Why car insurance is mandatory in Canada

Mandatory car insurance is meant as a financial protector for anyone involved in a car accident.

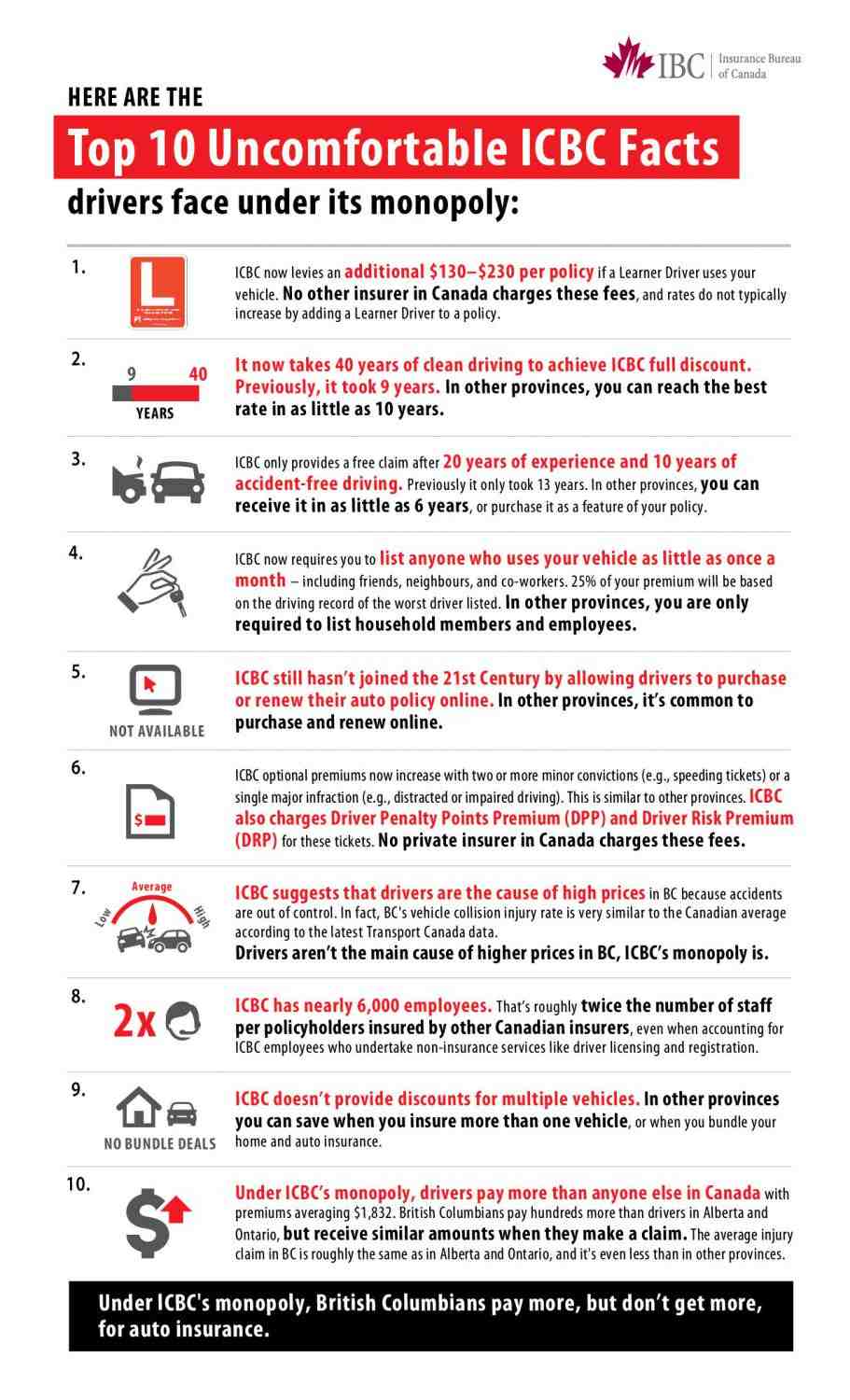

Car insurance is required in all provinces and territories, including those with public coverage, such as British Columbia, Manitoba, and Saskatchewan.

Advertisement 2

Contents

- 1 Advertisement 2

- 2 Mandatory versus optional auto insurance coverage

- 3 Article content

- 4 Article content

- 5 Why is auto insurance mandatory in Canada?

- 6 Driving.ca’s Blind-Spot Monitor

- 7 Who is the first person that insured his life?

- 8 Is it really necessary to have insurance?

- 9 What are the four benefits of insurance?

- 10 Can you get caught without insurance?

This ad has not been uploaded yet, but its article continues below. To see also : 96% of American drivers do not understand their car insurance policies.

In Ontario, car insurance became mandatory in 1990 when the Compulsory Car Insurance Act was introduced. If individuals choose to drive without insurance, the maximum fine for a first conviction is set at $25,000 and a maximum fine of $50,000 for a subsequent conviction.

Mandatory versus optional auto insurance coverage

In Canada, auto insurance rates and regulations are governed by provincial and territorial agencies. See the article : GoAuto car insurance company, bought by a private equity firm in Pennsylvania. However, certain coverages are required throughout the country. For example:

This ad has not been uploaded yet, but its article continues below.

Article content

Other forms of auto insurance that are optional but not required include: This may interest you : Lawmakers advance car insurance bill package despite affordability concerns.

Drivers can also choose to pay for insurance endorsements or “add-ons.” These can include things like loss of use coverage, in case you need to rent a car after a collision, and accident forgiveness, which will prevent your premium from going up after your first at-fault claim.

This ad has not been uploaded yet, but its article continues below.

Article content

Lorraine Explains: Carjackings are on the rise; make sure your auto insurance has you covered

Why is auto insurance mandatory in Canada?

Mandatory car insurance is meant as a financial protector for anyone involved in a car accident. Certain costs, such as medical and rehabilitation services, can be prohibitively expensive, and insurance provides a cushion for people who need those services but might not otherwise be able to afford them. In addition, compulsory insurance allows compensation to victims of collisions.

While each province has different rules and regulations on mandatory insurance, most have a minimum mandatory liability insurance limit of $200,000, although many experts recommend between $500,000 and $1 million. Adding endorsements to the bare minimum may increase costs depending on your insurance provider, but it can protect you and save costs in the long run.

LowestRates.ca is a free, independent rate comparison website that allows Canadians to compare rates on various financial products, such as auto and home insurance, mortgages, and credit cards.

Driving.ca’s Blind-Spot Monitor

Sign up for Driving.ca’s Blind-Spot Monitor newsletter on Wednesdays and Saturdays

By clicking the sign up button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Red Postmedia Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

1897: The first automobile policy is issued in Dayton, Ohio, in the name of Gilbert J. Loomis. Loomis was a mechanic who built his own single-cylinder cruiser car. This policy, purchased for $1,000, would protect Loomis if his invention hurt someone or damage property.

Who is the first person that insured his life?

The earliest known life insurance policy was made at the Royal Exchange, London, on June 18, 1583. Richard Martin insured William Gybbons, paying thirteen merchants £30 for 400 if the insured dies within a year.

Who was the first insurer? USA. The first American insurance company was organized by Benjamin Franklin in 1752 as the Philadelphia Contribution. The first life insurance company in the American colonies was the Presbyterian Ministers Fund, organized in 1759.

When was first life insurance issued?

Life insurance in its modern form came to India from England in the year 1818. Oriental Life Insurance Company, started by Europeans in Calcutta, was the first life insurance company on Indian soil.

When was the first life insurance sold?

The first American insurance company was organized by Benjamin Franklin in 1752 as the Philadelphia Contribution. The first life insurance company in the American colonies was the Presbyterian Ministers Fund, organized in 1759.

When did life insurance become mainstream?

The end of World War II and the economic boom that followed boosted life insurance sales in the United States. In the mid-1970s, 72 percent of the adult population of the United States and more than 90 percent of all husband-and-wife families had some form of life insurance.

When did life insurance become available in the United States?

The New England Mutual Life Insurance Company (1835) issued its first policy in 1844, and the New York Mutual Life Insurance Company (1842) began business in 1843; at least fifteen more mutuals were authorized in 1849.

Who were the first to insure people?

What some consider to be the first written insurance policy was found on an ancient Babylonian monument. In medieval Europe, the guild system emerged, with members paying a group that covered their losses. In 1600, ships sailing to the New World would insure multiple investors to spread risk.

What is history of insurance?

The history of general insurance dates back to the Industrial Revolution in the West and the subsequent growth of maritime trade in the 17th century. It came to India as a legacy of the British occupation.

When was the first insurance started?

Key takeaways. The first insurance company in the US dates back to colonial times: Philadelphia Contributionship, co-founded by Ben Franklin in 1752. Throughout US history, new types of insurance have evolved as new risks have emerged (such as the automobile).

Who started life insurance?

The first life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen.

Who was the first insurance company?

1735 The Friendly Society, the first insurance company in the United States, is established in Charleston, South Carolina. This mutual insurance company closed in 1740.

How did life insurance begin?

The first American life insurance companies date back to the late colonial period. The Presbyterian Synods in Philadelphia and New York established the Corporation for the Relief of Widows and Children of Poor and Distressed Presbyterian Ministers in 1759; episcopal ministers organized a similar fund in 1769.

Is it really necessary to have insurance?

Insurance is an important financial tool. It can help you live life with less worry knowing that you will receive financial assistance after a disaster or accident, helping you get back on your feet faster.

Why is it important to have insurance? It provides protection against theft, damage from hazards such as fire and water, and financial liability that could result from a visitor or guest being accidentally injured on your property.

Is it better not to have health insurance?

Without health insurance coverage, a serious accident or health problem that results in emergency care and/or an expensive treatment plan can result in poor credit or even bankruptcy.

What are the effects of not having health insurance?

The uninsured live sicker and die younger than the insured. They forgo preventive care and seek medical attention in more advanced stages of the disease. Society then bears these costs through lower productivity, higher rates of communicable diseases, and higher insurance premiums.

Is health insurance a waste of money?

Simply put, basic health coverage is not a waste of money. After all, accidents and emergencies are never planned. And medical debt can take years to come out. Saving money each month by not paying for health insurance won’t add up to more than the thousands of dollars medical emergencies can cost.

Why do people choose not to get health insurance?

In 2019, 73.7% of uninsured adults said they were uninsured because the cost of coverage was too high. Many people don’t have access to coverage through a job, and some people, particularly poor adults in states that haven’t expanded Medicaid, remain ineligible for financial assistance for coverage.

Is health insurance a waste of money?

Simply put, basic health coverage is not a waste of money. After all, accidents and emergencies are never planned. And medical debt can take years to come out. Saving money each month by not paying for health insurance won’t add up to more than the thousands of dollars medical emergencies can cost.

What is the point of paying for health insurance?

Health insurance protects you from high and unexpected medical costs. You pay less for covered in-network health care, even before you meet your deductible. You get free preventive care, like immunizations, screenings and some checkups, even before you meet your deductible.

Why is healthcare so expensive even with insurance?

Multiple systems create waste. The US health care system is extremely complex, with separate rules, funding, enrollment dates, and out-of-pocket costs for employer insurance, healthcare.gov private insurance, Medicaid, and Medicare, in all its many forms. parts.

Is it worth it to have health insurance?

The simple answer is “yes,” unless you can afford health care bills of tens or hundreds of thousands of dollars should your health unexpectedly take a turn for the worse. Even a quick, unexpected visit to an urgent care center can quickly add up to more than $1,000.

Is insurance really necessary?

In most cases, you will want to cover your life, health, and property. This means you must have: Health insurance to cover medical costs for yourself, as well as your spouse or children, if you have any. Life insurance to support your family or cover your debts after your death.

Is life insurance always necessary?

Life insurance isn’t for everyone, but some people and circumstances make having life insurance a good idea. If a person has accumulated enough wealth to care for their family upon death, life insurance may not be necessary.

Is insurance a waste of money?

Simply put, basic health coverage is not a waste of money. And medical debt can take years to come out. Saving money each month by not paying for health insurance won’t add up to more than the thousands of dollars medical emergencies can cost.

Why do we even need insurance?

Health insurance provides financial protection in case you have an accident or serious illness. For example, a broken leg can cost up to $7,500. Health coverage can help protect you from high and unexpected costs.

What are the four benefits of insurance?

Benefits of insurance coverage

- Provides protection. Insurance coverage reduces the impact of loss that one bears in dangerous situations. …

- Provides Certainty. Insurance coverage provides a sense of security to the insured. …

- Risk sharing. …

- Risk Value. …

- Capital Generation. …

- Economic growth. …

- Saving habits.

Can you get caught without insurance?

Penalties for driving without insurance If the case goes to court, you could receive an unlimited fine and be banned from driving. The police also have the power to impound and in some cases destroy a vehicle if it is driven without insurance.

What happens if you drive without insurance? What are the consequences of driving without car insurance? They can include fees, the seizure of your vehicle, the loss or suspension of your license, and even jail time.

How much is a no insurance ticket in Alabama?

Driving without insurance in Alabama is considered a misdemeanor and carries a fine of $500 to $1,000. You may also have your driver’s license and vehicle registration suspended for 180 days or more and face three to six months in jail if caught driving without insurance.

What fine do you get for not having insurance?

Penalties for driving without insurance You could receive a fixed penalty of £300 and six penalty points on your license if you are caught driving a vehicle that is not insured to drive. If the case goes to court, you could receive an unlimited fine and be banned from driving.

How can I get out of no proof of insurance ticket in Alabama?

The state of Alabama allows a person cited for driving without insurance or failure to show an officer proof of insurance to have their ticket dismissed if they appear in court before the court date and can provide proof that the vehicle was insured at the time. appointment time.

What happens if you wreck without insurance in Alabama?

Penalties for driving without insurance in Alabama include fines of up to $3,000, license suspension, and jail time. Drivers can avoid these uninsured driving penalties by meeting Alabama’s financial responsibility test requirements.

Can you go to jail for no insurance in Kentucky?

Penalties for a first offense of driving without insurance include the following: A fine ranging from $500 to $1,000. Up to 90 days in jail.

What happens if you get caught driving without insurance in Kentucky?

Paying a fine For the first violation of driving without insurance, you will be charged between $500 and $1,000. If you are caught driving without insurance in Kentucky for a second offense, you will have to pay between $1,000 and $2,500.

What is the punishment for no insurance?

Penalties for driving without insurance You could receive a fixed penalty of £300 and six penalty points on your license if you are caught driving a vehicle that is not insured to drive. If the case goes to court, you could receive an unlimited fine and be banned from driving.

Is driving without insurance a felony in Kentucky?

Penalties for Driving Without Insurance in Kentucky To aid in monitoring, requires insurance agencies to submit monthly records of all personal policies in force to the KYTC. If your car is identified as uninsured, this would mean that you have broken the law with a Class B misdemeanor, and the penalties can be quite severe.

How much is a no insurance ticket in Mississippi?

Under Mississippi Code section 63-15-4, driving without proof of insurance could result in a misdemeanor conviction, a $500 fine, and suspension of driving privileges for up to one year (or until the offender can show that he or she is properly insured).

What fine do you get for not having insurance?

Penalties for driving without insurance You could receive a fixed penalty of £300 and six penalty points on your license if you are caught driving a vehicle that is not insured to drive. If the case goes to court, you could receive an unlimited fine and be banned from driving.

What happens if the person at fault in an accident has no insurance in Mississippi?

In an at-fault state, the liability rests with the party responsible for the accident and their insurance company. While a no-fault state would require you to go through your own insurance company, Mississippi allows you to file a claim against the negligent person’s insurance provider.

How much is a insurance ticket in MS?

Breaking the Mississippi Code for Motor Vehicle Safety and Liability is considered a misdemeanor. It only takes one violation of the auto insurance law for a motorist to face a $500 fine and suspension of driving privileges for a full year, or until they can prove they have purchased mandatory auto insurance.