What is the A.M. Best rating for AAA insurance?

Why is AM Best rating important?

Contents

Best Rating Services AM evaluates the qualifications or reports of more than 16,000 insurance companies worldwide. To see also : Last of $ 400 car insurance reimbursements due to Michigan drivers. Our credit rating summarizes our views on the ability of the insurance company to pay claims, debts and other financial obligations in a timely manner.

What does AM Best A + rating mean? The following are AM Best rating categories and definitions: Top: A to A grade assigned to insurance companies who have a high level of ability to perform their financial obligations, such as making a claim.

Is AM Best A rating good?

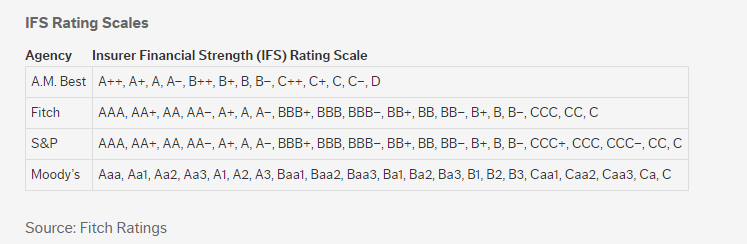

| A.M. the best | Fitch | Level and Poor |

|---|---|---|

| A, A- | A | A |

Why does AM Best rating matter?

Each time it assesses, it raises the rating agency’s assessment that the insurer will be there to provide policy for your beneficiaries. This may interest you : Safeco Car Insurance Review 2022 – Forbes Advisor. It serves as an independent, objective opinion based on their analysis of objects such as customer complaints, available cash flow, and acceptable risk.

What is the AM Best rating for Protective Life?

Life Coverage and Annuity Insurance Company has an insurance capability rating of A (Higher, 2nd out of 15 ratings) from AM. Best, AA- (Strongest, 4th highest 21 ratings) in the Poor and Poor, and AA- (High Quality, 4th highest 22 ratings) in Fitch.

Is AM Best rating reliable?

A.M. The best thing is to have a reliable source of financial strength for your service provider. Policygenius only provides policies for life insurance companies that have AM. Best A- (Excelent) rating or better.

What is a AM Best rating?

The BCR was developed taking into account the relevant aspects of the Best Assessment Methods (BRMs). AM Best assigns a variety of credit assessments, which are collectively referred to as the “Best Assessment” including: Best Financial Strength Rating (FSR) Guide To see also : Nigerian Etap gets $ 1.5 million in pre-seed to make buying auto insurance easier.

What does AM Best rating of A VII mean?

Carriers with an alphabetical rating of B or less are considered vulnerable. E is the final component provided, and carriers with such an evaluation are subject to regulatory oversight. Parker, Smith & Feek, Our minimum acceptable rating is A- VII.

What axis AM rating is best?

AXIS insurance and insurance companies are rated “A” (Strong) by Standard & Poor’s and “A” (Excelent) by A.M. It is best to claim power.

What are the AM Best insurance ratings?

| Rating logo | Rating rates | Section |

|---|---|---|

| A | High | |

| A | â € “ | Very good |

| B | Well | |

| B | â € “ | Justice |

What is the best AM rating for insurance? What is the best AM? AM Best is a credit rating agency that focuses exclusively on the global insurance industry. AM Best assigns credit assessments that assess the reputation of the insurance company, indicating the possibility that the company will shorten its obligations.

What axis AM rating is best?

AXIS insurance and insurance companies are rated “A” (Strong) by Standard & Poor’s and “A” (Excelent) by A.M. It is best to claim power.

What is an AM Best rating of A XV?

Roman numerals are allocated to each company, anywhere I (less than $ 1 million) to XV (more than $ 2 trillion). Most insurance companies have an A- (good) alphabet rating or better than AM Best.

What is the AM Best rating for Globe Life?

For over 30 consecutive years, Globe Life Insurance Company of New York has earned an A (Excelent) rating or higher than AM Best Company. This reflects the strength of our balance sheet, as well as â € aada strong performance, good business acumen, and proper business risk managementâ €

What rating by AM Best is considered superior?

The rating scale includes six â œ mSecurityâ €: A, A (Superior) A, A∠’(Excelent), and B and B (Excellent). Rating scales also include six â € oolLiveâ € TM ratings.

What is an A AM Best rating?

AM Best uses both qualitative and quantitative measures to assess the ability of an insurance company to pay claims and fulfill its financial obligations. AM Best’s financial value ranges from the highest A ++ to B +, up to 10 vulnerable ratings, between B and S, with the lowest indicating that ratings are suspended.

What is the best AM rating for A XV? Roman numerals are allocated to each company, anywhere I (less than $ 1 million) to XV (more than $ 2 trillion). Most insurance companies have an A- (good) alphabet rating or better than AM Best.

What is an AM Best rated insurance companies?

Founded in 1899, AM Best is the world’s first credit rating agency. It all started with the founder working in a one-room office in New York City and growing up to become what is now the world’s largest credit rating agency specializing in the insurance industry.

What is a good AM Best rating for insurance companies?

AM Best uses both qualitative and quantitative measures to assess the ability of an insurance company to pay claims and fulfill its financial obligations. AM Best rated its economic strength from the highest A to B, up to 10 vulnerable ratings, between B and S, with the lowest indicating that ratings have been suspended.

Do all insurance companies have an AM Best rating?

Insurance companies rely on financial assessments that try to define how financially stable they are. The most popular financial rating agency for insurance companies is A.M. Best of all, though the major lending agencies all look at insurance, too.

How do I find my insurance company rating?

Before you buy, check the insurance company’s financial assessment:

- A.M. Co. (www.ambest.com) 908-439-2200.

- Fitch Rating (www.fitchratings.com) 800-893-4824.

- Moody’s Investor Service, Inc. (www.moodys.com) …

- Level & Poor (www.standardandpoors.com) 800-523-4534.

- Weiss Rating (www.weissratings.com) 877-934-7778.

Is the B + rating good for an insurance company? Similarly, B and B FSRs, and bbb, bbb, and bbb- ICRs for insurers, are still considered reliable assessments.â € The updated Financial Strengthening Descriptions of insurance companies will appear in all electronic and offline publications published on or after January 2, 2007.