Auto insurance prices rise 25% in 3 states in 2022, and experts say US drivers should brace for even more sticker shock in 2023 – here are 5 ways to cut your costs now

Three states saw auto insurance prices rise 25% in 2022 and experts say American drivers should prepare for even more sticker shock in 2023 – here are 5 ways to cut your costs now.

A perfect storm of inflation, rising interest rates and volatile gas prices have left many American drivers strapped for cash in 2022 — and rising car insurance prices they only added to the financial burden.

Nearly half (47%) of American drivers see their car insurance costs increase in 2022, according to a recent survey by insurance comparison website Insurify. For some riders, it’s been less of a streak and more of a giant leap. In three states – Oregon, Maryland and Virginia – drivers were hit with a 25% increase on their insurance bills.

Drivers in Utah, South Dakota, Minnesota, Wisconsin, Ohio and Tennessee fared little better, experiencing average price increases of 20-25% – and experts predict that insurance companies are not ready to hit the brakes on further increases across the country.

The good news is even if inflation continues to drive up taxes, there are ways to reduce the impact on your monthly budget.

Don’t miss

Contents [hide]

- 1 Don’t miss

- 2 How much you’ll pay in 2023

- 3 Shop around and compare coverage

- 4 Low-risk, high-reward driving behavior

- 5 Budget for a larger deductible

- 6 Consider a pay-as-you-go option

- 7 Research all the ways you can save

- 8 What to read next

- 9 Do insurance companies check your credit?

- 10 What are the two factors that would influence the cost of premiums?

- 11 What credit score do insurance companies use?

- 12 What other factors influence the rate someone pays for their car insurance List 3?

‘Hold on to your money’: Jeff Bezos says you might want to rethink buying a ‘new car, fridge, or whatever’ – here are 3 best recession-proof buys On the same subject : Car insurance costs keep rising and it’s likely to get worse – here’s why.

Insurance rates are rising faster than inflation in some states – are your finances keeping up?

Better than NFT: You don’t have to be ultra-rich to own a piece of Pablo Picasso. Here’s how to get into the art market

How much you’ll pay in 2023

The average annual cost of auto insurance in the United States jumped 9% to $1,777 in 2022, based on Insurify’s review of more than 69 million auto insurance quotes. Read also : GoAuto car insurance company, bought by a private equity firm in Pennsylvania.

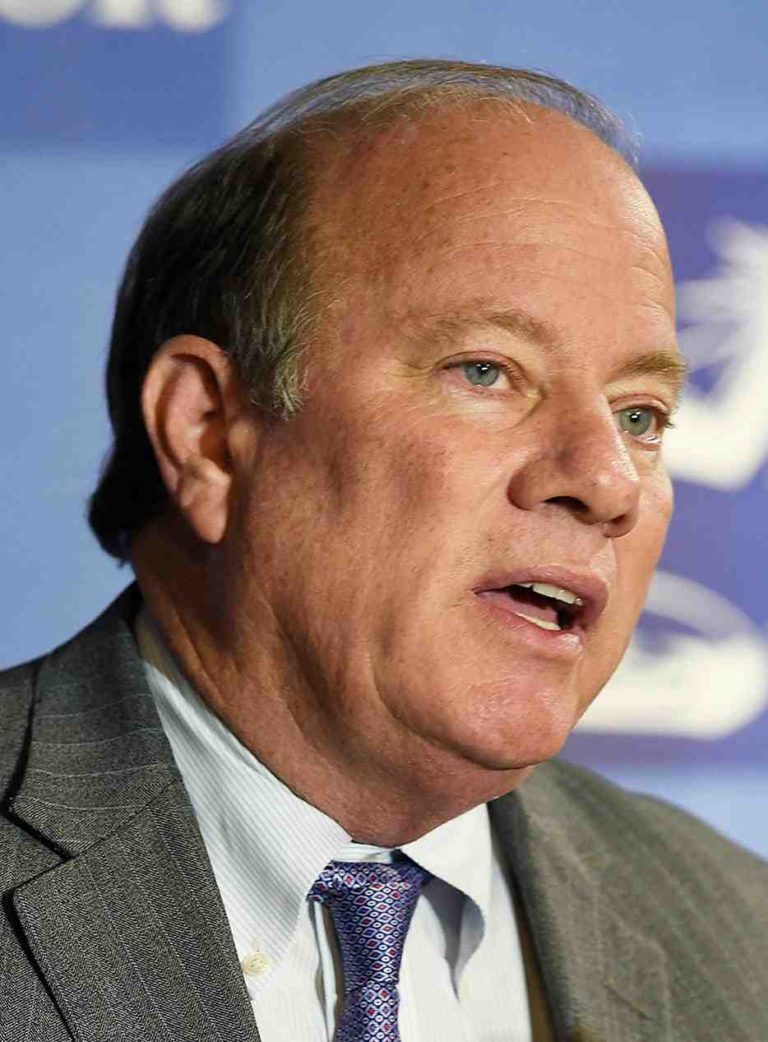

“There are two main ‘drivers’ for the spike in insurance rates: consumers are driving more, and cars are more expensive than ever to repair,” says Dan Roccato, professor of finance at the University of San Diego School of Business, in the Insurify report. “It’s hard to see how this is going to change until we solve our inflation problem.”

The company predicts that the average annual car insurance rate will increase by another 7% to $1,895 this year – and the prices may not stop there.

“The general consensus is that it will be eight to 12 months before rate increases begin to slow, and some think it could be several years before rates fully stabilize,” says Betsy Stella, Vice President of Insurance Partnerships. in Insurify, as part of the 2022 report.

If spiraling car insurance prices are already grinding your gears, here are five ways to boost your insurance costs.

Shop around and compare coverage

Can pay for shopping. If your policy is up for renewal and the cost has jumped significantly, you should consider getting at least three quotes from other insurance companies – just in case you can get a lower rate. This may interest you : Car Insurance to Grow 8.4% in 2023.

Drivers can shop online or get the help of a local insurance agent to find the best deals where you live – but remember, cheap doesn’t always mean good when it comes to car insurance.

Make sure you aren’t cutting corners with coverage that will leave you paying a lot more out of pocket when you need to make a claim.

Getting a vehicle appraisal to understand what your car is worth and how much it would cost to repair or replace is important when thinking about how much insurance coverage you need to buy.

If your car is old and worth less than 10 times the cost of your insurance, the Insurance Information Institute suggests dropping collision or comprehensive coverage to save money.

Low-risk, high-reward driving behavior

Safe driving protects you, other people on the road, and your wallet.

According to Insurify, having just one offense on your driving record can increase the price of your car insurance by an average of 34%. If you have a more serious violation on your record, such as a DUI, you may have to pay twice as much as someone with a clean driving record.

Many insurance companies will give you a discount if you have a history of no claims or no violations and do not pose a great risk to others on the road. If you’ve had a past accident, you can regain the trust of your insurer (and your chance of a discount) by participating in a vehicle safety or defense defense course.

READ MORE: Boomer’s remorse: Here are the top 5 “big money” purchases you’ll (probably) regret in retirement and how to make up for it.

Budget for a larger deductible

When you buy car insurance, you commit to a deductible, which is the amount of money you have to pay out of pocket before your insurance company will pay any expenses associated with a claim.

If you increase your deductible, you can lower your monthly bill substantially. But that means you need to make sure you have enough money set aside to pay the deductible in full if you need to file a claim.

Consider a pay-as-you-go option

With usage-based insurance or pay-as-you-go insurance, you pay for the driving you actually do — not the driving your insurance company thinks you do.

As part of the process for this type of coverage, the insurance company will have a plug-in device or mobile app that you use to monitor your driving habits, including how often and how far you travel, when you typically drive, and how . drive safely.

If the collected data works in your favor – for example, you make infrequent and short trips and always obey the speed limit – you can receive a discount from your insurance company.

But it works both ways. If you are regularly driving long distances and are heavy on the brakes, your insurance company could penalize you.

Research all the ways you can save

There are many discounts that drivers can access to lower the cost of car insurance.

Long-term loyal customers are often rewarded with a special price, such as those who insure more than one driver or car and those who combine (or bundle) their home and car insurance with the same company d insurance.

Certain groups such as students with good grades, and active, retired or reserved members of the military can also get discounts from many insurers – but qualifying rules vary by company.

Buying your insurance policy online, or using a payment method that is preferred by insurance companies – such as paying in a single sum – can also be savings.

Insurance companies like to understand your payment history and money management skills. Having a good credit score can help limit your car insurance costs because it indicates that you are a risk averse individual.

You can also invest in advanced security and anti-theft features, such as car alarms and LoJacks, which can reduce insurance costs in the long run.

What to read next

Americans are paying almost 40% more in home insurance compared to 12 years ago – here’s how to spend less for peace of mind * The US dollar has lost 98% of its purchasing power since 1971 – but this assets can protect your retirement.

It could be the owner of Walmart, Whole Foods and CVS (and collect the fat food revenue on a quarterly basis)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Do insurance companies check your credit?

Yes. A federal law, the Fair Credit Reporting Act (FCRA), states that insurance companies have a “permissible purpose” to view your credit information without your permission.

Can you be rejected for insurance because of your credit score? Auto insurers can use your credit history to help determine your rates on a new policy, but they can’t use it to deny your initial application, cancel a policy, refuse to renew your policy or increase your premiums during a renewal.

Do insurance companies do hard credit checks?

It is true that insurance companies check your credit score when they give you a quote. However, what they do is called a “soft pull” – a type of inquiry that won’t affect your credit score. You may see these questions on your personal credit reports, but that’s it.

Do insurance companies check credit?

If you are shopping for auto or home insurance, or if your current policy is due for renewal, your insurance company may be looking at your credit history. Here are some tips to help you understand how your credit information may be used and how it may affect your insurance premiums.

Do insurance companies do hard pull?

No, there is no “hard credit pull” when you get an auto insurance quote, so shopping around won’t impact your credit score. A bad credit usually happens when you apply for a loan, such as a mortgage or a credit card.

What credit score do insurance companies use?

Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit agencies – Experian, TransUnion or Equifax.

What credit score do car insurance companies use?

Key things to know about auto insurance scores Insurance scores are usually from Fair Isaac Corporation (FICO), LexisNexis and TransUnion. A good insurance score is around 700 or higher, although it varies by company.

Do insurance companies use FICO scores?

Auto insurance companies often use what’s called a “credit-based insurance score” to set rates. These are different from typical credit scores like your FICO score. Credit-based insurance scores place different weights on factors compared to other scores.

What credit bureau does Progressive use?

Progressive Leasing will only make soft inquiries at the three major Credit Bureaus (Transunion, Experian & Equifax). Other secondary offices, however, do not offer a soft inquiry option.

Do car insurance companies look at your credit score?

Do all auto insurance companies check your credit? Most insurance companies use credit checks to create a credit-based insurance score to help determine your rate. Some insurers provide car insurance without a credit check, which can be attractive if you have a poor credit history.

What are the two most important factors that influence life insurance premiums?

Several metrics factor into the price of an insurance premium, including age, state and county of residence, and amount of coverage.

What are the 3 typical requirements in an insurance policy?

Conditions Common conditions in a policy include the requirement to file proof of loss with the company, to protect property after a loss, and to cooperate during the company’s investigation or defense of a liability lawsuit.

However, they are still individuals and each will be evaluated based on their own life insurance risk factors. Life insurance premiums are generally based on three factors – age, gender and physical condition.

Some factors that can affect your car insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

What credit score do insurance companies use?

Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit bureaus – Experian, TransUnion or Equifax.

How do insurance companies check your credit score? It is true that insurance companies check your credit score when they give you a quote. However, what they do is called a “soft pull” – a type of inquiry that won’t affect your credit score. You may see these questions on your personal credit reports, but that’s it.

What credit score do car insurance companies use?

Key things to know about auto insurance scores Insurance scores are usually from Fair Isaac Corporation (FICO), LexisNexis and TransUnion. A good insurance score is around 700 or higher, although it varies by company.

Does car insurance do a hard credit check?

No, there is no “hard credit pull” when you get an auto insurance quote, so shopping around won’t impact your credit score. A bad credit usually happens when you apply for a loan, such as a mortgage or a credit card.

Do insurance companies use FICO scores?

Auto insurance companies often use what’s called a “credit-based insurance score” to set rates. These are different from typical credit scores like your FICO score. Credit-based insurance scores place different weights on factors compared to other scores.

Do car insurance companies look at your credit score?

Do all auto insurance companies check your credit? Most insurance companies use credit checks to create a credit-based insurance score to help determine your rate. Some insurers provide car insurance without a credit check, which can be attractive if you have a poor credit history.

Do insurance companies use FICO scores?

Auto insurance companies often use what’s called a “credit-based insurance score” to set rates. These are different from typical credit scores like your FICO score. Credit-based insurance scores place different weights on factors compared to other scores.

Is insurance credit score the same as credit score?

Your credit-based insurance score is not the same as your regular credit score. According to FICO, a data and analytics company that measures credit risk, many insurers use credit-based insurance scores in states where it is legally allowed.

What credit score do insurance companies use?

Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit agencies – Experian, TransUnion or Equifax.

Do insurance companies consider your credit score?

Most insurance companies that use credit information will include it as a factor in determining your rate. For example, someone with a relatively high credit score may pay a lower premium than someone with a relatively low credit score.

What is a good credit score for insurance?

The higher your insurance score, the better an insurer will assess your risk level in states where insurance scores are a qualifying factor. According to Progressive, insurance scores range from 200 to 997, with anything below 500 considered a poor score, and anything from 776 to 997 considered a good score.

Does insurance consider credit score?

Most insurance companies that use credit information will include it as a factor in determining your rate. For example, someone with a relatively high credit score may pay a lower premium than someone with a relatively low credit score.

What credit score do insurance companies use?

Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit agencies – Experian, TransUnion or Equifax.

Do you need a good credit score to get insurance?

Many auto insurance companies use a credit-based auto insurance score to help decide whether to take you as an insurer, as well as the premium you will pay if they do. While it’s just one of many factors that go into determining your rate, having good credit can help you save money.

What other factors influence the rate someone pays for their car insurance List 3?

Some factors that can affect your car insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

What factor influences the amount you pay for car insurance quizlet? The factors that can influence a car insurance premium are: -Value of the insured vehicle: the higher the value of the car, the higher the premium. -Car repair record: the easier the car damage can be repaired, the lower the premium. -Your age: Younger drivers have less experience and pay higher premiums.