Our goal is to give you the tools and confidence to improve your finances. Although we receive compensation from our partner lenders, who we always identify, all opinions are our own. When refinancing a mortgage loan, the total financial costs may be higher during the term of the loan. Credible Operations, Inc. NMLS #1681276 is cited here as “reliable”.

Being in a car accident is both scary and stressful, from headlight fender benders to road accidents. Even if everyone walks away unscathed, your vehicle will likely need repairs. In some cases, it can even be summed up.

If your insurer determines that your car is a total loss, you will need to obtain total car insurance coverage from either your insurance company or the at-fault party’s insurer.

Here’s what you need to know about auto total loss insurance settlements:

What is a total loss car insurance settlement?

Contents

- 1 What is a total loss car insurance settlement?

- 2 When does an insurer declare a car a total loss?

- 3 How much will insurance pay for a total loss settlement?

- 4 What if I have a loan on a totaled car?

- 5 Can I negotiate a total loss car insurance settlement?

- 6 What does is mean if the coverage limits are $250000 /$ 500000?

- 7 How much should I ask for my totaled car?

- 8 Is my car totaled If the frame is bent?

- 9 What is actual cash value coverage?

Total loss car insurance premium is the amount the insurance company is willing to pay for your vehicle if it is involved in an accident. Read also : What are the 3 main types of insurance?. Generally, if the vehicle costs more to repair than the car is worth, the insurer will consider the car a “total loss”.

This settlement is usually paid by the at-fault insurer (who is responsible for causing the accident). If there was no other driver (eg you hit a tree), your insurer will pay the settlement.

In order to receive full compensation for your loss – or indeed any settlement – you must file an accident claim after the loss has occurred. Each car insurer has its own requirements about how and when you must notify them of an accident; Be sure to read the fine print on your policy to ensure you file a claim on time. This will improve the chances of your claim being approved.

Compare car insurance from top carriers

When does an insurer declare a car a total loss?

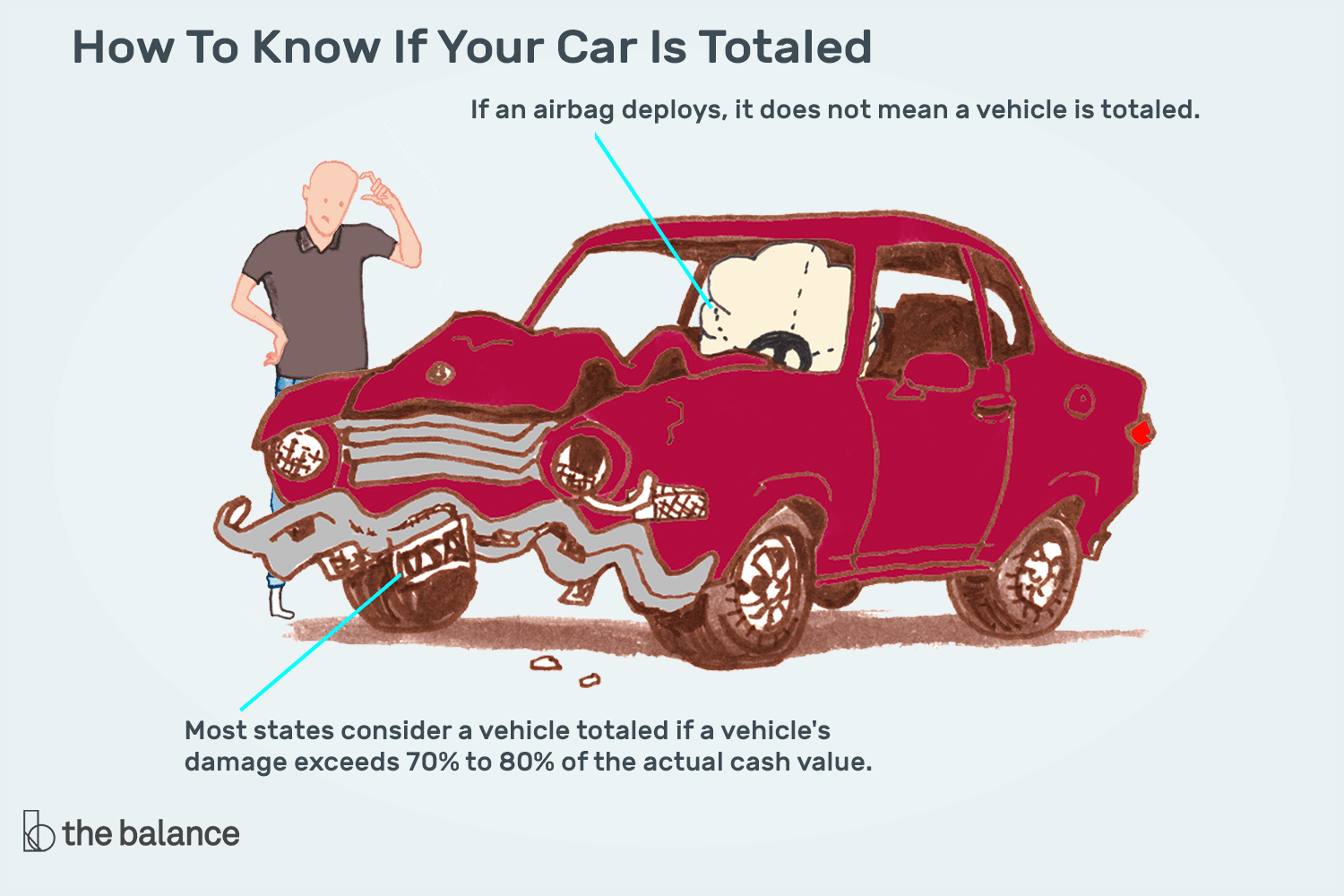

In vehicle insurance, a vehicle is considered a total loss if the insurer determines that it would cost more (or about the same) to repair the vehicle than it is worth. See the article : 96% of American drivers do not understand their car insurance policies.

However, the total loss calculation usually uses several variables that the appraiser determines after inspecting your vehicle. These may include:

An insurer may consider a car totaled for a number of reasons, including:

See: How long after a car accident can you file a claim?

Whose insurance pays for a totaled car?

In most states, the driver who caused the accident—known as the at-fault driver—is responsible for paying for the entire car. To see also : 58% of drivers think they are overpaying for car insurance, 29% have recently changed companies. Generally, their liability insurance will pay for damage to other vehicles if they are found to be at fault.

However, there are some exceptions. For example, if your vehicle has been hit by a motorist, the responsible party may never be identified, making it difficult for them to pay for the entire loss. Or you may be involved in a single-vehicle accident and have to put your car together without the involvement of the other driver. In either case, your own policy’s collision coverage (if you chose to purchase it) would pay for all damages up to your policy’s limits.

Remember: If you’re in a single-car accident—hitting a telephone pole or other structure that damages your car—your insurance may only cover the damages if you have collision coverage. If you don’t have collision coverage, you’ll be responsible for repairing your car out of pocket.

Additionally, some states have joint tort laws. This means that more than one driver can be held responsible for an accident, even if their role was minimal. Arizona, for example, has a comparative negligence statute that reduces a driver’s damages in proportion to his or her own level of fault. So, if the accident is caused by another driver, but you are even 1% at fault, you will receive a reduced amount of total loss compensation.

Learn more: What you should know about insurance scores

How much will insurance pay for a total loss settlement?

Many different factors can affect your claim offer or how much insurance is willing to pay for your entire vehicle.

Remember: If you are found to be at fault in an accident or if fault has not yet been determined, you will usually have to pay your policy’s deductible in order to receive your full compensation check. This deductible can be hundreds or thousands of dollars, depending on what you chose when you purchased your coverage.

Calculating your vehicle’s total settlement is a separate process from calculating the cost of bodily injury, medical fees, or other property damage compensation as a result of an accident.

What if I have a loan on a totaled car?

One thing that won’t affect your total claim amount is how much you still owe on the vehicle, assuming you bought it with a loan.

The insurer will contact your lender because the vehicle technically belongs to the lender, not you. The insurer will then send the first check to your lien holder after reaching an agreement. If there is any money left over after the debt is paid, the rest goes to you in another check.

Unfortunately, you may owe the pawn shop more than the vehicle is worth. If this happens, your lender will receive a check for the entire loss. You will then be left out of pocket to pay the remaining loan balance.

Good to know: this is why some drivers choose GAP coverage. With a GAP policy, your vehicle’s negative equity is covered (up to your insurance limit). If your car is totaled but you owe more than it’s worth, GAP coverage will step in to help cover the difference. Keep in mind that while GAP coverage can ensure that you don’t owe the lender the entire car, you still won’t get any money from the payout.

Can I negotiate a total loss car insurance settlement?

Simply put: yes, you can negotiate the total amount of compensation you will be offered. In some cases, you may be able to get more money for your totaled car.

It’s important to note that the process may vary slightly depending on your state’s rules and even the specific insurer. However, in general, the following are the steps you need to take.

Compare car insurance from the best providers

Disclaimer: All insurance related services are provided through Young Alfred.

Stephanie Colestock is a Washington, D.C.-based writer with more than 11 years of experience writing about investing, business, and personal finance. He has contributed to outlets such as Yahoo! Finance, MSN, Investopedia, Credit Karma, Credible and more. He holds a bachelor’s degree from Baylor University and is pursuing his CFP® certification.

What does is mean if the coverage limits are $250000 /$ 500000?

If your auto insurance policy has coverage limits of $250,000 / $500,000, you have bodily injury liability up to $250,000 per person and $500,000 per accident. This is also known as premium cover and is generally the maximum amount that people can buy for personal car insurance.

What do policy limits 25 50 25 mean? If you purchased a 25/50/25 auto insurance policy, that means you have $25,000 liability per person for bodily injury, $50,000 for bodily injury per accident, and $25,000 for property damage.

WHAT DO coverage limits mean?

A limit is the maximum amount your insurer will pay for a claim that your insurance policy covers. Think of it this way: it’s like filling a fishbowl. If you make a covered claim, your insurance policy will pay up to a certain amount. You are responsible for any charges that exceed the limit.

What are the 3 limits of insurance policies?

Insurance Policy Limits Per Person Limits: The maximum amount that an insurer will pay for one person’s claims. Combined Limits: One limit that can be applied to multiple types of coverage. Aggregate Limits: The total amount that can be paid out for all claims over a period (often a year).

What would 100 300 100 mean on an insurance policy?

Buy at least standard 100/300/100 coverage, which means $100,000 per person for bodily injury to others, including death; $300,000 per BI accident; and property damage up to $100,000. If you have a high net worth, increase your BI coverage to 250/500/100.

How do you understand insurance policy limits?

These limits are usually stated as a ‘Per Person/Per Accident’ amount and can be found on the Declarations page of the policy. For example, if you have $30,000/$60,000 coverage, the company will pay a maximum of $30,000 to each person injured in your accident, up to $60,000 per accident.

What is the full coverage amount?

1. Maximum Limits of Liability Available. These limits can go up to $250,000 per person for bodily injury, $500,000 for an accident, and $100,000 and more for property damage.

Is full coverage really full coverage?

When people talk about “comprehensive” car insurance, they are often referring to a combination of coverages that help protect the vehicle. But in reality, there is no such thing as “full coverage” for your car. Some coverages, such as auto liability, are required by state law.

What is covered in full coverage?

Comprehensive auto insurance is a term that describes all the main parts of auto insurance, including bodily injury, property damage, uninsured motorist, PIP, collision and comprehensive coverage. You are usually legally required to carry about half of these coverages.

What does it mean if the coverage limits are 250000 500000?

Let’s explain. The amount is $250,000 per person, $500,000 per accident and $100,000 for property damage. In other words, your insurance company will pay a maximum of $250,000 (per person) for injuries to one person, $500,000 (per accident) for multiple injuries, and $100,000 for property damage.

What does $100000 /$ 300000 /$ 100000 mean for liability coverage?

The first number here, $100,000, refers to the amount insured per person. If a person suffers an injury caused by you, the policy will cover up to $100,000 of their damages for medical bills and other claims. The second figure, $300,000, represents the total amount available per accident.

What does the 25k 50k mean on insurance?

The first number, 25, represents $25,000. This is your maximum personal injury liability coverage for one person injured in an accident or incident. The second number, 50, represents $50,000. This is your maximum personal injury liability coverage for everyone injured in a single accident.

How much should I ask for my totaled car?

But if you’re asking yourself, “How much is my car worth in total,” here’s a rough calculation you can do yourself: Find your Kelley Blue Book Value in the right condition. Depending on how bad your car’s overall condition is, calculate between 20 and 40 percent of the fair condition value.

Can you agree on the entire payment for the car? The entire damage negotiation process is simple. A vehicle is legally considered a total loss if the cost of repairs and additional claims equals or exceeds 75% of the fair market value – which, again, is usually negotiable.

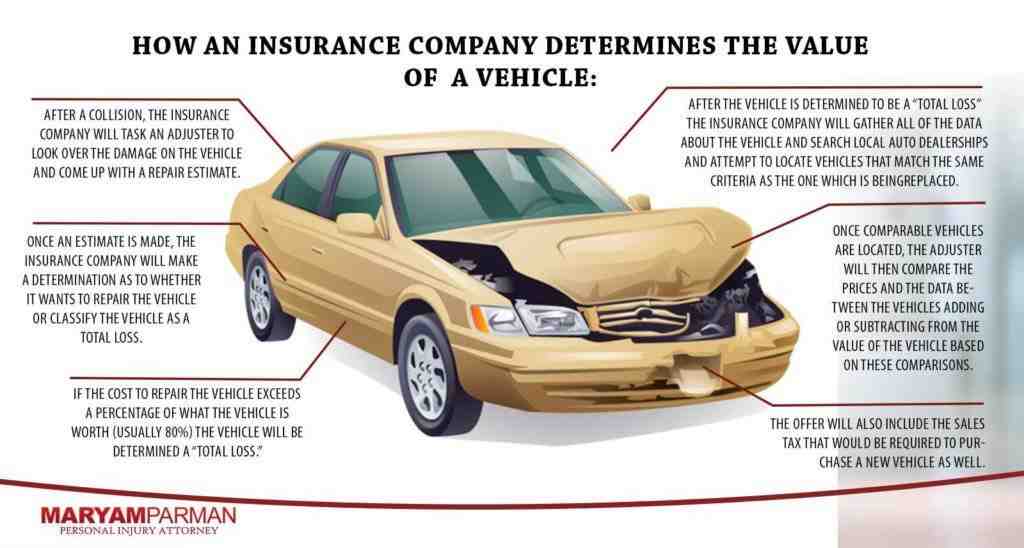

What do insurance companies use to value a totaled car?

ACV depends on several factors, including year, make, model, vehicle options, mileage, wear and tear, and accident history. If you disagree with the insurance company’s estimate of your vehicle’s value, you may be able to negotiate with them for a higher payout.

What do insurance adjusters use to value cars?

To conduct an appraisal, the adjuster assesses the damage to the car and then estimates how much it would cost to repair it. The adjuster tries to determine how much your car would have been worth before the accident. Once they have completed their investigation, the claims adjuster will decide if the car is worth repairing.

How does insurance companies determine the value of a totaled car?

Key Takeaway: Total loss value is determined by adding up the cost of repairs and related expenses, the value lost to your car in an accident, and the cost of reimbursing rental costs if your vehicle is down for repairs. The value that the insurer sells to salvage the damaged car is then deducted.

How do you value a totaled car?

To get an idea of how much your car is worth in total, find the Kelley Blue Book value in the right condition. Figure out what the fair condition value is between 20 and 40 percent. Depending on the amount of damage to your vehicle, it’s likely closer to 20 percent, according to CarBrain.

How much is my car worth after being totaled?

When the insurer totals your car, they pay you the actual cash value (ACV) of the vehicle. Actual cash value is what it was worth immediately before the loss. This includes the reduction in depreciation value, so the ACV is less than what you paid for the vehicle, even if it is relatively new.

Is my car totaled If the frame is bent?

If your car has a bent or damaged frame as a result of an accident, it is likely that the car will be totaled. If it is repairable, you may be able to claim the cost of the repair through a personal injury claim.

How much does it cost to bend a car frame? Estimates vary depending on the severity of the damage in question, but a full frame straightening usually costs between $500 and $750 plus repairs to other areas of the vehicle. This process is very situational – it’s best to have a body shop evaluate the vehicle before you plan to do any frame work.

Does frame damage mean the car is totaled?

DOES FRAME DAMAGE MEAN MY VEHICLE IS TOTAL? No. Most frame damage is repairable. Although it is possible for severe structural or frame damage to completely destroy the vehicle’s structure.

Does frame damage mean total loss?

Damage to the frame does not automatically mean that the car is lost. However, depending on the severity of the damage, the car may experience total structural damage. If the damage is so extensive that it is not even certain whether the repairs can be completed, the car can be considered a total structural failure.

Is it worth fixing a car with frame damage?

The simple answer is no. If the car’s frame is damaged, it reduces optimal handling and endangers the driver and road users. In addition to these risks, frame damage can cause additional mechanical problems for your vehicle if not attended to soon.

Is frame damage an automatic total?

The certainty that the car has suffered frame damage is an unpleasant surprise, to say the least. If your insurance company or auto technician makes this determination, you can assume your vehicle is totaled. However, damage to the frame does not ensure that the vehicle is considered a total loss.

Is it worth fixing a car with a bent frame?

The simple answer is no. If the car’s frame is damaged, it reduces optimal handling and endangers the driver and road users. In addition to these risks, frame damage can cause additional mechanical problems for your vehicle if not attended to soon.

Can a bent car frame be fixed?

Yes, bent car frames can be repaired. They are repaired by trained auto body repair technicians with high precision tools and hydraulic machines. These machines use tremendous force to push your frame back to true and the way your car manufacturer intended it to be.

Is it worth to fix bent frame?

Damage to a car’s frame can be devastating. Your entire vehicle is out of alignment, and since it can be expensive to correct frame bends, it may not be worth it. Your best bet would be to compare your options by getting a quote on the damaged car to see if it’s worth throwing money at to fix it.

How much does it cost to fix a bent frame on a car?

Repairing a bent car frame can cost around $750, but it depends on how badly the frame is damaged and how long it takes to fix it. When you repair a bent frame, technicians use a large clamp and hydraulic cylinders to push your frame back into place.

Is it safe to drive a car with a bent frame?

If the frame or structure of your car is seriously damaged, it is not safe to drive. This is because the overall integrity of your car’s frame has been compromised. Since the purpose of the frame is to keep the vehicle stable, if the frame itself is damaged, it can be dangerous for you while driving.

How much does it cost to fix a bent frame on a car?

Repairing a bent car frame can cost around $750, but it depends on how badly the frame is damaged and how long it takes to fix it. When you repair a bent frame, technicians use a large clamp and hydraulic cylinders to push your frame back into place.

What happens if you drive a vehicle with a bent frame?

Riding with a bent frame can absolutely cause alignment issues. Your vehicle relies on the frame for stability and alignment. If the frame is damaged due to bending, it will cause your car’s suspension to lean. This also causes the tires to level out.

Can you fix a bent frame on a car?

Yes, bent car frames can be repaired. They are repaired by trained auto body repair technicians with high precision tools and hydraulic machines. These machines use tremendous force to push your frame back to true and the way your car manufacturer intended it to be.

What is actual cash value coverage?

A policy that provides actual cash value coverage will usually reimburse you for the item’s depreciated value. For example, if a fire damages your TV, an actual cash value policy will reimburse you for its depreciated value, which may be less than buying a new one.

Does the actual cash value fully cover? After the loss, the actual cash value (ACV) pays you what your property is worth today. Actual cash value is calculated by taking into account what your property would cost to buy new today and deducting depreciation for factors such as age, condition and obsolescence.

Which is better replacement cost or actual cash value?

These are the different methods used to calculate your benefits. Although the actual cash value is cheaper, the replacement cost provides better coverage because it includes the depreciation your property covers.

Why do insurance companies pay actual cash value?

Sometimes insurance companies use the actual cash value to determine the amount to be paid to the policyholder after loss or damage to the insured property or vehicle.

What is the difference between actual cash value and replacement cost coverage?

While both types of coverage help cover the cost of rebuilding your home or replacing damaged items after a covered loss, true cash value principles are based on the items’ depreciated value, while replacement cost coverage does not consider depreciation.

What is better ACV or RCV?

Actual cash value (ACV) policies tend to have lower premiums than RCV policies, and for good reason: they offer less compensation in the event of a claim.

What is actual cash value example?

An example of real cash value His insurance company says that all TVs have a 10-year life. A similar TV costs $3,500 today. 50% (five years) of the life of the destroyed television was left. Actual cash value equals $3,500 (replacement cost) times 50% (remaining useful life), or $1,750.

What does actual cash value mean on insurance?

Actual cash value (ACV) is a way of determining the value of your business’s assets that will be repaired or replaced after a covered loss. Insurance companies calculate ACV by subtracting depreciation from the item’s replacement cost value.

Does insurance pay actual cash value?

What is the actual cash value? After the loss, the actual cash value (ACV) pays you what your property is worth today. Actual cash value is calculated by taking into account what your property would cost to buy new today and deducting depreciation for factors such as age, condition and obsolescence.

Why do insurance companies pay actual cash value?

Sometimes insurance companies use the actual cash value to determine the amount to be paid to the policyholder after loss or damage to the insured property or vehicle.