CAR INSURANCE CAN BE CHEAPER IN NEW JERSEY

Two state senators — both personal injury attorneys — are pushing a bill that would raise minimum requirements for automotive liability insurance and could lead to higher premium costs for drivers.

Senate President Nicholas Scutari, D-Union, and Senator Jon Bramnick, R-Union, claimed the changes would ultimately benefit motorists. But insurance experts – and even their colleagues in the Legislature – say the couple stands to gain financially from the insurance overhaul if Gov. Phil Murphy signs their legislation into law.

Bramnick, who also does stand-up comedy, and Scutari, the most powerful elected official behind Murphy, spent little time pushing for the legislation. It was Bramnick’s first session as a senator after years in the Assembly. And it was Scutari’s first session as Senate president.

Bramnick said the legislation is happening now because “you have someone leading the Senate now who really represents the individual and not the insurance company.”

Both dismissed questions as to whether the proposed legislation violates state policy on conflicts of interest. The Office of Legislative Services, which includes ethics counsel to advise members of Parliament, declined to comment.

“I never asked” for a legal opinion “because I know it’s an unfair question, and I think if you raise it you’re saying things that are 100% not true,” said Bramnick.

Scutari said raising the ethics question was “ridiculous” and suggested that since he had been in the Legislature for two decades he knew the rules and would not break them.

But even their colleagues are not sure.

Assembly members Robert Auth and Beth Sawyer spoke against the bill before voting no last month. Auth said he would understand if there was a “real need for this” but the bill, if signed, would only “force New Jersey motorists to spend more money on insurance.”

“We’re just trying to accommodate a small portion of the legal community on the back of a New Jersey motorcycle,” said Auth, R-Bergen. “It’s the average middle- and lower-class New Jerseyan who is trying to make ends meet who is going to have to fight for this.”

Similarly, Sawyer asked people to vote against the bill, which the Gloucester County Republican said is “only supporting wealthier lawyers.”

Douglas Heller, an insurance expert with the Consumer Federation of America, said this would likely have a negative impact on consumers while benefiting lawyers who file higher claims.

“Lawyers who bring claims, they will be OK because they have a bigger pot for claims and cover their costs, but the most financially vulnerable consumers are the ones attacked by this legislation,” he said.

Bruce Nagel, an attorney known for handling personal injury, transportation accidents and class-action lawsuits, said the legislation will benefit injured parties as well as the attorneys representing them.

In New Jersey, attorneys typically charge a fee of 33.3%, or one-third, for the first $750,000 of an insurance settlement or judgment, and then the percentage drops after that, according to Nagel.

“If the recovery is higher, by definition the attorney fees are going to be higher because that’s a percentage of the recovery,” Nagel said.

Public officials must avoid conduct that violates public trust or gives a “justifiable impression” that that trust has been violated, according to a 1972 state law.

Among those standards are rules for members of parliament who vote for their own benefit, or for immediate family members. They must not “participate by voting or other action, on the floor of the General Assembly or Senate, or in committee or elsewhere, in the enactment or defeat of legislation in which he has a personal interest.”

In this case, “personal interest” is when members of the DPRD or direct family members will gain or lose money due to legislation – but only if individual members of the legislature will be impacted more than other people in the same business, profession or group, according to the law.

While Scutari did not explain why it was “ridiculous” to ask whether his support for the bill could violate the law, Bramnick said that the members of parliament all have different professions and that “as long as it is not specific to me, which is not, and generally to the industry ,” it is not a conflict of interest law violation.

Updating insurance premiums has been needed for two decades, Bramnick said, but the bill was first introduced last year. Bramnick was not a sponsor of the bill but was the lead sponsor of the one sent to Murphy when it passed both chambers June 29.

“I couldn’t be more proud that once again the Senate president and I are willing to take the heat to protect policyholders and not have to work for insurance companies,” Bramnick said.

State law requires all drivers to have car insurance. Types and coverage for accidents vary, but standard policies cover $15,000 for bodily injury per person; $5,000 for property damage; and $30,000 for uninsured motorists.

The bill would require an increase in standard auto insurance policies in January and again in 2026. This change would more than double the minimum requirement for a standard policy from $15,000 now to $35,000 in 2026.

The minimum policy requires vehicle owners to maintain $25,000 in coverage for an accident resulting in the injury or death of a person; $50,000 for an accident that causes multiple injuries or death; and $25,000 for an accident with no injuries. All liability policies also include payment for all or part of the driver’s legal right to recover as damages from an uninsured and underinsured motorist.

Bramnick said New Jersey has the lowest limit in the country and the changes in the bill would be a “relatively small increase.”

But Heller said the move would “definitely raise rates” because it would require people to buy more insurance than they currently have to.

Heller said that “auto insurance is like almost no other product in society” because the government requires drivers to buy it and drivers who buy the minimum requirements because it’s all they can afford will be “the ones who will bear the most. pain for the increase in speed will come.”

That sentiment was echoed by Alison Cooper, vice president of state government relations for the Property Insurance Underwriters Association of America, a group that lobbied against the bill.

Cooper said in a statement that they are “concerned that this legislation will increase costs, especially for those who have a fixed income and may be forced to choose between paying for basic needs such as gas, rent, groceries, etc. or insurance.”

“This type of legislation could have serious negative consequences for many New Jerseyans, not to mention the state’s auto insurance market, which is currently healthy and competitive,” said Cooper. “This type of legislation forces many consumers with lower coverage under new requirements to purchase more coverage.”

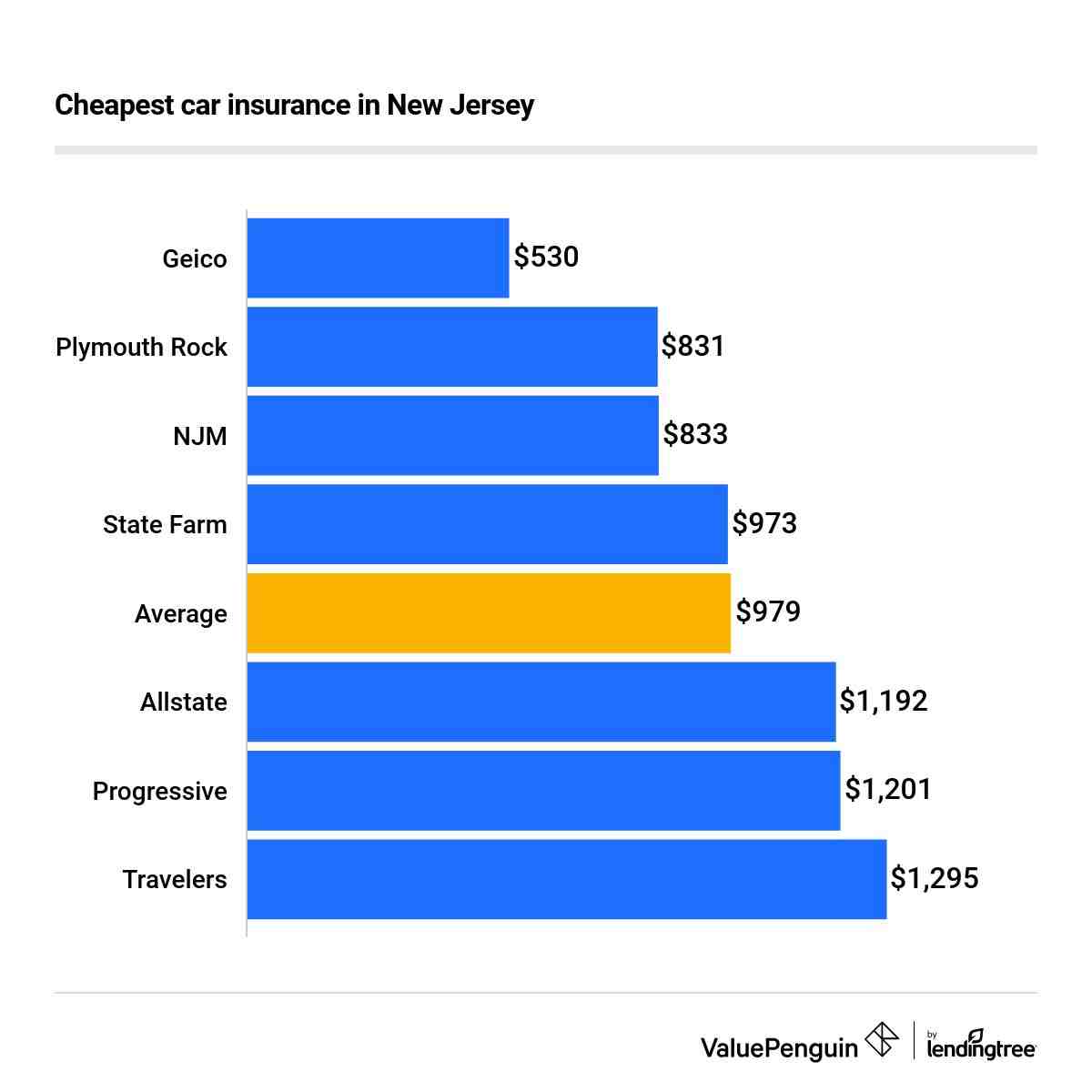

Scutari maintained that the legislation will not lead to an increase in the premiums of individual drivers across the country because insurance companies must go before the Ministry of Banking and Insurance to request it and it will not be approved.

Scutari said his review of the data as well as testimony from insurance companies showed that profit margins were so high in New Jersey that it was “impossible” for them to get the increases approved.

“They have to provide an additional $10,000 in coverage to motorists and they can’t raise the price,” he said. “They have no excuse for it.”

He also stressed that with New Jersey’s current minimum requirement it is “below all” and that an increase of $10,000 would “tie us for last.”

Cooper noted that drivers have the option to buy higher limit or additional underinsured and uninsured motorist coverage if they want and “forcing consumers to buy more coverage means their insurance costs will increase and this may be more coverage than they need, want, or can afford. .”

The legislation includes a gradual increase in the required minimums, the first in 2023 and the second in 2026. Gary La Spisa, Vice President of the Insurance Council of New Jersey, said the second phase of his attention.

La Spisa said that insurers have sold policies with the limits of liability required by the bill and the increase in 2026, which raises the minimum to $35,000 per injury and $70,000 per accident, not considering what may change after the first phase. .

“This second increase comes without a review of the impact that the initial increase will have on New Jersey drivers,” said La Spisa. He said that “more than 1.36 million drivers will be affected by these changes, with three-quarters of drivers affected by both increases.”

Although nothing in the bill requires it, Scutari said that after the first increase, the Legislature will “see” the impact of the increase before the second phase is implemented. In that case, he said, there may be an increase.

“They have [the insurance industry] indicated that there is a possible demand for an increase of $10 a month,” said Scutari. “The worst case scenario is that they could try to increase the rates in four years.”

This legislation will benefit everyone except those who are most financially vulnerable because insurance companies will have more money to invest and potentially injured parties will have access to more coverage, said Heller.

Bramnick defended the legislation saying that for two decades insurance companies and “tremendous resources in Trenton” have blocked policies that would benefit consumers. He said that this legislation would add benefits to drivers and said that the insurance lobby is “very good at raising all the emotional responses” that he considers “anti-consumer.”

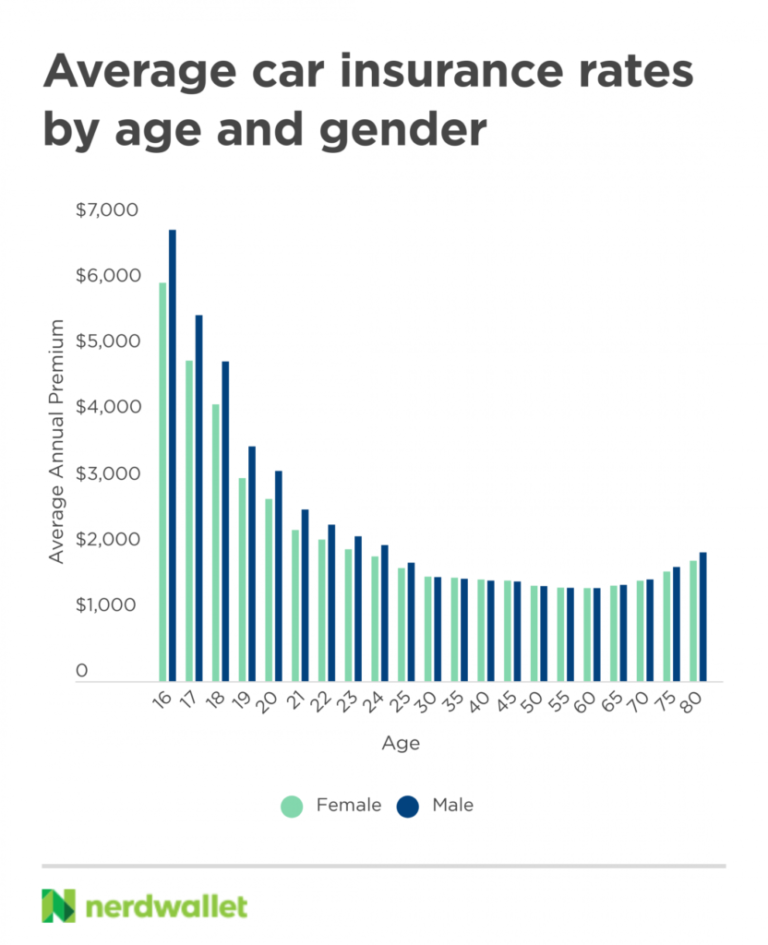

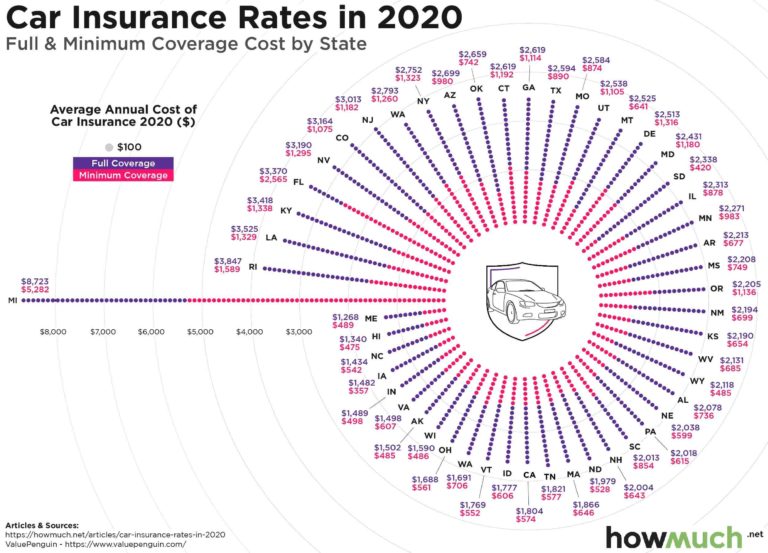

New Jersey is among the states with the lowest limit, but it is among the highest in rates, which Heller says is a “big problem”.

“You can’t separate the fact that people are charged more than most countries. ,” he said. “It has to do with the way insurance companies are allowed to treat customers and charge them more than they need to based on things that have nothing to do with their driving.”

James Lynch, president of the New Jersey Justice Association, said his group strongly supports the legislation because the minimum requirements for coverage have not been updated in 50 years.

“In the past half century, the cost of medical care has exploded, there are more cars on the road than ever before, the cost of repairing a broken car has increased dramatically – but the minimum required amount of car insurance has remained the same,” Lynch said. “The minimums should simply be raised – it can be economically devastating to get into an accident without enough insurance to cover your medical expenses and damages”.

Crime Rates Have you compared public safety rankings from state to state? The state of Texas is currently ranked #36, while New Jersey far outshines it at #4.

Is car insurance less expensive in Texas?

Contents

- 1 Is car insurance less expensive in Texas?

- 2 How can I lower my car insurance in NJ?

- 3 Can I lose my house due to at fault car accident in Florida?

- 4 Is it illegal to drive without insurance in the state of Florida?

| Cover level | Average Annual Premium |

|---|---|

| Minimum Conditions – Liability only | $782 |

Why are insurance rates high in Texas? Auto insurance in Texas is expensive because the state has three of the 10 largest cities in the country and a large, growing population across the country. This may interest you : What is a good score for insurance?. In Texas, you can expect to pay about $2,312 per year for full coverage auto insurance or $780 per year for minimum coverage.

Is car insurance cheaper in Texas?

The average cost of full coverage auto insurance in Texas is $1,749 per year, or about $146 per month, according to a NerdWallet analysis. On the same subject : Bill increasing minimum car insurance coverage clears legislature. Minimum coverage in Texas averages $611 per year, but we’ve found you can likely get a cheaper policy than that.

Is Geico cheap in Texas?

Average cost of car insurance in Texas For example, Geico offers the cheapest rates in Texas at $377 per year, on average, for car insurance with minimum liability coverage for a 35-year-old driver with a clean driving record.

How much is car insurance in Texas per month?

We found that the average price of auto insurance in Texas is $666 per year, or $56 per month, for minimum coverage. The average cost of full coverage including comprehensive and collision is $1,872 per year, or $156 per month. But remember that you will pay different rates based on your driver profile.

How much is the average car insurance per month in Texas?

According to Bankrate’s annual study of quoted premiums, drivers in Texas pay an average of $1,868 per year, or $156 per month, for full coverage auto insurance. To see also : Can I lie about my job on car insurance?. Drivers nationally pay an average of $1,771 per year for full coverage auto insurance.

What is the minimum car insurance in Texas?

Texas law requires you to have at least $30,000 coverage for injuries per person, up to a total of $60,000 per accident, and $25,000 coverage for property damage. This is called 30/60/25 coverage. Consider buying more responsibly.

How much is car insurance in Texas per month?

We found that the average price of auto insurance in Texas is $666 per year, or $56 per month, for minimum coverage. The average cost of full coverage including comprehensive and collision is $1,872 per year, or $156 per month. But remember that you will pay different rates based on your driver profile.

Is Texas expensive for car insurance?

Car insurance is expensive in Texas. The average rate of auto insurance in Texas is $1,810 per year — 26.8% more than the US average.

How can I lower my car insurance in NJ?

Here are some recommended ways to get lower car insurance rates in New Jersey:

- Don’t Double Your Medical Coverage. …

- Increase Your Deductible. …

- Enter Vehicle Safety Options. …

- Choose Your Vehicle Wisely. …

- Eliminate Unnecessary Signals. …

- Inquire About Other Price Reductions. …

- Keep Your Driving Record Clean.

Can you really lower your car insurance? There are two ways you can save on car insurance by reducing your coverage. First, you can lower your policy limits. Another option is to remove unnecessary types of coverage. For example, if you have an old car that is not worth much, you can consider dropping collision and comprehensive coverage.

Can I lose my house due to at fault car accident in Florida?

Could you lose your home due to a car accident? In Florida, you cannot lose your home because of an at-fault car accident. The Florida homestead exemption, in most cases, will protect the driver’s home at-fault.

Can someone sue me personally after a car accident in Florida? You can sue someone personally after a car accident if their car insurance liability limit has been reached. In this situation, the victim can try to get compensation from the at-fault driver in the court of law. To recover compensation, you must be able to prove that the driver was negligent.

How long can someone sue you after a car accident Florida?

In most situations, you have four years after a car accident to bring a lawsuit against the negligent party in Florida. This date is a hard deadline, which means that the court cannot change it for you.

How long does someone have to sue after a car accident in Florida?

Under the Florida statute of limitations, you generally have four years from the date of a car accident to file a lawsuit to pursue compensation from the driver or party responsible for the accident and your injuries.

How long can you wait to sue someone in Florida?

Most legal actions in the United States can only be filed in court if the cause of action occurred before a specified time. For example, in Florida, lawsuits alleging negligence must be filed within four years from the date of the incident. The four-year window is known as the statute of limitations.

Can someone sue you personally after a car accident in Florida?

You have the legal right to take action against the driver who caused the accident and sue them for damages under Florida law. The Law Place will assist you by proving the other driver’s negligence and negotiating with their insurance company to recover the compensation you are owed in the State of Florida.

What is the average settlement for a car accident in Florida?

The average accident settlement in Florida is around $15,000. When the injury is severe, the average settlement is higher.

How much is the average personal injury settlement in Florida?

A successful claim can force the wronged party to pay for your economic and noneconomic damages. The average personal injury settlement in Florida is between $3,000 and $75,000. This is a wide range, however, and it is important to remember that each personal injury claim is unique.

What is the average payout for a rear end collision in Florida?

The circumstances of an accident are not always the same as a settlement depends heavily on the unique circumstances of each case. According to the examples of rear-end car accident settlements listed on this page, the typical Florida rear-end accident settlement is anywhere from $500,000 to $875.00.

How much can you get from a car accident settlement in Florida?

The average amount stated among Florida law sources for car accident settlements is anywhere from $10,000 to $60,000 or more. As you can imagine, the amount of settlement can vary depending on various factors.

What happens when you are at fault in an accident in Florida?

If the other driver was completely at fault for your car accident, the result is usually predictable: The other driver (through their insurance carrier) will pay to compensate you for medical bills, lost wages, and other losses you suffered.

What happens if Im found at fault?

In most states, if you are at fault for your accident (or your insurance company if you have liability coverage) must pay for the losses of the other driver, passengers, and anyone else injured in the accident. Damages include things like car repairs, medical bills, lost income, and pain and suffering.

How much will my insurance go up with an at fault accident Florida?

How much does insurance cost after an accident? Auto insurance premiums increase an average of 46% after accidents and bodily injury claims, according to an analysis of national-level data. Accidents and extensive property damage â € ” $ 2,000 or more â € ” can raise the cost even more than that.

Can I sue if im at fault Florida?

In Florida, you can make a claim or file a lawsuit even if you were partially responsible for the accident. In the concept of comparative negligence, and the recovery of injured people can be reduced by the percentage of those at fault. This can be a significant point of contention in negotiations.

Is it illegal to drive without insurance in the state of Florida?

Driving without insurance is illegal in Florida, and it is a serious matter that can result in the suspension or revocation of your driver’s license.

What happens if you are caught driving without insurance in Florida? Driving without insurance in Florida can result in driver’s license and license plate suspensions, making proper coverage critical. Driving without insurance in Florida can result in driver’s license and license plate suspensions, making proper coverage critical.

How long can I go without insurance Florida?

You must maintain the required insurance coverage during the registration period or your driving privileges and license plate may be suspended for up to three years. There is no provision for a temporary driver’s license or trouble for insurance-related suspension.

Can you go to jail for no insurance in Florida?

No, you cannot go to jail for driving without insurance in Florida, but you can face serious consequences, such as license and registration suspension. Driving without insurance in Florida is illegal and can have a serious impact on your car insurance rates going forward.

How long does insurance lapse grace period in Florida?

627,453 era of Grace. —Each insurance contract must provide that the insured has a grace period of not less than 30 days in which to pay the premium after the first one can be made.

Can you go to jail for not having car insurance in Florida?

No, you cannot go to jail for driving without insurance in Florida, but you can face serious consequences, such as license and registration suspension. Driving without insurance in Florida is illegal and can have a serious impact on your car insurance rates going forward.

What happens if you do not have car insurance in Florida?

If you do not purchase this coverage, your license plate and registration will be suspended immediately. This is in addition to the $150 to $500 reinstatement fee you must pay. If the accident was the fault of the other driver, you will have to pay for the damage to your car, including medical payments and lost wages as well.

How long can you go without insurance before your license is suspended in Florida?

The Department will then notify you to provide proof of new coverage. If you continue to fail to provide proof of insurance, your driver’s license and license plate will be suspended for up to three years. You must maintain insurance coverage throughout the vehicle registration period.

Is driving without insurance a felony in Florida?

If you present to a law enforcement officer proof of insurance that you know is not current, you can be charged with a first-degree felony, punishable by up to one year in jail, as noted in F.S. 316,646. If you get a ticket for driving without car insurance and want to fight it, we’re here to help.