What is the legal minimum car insurance?

What is the minimum car insurance required in UK?

Contents

- 1 What is the minimum car insurance required in UK?

- 2 What are the 5 parts of an insurance policy?

- 3 What is the cheapest car insurance type?

- 4 How does minimum insurance work?

Third party insurance is the legal minimum. This means that you are covered in the event of an accident that causes damage or injury to any other person, vehicle, animal or property. To see also : How auto insurance claims are deposited. It does not cover other costs such as repairing your vehicle. You may want to use an insurance broker.

What is the legal minimum car insurance? Explanation: The minimum insurance required by law is third party coverage. This covers your liability to other people involved in a collision, but not damage to your vehicle. Even basic liability insurance does not cover damage from theft or fire.

What are the 3 types of car insurance in UK?

There are three main types of auto insurance: This may interest you : Budget Insurance Launches High-Risk Driver Insurance Plan – PR Newswire APAC.

- Third. this is the minimum coverage required by law in the UK. …

- Fire and theft of third parties. basic third party coverage with additional protection against damage, theft or destruction of your vehicle in a fire.

- Full. this is the highest level of coverage available.

What is 3rd Party insurance UK?

Third party auto insurance, sometimes known as third party only, is the minimum level of coverage you need to drive on UK roads. It offers the most basic level of protection, covering injury or damage caused to another person, their vehicle or property.

Is car insurance obligatory in UK?

Is car insurance mandatory in the UK? Yes, it is a legal requirement in the UK for motor vehicles using public roads to have insurance. Therefore, in order to legally drive your car, you must have an auto insurance policy in place. To see also : Nigerian Etap gets $ 1.5 million in pre-seed to make buying auto insurance easier. Liability insurance is the minimum required by law.

Is it compulsory to have car insurance?

In India, and around the world, car insurance is mandatory by law, not an option. The Motor Vehicle Act of 1988 makes it mandatory that all vehicles are covered by an adequate insurance policy before they can travel on the road.

What happens if I dont have car insurance UK?

Penalties for uninsured driving You may receive a flat penalty of £ 300 and six penalty points on your license if you are caught driving a vehicle that you are not insured to drive. If the case goes to court you could get an unlimited fine and be disqualified from driving.

When did car insurance become mandatory in UK?

With the Road Traffic Act of 1930 it became mandatory for drivers to be insured for their liability in the event of an accident. While auto insurance had existed for 30 years at this point, this was the first time it had become mandatory.

What are the 5 parts of an insurance policy?

Each insurance policy consists of five parts: statements, insurance agreements, definitions, exclusions and conditions. Many policies contain a sixth part: endorsements. Use these sections as guidelines for policy review. Examine each part to identify its key requirements and arrangements.

What are the six key parts of an insurance contract? Fundamental parts of an insurance contract

- Statements.

- Definitions.

- Insurance agreement.

- Exclusions.

- Conditions.

- Various provisions.

What are the five parts of a standard insurance policy?

The type or name of the coverage provided. Policy details such as the policy period, number and premium. Names of covered persons and assets (if applicable). The dollar limits on coverage and corresponding deductibles.

What are the basic parts of an insurance policy?

Most policies have four parts: declarations, insurance agreements, conditions and exclusions.

What is a standard policy in insurance?

Standard Form or Standard Policy: An insurance policy form designed to be used by many different insurers and has exactly the same provisions, regardless of the insurer issuing the policy.

What are the three main components of an insurance policy?

Insurance Policy Components There are three components of any type of insurance (premium, policy limit, and deductible) that are crucial.

What are the main components of an insurance policy?

Each insurance policy consists of five parts: statements, insurance agreements, definitions, exclusions and conditions.

What are the 3 essential elements of an insurance contract?

Since contract law is used to interpret an insurance policy, the basic elements of the contract (offer, acceptance and consideration) must be in place for a court to uphold an insurance contract.

What are the three 3 main types of insurance?

So let’s take a closer look at the three most important types of insurance: property, liability, and life.

What is the cheapest car insurance type?

The state minimum liability coverage is the cheapest type of auto insurance. Liability-only insurance averages $ 1,333 less than a full-coverage policy.

What is the basic car insurance coverage? While different states impose different types of insurance and there are several additional options available (such as gap insurance), most basic auto policies consist of: personal injury liability, personal injury protection, property damage liability, collision, complete and uninsured / underinsured motorist.

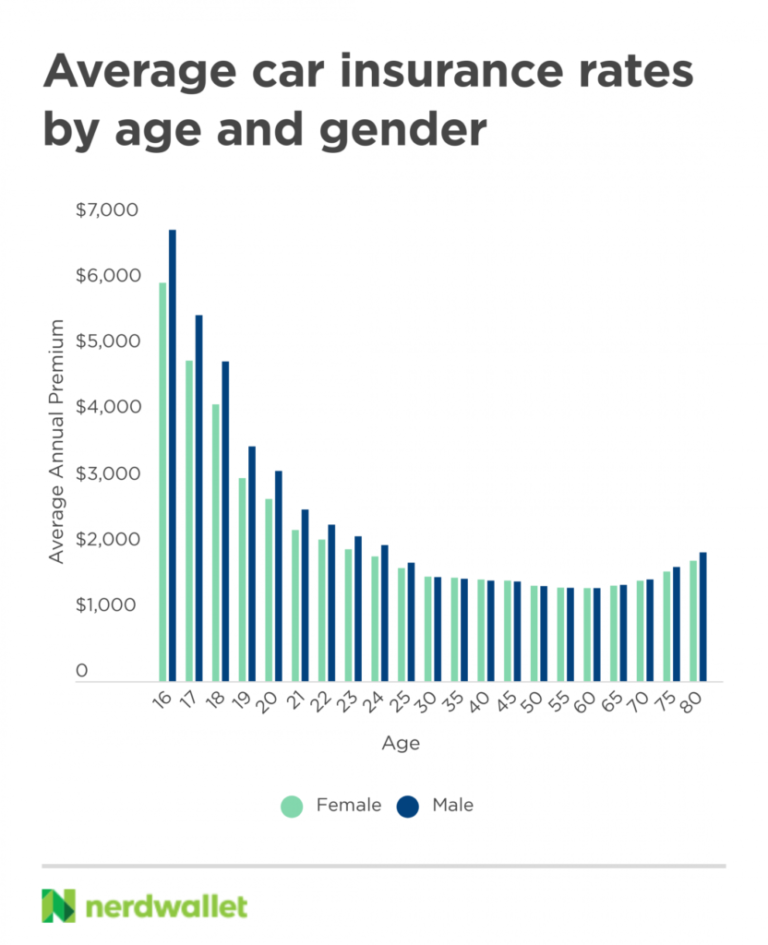

Who usually has the lowest car insurance?

Geico is the nation’s leading cheapest auto insurance company, according to NerdWallet’s most recent analysis of minimum coverage rates. Geico’s average annual rate was $ 354, or about $ 29 per month.

Why are Geico rates so low?

Geico is so cheap because it sells insurance directly to consumers and offers a lot of discounts. Direct-to-consumer insurance sales eliminate middleman costs and allow Geico to have significantly fewer local offices and agents than companies like State Farm and Allstate.

Who typically has the cheapest auto insurance?

Who has the cheapest car insurance? Among domestic insurers, USAA has the cheapest rates, at $ 36 per month, with State Farm in second place, at $ 44 per month. The best low-cost local businesses are Farm Bureau, at $ 39 per month, and Erie, at $ 42 per month.

Who is cheaper Progressive or Geico?

Progressive price. Both Geico and Progressive offer affordable auto insurance to drivers across the country. Geico’s rates are typically lower overall, but Progressive tends to offer better prices to those with a recent DUI, fault-based accident, or speeding fine on their driving record.

What group of insurance is cheapest?

Each car belongs to one of the 50 auto insurance groups, which are used by insurers to help determine the premium to pay. Group one cars are the cheapest to insure, while group 50 cars are the most expensive – and the more powerful and luxurious your car, the higher the group it will be in.

What insurance type is cheapest?

Third Party Insurance You would expect third party only insurance to be the cheapest option as it offers the least protection of all types of coverage available, so you may be surprised to learn otherwise.

What is the lowest insurance group number?

Group one cars are the cheapest to insure, while group 50 cars are the most expensive – and the more powerful and luxurious your car, the higher the group it will be in.

Is insurance Group 1 high or low?

Cars in group 1 are usually the cheapest to insure because they score well on the set of factors used to calculate the groups. These cars are usually some of the cheapest to buy, but just as importantly, they are also some of the cheapest to repair if damaged in an accident.

Which is the least expensive type of car to insure?

| Rank | Average annual insurance premium | Insurance in% of the recommended price |

|---|---|---|

| 1. Subaru Outback | $ 1,336 | 5.0% |

| 2. Subaru Forester | $ 1.347 | 5.3% |

| 3. Honda CR-V | $ 1,359 | 5.1% |

| 4. Jeep Wrangler | $ 1,406 | 4.7% |

Is an old car cheaper to insure?

Are older cars cheaper to insure? Yes, most older cars are cheaper to insure, especially in terms of comprehensive and collision insurance. Cars lose value with age, so potential insurance payments after an accident also decrease. This is not the case with many classic or collector cars.

What type of car purchase is the most expensive to insure?

Sports cars, luxury cars, and high-performance cars can cost more for insurance because they also cost more to repair, can be stolen more frequently, and can be involved in more accidents.

What are least expensive cars to insure 2021?

The Honda CR-V, Jeep Wrangler Sport and Subaru Crosstrek are the least expensive cars to insure among the popular 2021 vehicle models.

How does minimum insurance work?

How does the minimum insurance work? This type of insurance covers damage to another person’s vehicle or bodywork and only for the amount of coverage.

Is this an example of driving on the wrong side of the road? Under VC 21651 (b), it is a violation to drive on the wrong side of the road. Driving on the wrong side of the road can be a crime or a crime. If someone is injured or killed in the incident, the prosecutor may try to charge the offense as a crime, depending on the circumstances.

What happens if you are caught driving without insurance quizlet?

What happens if you are caught driving without insurance? fined up to $ 200 on your first sentence. Additionally, you may have your car impounded (impounded) and your driving license suspended.

What is the purpose of minimum insurance coverage quizlet?

The minimum insurance will only cover drivers’ injuries and property damage costs; it will not cover your medical bills, or auto repairs, and in some cases it will not cover any costs in excess of the amount assigned as part of the insurance assistance.

What should you do if your car hydroplanes quizlet?

If your vehicle begins to hydroplane, slow down gradually; do not apply the brakes. Ice and packed snow on the road can cause the car to skid, especially if you’re driving fast or downhill. In the event of a slip, release the accelerator pedal, stop braking and turn the steering wheel in the direction of the slip.

What is a traffic break quizlet?

Traffic disruptions are used by law enforcement for. remove hazards from the roadway. To assist the officer in a traffic disruption. Turn on the hazard warning lights. During a stay of execution.