If you are bringing your own car into the UK you may at least be covered for third party damage under your existing overseas car insurance policy. However, you may want to upgrade your insurance coverage to fully comprehensive so that you and your vehicle are financially secure.

What does ot mean in auto insurance?

Contents

- 1 What does ot mean in auto insurance?

- 2 What type of car insurance is the most important?

- 3 Does car insurance cover the car or the driver?

- 4 Is Progressive insurance Global?

OT – Other party or other person. To see also : Can you pause car insurance?. OTC – Other than collision. OV – Other vehicle.

What are the 3 types of car insurance? The three commonly offered types of car insurance are third party, collision damage waiver, and comprehensive insurance. Drivers can still get other types of auto insurance, such as:

What does me stand for in auto insurance?

Personal injury liability covers personal injury or death to another person for which the insured is responsible. On the same subject : What are the 3 types of car insurance?. Property damage liability covers the insured if the insured’s car damages someone else’s property.

What are the common terms for auto insurance?

Below are definitions of some of the most commonly used terms when dealing with auto insurance.

- adjuster. …

- liability for injuries. …

- claim. …

- collision protection. …

- Comprehensive coverage. …

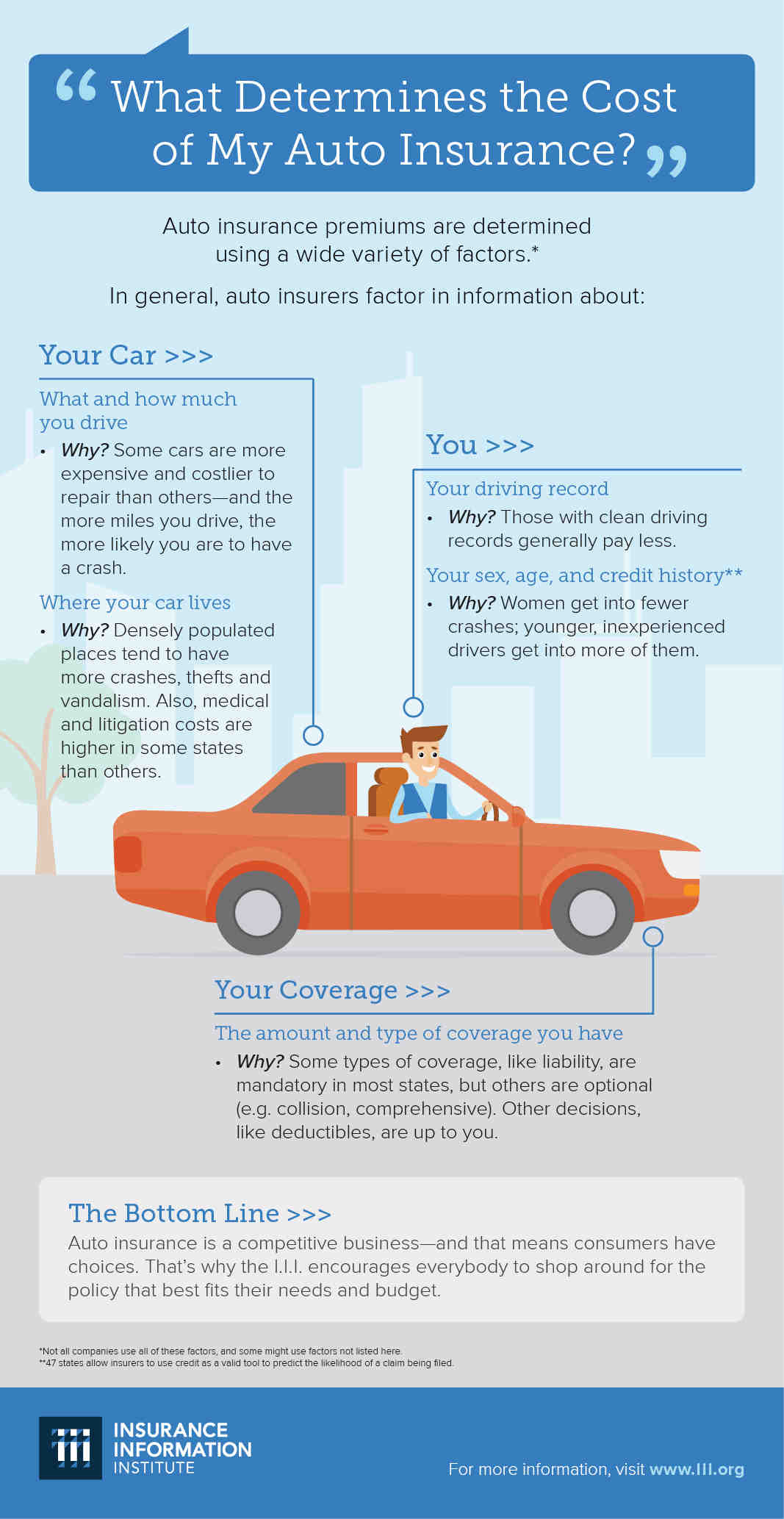

- Credit-based insurance score. …

- deductible. …

- defensive driving.

What does me mean in insurance?

Personal Injury: Injury, illness, disease or death resulting from an automobile accident. Personal Injury Liability Insurance: Protects your assets if you are responsible for an accident that injures or kills someone else. C

What are terms used in insurance?

Here are some of the basic life insurance terms: Insured – The person(s) covered by the insurance policy. Premiums – The monthly or yearly amount you must pay to receive coverage. Principal – The dollar amount that the insurance policy would pay out upon the death of the insured.

What are terms used in insurance?

Here are some of the basic life insurance terms: Insured – The person(s) covered by the insurance policy. Premiums – The monthly or yearly amount you must pay to receive coverage. Read also : What’s the best insurance company to work for?. Principal – The dollar amount that the insurance policy would pay out upon the death of the insured.

What are components in insurance terms?

With any type of insurance, three components (premium, policy limit and deductible) are critical.

What are the basic terms in insurance?

Life insurance terms you should know

- Policyholder: The policyholder is the person who proposes the conclusion of the life insurance and pays the premium (see No. 7 Premium). …

- Life insurance: …

- Sum insured (coverage): …

- Candidate: …

- Political tenure: …

- Age of maturity: …

- Bonus: …

- Premium payment deadline/mode/frequency:

What is insurance term?

Term life insurance is the simplest and purest form of life insurance. It offers your family financial protection at the most affordable prices. … In the event of the death of the insured person, the benefit amount is paid out to the nominee during the term of the contract.

What does ot mean in insurance?

OT – Other party or other person. On the same subject : Can you have two car insurance policies?. OTC – Other than collision.

What does it mean for insurance to cover?

Protection provided by an insurance company when it agrees to pay money if a specific event occurs, such as someone being injured or property being lost or damaged: When applying for home insurance, make sure that you are as detailed about the property as possible.

What does 100k 300k 100k mean?

You should have at least 100,000/300,000/100,000 split limit coverage. That means $100,000 coverage per person in a car accident, $300,000 total coverage for injuries in a car accident. $100,000 coverage for property damage to someone else’s vehicle.

What are the common terms for auto insurance?

Below are definitions of some of the most commonly used terms when dealing with auto insurance.

- adjuster. …

- liability for injuries. …

- claim. …

- collision protection. …

- Comprehensive coverage. …

- Credit-based insurance score. …

- deductible. …

- defensive driving.

What type of car insurance is the most important?

There are now different types of car insurance. On the same subject : What are the 3 types of car insurance?. The most important are liability, comprehensive insurance and collision insurance.

What is the most important car insurance? The primary coverage must be your state’s minimum liability and property damage coverage. More than anything, you need auto insurance to drive legally. You risk losing your driver’s license and fines if you drive without it.

Does car insurance cover the car or the driver?

Contrary to popular belief, car insurance usually follows the car – not the driver. This may interest you : Car Insurance. If you let someone else drive your car and they get into an accident, your insurance company will likely be responsible for paying the damage, depending on the coverages in your policy.

Does progressive insurance follow the car or driver? Progressive’s collision and comprehensive insurance also follows the car, so you’ll need to make a claim with your policy to have your own vehicle repaired or replaced if someone else gets into an accident while driving.

Does car insurance cover you or the other person?

Most auto insurance policies cover drivers you list on the policy or anyone you give permission to drive your car, says Nolo.com. This means that in the event of an accident, your insurance will likely cover another driver, as long as they had your permission to drive your vehicle.

Can someone drive my car and be covered on my insurance Progressive?

As long as you gave them permission to drive your car, they should be covered. Your policy extends to your car and covers you just as if you were driving your own car. Damage they cause to other cars, property or even personal injury is covered. In the event of a collision, damage to your car is covered.

Can someone drive my car and be covered on my insurance Progressive?

As long as you gave them permission to drive your car, they should be covered. Your policy extends to your car and covers you just as if you were driving your own car. Damage they cause to other cars, property or even personal injury is covered. In the event of a collision, damage to your car is covered.

How do I add someone to my Progressive insurance?

Log in to your policy or call 1-866-731-8075 to add your roommate. We need your roommate’s date of birth, vehicle identification number, driving history and driver’s license information.

Does it cost to add a driver progressive?

It costs about $1,231 per year to add a teenager to progressive auto insurance. Progressive typically charges less than the average auto insurance company to add a teenage driver to a parent’s auto insurance.

Is it cheaper to be added to someone’s car insurance?

Find cheap car insurance deals near you Adding someone to your car insurance does affect your rates, but it doesn’t always have a negative impact – sometimes you’ll even save money, depending on the age and driving experience of everyone you add to your policy.

Is Progressive insurance Global?

Progressive also offers home, life, pet and other insurance through select companies. Progressive has also expanded internationally, offering auto insurance in Australia. The company is ranked #74 on the 2021 Fortune 500 list of America’s Leading Companies.

Does Canada have progressive insurance? Your US policy automatically covers you in Canada whether you are renting or driving your own vehicle. Your policy will cover you for as long as you drive there and you don’t have to notify your insurance company.

Is Progressive Insurance Nationwide?

No, Nationwide and Progressive are not the same company. Progressive and Nationwide are two separate companies and both are independent investor and shareholder owned companies.

How many states is Progressive insurance in?

Snapshot is currently available in 45 states plus the District of Columbia. Because insurance is regulated at the state level, Snapshot is not currently available in Alaska, California, Hawaii, and North Carolina.

Is Progressive insurance in all 50 states?

Your progressive auto policy will cover you in all 50 states (and Canada) if you are traveling short term, but if you have another home in another state and keep a vehicle there you will need to maintain a separate auto insurance policy for that Out of state address if you want to use this car.

Are Geico and Progressive the same company?

Read our Advertiser Disclosure for more information. GEICO and Progressive are two of the biggest names in insurance. Both companies offer dozens of insurance products, including popular policies like auto, home, rental, and commercial insurance.

What company owns Progressive?

Progressive is owned by its shareholders as it is a publicly traded company. Its largest shareholders are The Vanguard Group, BlackRock Fund Advisors, and Wellington Management, which together hold nearly 20% stakes as of the first quarter of 2021, according to public records.

Who is the owner of GEICO?

| shareholder | use | Total Value ($) |

|---|---|---|

| The Vanguard Group, Inc. | 7.67% | 4,745,237,844 |

| BlackRock Fund Advisor | 4.90% | 3,033,960,833 |

| Wellington Management Co. LLP | 4.84% | 2,993,753,724 |

| SSgA Funds Management, Inc. | 4.65% | 2,879,467,648 |

Are GEICO and Progressive the same company?

Read our Advertiser Disclosure for more information. GEICO and Progressive are two of the biggest names in insurance. Both companies offer dozens of insurance products, including popular policies like auto, home, rental, and commercial insurance.

Does my car insurance cover me internationally?

The short answer is no. Generally, the auto insurance you carry on your car in the US won’t work abroad because you’re not driving the same car. Unless you plan to have your car shipped abroad, you won’t have your car with you when you land in another country. You drive a rental car.

Does my car insurance cover me in Europe?

If you register a car in an EU country, you must insure it against third party liability. This compulsory insurance applies in all other EU countries. It covers you if you have an accident that causes property damage or injury to someone other than the driver.

Does my UK car insurance cover me in USA?

Yes. To legally drive in most states, you must meet the state’s minimum vehicle insurance requirements. Your specific situation as an international visitor will affect the type of policy you need.

Does my US car insurance cover me in Canada?

In general, American auto insurance works the same in Canada as it does in the United States. For example, your collision damage waiver and comprehensive insurance will still cover damage to your vehicle if you are involved in an accident while driving in Canada.