Why does my car insurance change every month?

Contents

- 1 Why does my car insurance change every month?

- 2 Why do insurance companies take rate increases?

- 3 Do insurance rates go up after no fault accident?

- 4 What makes car insurance go down?

Changes to your life, driving record or auto insurance policy can affect rates, but they are not the only factors. This may interest you : Will Geico lower my rate?. More vehicles are on the road and drivers are distracted behind the wheel, which leads to more accidents, more serious damage and injuries, and increased claims.

Why did my car insurance go up when nothing changed? Your new zip code may have higher crime rates or be more densely populated, both of which can affect your premiums. Sometimes, even if nothing in your life has changed, your insurance premiums can still go up due to factors totally out of your control.

Why do car insurance rates change?

Since car insurance is designed to pay for costs after an accident – including property damage and medical costs – anything that increases those costs is likely to drive up rates. On the same subject : Which is a type of insurance to avoid?. Insurers need to ensure they have enough funds to pay claims so that when inflation hits car insurance rates will be affected.

Why do car insurance rates go up every year?

Rate level increases occur when an insurance company discovers that its overall rates are too low, given the expenses (losses) incurred on recent claims that have been submitted and industry trends towards more expensive repairs and medical costs.

What makes insurance rates go down?

Common Reasons Why Car Insurance Rates Decrease Car insurance costs often decrease for the following reasons: You get older. You drive safely for three years after an accident or other infraction. You change insurers.

Why do car insurance rates fluctuate?

Car accidents and traffic violations are common explanations for the insurance rate increase, but there are other reasons car insurance premiums increase, including a change of address, a new vehicle, and claims to your zip code.

Why does my car insurance keep going up every month?

Rate level increases occur when an insurance company discovers that its overall rates are too low, given the expenses (losses) incurred on recent claims that have been submitted and industry trends towards more expensive repairs and medical costs. To see also : Will Geico Drop me after 2 accidents?.

Why does my car insurance go up every month?

Even drivers with a clean record can see an increase in their insurance renewal price. As mentioned above, automatic rate increases are sometimes based on factors outside of your control, such as claims in your zip code. Or, if you’ve added a new driver or vehicle to your policy, your rate may also increase at the time of renewal.

Why does my car insurance keep fluctuating?

Car insurance rates fluctuate frequently for a variety of reasons. These reasons include your driving record, drivers on the policy, vehicles on the policy, state laws, and the accidents and crimes in your area. Driving Record – Your driving record is a major contributor to higher fees.

Why does my auto insurance go up every 6 months?

Increases in auto insurance rates are usually related to increases in the insured’s insurance risk. But another reason Progressive might raise rates after 6 months is that insurance costs across the market have been increasing over time. … You have moved to a more densely populated area (considered higher risk).

Why does my car insurance keep going up every 6 months?

Increases in auto insurance rates are usually related to increases in the insured’s insurance risk. But another reason Progressive might raise rates after 6 months is that insurance costs across the market have been increasing over time.

Is it normal for car insurance to go up every year?

Annual increases are very common across the industry, but how your risk factors are viewed by any particular company can vary. To ensure you’re not paying too much, you should know your coverage and discounts to ensure you’re getting the best price for the coverage you need.

Why did my auto insurance go up for no reason?

Car accidents and traffic violations are common explanations for the insurance rate increase, but there are other reasons car insurance premiums increase, including a change of address, a new vehicle, and claims to your zip code.

Does car insurance lower every 6 months?

Evaluating your insurance policy every six to 12 months will update potential discounts and coverage options such as collision and comprehensive that will match the decreasing value of your car.

Why do insurance companies take rate increases?

Since car insurance is designed to pay for costs after an accident – including property damage and medical costs – anything that increases those costs is likely to drive up rates. Insurers need to ensure they have enough funds to pay claims so that when inflation hits car insurance rates will be affected.

Why do insurers charge different rates? Car insurance premiums can vary significantly between insurers due to the rating factors they use, the statistical information they analyze, their own claims experience and the cost of doing business.

Americans spend a huge amount on healthcare every year, and the cost keeps rising. In part, this increase is due to government policy and the start of national programs like Medicare and Medicaid. There are also short-term factors like the 2020 financial crisis that drive up the cost of health insurance.

Typically, the premium amount increases on average by about 8% to 10% for each year of age; it can be as low as 5% per year if you are 40 years old and as high as 12% per year if you are over 50 years old. With life insurance, your premium is set when you buy a policy and stays the same each year.

Here are some reasons why car insurance premiums go up. more risk for insurers. If there has been an increase in car crime, road fatalities, weather events or other factors you can complain about, it increases the risk to the insurer. As such, they can raise premiums to protect themselves.

What does increase in insurance rates mean?

Your auto insurance company increased your rates because you had an accident or received a fine. Your car insurance may increase if you are involved in an accident — whether or not you caused it. Your rates can also go up if your insurance company finds out that you’ve received a speeding ticket or other traffic ticket.

What does higher insurance rate mean?

In short, the cleaner your driving history, the better your insurance rate. If you’ve had accidents or serious violations—such as a DUI or DWI conviction, too many fines in a short period of time, or driving without insurance—insurers will consider you a high-risk driver and charge you a higher premium.

What does it mean to rate insurance?

Rating — determining the amount of premium to be paid to insure or reinsure a risk. Guaranteed cost rates are fixed over the term of the policy.

What does it mean for insurance to go up?

In general, when you make a claim against your insurance policy above a specific amount due to an incident that is primarily your fault, an insurer will increase your premium by a certain percentage.

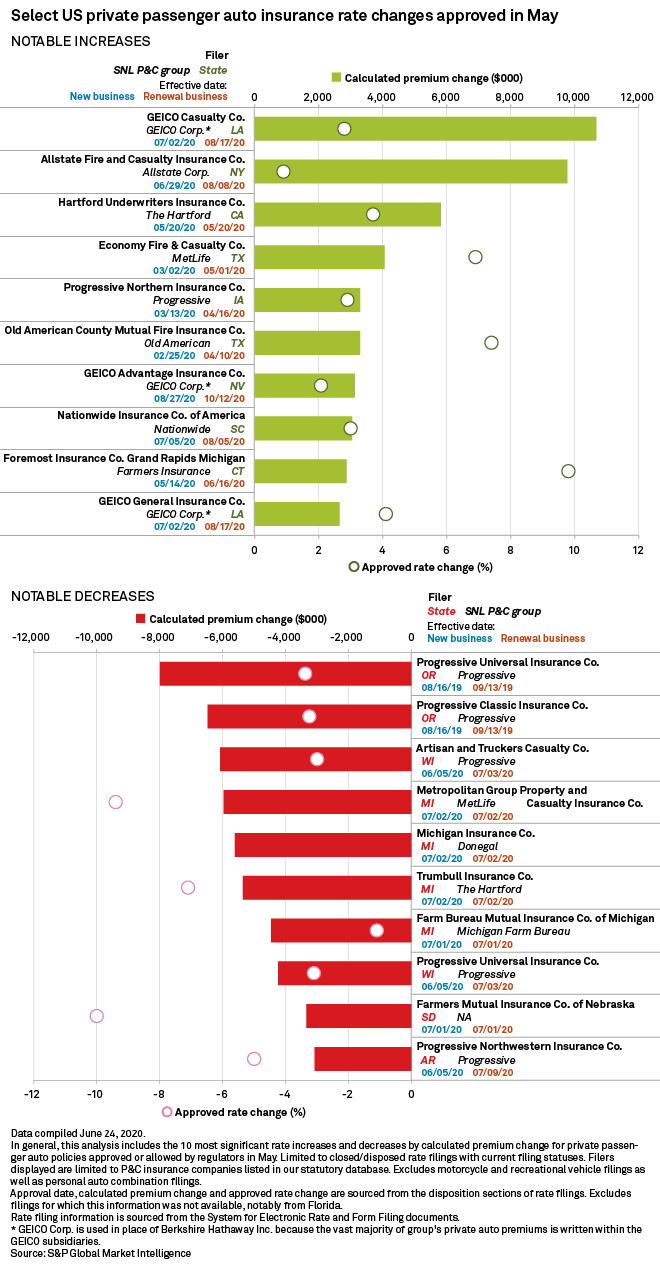

Why does Allstate keep raising rates?

Allstate is raising its auto insurance rates “almost everywhere” and focusing on increasing returns in this part of its business in response to a decline in net income in the third quarter of 2021, company officials told analysts during a press conference. results conference call. Thursday morning.

Why did my Allstate payment go up?

Allstate’s average car insurance premium has increased by 2.8% from 2018 to 2019, and Allstate’s rates have increased by about 25% since 2012. Allstate individual premiums may increase after policy renewal due to driver actions, such as getting into an accident through fault or receiving a speeding infraction.

Why did my auto insurance go up for no reason?

Car accidents and traffic violations are common explanations for the insurance rate increase, but there are other reasons car insurance premiums increase, including a change of address, a new vehicle, and claims to your zip code.

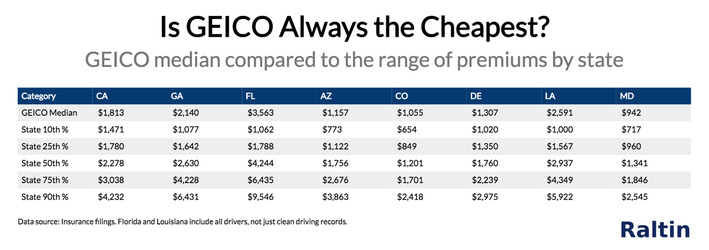

Why is my Allstate quote so high?

Allstate is so expensive because of agent commissions and rising costs for insurance companies. At $954 per year, the average Allstate car insurance policy is more expensive than the national average of $720 for a policy with minimal coverage.

Do insurance rates go up after no fault accident?

Unfortunately, it does. In many cases, your premiums will increase after you file a no-fault claim with your insurance provider. This is because certain circumstances surrounding the accident, even if it was not your fault, can lead to more accidents in the future.

Does Progressive Insurance offer accident forgiveness? Progressive provides accident forgiveness and is automatically included in your auto insurance policy for certain accidents in most states. Progressive offers two types of accident waivers, and eligibility depends on how long you’ve been a Progressive customer.

Will my insurance go up even if it wasn’t my fault?

On average, a no-fault accident causes insurance costs to rise by about 12%, compared to 45% for a no-fault accident. Insurance rates can go up after a no-fault accident because statistics show that having any accident on your driving record makes you more likely to file a claim in the future.

Do I pay deductible if not at fault Geico?

That means you can use it whether you’re at fault or not. Unlike some coverages, you do not select a collision limit. The most he will pay is based on the actual cash value of your vehicle. You will be responsible for paying the selected deductible.

Does your insurance go up if its someone elses fault?

If a car accident is not your fault, your insurance rate could still go up, depending on your state and insurance company. On average, a no-fault accident causes insurance costs to rise by about 12%, compared to 45% for a no-fault accident.

Does Geico go up after 6 months?

Does Geico increase fees after a claim? Geico does not always increase your premium if you file a claim. They’ll consider your driving history, the number of claims you’ve had in the past, the payment amount and type of claim, and whether you qualify for an accident waiver before raising your rate.

How long does an accident stay on Progressive Insurance?

An accident stays on your Progressive insurance record for 3 to 5 years. Progressive accident factors into your insurance premium for the first 3 years. At this point, the accident no longer affects your premium, but it will still appear on your record and may affect your eligibility for certain discounts.

What is the accident forgiveness program?

What is Accident Forgiveness? Accident Forgiveness is additional coverage that you may qualify for and that can be added to your auto insurance policy, where your price will not increase due to your first accident. You may be eligible for this benefit if you have 5 years of accident-free driving.

Does Progressive have first time forgiveness?

Progressive forgives minor accidents (less than $500 in damages) automatically for customers in its loyalty program. (Enrollment is automatic in states where it is available.) After five years with the company, Progressive forgives the first accident with damages greater than $500 for program customers.

Does Progressive increase rates for not-at-fault?

No-Fault Accidents It may seem unfair, but accidents that are not your fault can still increase your rate in certain states. However, they may not cost as much as failed accidents.

How does car insurance work when you are not at fault Progressive?

Who pays my deductible if it’s not my fault? If someone else is found to be at fault for the accident, we will work with you to ensure that they or their insurance company pays for your damages and losses and recovers any money you may have paid for your deductible or repairs.

What makes car insurance go down?

Your age, driving history, credit score, address, occupation and car use can all affect the cost of insuring your car. You may see your car insurance decrease with age – particularly between the ages of 18 and 25 – if your insurance company offers age discounts.

What can help reduce your car insurance? Listed below are other things you can do to reduce your insurance costs.

- Shop around. …

- Before buying a car, compare insurance costs. …

- Ask for higher deductibles. …

- Reduce coverage on older cars. …

- Buy your real estate and auto coverage from the same insurer. …

- Maintain a good credit history. …

- Take advantage of low mileage discounts.

What would cause a person’s car insurance rates to decrease?

Your rates will be lower if you keep your record free of accidents, speeding tickets and other infractions. Pay the bills on time. In most states, having a good credit history can save you hundreds of dollars a year on car insurance compared to a driver with bad credit. Choose your vehicle well.

What can impact an individual’s insurance rating?

Your gender, age, marital status, geographic location and credit score affect your insurance rates in different ways. Young men generally incur higher rates than young women, as statistically, more male adolescents have accidents than female adolescents. However, older men generally have better rates than older women.

What makes your car insurance go down?

Your age, driving history, credit score, address, occupation and car use can all affect the cost of insuring your car. You may see your car insurance decrease with age – particularly between the ages of 18 and 25 – if your insurance company offers age discounts.

What factors can lower or increase insurance rates?

The biggest factors that affect car insurance rates are state, age, and car make and model coverage requirements. The more coverage you need to buy in your state and the more valuable your vehicle is, the more you will pay for car insurance.

How does car insurance go down?

Your age, driving history, credit score, address, occupation and car use can all affect the cost of insuring your car. You may see your car insurance decrease with age – particularly between the ages of 18 and 25 – if your insurance company offers age discounts.

How long does it take before car insurance goes down?

It takes 3 to 5 years for car insurance to fall out after a faulty accident in most cases. Three years is a common penalty period for property damage claims. Insurers penalize drivers longer for accidents that cause serious bodily harm or result from reckless or drunk driving.

Do car insurance payments go down?

When do car insurance premiums drop? From 16 to 25, your car insurance rates will steadily drop each year you keep your driving record clean. Car insurance rates drop at age 25 by a large margin. Rates then decline slowly but surely until age 65, before rising again.

What factors affect price of car insurance?

The biggest factors that affect car insurance rates are state, age, and car make and model coverage requirements. The more coverage you need to buy in your state and the more valuable your vehicle is, the more you will pay for car insurance.

If your credit score drops due to increasing debt, decreasing income, missed or late payments, too many credit inquiries, or some other reason, your insurer may choose to increase your premiums to protect yourself.

What will increase my car insurance?

Car accidents and traffic violations are common explanations for the insurance rate increase, but there are other reasons car insurance premiums increase, including a change of address, a new vehicle, and claims to your zip code.

Why does car insurance keep increasing?

These reasons may include having made a new claim or having a traffic violation added to your driving history, adding or changing a vehicle, adding or changing a driver, and increasing your coverage amount.