Why is insurance cheaper for females?

What is the gender rule in insurance?

Contents

- 1 What is the gender rule in insurance?

- 2 Does gender affect life insurance?

- 3 Are men better drivers?

- 4 Are taxes higher in France or us?

Insurance rule. It determines the policy of which parents the offspring cover. On the same subject : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have. Typically, the father’s policy is primary, providing coverage for dependent children before any other potential coverage is considered.

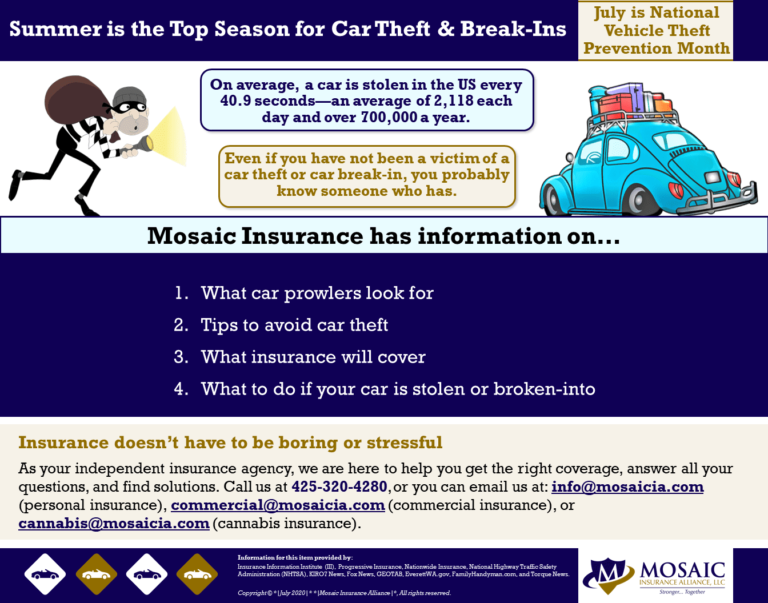

Does gender play a role in insurance? 1 But insurance companies have traditionally linked gender to candidate risk, so this has often been a factor in determining premiums. However, insurers cannot always take gender into account – it depends on the type of insurance and where someone lives.

Does gender matter for life insurance?

Premiums for life insurance policies are lower for women than for men. This may interest you : What does full coverage car insurance consist of?. This is simply because the risk that a life insurance company will pay compensation for men rather than a woman is statistically much higher.

Can insurance companies charge more based on gender?

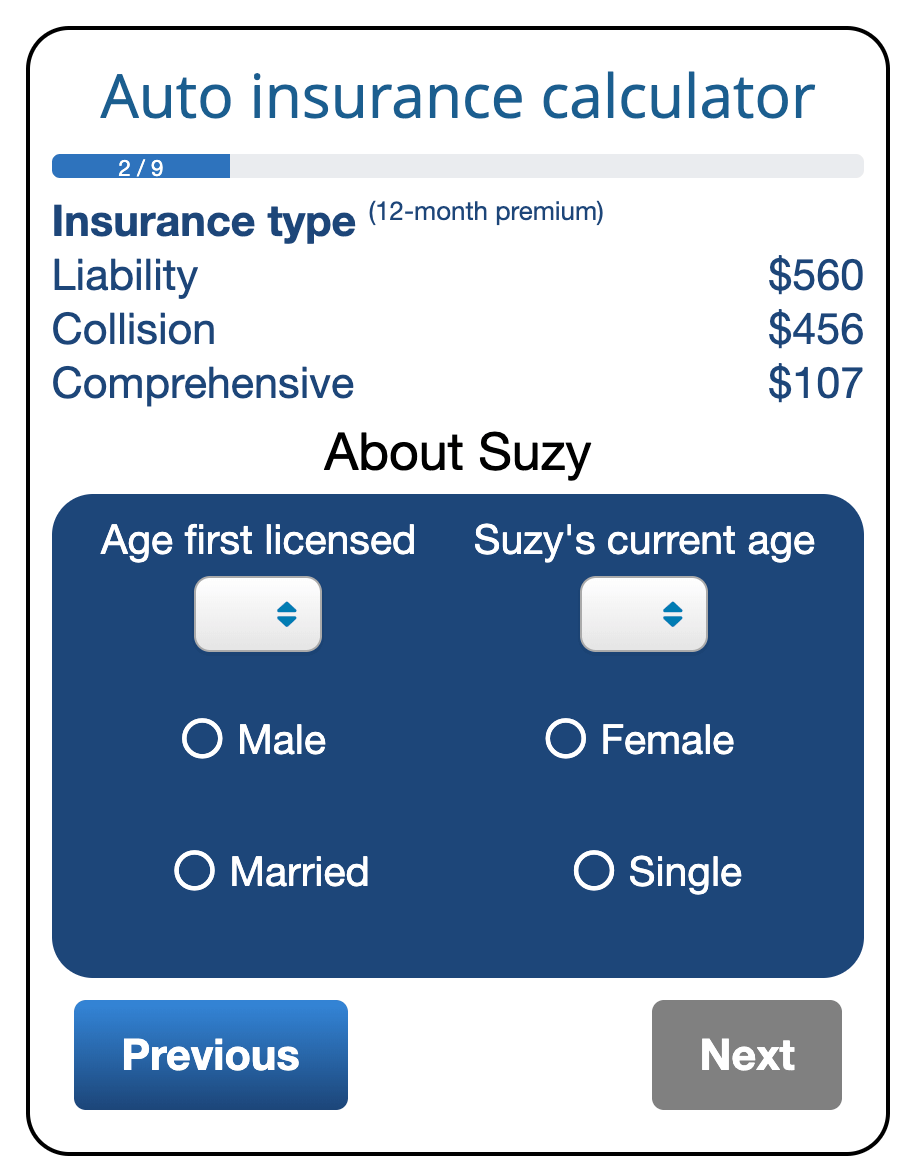

The difference in costs between teenage drivers and female drivers is easy to explain. Men pay significantly more for car insurance than women in their teens, while women pay slightly higher premiums in later years. On average, we found that men pay $ 720 a year for car insurance, while women pay $ 739 a year.

Can a UK resident drive a French registered car in France? This may interest you : 96% of American drivers do not understand their car insurance policies.

If you are moving to France from another European country, then you are allowed to drive a foreign vehicle (registered in your home country) for up to six months before it is officially registered in France.

Does French car insurance cover me in UK?

Coverage for expatriates living in France Sterling can provide a vehicle registered in the UK whether you have retired to France or moved there for work. We can also arrange coverage if you plan to drive to additional European countries and even further.

Can I drive in the UK with a foreign insurance?

If you have a ‘country-specific’ driving license, you can use it in the UK for up to 12 months, but then you will have to exchange it for a UK license. If you apply within five years of becoming a UK resident, you will not be required to take a UK driving test.

Can insurance companies discriminate based on gender?

The Affordable Care Act (ACA), or Obamacare, prohibits discrimination based on sex, including discrimination against transgender people, by most health care workers and insurance companies, as well as discrimination based on race, national origin, age, and disability.

Can car insurance companies discriminate based on gender?

Types of discrimination in insurance that are not allowed On the other hand, insurance companies are not allowed to discriminate on the basis of socially unacceptable factors, such as race, gender and religion. Some other examples of socially unacceptable factors include: National origin.

Can insurance companies ask for gender?

Car insurance companies usually look for the “gender” of the candidate during the application process and may ask the applicant to choose between only “male” and “female”. Gender identity can be complex and fluid, so it may be impossible for some drivers to answer these questions.

Does insurance depend on gender?

Men and women generally pay about the same amount for car insurance. For typical adult drivers, we found only a small difference between the insurance costs between men and women. We found a price difference of less than 1% between men and women in their 30s.

Does gender affect life insurance?

Men can pay thousands of dollars more than women for life policy. Why is there a difference? Men are considered at higher risk. Men die younger and are more prone to riskier jobs and lifestyles.

Are men better drivers?

Compared to women, male car and van drivers were involved in twice as many fatal accidents.

Do men drive more often? Overview. Every year, many more men than women die in traffic accidents. Men tend to drive more miles than women and are more likely to engage in risky driving procedures, including not wearing seat belts, driving under the influence of alcohol, and speeding.

Are taxes higher in France or us?

The United States has the highest tax rate of 39.6% since 2016. In France, the highest tax rate is 50.2% since 2016.

Are taxes higher in the US or Europe? Key Takeaways. Overall, Europe has lower living costs due to lower health care costs, a weakening euro currency and low inflation. Europeans, however, tend to pay more of their tax revenue, and average wages are usually lower than in America.

What is the tax rate in France compared to us?

| Gross salary | After taxes | Tax rate |

|---|---|---|

| 28,000 € | € 19,294 | 31.8% |

| 45,000 € | € 26,616 | 41.2% |

| 113,000 € | 45,945 € | 59.4% |

How much does the average person pay in taxes in France?

In France, the average single faced a net average tax rate of 27.3% in 2020, compared to the OECD average of 24.8%. In other words, in France, the salary of the average single worker, after taxes and benefits, was 72.7% of their gross salary, compared to the OECD average of 75.2%.

Do the French pay high taxes?

That is why France is still among the OECD countries with the highest tax rate. Taxes make up 45% of GDP compared to 37% on average in OECD countries. The total rate of social security and taxes on the average wage in 2005 was 71.3% of gross wages, the highest rate in the OECD.

Do the French pay high taxes?

That is why France is still among the OECD countries with the highest tax rate. Taxes make up 45% of GDP compared to 37% on average in OECD countries. The total rate of social security and taxes on the average wage in 2005 was 71.3% of gross wages, the highest rate in the OECD.

Do French people pay a lot of taxes?

2. Exemption thresholds 2022 (income from 2021) In practice, only 44% of the population of France pay any income tax at all; only about 14% pay at the rate of 30%, and less than 1% pay at the rate of 45%. Thus, 56% of the population does not pay income tax.

How much does the average person in France pay in taxes?

In France, the average single faced a net average tax rate of 27.3% in 2020, compared to the OECD average of 24.8%. In other words, in France, the salary of the average single worker, after taxes and benefits, was 72.7% of their gross salary, compared to the OECD average of 75.2%.

What countries have higher taxes than the US?

Top 10 Countries with Highest Income Tax Rates – Trade Economy 2021:

- Ivory Coast – 60%

- Finland – 56.95%

- Japan – 55.97%

- Denmark – 55.90%

- Austria – 55.00%

- Sweden – 52.90%

- Aruba – 52.00%

- Belgium – 50.00% (equal)

Is the US the most taxed country?

It compares how much money is allocated for taxes in the country with the economic production of the country. According to this measure, the United States has the fourth lowest tax burden of any OECD country, and only South Korea, Chile and Mexico are lower.

Does the US have high taxes compared to other countries?

How are US taxes compared internationally? Total U.S. tax revenue was 24 percent of gross domestic product, well below the weighted average of 34 percent for other OECD countries. Total U.S. tax revenue was 24 percent of gross domestic product, well below the weighted average of 34 percent for other OECD countries.