Why does my car insurance premium go up every year?

Several factors can increase your car insurance rate annually. Comparing car insurance rates should be standard practice.

If you own a vehicle, you know that car insurance is a mandatory fixed expense over the policy period. But as the years go by, your car insurance premium can increase – even for reasons beyond the individual risk you pose as a driver.

Advertisement 2

Contents

- 1 Advertisement 2

- 2 Factors that can increase your car insurance rate

- 3 Article content

- 4 Advertisement 4

- 5 How rate increases are approved across the provinces

- 6 Article content

- 7 How to get the lowest auto insurance rate annually

- 8 Driving.ca’s Blind-Spot Monitor

- 9 How long do speeding tickets stay on your record?

- 10 Is Progressive insurance Good?

- 11 What can you do to make your insurance rates go down?

- 12 Is Progressive cheaper than Geico?

This ad hasn’t loaded yet, but your article continues below. To see also : Does your credit score affect your car insurance?.

While the rate isn’t guaranteed to increase every year you’re insured, it can vary for a number of reasons, from the state of Canada’s economy to the current claims data on your particular vehicle model, as well as your current zip code. Provinces may also experience rate increases at different times, depending on the provincial auto insurance regulator’s approval process. Although many of these factors are out of your control, it is possible to offset any increases you may experience at renewal by comparing car insurance rates annually.

Factors that can increase your car insurance rate

When the cost of living puts pressure on the Canadian economy, you can expect your car insurance premium to reflect that. To see also : Who is cheaper than Geico?. For example, in June we experienced the sharpest annual increase in inflation we’ve seen in nearly 40 years, and that has had an impact.

This ad hasn’t loaded yet, but your article continues below.

Article content

Many of our daily expenses increase when inflation is high, including transportation costs such as gas. However, Statistics Canada’s Consumer Price Index (CPI) also regulates car insurance premiums and the cost of car parts, maintenance and repairs. To see also : How To Get Cheap Car Insurance. Unfortunately, with inflation at 8.1 percent, these costs are higher than usual.

Lorraine Explains: Carjackings are on the rise; make sure your auto insurance has you covered

Due to ongoing supply chain delays caused by COVID-19, auto parts are also more difficult to obtain, leading to longer wait times for repairs. Drivers are left without their primary mode of travel and need replacement rental cars for longer periods of time, which can increase claim costs and subsequently premiums.

Advertisement 4

This ad hasn’t loaded yet, but your article continues below.

The car model’s risk rating may also change annually according to the Canadian Loss Experience Automobile Rating (CLEAR), which measures the likelihood of a claim, how much a claim might cost, and whether it is likely to be stolen. This risk can change from year to year based on insurance claims data, as can your zip code’s collective claim rate, which can also increase your rate even if you haven’t made a claim yourself.

How rate increases are approved across the provinces

When insurance companies notice that claims costs are increasing, they can apply for a rate increase with their provincial insurance regulator. If granted, however, this increase can only be applied at the start of the next insurance year. Customers will therefore only see an interest rate increase when the policy is renewed, rather than mid-term.

This ad hasn’t loaded yet, but your article continues below.

Article content

For example, in Ontario, the Financial Services Regulatory Authority of Ontario (FSRA) must approve rate increases before a private insurer can raise rates.

Similarly, state-owned auto insurers such as those in British Columbia, Manitoba and Saskatchewan must submit a proposal for a new rate program to a provincial review panel that must be approved by the government.

How to get the lowest auto insurance rate annually

One of the best ways to avoid paying more for your car insurance premium each year is to compare car insurance rates before your policy automatically renews. While it may seem convenient to automatically renew your policy with your current insurance provider, you could be missing out on savings.

Comparing prices between different providers in Canada can ensure you get the lowest price possible for the coverage you need. Just as rates can vary from province to province, they also vary from company to company, based on the number of claims they pay out. So make sure you shop the market before renewing your policy.

LowestRates.ca is a free and independent price comparison website that allows Canadians to compare prices for various financial products, such as auto and home insurance, mortgages and credit cards.

Driving.ca’s Blind-Spot Monitor

Sign up to receive Driving.ca’s Blind-Spot Monitor newsletter on Wednesdays and Saturdays

By clicking the sign up button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Inflation. Perhaps the biggest driver of higher 2022 car insurance premiums is the same thing that drives up costs across the board – inflation. Between June 2021 and June 2022, the consumer price index (CPI) rose 9.1 per cent.

How long do speeding tickets stay on your record?

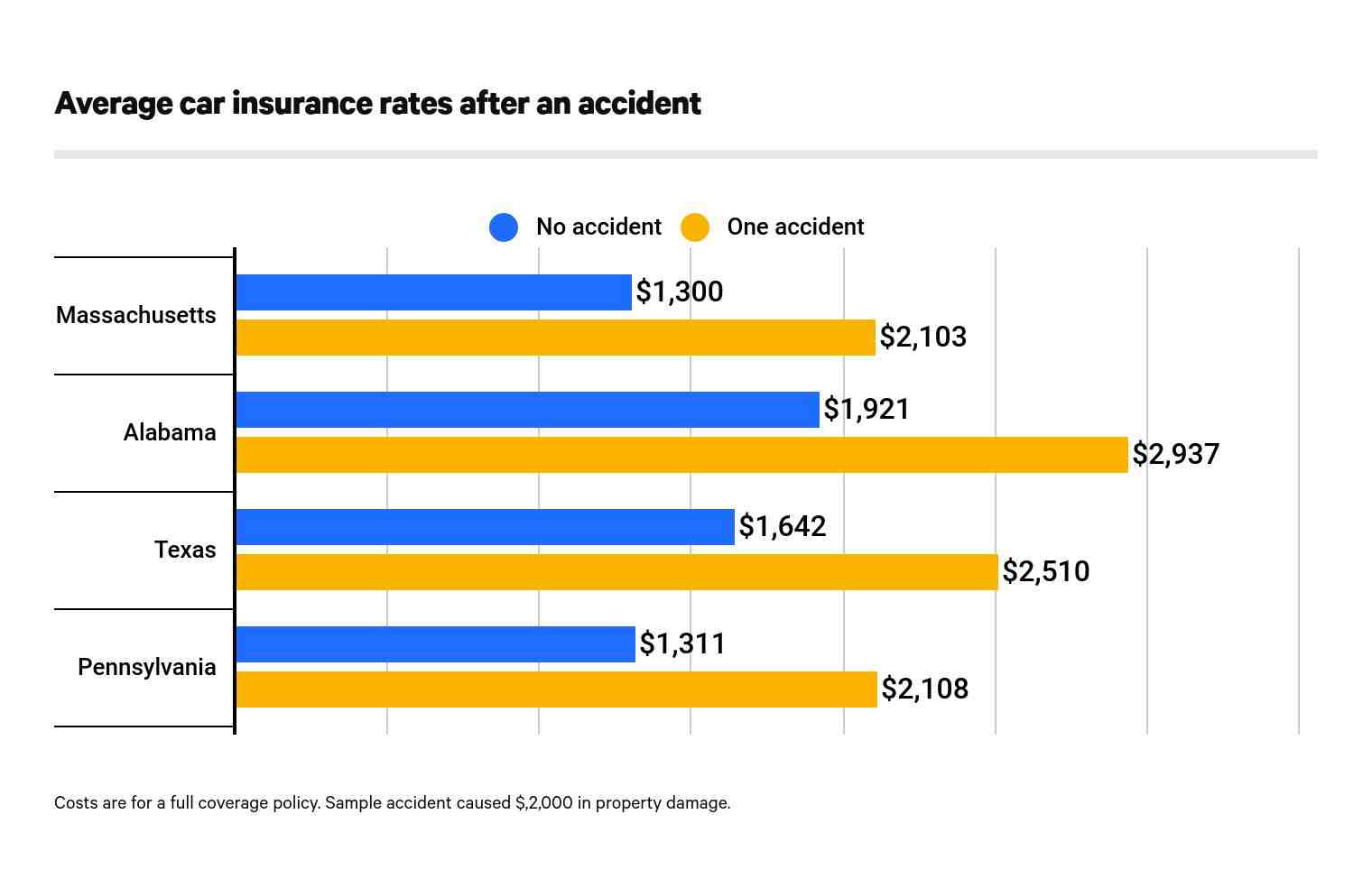

A speeding ticket will usually stay on your record for three to five years. The exact time frame varies depending on the state you live in and how fast you were driving over the speed limit.

How long do tickets stay on your record in Colorado? Tickets remain on record in Colorado for 7 years. Tickets on your Colorado driving record can affect your driver’s license points, driving privileges and car insurance rates.

How do I clear my driving record in Colorado?

Once points are registered against your license, the only way to get them off your record is with time. As months and years go by, your old traffic violations and the points that go with them will fade into irrelevance and will not count against future points or license suspensions.

How do I check points on my license Colorado?

To check how many Colorado DMV points you have from previous traffic violations, go to the Department of Revenue website (or submit a record request form or go to the DMV in person). Requesting your driving record costs $9 (or $10 for a certified record).

How long do traffic violations stay on your record in Colorado?

| State | How long a speeding ticket remains registered |

|---|---|

| California | 3 years and 3 months (39 months) |

| Colorado | May reduce points, but the event is permanently recorded |

| Connecticut | 3 years |

| Delaware | 2 years |

Do points on license go away?

Points can remain on your driving record for 4-11 years.

How long does a ticket stay on your record in Alabama?

Tickets remain on your record in Alabama indefinitely, although they will stop counting toward a license suspension after two years. Alabama driving record tickets can affect your driver’s license points, driving privileges and car insurance rates.

How long do points stay on your record in Alabama?

Points stay on your license for two years in Alabama, although they will stay on your record longer. After two years, license points will no longer affect your driving privileges, so it’s worth keeping track of how much longer your points last.

Is there a statute of limitations on tickets in Alabama?

There is a 12-month statute of limitations on traffic tickets in Alabama, since they are misdemeanors. When a police officer issues a ticket during a stop, the statute of limitations begins. The ticket driver must respond to the ticket within 15 days of the offence.

How do I get a speeding ticket off my record in Alabama?

Another option to prevent a speeding ticket from going on your record is to request a lawsuit to challenge the evidence against you. In some cases, your lawyer may be able to negotiate with the prosecutor and ask for a dismissal or keep the note off your record if you agree to attend driving school.

How many points is a speeding ticket in Ohio?

Ohio Driver’s License Points for Speeding Tickets Speeding 30 mph over the speed limit: 4 points. Speeding 11 mph to 29 mph over a posted speed limit of 55 mph or more: 2 points. Speeding 6 mph to 29 mph of a posted speed limit of 54 mph or less: 2 points.

How long does it take for points to come off your license in Ohio?

How long do points stay on your Ohio license? Each set of points remains on the convicted driver’s Ohio BMV record for two years. The record is public information, such as a criminal or arrest record. Insurance companies and employers will be able to access it if they want.

How many points does a speeding ticket put on your license in Ohio?

| Break | Point |

|---|---|

| Exceeding the speed limit by 30 miles per hour | 4 |

How many points is 15 over the speed limit in Ohio?

For example, a speeding violation involving speeds less than 25 miles per hour over the speed limit results in two points against your driving record. A speeding offense involving speeds over 25 miles per hour over the speed limit results in four points against your driving record.

Is Progressive insurance Good?

With a long history in the insurance industry and strong financial rating, Progressive has a good reputation. Our expert review team gave the insurer a score of 9.0 out of 10.0 after considering factors such as policy offerings and the customer experience.

Is Progressive Insurance Really Good? Progressive received an overall satisfaction score of 76 out of 100 from a group of customers, in a NerdWallet survey conducted online in July 2021. To put that in perspective, the average score among seven insurance companies was 79, and the highest was 83.

Is Geico as good as Progressive?

Is Progressive or Geico Better? Both Geico and Progressive are reputable insurance companies with positive industry reputations, but which is better for you depends on your situation. We found that Geico offers slightly better rates for the average driver, while Progressive tends to have lower rates especially for high-risk drivers.

Is Geico good about paying claims?

Is Geico good at paying claims? According to our insurance study, Geico excels at paying out claims to customers.

Who has a better rating Geico or Progressive?

U.S. News Rating Geico ranked higher than Progressive in our customer survey and offers cheaper rates. Geico also came in second when we asked consumers how likely they were to recommend their insurance company to others.

What’s the most reliable car insurance?

USAA and State Farm are the top auto insurers, according to our latest data analysis. USAA has the highest overall score in our customer survey and also ranks first in nearly every subrating we analyzed.

Is Progressive Insurance really cheaper?

In our progressive insurance review, the Home Media review team found that the company’s full coverage rates tend to be about 7% cheaper than the national average for good drivers. We rated Progressive as one of the best car insurance and cheapest car insurance companies in 2022.

Why does Progressive charge so much?

Editorial and user-generated content is not provided, rated or approved by any company. Progressive is so expensive because car insurance is expensive in general, due to rising costs for insurance companies.

Is Progressive insurance expensive?

Is Progressive good car insurance? Progressive’s average auto insurance premiums are slightly below the national average. But compared to the other insurers on our list of the best car insurance companies in 2022, Progressive’s average rates are relatively expensive.

Why are progressives rates so low?

That’s because Progressive has special savings opportunities for drivers in this category, such as lower rates for drivers who haven’t had any accidents or tickets in at least three years. However, your final premium is based on a number of factors, such as your driving record, insurance history and more.

Does Progressive pay well on claims?

How much does a Claims Adjuster make at Progressive in California? The average annual salary for a Progressive Claims Adjuster in California is approximately $57,527, which meets the national average.

How long does it take to get a settlement check from Progressive?

After reaching a settlement, it may take up to six additional weeks to receive the settlement check from Progressive.

How is Progressive on paying claims?

We’ll pay you the actual cash value – which is the market value of your vehicle based on several factors, such as pre-loss condition, age, options, mileage, etc. – minus any deductible if you Progressively insured. We work with a third party to help determine the actual cash value.

Is Progressive good at paying out claims?

Based on our survey data, Progressive cannot be compared to other insurance companies. It scored poorly for customer service, claims handling and customer loyalty.

What can you do to make your insurance rates go down?

Here are some ways to save on car insurance1

- Increase your deductible.

- Look for discounts you qualify for.

- Compare car insurance offers.

- Maintain a good driving record.

- Participate in a safe driving program.

- Take a defensive driving course.

- Explore payment options.

- Improve credit score.

What makes insurance rates go down? Common reasons why car insurance prices go down Car insurance costs usually go down for the following reasons: You get older. You drive safely for three years after an accident or other offence. You change insurance company.

Is Progressive cheaper than Geico?

Is Progressive cheaper than Geico? Both Geico and Progressive offer cheap car insurance to drivers across the country. Geico’s rates are usually lower overall, but Progressive tends to offer better rates to those with a recent DUI, at-fault accident or speeding ticket on their driving record.

Is Progressive Insurance Really Cheaper? In our progressive insurance review, the Home Media review team found that the company’s full coverage rates tend to be about 7% cheaper than the national average for good drivers. We rated Progressive as one of the best car insurance and cheapest car insurance companies in 2022.

What is the difference between Progressive and Geico?

We compared a variety of insurance products from GEICO and Progressive and found that Progressive is the superior carrier in most categories. Progressive has more coverage options and more discounts overall. However, many consumers will find that GEICO’s policy is cheaper, even though coverage is limited.

What is the difference between Geico and Progressive?

Both Geico and Progressive offer cheap car insurance to drivers across the country. Geico’s rates are usually lower overall, but Progressive tends to offer better rates to those with a recent DUI, at-fault accident or speeding ticket on their driving record.

Is Geico really cheaper?

Geico has the cheapest auto insurance for most drivers in California. The company charges an average of $390 per year for a minimum liability policy. That’s 35% cheaper than the national average. The average cost of minimum coverage auto insurance in California is $604 per year, or $50 per month.

Is Progressive worse than Geico?

Geico ranked higher than Progressive in our customer survey and offers cheaper rates. Geico also came in second when we asked consumers how likely they were to recommend their insurance company to others.

Who has a better rating Geico or Progressive?

U.S. News Rating Geico ranked higher than Progressive in our customer survey and offers cheaper rates. Geico also came in second when we asked consumers how likely they were to recommend their insurance company to others.

Is Geico as good as Progressive?

Is Progressive or Geico Better? Both Geico and Progressive are reputable insurance companies with positive industry reputations, but which is better for you depends on your situation. We found that Geico offers slightly better rates for the average driver, while Progressive tends to have lower rates especially for high-risk drivers.

Who beats Progressive Insurance?

Geico also beats Progressive when it comes to attracting customers. Geico was the second-largest auto insurance provider in the country in 2020, having captured 13.5% of the personal auto insurance market that year, according to data from the Insurance Information Institute.

What insurance company has the best ratings?

U.S. News Rating USAA is the best insurance company in our ratings. According to our 2022 survey, USAA customers report the highest level of customer satisfaction and are the most likely to renew their policies and recommend USAA to other drivers.

Is Geico really cheaper?

Geico has the cheapest auto insurance for most drivers in California. The company charges an average of $390 per year for a minimum liability policy. That’s 35% cheaper than the national average. The average cost of minimum coverage auto insurance in California is $604 per year, or $50 per month.

Is GEICO cheaper than other insurance?

Geico is cheaper for minimum coverage Compared to the national average rate for car insurance with minimum coverage, Geico offers a lower average price, while Nationwide offers a higher insurance rate. Geico’s rate is the lowest among all insurers for minimum coverage, except USAA.

Why is GEICO less expensive?

Geico is so cheap because it sells insurance directly to consumers and offers many discounts. Selling insurance directly to consumers eliminates the cost of middlemen and allows Geico to have significantly fewer local offices and agents than companies such as State Farm and Allstate.

Can GEICO really save you?

Also, in many states even a 25% percentile offer can be cheaper than the GEICO median price. But as this analysis shows, GEICO can truthfully make the claim of saving you over 15% on your auto insurance. As for whether it only takes you 15 minutes to get the discount, that’s a story for another day.