insurance: a domino effect that increases your premiums. See the numbers that you would like to send to our website for free verification of your phone call: TransUnion: 1-877-713-3393 (shub les résidents of Quebec). Equifax: 1-800-465-7166.

Comment avoir une cote de crédit parfaite ?

Améliorer votre cote de credit See the article : How auto insurance claims are deposited.

- Surveillez l’historique de vos paiements.

- Take advantage of respect.

- Augmentez la durée de vos antécédents en matière de crédit.

- Limit the number of demand and demand needs.

- Utilisez different types of credit.

Quel chiffre pour une bonne cote de crédit ?

To apply cote de crédit se trouve entre 725 and 759, if possible consider available. A copy of 760 or more is considered useful as2. The four crescent crescent varied from 300 to 9002. Plus your cute print is live, miles are your crescent 2.

Quel pointage de crédit pour un prêt auto ?

The fa gé généralement shows a cote superhero at 660 to guarantee the self-driving car. If you want to be a superhero, but the 660 proche, it does not have to be so much even more refreshing. If you want to get the most out of your favorite quotes, you have to find a suite to 725.

Comment savoir si un crédit auto sera accepté ?

The percentage of most people who are not satisfied with the text of the text, but the banks of the same geographical range say that it is possible to pass 33% of the disposable. According to the report that you are looking for a supporter of 33%, you will be required to repay the loan automatically.

Quel revenu pour un crédit auto ?

Il n’existe pas réellement de salaire ugu minimum shub faire un crédit auto. Néanmoins, the organisms are so different that the pioneer dispose of the sufficiently sufficient shub remourser l’intégralité du creed. We have the quintessence of a minimum of 1 000â ‚¬ by which we are now.

Comment obtenir un prêt voiture avec de faibles revenus ?

Il n’existe pas de revenu at least shub obtenir un crédit. As you can see from SMIC to get a guide, it is a very difficult question. Connection son taux d’endettement est également primordial.

Quelle est la bonne cote de crédit ?

To apply cote de crédit se trouve entre 725 and 759, if possible consider available. A copy of 760 or more is considered useful as2. The four crescent crescent varied from 300 to 9002. Plus your cute print is live, miles are your crescent 2.

C’est quoi un mauvais crédit ?

Some empires are considered to be “detached”, not realizing the concepts in the conjugation of the present tense, and then, as the “bones” dettes, for example, how to make a contract shub investir, puisqu’ils sont liés à un actif.

Quelle est la cote de crédit maximum ?

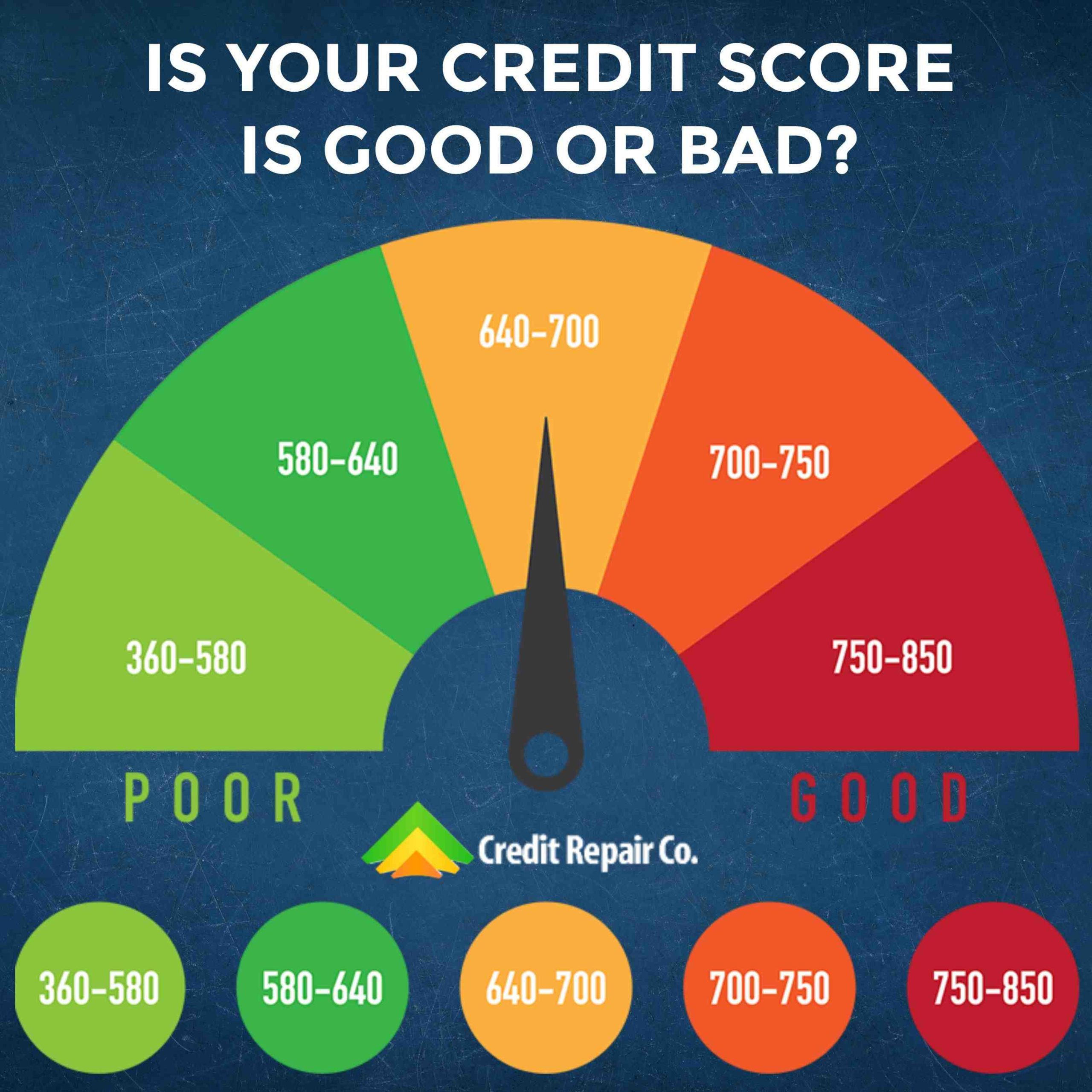

The value of credit is estimated to be between 300 and 900 points. Plus it’s elevée, and was added to your preferences font confidence. Dessus de 700: vous pouvez négocier des shurooyinka avantageuses. De 500 à 700: you can use a fork if you have a problem, but a little plus.

What is the average credit score of a 20 year old?

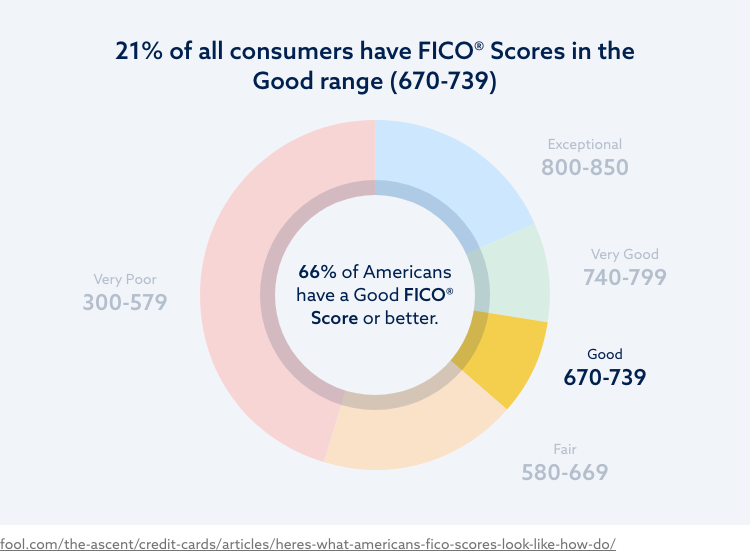

Average Points Score for 20-Year-Olds The average score for FICO® scores for 20-year-olds is 660. Between the ages of 20 and 29, clients begin to build their scores. These customers may have a limited student credit card and pay off their student loans.

Is 900 a good credit score?

The most common variation in FICO scores is 300 to 850. Anything above 670 is generally considered good. FICO also offers industry-specific FICO scores, such as credit cards or car loans, which range from 250 to 900.

850 is a good credit score in Canada? In Canada, 850 are excellent credit scores.

Does credit Karma hurt your credit score?

Checking your credit score on Credit Karma does not hurt your credit. Credit score checks are called fraudulent inquiries, which do not affect them at all. Difficult inquiries (also known as œhard pullsâ & # x20AC; & # x2122) generally occur when the lender checks the credit when reviewing your cash application.

What credit score is excellent?

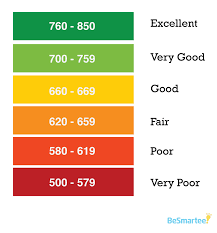

Although variability varies depending on the shape of the score points, overall grades from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 is considered very good; and 800 and more are considered excellent.

What is the average excellent credit score?

Scores between 300 and 850, a score of 700 or more are generally considered good. A score of 800 or more on the same limit is considered very good. Most customers have credit scores between 600 and 750.

What is a perfect credit score 2021?

The maximum credit score you can have on a widely used scale is 850. Typical types of FICO and VantageScore, weigh between 300 and 850 and lenders typically consider anything above 720 high credit.

Is 740 a good credit score to buy a house?

Because lending so much money is inherently risky, lenders are looking for home buyers to get a solid loan, including strong credit points. When you have a FICO score of 740 or higher, you are more likely to get the best jumbo loan rates.

What is a good credit score Canada?

It depends on how the points are used. In Canada, according to Equifax, a good credit score is usually between 660 and 724. If your credit score is between 725 and 759 it is likely to be considered very good. Credit scores of 760 and above are generally considered to be excellent credit scores.

Is credit score of 725 OK?

A score of 725 FICO® is OK, but when you raise your scores to a very good level, you may qualify for lower interest rates and better loan terms. The best way to get started is to get your credit report from Experian free of charge and check your credit score to find out the specific issues that affect your credit score the most.

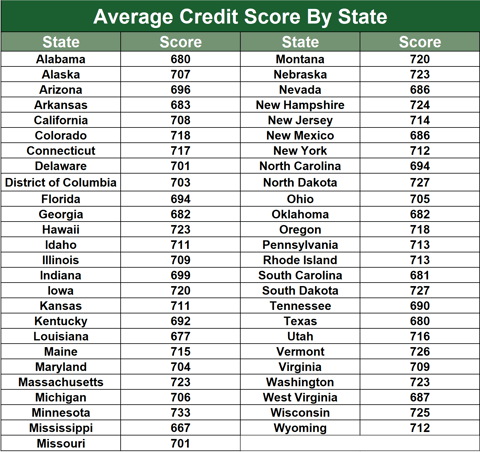

What is the Canadian average credit score?

It is also a good idea to understand what your credit score stands for compared to other Canadian customers. According to a 2021 study of more than 1 million Borrowell members, the average Canadian bridge score is 667.

Is 800 a good credit score in Canada?

A score of 800 or more is considered very good. A score between 720 and 799 is considered very good. Between 650 and 719, you are considered to have good credit points. 600 to 649 is considered fair.