24 auto insurance discounts worth asking about your insurance today

24 car insurance discounts worth asking about your insurance today

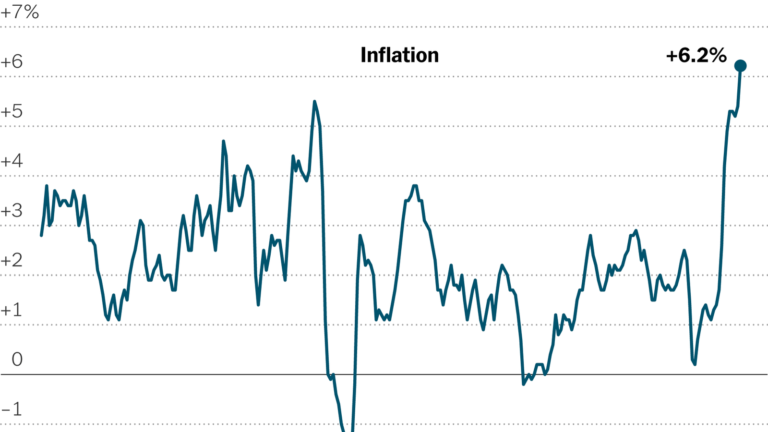

With high inflation and rising interest rates, it can feel impossible to save money. But when every dollar counts, reevaluating where and how much you spend each month can go a long way.

One of the areas where you may be able to cut costs is your car insurance payments and we have found a number of ways to save on your premiums.

Several of America’s largest auto insurers offer discounts for all sorts of reasons from being a loyal customer to driving safely.

We’ve collected information from the 10 largest insurance companies in the United States (Allstate, Farmers, American Family, Geico, Travelers, USAA, State Farm, Nationwide, Liberty Mutual, Progressive) and compiled discounts into one list so you don’t have to.

To make every dollar count, make sure you’re getting every discount you’re eligible for.

Don’t miss

Contents

- 1 Don’t miss

- 2 1. Multiple policy discount

- 3 2. Multiple vehicle discount

- 4 3. Sign up early

- 5 4. Paying in full discount

- 6 5. Pay electronically or sign up online discount

- 7 6. New car discount

- 8 7. Responsible payer discount

- 9 8. Loyalty discount

- 10 9. Switching providers discount

- 11 10. Good driving discount

- 12 11. Seat belt discount

- 13 12. Auto safety features discount

- 14 13. Young volunteer

- 15 14. Student discount

- 16 15. Student living away discount

- 17 16. Family discounts

- 18 17. Homeowner discount

- 19 18. Driver education discount

- 20 19. Defensive driver discount

- 21 20. Program discount

- 22 21. Lower mileage

- 23 22. Alternative fuel discount

- 24 23. Military discount

- 25 24. Affinity discount

- 26 What to read next

- 27 What is the number to Geico customer service?

- 28 What to do after an accident that is your fault?

- 29 Is Progressive owned by Geico?

- 30 Is Progressive Insurance Worth?

Many Americans still lack affordable auto insurance This may interest you : Car insurance won’t pay because….

A TikToker paid off $17,000 in credit card debt with ‘cash-out’ – can it work for you?

What do Ashton Kutcher and a Nobel Prize winning economist have in common? An investment app that converts spare change into portfolios

1. Multiple policy discount

Offered by: Allstate, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Advance, State Farm, Travelers, USAA See the article : The states where motorists pay the most for car insurance.

It is one of the biggest discounts offered by insurers.

If you have multiple policies with coverage, such as home, auto, small business, renters or home insurance, you will get a better rate.

With some providers, you can save up to 13% when you book your insurance.

2. Multiple vehicle discount

Provided by: American Family, Farmers, Geico, Liberty Mutual, Progress, State Farm, Travel, USAA On the same subject : Is comprehensive insurance full coverage?.

If you have more than one car that needs insurance you may qualify for a big discount. Most major lenders will offer you a discount if you own multiple vehicles from the same company.

For example, Geico will give you up to 25% off most auto insurance policies when you add two or more cars to your coverage.

3. Sign up early

Offered by: American Family, Allstate, Liberty Mutual, Travelers

If you are looking for a new provider or policy, make sure you sign up before your current policy expires, it could save you a lot.

Switching to a new company before your current policy expires, or at least 7 days before you need the new policy to take effect, will qualify for a discount.

How much you’ll save may depend on where you live, but if you’re looking for a change, this is an easy win.

4. Paying in full discount

Offered by: Allstate, American Family, Farmers, Advance, Travel

Being prepared to pay the full cost of the policy up front can actually save you money.

Several insurers will give you a discount if you pay your entire premium at once at the time of purchase instead of paying in installments.

It can be a big upfront cost, but it can save you up to 10% overall.

5. Pay electronically or sign up online discount

Offered by: Allstate, American Family, Farmers, Liberty Mutual, Nationwide, Progressive, Travel

Signing up to pay your bills automatically is convenient and can save you a lot of money.

Many insurance providers have automatic payment systems and will offer discounts when you sign up for paperless payments.

6. New car discount

Offered by: Allstate, Geico, Travelers, USAA

There are benefits to owning a new car beyond the smell.

Several providers will offer discounts on your insurance if you are the first owner of your car, if your car is a current model or less than three years old.

7. Responsible payer discount

If you pay your insurance bill on time each month, and have not received a non-payment notice in the last year, then you are likely to qualify for this discount.

Check with your provider when you renew your policy to make sure the discount has been applied.

8. Loyalty discount

Insurance: American Family, Travelers, USAA

Being honest with your insurance provider can save you some money.

The amount of discount you will receive depends on how long you have been with the company and whether you have any gaps in your time as a customer.

And you can get additional discounts from American Family for being a second generation customer. If your parents are also with the company, you can save.

9. Switching providers discount

Insurance: American Family, Progressive, USAA

Unlike saving because you’ve been with a company for a long time, you can save if you switch to the competition.

The amount of the discount may depend on the state you live in or how long you have been with your previous provider.

If you are comparing providers, be sure to ask if they offer any such incentives.

10. Good driving discount

Offered by: Allstate, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Advance, State Farm, Travelers, USAA

A clean driving record is one of them

Most major car insurance providers will offer you a discount for being a good driver.

For example, if you haven’t had an accident in five years, you can get up to 22% with Geico.

11. Seat belt discount

At least one insurance will give you a discount if you and everyone in your car always drive up.

At Geico, you can get discounts on the medical expenses or personal injury portion of your premiums.

12. Auto safety features discount

Offered by: American Family, Geico, USAA, State Farm, Allstate, Farmers, Liberty Mutual

Does your car have airbags? What about anti-lock, or anti-theft systems? Daytime running lights? These tips can save you money on several insurances.

You can get up to 40% discount on your health related insurance.

You may have to prove that you have certain methods.

13. Young volunteer

Insurance premiums tend to be higher for younger drivers, luckily there are smaller discounts for them.

Giving back to your community can also save you money when it comes to your car insurance.

You can save money with at least one provider if you are under 25 and do 40 hours of volunteer work a year at a non-profit organization.

14. Student discount

Offered by: AllState, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Advancement, Travel, USAA

Here’s one more reason to study, most lenders will offer you a discount to boost your score.

As long as you’re under 25 and maintain at least a B average, you’re likely to qualify for this discount.

Getting on the Dean’s list or in the top 20% of your class can help you save up to 15% on your insurance premiums.

15. Student living away discount

Provided by: American Family, Farmers, Mutual Freedom, Progress, Travelers

Moving your child to school can be difficult but it can save you money on your car insurance policy.

If your child is still on your policy, under the age of 25, lives more than 100 miles away and only occasionally drives your car, then you may qualify for a discount.

16. Family discounts

Provided by: Farmers, Development, State Farm

Young drivers are usually more expensive to insure, but some providers will help you save on that.

Some providers will offer discounts for having a teenager, new driver or driver under 25 on your policy.

Are your kids asking to use the car all the time? If you have at least one driver in your household under the age of 20 and you have active drivers, you can get a discount that applies to each vehicle on your policy.

17. Homeowner discount

Insurance: Farmers, Liberty Mutual, Development, Travel

Home ownership comes with many benefits and one of them is getting cheap car insurance.

Many providers will give you a discount for owning a home or condo even if the home is not insured with that company.

18. Driver education discount

Provided by: Geico, Travelers, USAA

Here’s an example where a little education can go a long way.

If you have a young driver on your policy make sure they have done driver’s education training. If you, or the driver on your policy, have completed an approved education course, you may receive a discount.

19. Defensive driver discount

Provided by: American Family, Farmers, Geico, Nationwide, State Farm, USAA

If you are over 55 you may want to consider doing a driving course. Many of the courses can be done online.

Not only will it help you hone your skills, it can save you money from several insurance providers.

How much you save after completing the course depends on the state you live in.

20. Program discount

Offered by: American Family, Liberty Mutual, State Farms, Travelers

Several of the major providers will offer discounts if you sign up and qualify for certain programs, such as Know Your Drive and Intel-Drive Drive.

However, some of these programs capture your driving data, and if you do it unsafely, it could result in you paying more for your insurance.

21. Lower mileage

Offered by: American Family, Nationwide, USAA

You don’t have to do much to get this discount, the less you drive the less you pay.

Several providers will offer discounts for low mileage, which is less than 7,500 miles per year, according to American Family.

Plus, if you’re saving your car you can get up to 60% off with USAA.

22. Alternative fuel discount

Going green can save you some green when it comes to your insurance.

If you’ve chosen a vehicle that runs on something other than gasoline, such as hybrid, electric or even propane, you’ll qualify for a discount.

For Farmers, the discount is only available in California.

23. Military discount

Provided by: Farmers, Geico, State Farm, USAA, Liberty Mutual

Members of the military, National Guard or Reserve, including retired members, will qualify for discounts from several major providers. At Geico you can get up to 15% off certain insurance rates.

You may also qualify for an additional 25% discount if you are part of an express activation. And if you are going to unload and store your vehicle, there are discounts available for that.

24. Affinity discount

Offered by: Farmers, Geico, Liberty Mutual, Nationwide, Travelers

Even if you are not in the military, there are still other discounts for other skills and connections you have.

For example, Travelers offers savings to members of certain businesses and credit unions, while Geico has discounts for federal employees and a list of more than 500 groups that qualify for savings.

What to read next

Mitt Romney says the billionaire tax will stimulate demand for these two physical assets – get in now before the super-wealthy flood.

High rates, rising interest rates and a volatile stock market – here’s why you need a financial advisor as the recession hits.

You can be the owner of Walmart, Whole Foods and Kroger (and collect the fat store income every quarter)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

What is the number to Geico customer service?

How do I cancel my GEICO complaint? You can cancel a Geico claim online, using the Geico mobile app, or by calling (800) 207-7847. But if you file a claim with Geico, or another insurance company, the accident and attempted claim will still appear on your driving record.

How do I change my GEICO payment method?

Remember, you can change your payment plan or payment methods at any time. Just call (800) 932-8872 to discuss your options with a GEICO customer service representative.

What forms of payment does GEICO accept?

Payment options at Geico are check, debit, or credit card. Geico customers can also set up direct payments using a credit card, debit card, or bank account using Electronic Funds Transfer (EFT).

Can you skip a payment with GEICO?

Geico has a nine-day grace period if you can’t make your payment on time. After that, your policy can be deleted. Geico does not have a late fee, but if you miss a payment, they will send a formal notice of cancellation within 14 days of the original date.

Can you pay your car insurance with a credit card?

Yes, you can generally pay for your car insurance with a credit card and doing so can lead to special benefits such as cash back or other credit card benefits. Due to the prevalence of insurance programs and e-commerce, credit card insurance coverage is common.

How do I talk to a real person at GEICO?

(800) 841-2964.

How do I send a message to GEICO?

Text HELP 43426 for help or email us at texthelp@geicomail.com Please review our Terms and Conditions.

How do I escalate an issue with GEICO?

The main customer support number is (800) 207-7847. From the Contact Us page, select “Geico Experience” from the drop-down menu and fill out the form provided. The company usually responds to email complaints within 48 hours.

Does GEICO have local agents?

Yes GEICO sells its products through exclusive GEICO Agents. These agents sell GEICO products and partner company products only. GEICO Local Agents are not authorized to represent other insurance companies that compete with GEICO and its affiliates in any way.

How much does a GEICO local agent make?

The average GEICO Insurance agent annual salary in the United States is approximately $55,800, which is 11% below the national average. Salary information comes from 2,249 data points collected directly from employees, users, and former and current advertisers of Reality over the past 36 months.

How do I speak to a human at GEICO?

At GEICO we always strive to address your questions and concerns as quickly as possible. (800) 841-2964.

What to do after an accident that is your fault?

What happened and who is to blame is for the insurance companies or the police to decide.

- Stop the car as soon as possible Make sure you turn on your hazard lights if possible.

- Make sure you and your passengers are OK. …

- Try to calm down. …

- Exchanging details of anyone involved; …

- Look at the scene of the accident.

Should you admit it was your fault in a car accident? Don’t Admit Fault in a Car Accident. Even if the accident appears to be your fault, never admit fault after being in a car accident. Admitting fault puts you at risk of not receiving any compensation you may otherwise be entitled to.

What happens after a fault?

Aftershocks are the most common aftershocks. The stress on a main shock fault changes during the main shock and most aftershocks occur on the same fault. Sometimes the change in stress is enough to trigger tremors behind nearby faults as well.

What are the 3 parts of a fault?

Fault Components The main fault components are (1) the fault plane, (2) the fault trace, (3) the hanging wall, and (4) the footwall.

What happens to faults over time?

Most faults in the Earth’s crust do not move for long. But in some cases, the rock on both sides of the fault gradually changes over time due to tectonic forces. Earthquakes are usually caused when the underground rock suddenly breaks and there is rapid movement along the fault.

What happens when fault suddenly?

An earthquake is caused by a sudden fault. Tectonic plates are always moving slowly, but they are stuck at their edges due to friction.

What should you not say after an accident?

Don’t say “I’m sorry†DON’T say it! A simple “I’m sorry†can be used to show that you have admitted guilt and responsibility for the accident. Even if you mean “I’m sorry you’re late for work” or “I’m sorry you’re hurt” try to avoid using the words “I’m sorry”.

Why you shouldn’t say sorry after a car accident?

But even if you think you were at fault, never apologize at the scene of the accident. It can be used as evidence against you as you file your case in the coming days and weeks, and give the insurance company a valid reason to deny your case, delay your case, or pay less for your case.

Should you apologize after a car accident?

Never apologize or admit fault: Determining who is at fault after an accident is a job best left to a personal injury attorney. Your duty at the time is to call law enforcement and assist the injured parties. Never leave the scene: Not only can this jeopardize your case, but it is also illegal in many jurisdictions.

What should you not say when making an insurance claim?

Never say you are sorry and never admit any kind of wrongdoing. Remember that claims adjusters are looking for reasons to reduce the insurance company’s liability, and any admission of negligence can seriously damage the claim.

Can you claim even if it was your fault?

To claim compensation you will need to show that the accident was the fault of another person or organisation. If the accident was entirely your fault you will most likely be able to make a claim. If you were partially at fault, however, you may be able to make a complaint.

Is Progressive owned by Geico?

Geico does not have Progressive. Berkshire Hathaway owns Geico, while Progressive Corporation is an independent company. Progress is the second largest auto insurance company in the United States, according to the NAIC.

Which company has progress? Progress belongs to its shareholders, as it is a publicly traded company. The largest shareholders are the Vanguard Group, BlackRock Fund Advisors, and Wellington Management, which have a combined ownership stake of approximately 20%, according to public records, as of Q1 2021.

Does Allstate own progressive?

No, Progress and Allstate are separate companies. Progressive Corporation and Allstate Corporation are both independent, publicly held companies.

Who is cheaper Allstate or Progressive?

Overall, Progressive tends to be cheaper than Allstate, with an average of $1,334 and $1,788, respectively. In fact, Allstate has the highest average rating of any other auto insurance company in our rankings.

What other companies does Allstate own?

Allstate Non-Insurance, Inc. Allstate Enterprises, Inc. Northbrook Services, Inc. Sterling Collision Centers, Inc. Tech-Cor, Inc.

Who is Allstate merging with?

Allstate agreed to acquire SafeAuto in a deal valued at $300 million, including a $270 million sale price plus approximately $30 million in upfront dividends on certain uninsured assets.

Who bought GEICO?

GEICO is a subsidiary of Berkshire Hathaway that provides insurance for more than 24 million vehicles owned by more than 15 million policyholders as of 2017. GEICO writes private passenger car insurance in all 50 states of the United States and the District of Columbia.

Why did Warren Buffett buy GEICO?

Buffett was so impressed with Geico’s model (which involved direct marketing to low-risk customers, rather than through insurance agents) that when he returned to Omaha later that year, he “focused solely on Geico.”

When did Warren Buffett buy GEICO?

1996 â Warren Buffett buys outstanding GEICO stock, making GEICO a subsidiary of Berkshire Hathaway, Inc.

Who owns Geico Insurance 2020?

What is the relationship between Berkshire Hathaway? In 1996, GEICO became a wholly owned subsidiary of Berkshire Hathaway, headed by Warren Buffett, one of the country’s most successful investors.

Is Progressive Insurance Worth?

Progressive received an overall satisfaction score of 76 out of 100 from its customer pool, in a NerdWallet survey conducted online in July 2021. For this review, the average score of the seven insurers was 79, and the highest was 83.