Car insurance: a domino effect that increases your premiums

Car insurance: The domino effect that raises your premium Cars in minor accidents add up more than ever. (WFTV)

ORLANDO, Fla. — Some drivers in Florida get sticker shock when they see their latest auto insurance update, and those who haven’t overpaid to make sure their car can do so soon.

When the COVID-19 pandemic hit, people no longer drove to work as often.

Many roads are empty and drivers get discounted insurance, but all that has changed.

“Today, with more vehicles on the road – obviously that will create more accidents,” said Diana Giron, of the Universal Insurance Agency.

He said that the end of work from home for many people may be a part of it, but there are also many people moving to Florida every day, adding to the increased traffic.

Giron said the biggest factor influencing the increase in insurance interest rates was the cost of auto parts.

Read: Florida homeowners face rising property insurance rates; this is the reason

The supply chain problems caused by the pandemic make spare parts harder to come by and therefore more expensive.

“Let’s just say (a) the vehicle had an accident, then the vehicle to fix it, fix it properly — if you can get the parts, if you can find the parts — now it’s going to cost you another $5,000.

That’s $5,000 more than before the pandemic.

Orlando City Auto Body told Channel 9 that they saw auto parts prices start to increase last year.

Read: ‘I panicked’: Florida homeowner stunned by rising insurance costs

Now, repair labor costs are also increasing. New cars are also in short supply, driving up the cost of used cars.

More valuable cars are more expensive to insure.

Giron said that a vehicle worth $10,000 before the pandemic might be worth $17,000 post-pandemic.

It creates a domino effect.

Read: Florida homeowners insurance market continues to spin with 9 companies in liquidation

Driver Rustina Gibson said she had a minor accident and was initially told it would take a few weeks to get her vehicle repaired.

He later found out that the insurance company decided to add it up because the repair costs were too high and the time to fix it would take too long.

“I don’t want it to be total,” he said. “I want it fixed. And I kind of fought them, saying, ‘Why can’t you fix it?’”

Gibson then had to buy a used car, which cost a lot more than his previous vehicle and which cost him more than the insurance money he received.

He said he expected his insurance rate to increase.

Giron said he expected the same for many others in Central Florida, some rates increasing as much as 20 percent.

“It costs more to insure and everyone is frustrated,” he said. “I feel them, because it happened to me too.”

Upgrades may depend on factors including the driver’s zip code.

Giron said some in the insurance industry believe rates could be lowered towards the end of the year as they hope the chip shortage will be resolved, allowing more new cars to be built.

Click here to download the free WFTV news and weather app, click here to download the WFTV Now app for your smart TV and click here to stream Channel 9 Eyewitness News live.

Action insurance inspection 9 (WFTV)

Why does insurance go up every year?

Contents

- 1 Why does insurance go up every year?

- 2 Why is AAA insurance so expensive?

- 3 What is the simplest way to lower your auto insurance premium?

- 4 Which group pays more for car insurance?

These reasons may include filing a new claim or having a traffic violation added to your driving history, adding or changing vehicles, adding or changing drivers and increasing your coverage amount. On the same subject : Lemonade Car Insurance Review 2022 – Forbes Advisor.

How do I stop my insurance increase? The best way to prevent auto insurance increases is to keep your California driving record clean. You might even qualify for a “Good Driver Discount” if you don’t have too many points on your record. Contact your insurance provider to see if you qualify.

Why do insurance rates go up for no reason?

Car accidents and traffic violations are common explanations for rising insurance rates, but there are other reasons why auto insurance premiums go up including a change of address, a new vehicle, and claims in your zip code. To see also : UK motor insurance premiums in first quarter at highest level since 2020 – survey.

Why did my car insurance go up $100?

Because auto insurance is designed to cover expenses after an accident – including property damage and medical costs – anything that raises these costs will likely increase rates. Insurers need to make sure they have enough funds to pay claims, so when inflation hits, auto insurance rates are affected.

What causes your insurance rates to go up and why?

There are some things that are beyond your control but can still affect your premium, including: increased repair costs, increased drivers who are distracted on the road, more drivers on the road, higher speed limits in your geographic area, and increased drivers who don’t. insured.

Why did insurance rates go up in 2020?

US auto insurance companies spent nearly $1 on claims and expenses last year for every $1 they collected in premiums, according to III. The increase comes after the auto insurance industry offered premium refunds and discounts in 2020, as drivers stayed home at the start of the pandemic.

Is it normal for car insurance to go up every year?

Unfortunately, the answer is yes, you will usually see improvements every year. On the same subject : Tesla Insurance could pose a long-term threat to the US auto insurance industry: Morgan Stanley. Be aware of the maximum increase in auto insurance rates allowed for a contract – although there is no maximum increase allowed, the country in which you live does determine how much increase the company needs.

Does the cost of insurance increase every year?

In 2018 the average annual premium for employer-based family coverage rose 5% to $19,616 for single coverage, premiums rose 3% to $6,896. Covered workers contributed 18% of costs for single coverage and 29% of costs for family coverage, on average, with considerable variation across companies.

Americans spend a lot of money on health care every year, and the costs continue to rise. In part, this increase is due to government policies and the start of national programs such as Medicare and Medicaid. There are also short-term factors, such as the 2020 financial crisis, that push up the cost of health insurance.

What can cause car insurance to increase?

According to The Balance, here are some common factors that cause an increase in auto insurance premiums:

- Traffic violations. …

- At-Fault Accident. …

- Comprehensive Claims. …

- aging. …

- Hose in Vehicle Insurance. …

- Drop Credit Score. …

- High Risk Area.

Why is my insurance suddenly so high?

There are several reasons why your auto insurance may be higher than you’d like it to be – including having a poor driving record, claims history, and a bad credit history. Also, if you drive a lot, you drive a car that is deemed unsafe, or you have children on your policy, you may see a rate increase.

Why is AAA insurance so expensive?

AAA is very expensive because it doesn’t write its own insurance policy. Each regional AAA club operates independently and sells insurance policies covered by different agencies, so rates can vary widely.

Is Triple AAA better than State Farm? Despite the higher-than-average rates, State Farm is still above the AAA for homeowners insurance. State Farm’s strong coverage options and positive third-party ratings outperform the AAA structure.

Can you negotiate with AAA?

Vehicles in the AAA program are free of bargains. The price has been set at a discount for AAA members, so you can’t negotiate the price of the vehicle. These are pros and cons (as we will discuss later).

How do you score a car deal?

6 Tips to Help You Score a Deal For A New Car

- Shop Nearby for the Best Value for Your Trade-in. …

- Don’t mention your trade-in until you’re ready to buy. …

- Search and Compare Online to Find the Best Prices. …

- Ask for a Detailed Price List. …

- Secure Your Financing Before Going to Dealer.

Is Costco the cheapest way to buy a car?

A Costco representative told Business Insider in 2018 that Costco members save an average of more than $1,000 off the average vehicle price when using the program, and members can also get 15% off parts, service, and accessories at service centers. participating.

How does NEA auto buying program work?

The NEA Automated Purchase Program gives you free access to online research tools and connects you with experienced Certified Dealers who are committed to price transparency and great service. See what others are paying, then get your member price and head to the dealer for a trial.

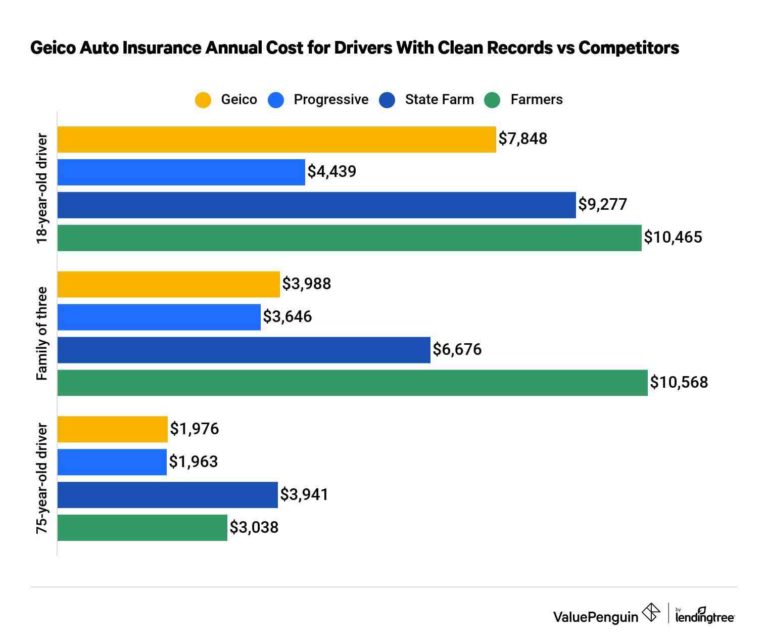

Is State Farm more expensive than AAA?

Is State Farm or AAA Cheaper in Your Country? State Farm is cheaper than AAA in more states. Because the average cost of auto insurance rates can vary greatly at the state and national level, be sure to compare insurance companies by state, not just nationally.

Is State Farm the most expensive insurance?

Is State Farm expensive? According to our rate estimates, State Farm is one of the more affordable providers out there. We found State Farm’s full coverage rate to be around $1,339 per year, which makes it cheaper than the average for providers like Progressive, Nationwide, and Allstate.

Who is more expensive State Farm or Allstate?

State Farm Cheaper for Adults For adults, State Farm’s average auto insurance rates are significantly lower than Allstate’s rates, and lower than the national average.

Is AAA more expensive?

AAAs are more expensive but offer the added benefit of being part of their standard coverage and have a better customer complaint ratio.

Set a higher deductible on your auto insurance. The higher your deductible – the amount you will pay in the event of a claim – the lower your premium will generally be. Typically, the deductible ranges from $0 to $1,500.

What is the difference between a quote and a premium when it comes to auto insurance? Insurance premiums are the amount you pay the insurance company for your policy. While quotes are estimates of costs, premiums are actual costs.

The best way to lower your auto insurance premium is to compare prices between insurance companies, take advantage of all the discounts you can, and adjust your coverage to fit your budget. Drivers can save an average of 64% by switching from full coverage to minimum coverage, for example.

You can reduce your auto insurance premium by increasing the deductible component, which is what you pay when you make a claim. But, only pay as much as you can afford. If you pay too much, the purpose of insurance is defeated.

Below are other things you can do to lower your insurance costs.

- Have a look. …

- Before you buy a car, compare insurance costs. …

- Ask for a higher deduction. …

- Reduce coverage on older cars. …

- Purchase your homeowner and auto coverage from the same insurance company. …

- Maintain a good credit record. …

- Take advantage of low mileage discounts.

Below are other things you can do to lower your insurance costs.

- Have a look. …

- Before you buy a car, compare insurance costs. …

- Ask for a higher deduction. …

- Reduce coverage on older cars. …

- Purchase your homeowner and auto coverage from the same insurance company. …

- Maintain a good credit record. …

- Take advantage of low mileage discounts.

You can reduce your auto insurance premium by increasing the deductible component, which is what you pay when you make a claim. But, only pay as much as you can afford. If you pay too much, the purpose of insurance is defeated.

In what ways can I keep the cost of car insurance lower?

To reduce auto insurance costs, drivers need to maintain a clean driving record, maintain a high credit score, and seek personalized quotes from at least three auto insurance companies. These tasks can be very helpful in finding and receiving lower costs for your car insurance.

Which group pays more for car insurance?

Men tend to pay more for auto insurance overall, although the difference is slight — around 1%. The difference is most pronounced for teens and young adults.

What age group pays the most for car insurance? Statistically, drivers under 25 and over 65 pay more for auto insurance than middle-aged adults. The reason: teens are three times more likely to be in an accident than drivers aged 20 and over, giving them the highest premiums of all age groups.

What group pays the most for car insurance?

Average auto insurance rates by age group range from $716 per year for drivers aged 45 to $3,343 per year for drivers aged 16. Car insurance rates are highest for teens and seniors, on average, because they are considered high risk due to the increased likelihood of accidents and expensive claims.

Age is the main factor that insurance companies look at when determining policy rates for one of their drivers. No matter their gender, younger drivers will pay more for their auto insurance premiums than any other demographic, according to HuffPost.

Which group pays more for car insurance married or single?

Car insurance is cheaper when you are married than when you are single. Based on our analysis, for drivers in the U.S., we found that full coverage auto insurance costs $123 less per year for married couples than for single drivers – a 5% savings. The rate is the average annual premium for a full coverage policy.

Which group pays more for car insurance married or single?

Car insurance is cheaper when you are married than when you are single. Based on our analysis, for drivers in the U.S., we found that full coverage auto insurance costs $123 less per year for married couples than for single drivers – a 5% savings. The rate is the average annual premium for a full coverage policy.

Is marital status important for car insurance?

Even if you have an impeccable driving record, a steady job, and good credit, you should know that there is one more factor that can affect your insurance premiums: your marital status. Whether you are single, married, divorced, or widowed can make a huge difference in the cost of your car insurance.

Is car insurance cheaper if married?

Yes, auto insurance is usually cheaper if you are married, whether you are sharing a car as a married couple or you each have your own car and you need a joint insurance policy. Car insurance may also be cheaper for spouses in civil unions or domestic partnerships in some states.

Is it better to be married for car insurance?

According to Balance, insurance companies consider married drivers to be safer drivers than their single counterparts. Single drivers are more likely to drive recklessly and get into accidents, but this isn’t the only reason married drivers get better auto insurance rates.

What types of drivers usually pay more for insurance?

Insurers generally charge more if a teenager or young person under the age of 25 drives your car. Your gender – Statistically, women tend to have fewer accidents, have fewer accidents while driving (DUI) and—most importantly—have fewer accidents than men.

Who generally pays the most for their car insurance?

On average, we found that men pay $720 per year for auto insurance, while women pay $739 per year. The difference in cost between male and female teenage drivers is easy to explain. Men pay significantly more for auto insurance than women in their teens, while women pay slightly higher premiums in later years.

{ 16-19 } Drivers aged between 16 and 19 have the highest insurance rates of all age groups. Their insurance rates are high because this demographic group is the most likely to have an accident. Insurance is always a reflection of risk, and teenage drivers represent a higher risk.

What drives the cost of insurance?

Insurance costs are higher in areas with more drivers. Postal codes that are susceptible to flooding, forest fires, crimes such as vandalism or theft, or other risks also face higher rates. In many cases, those in rural areas pay less in auto insurance premiums than their urban counterparts.