Car Insurance: Average Cost in 2022

Vera_Petrunina / Getty Images/iStockphoto

You wish you never had to use it, but auto insurance is required in nearly every state. New Hampshire is the only exception to this rule, but drivers who opt out of cover are required to prove they have the funds to meet state financial requirements if they cause an accident.

Read: If Your Credit Score Is Under 740, Take These 4 Steps Now

So how much is car insurance a month? This amount will be different for everyone, as several variables can affect your auto insurance premium, including your car, driving habits, demographic factors, and your coverage, according to Allstate.

Average Cost of Car Insurance

Contents

- 1 Average Cost of Car Insurance

- 2 States With the Cheapest Minimum Coverage Insurance Premiums

- 3 States With the Cheapest Full Coverage Insurance Premiums

- 4 States With the Most Expensive Minimum Coverage Insurance Premiums

- 5 States With the Most Expensive Full Coverage Insurance Premiums

- 6 Car Insurance Rates by Age

- 7 Cheap Car Insurance Companies

- 8 Best Car Insurance Companies

- 9 Importance of Car Insurance

- 10 Why are health insurance premiums rising?

- 11 How can I lower my health insurance premiums?

- 12 Why did my healthcare premiums go up?

The average cost of auto insurance in the US is $124 per month or $1,483 per year, according to The Zebra. See the article : VIEW: Is Del. does car insurance really protect drivers?. Of course, as noted above, the amount you will pay will vary based on many factors, including the amount of coverage you choose.

Each state has a minimum amount of auto insurance coverage that drivers must carry. Most states have a minimum liability for coverage, and some states also require additional coverage, including personal injury coverage or uninsured/underinsured coverage.

Here are the states with the cheapest and most expensive six-month minimum coverage insurance premiums, according to The Zebra.

So if you’re wondering, “Is $200 a month a lot for car insurance?” the answer is yes. On the same subject : How to save money on car insurance for teenagers. When broken down into monthly payments, the average cost of full coverage auto insurance premiums just exceeds this amount in three states.

Car Insurance Rates by Age

How much is the monthly payment for car insurance? As mentioned above, this figure is different for everyone. Read also : How to Save on Auto Insurance If You Have Geico. has.

However, age is one of the factors that affect car insurance rates. Younger and older drivers tend to pay the most, while those in between often pay lower rates.

The following is the average cost of car insurance by age group, according to data from The Zebra.

As you can see, age doesn’t seem to have a big impact on auto insurance rates – except for teenage drivers.

Of course, the rates above are only national averages. Some states have higher average rates for this age group, while some lower.

For example, if you’re trying to figure out “How much is car insurance in Connecticut for a 17 year old?” You may be in for a pleasant surprise.

Geico offers the cheapest auto insurance for teen drivers in the state, according to US News. Teenage girls pay an average annual rate of $2,697 — $224.75 per month — while the average rate is higher for boys of $3,138 per year — $261.50 per month.

On the other hand, if you try to figure out “How much is car insurance in Pennsylvania for a 22 year old” you may find yourself paying around the national average. Specifically, Pennsylvania drivers in their 20s have an average annual auto insurance premium of $1,789.79 — $149.90 per month — according to The Zebra.

Cheap Car Insurance Companies

When asked “How much is car insurance a month?” You will find this varies a lot by company. Therefore, it is important to shop around to find the best price for you.

You may find that a friend with a similar demographic in your area gets lower auto insurance rates from certain companies than you do. For example, the cheapest average auto insurance for good drivers is Geico, but if you get a ticket, State Farm offers the lowest rates, according to US News.

However, some auto insurance companies tend to have lower rates than others. The following are national average rates for annual auto insurance policies, according to US News.

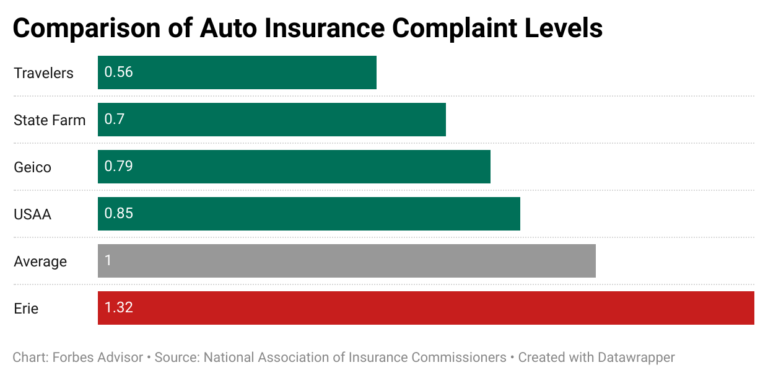

Best Car Insurance Companies

When you are shopping for auto insurance, price is likely an important factor. However, that shouldn’t be the only variable that matters.

If you need to use your insurance, you’ll want a company that makes the process as smooth as possible. In 2022, US News surveyed more than 10,000 drivers to learn about their auto insurance experience, including issues such as customer service, claims handling and customer loyalty.

Here are the top 10 ranked auto insurance companies for 2022, according to the survey.

Importance of Car Insurance

It’s easy to see auto insurance as just another expense, but it’s so much more than that.

It’s important to be informed when adjusting your policy because you need to be prepared for the unexpected. If you are in a car accident and found guilty, you could be liable for legal fees, medical expenses for the injured party, and their lost income.

Having sufficient liability coverage — or a liability limit — can be the difference between asking your insurance company to pay for this fee or having to pay it yourself. It can also provide coverage for the passengers in your car, as they may be able to receive medical payment coverage and personal injury coverage to help pay for their expenses in the event of an accident.

In the end, auto insurance policies are very personal and customizable. When shopping, it makes sense to ask “How much is car insurance a month?” so you have a basic comparison.

However, you can’t get too close to the average number, as factors such as driving history, age, vehicle type, and other demographics will work together to determine the cost of your auto insurance. Some companies will offer less expensive coverage than others, but it’s important to read the fine print and really understand your policy.

You don’t want to find out hard that you don’t have the protection you thought you had, when you really needed it. Therefore, it is best to look for a policy that offers comprehensive coverage at the most competitive rates.

Accurate information as of November 23, 2022.

Jennifer Taylor is a freelance writer based on the West Coast with over a decade of experience writing about just about anything. Since earning her MBA, personal finance has become her favorite topic, as she is passionate about writing stories that educate, inform and empower. Specifically, she specializes in budgeting, debt servicing, savings and retirement.

U.S. population increasingly unhealthy As the health problems of the U.S. population increase, the risk of insuring the average American increases. And in turn, the higher the risk, the higher the cost of annual health insurance premiums.

How much will the health insurance premium increase in 2023? Time to open registration again. Millions of workers will be asked to vote for their 2023 health benefits in the coming weeks as the open employer season begins. Employer healthcare costs are rising, with large employers predicting a 6.5% increase in those spending for 2023.

The average annual premium in 2022 is $7,911 for single coverage and $22,463 for family coverage. This amount is similar to the 2021 premium ($7,739 for single coverage and $22,221 for family coverage). The average family premium has increased 20% since 2017 and 43% since 2012.

For families who obtain health insurance through their employer, the annual out-of-pocket cost for premiums has averaged $6,106 this year, or an estimated 2% increase from $5,969 in 2021, according to a new study released Thursday by the non-profit Kaiser Family Foundation. (KFF).

How much have healthcare costs increased 2022?

PwC’s Health Research Institute (HRI) projects a medical cost trend of 6.5% in 2022, slightly lower than the 7% trend in 2021 and slightly higher than between 2016 and 2020.

Why is health insurance going up 2022?

“The inflation that the entire economy is experiencing in 2022 could push prices up, leading to higher premiums in the coming year,” said the Kaiser report. This report is based on a survey of more than 2,100 employers randomly selected from February to July.

How can I lower my monthly health insurance costs?

- You can’t control when you get sick or injured. …

- See if you qualify for a subsidized tax credit. …

- Choose HMOs. …

- Choose a package with a high deductible. …

- Choose a plan that pairs well with a health savings account. …

- Related Items.

Is it cheaper to pay out of pocket for health care? Fernandez: What many people don’t realize, is even if you’re insured with a high-deductible health plan, paying out-of-pocket may be less than using your insurance — and costs can vary dramatically between the hospital, your doctor’s office, or local emergency care You.

There are a number of factors that influence how expensive health insurance can be for individuals and their families. Administrative costs, rising costs for prescription drugs, and lifestyle choices have all played a role in rising health care costs. While some of these factors are not within your control, others are.

Why is healthcare so expensive even with insurance?

The United States health care system is complex and most of the costs are market driven. The high, unregulated cost of prescription drugs and the salaries of healthcare providers are higher than in other western countries, and hospital care accounts for 31% of the country’s health care costs.

Health care plans can be expensive, especially if you have dependents. Negotiating employer-paid health insurance premiums vs. a raise can save you hundreds of dollars a month. If health care premiums increase each year, your negotiating value increases as well.

The average annual premium in 2022 is $7,911 for single coverage and $22,463 for family coverage. This amount is similar to the 2021 premium ($7,739 for single coverage and $22,221 for family coverage). The average family premium has increased 20% since 2017 and 43% since 2012.

That time comes every year when your health insurance provider wants to increase your premium rate. What many people in small to mid-sized companies don’t realize is that the new high rates that your provider gives you are likely to be negotiable.

Can you negotiate health insurance prices?

Key takeaways. You can often negotiate your medical bills with providers, but you can’t negotiate healthcare costs with insurance companies. You may qualify for Medicaid for maternity care, even if you are on a moderate to high income.

Can you negotiate health benefits?

Can you negotiate benefits? Employees often focus on salary during the negotiation process, but you can also negotiate benefits or other job benefits. Benefits contribute to your overall compensation, so keep that in mind when reviewing job offers.

Increase in medical costs This increase in demand and hospital visits has effectively led to a similar increase in medical care costs and premiums. Spending on prescription drugs is also increasing, which adds another layer to why health insurance costs continue to rise.

Why have health insurance premiums increased? Increased use of health plans is the biggest reason for the increase, accounting for four percentage points, according to Jessica Altman, executive director of Covered California. “That’s really a consistent message that other states are also seeing, and even more so than California,” he said.

The average annual premium in 2022 is $7,911 for single coverage and $22,463 for family coverage. This amount is similar to the 2021 premium ($7,739 for single coverage and $22,221 for family coverage). The average family premium has increased 20% since 2017 and 43% since 2012.

For families who obtain health insurance through their employer, the annual out-of-pocket cost for premiums has averaged $6,106 this year, or an estimated 2% increase from $5,969 in 2021, according to a new study released Thursday by the non-profit Kaiser Family Foundation. (KFF).

How much have healthcare costs increased 2022?

PwC’s Health Research Institute (HRI) projects a medical cost trend of 6.5% in 2022, slightly lower than the 7% trend in 2021 and slightly higher than between 2016 and 2020.

Why is health insurance going up 2022?

“The inflation that the entire economy is experiencing in 2022 could push prices up, leading to higher premiums in the coming year,” said the Kaiser report. This report is based on a survey of more than 2,100 employers randomly selected from February to July.

If your credit score has dropped due to increased debt, decreased income, missed or late payments, too many credit inquiries, or other reasons, your insurance company may choose to increase your premium to protect themselves.

Car accidents and traffic violations are common explanations for increased insurance rates, but there are other reasons why auto insurance premiums may increase including a change of address, a new vehicle, and claims in your ZIP code.

The number of car accidents has increased, leading to more insurance claims. This higher claim volume, coupled with higher vehicle repair and replacement costs, ultimately drives up insurance rates across the industry.

Time and inflation affect your cost of living, including your health insurance premium. And like most things in life, one of the main reasons for this increase is inflation. This may surprise you (or not), but inflation in the healthcare industry is much higher than in most other industries.