Drivers urged to check car insurance, stay alert for theft

MONTGOMERY, Ala. (WSFA) – Montgomery County Sheriff Derrick Cunningham urges drivers to check their insurance policy before their car is stolen.

“If you don’t have comprehensive and complete insurance, they won’t cover it,” Cunningham said.

An Alabama attorney recently told WSFA 12 News that some insurance companies don’t cover vehicle thefts when there’s no evidence of wiring or tampering.

“You could be walking to your car after a [Montgomery] Biscuits game, someone could beat you over the head with a crowbar, take your keys and then take your car and there would be no coverage for you,” said Aaron Luck, an attorney with McPhillips Shinbaum.

The Alabama Department of Insurance said drivers with liability-only coverage are not covered for the loss of a car due to theft. The sheriff adds that the same applies to auto parts.

“It only covers you in the event of an accident, not in the event of theft or any theft from inside your vehicles — stolen tires and that kind of thing,” Cunningham said.

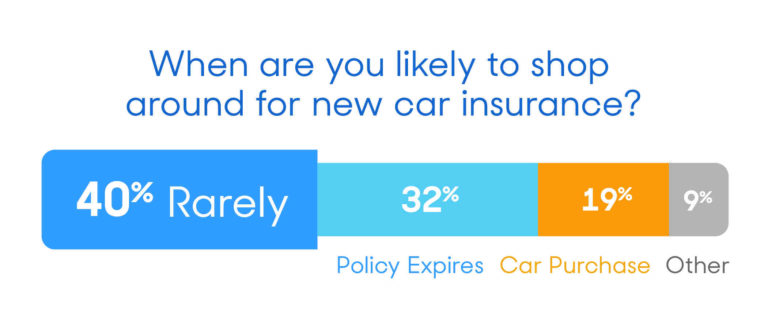

That’s why it’s important to look at the details in your policy.

Additionally, the sheriff warns drivers that car theft often occurs when your vehicle is left unattended with the keys inside.

“However, most of the ones we’ve seen lately have been people getting out of their cars at grocery stores, leaving them running, and people jumping in their cars and driving away,” Cunningham said.

This is especially common when it gets cold and people go outside to start their cars and turn on the heat.

“Thieves look for opportunities,” he said.

Drivers should be aware of their surroundings, always turn off the car and lock those doors so that criminals are less tempted to steal.

Sheriff Cunningham adds that you should also take any valuables you have inside to reduce the risk of the car being stolen. This is especially true of weapons.

Not reading this story on the WSFA News App? Get news notifications FASTER and for FREE in the Apple App Store and Google Play Store!

Copyright 2022 WSFA. All rights reserved.

What is third-party insurance?

Contents [hide]

- 1 What is third-party insurance?

- 2 What are the 7 basic types of coverage needed?

- 3 Is it more expensive to insure a new or old car?

- 4 What is the difference between collision and comprehensive insurance?

Third-party insurance is basic insurance that covers only third-party damages. To see also : Protected: 7 Tips for Getting Affordable Car Insurance Plans » FINCHANNEL. The recipient of the claim is not the policyholder, but the other person or vehicle hit by the insured car of the first party.

Why is it called third party insurance? It is called ‘third party’ cover since the beneficiary of the policy is someone other than the two parties involved in the contract (the car owner and the insurance company). The policy does not bring any benefit to the insured.

What is difference between first and third party insurance?

What is the difference between first and third party insurance? In the case of first-party insurance, the insured car and its owner benefit, as well as a third party if necessary. This may interest you : TikTok made me buy: Auto insurance issue. Third party insurance policies only cover damage or injury/death to third party property or persons.

What is a first party insurance policy?

First-party insurance that indemnifies the owner or occupier of property for loss or loss of earning capacity, when the loss or damage is caused by a covered peril, such as fire or explosion.

What is the difference between first party and third party?

First and third party insurance claims are different. A person submits a first-party claim to their insurance company. In contrast, a person files a third-party claim with the insurance company of the driver who caused the accident.

Which insurance is best first party or third party?

Car insurance covers only damages caused to a third person or vehicle. In the event of bodily injury, death or damage to property or persons of third parties, they are entitled to compensation from the insurance of the first party.

What is third party insurance difference?

The main difference between third party insurance and comprehensive insurance is the type of coverage it offers. Read also : Is car insurance cheaper for older cars?. While third-party insurance only covers you against damages and losses from third parties, comprehensive car insurance also covers your own damages.

What does third party in insurance mean?

Third party – someone who is not the insured and the insurer. In liability insurance, the insurer provides a defense against claims or lawsuits brought by third parties – hence the term “third party insurance.”

What is an example of a third party insurance?

Third party insurance covers an individual or business against loss caused by a third party. An example is car insurance that will compensate the insured if another driver causes damage to the insured’s car. The two main categories of third party insurance are liability coverage and property damage coverage.

What is the difference between insurance and third party insurance?

Casco car insurance protects your car and passengers and the car and passengers of third parties against financial losses caused by an accident. Independent third-party car insurance only covers financial and legal liabilities arising from third-party claims.

What does a third party insurance mean?

Third party – someone who is not the insured and the insurer. In liability insurance, the insurer provides a defense against claims or lawsuits brought by third parties – hence the term “third party insurance.”

What are the 3 types of car insurance?

3 types of automatic coverage are explained

- Liability coverage. It protects you if you harm others and/or their belongings. …

- Collision coverage. It covers your car if you hit another car, person, or stationary object (like those damn decorative rocks Cousin Todd has at the end of his driveway). # …

- Comprehensive coverage.

What is the difference between insurance and third party insurance?

Casco car insurance protects your car and passengers and the car and passengers of third parties against financial losses caused by an accident. Independent third-party car insurance only covers financial and legal liabilities arising from third-party claims.

What exactly is third party insurance?

Third-party insurance provides protection against damage to a third party by the insured vehicle. It covers bodily injury, vehicle damage, property damage and death. Third party insurance does not provide any compensation if: the accident is caused by drunk driving.

What are the 7 basic types of coverage needed?

The best travel insurance plans for Covid-19

- Life insurance. There is a wide variety of life insurance policies. …

- Disability insurance. …

- Long-term care insurance. …

- Homeowners and renters insurance. …

- Liability Insurance. …

- Car insurance.

What are the 4 main types of coverage and insurance? Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.

How many types of coverage are there?

The four main types of insurance are life, health, auto and home insurance.

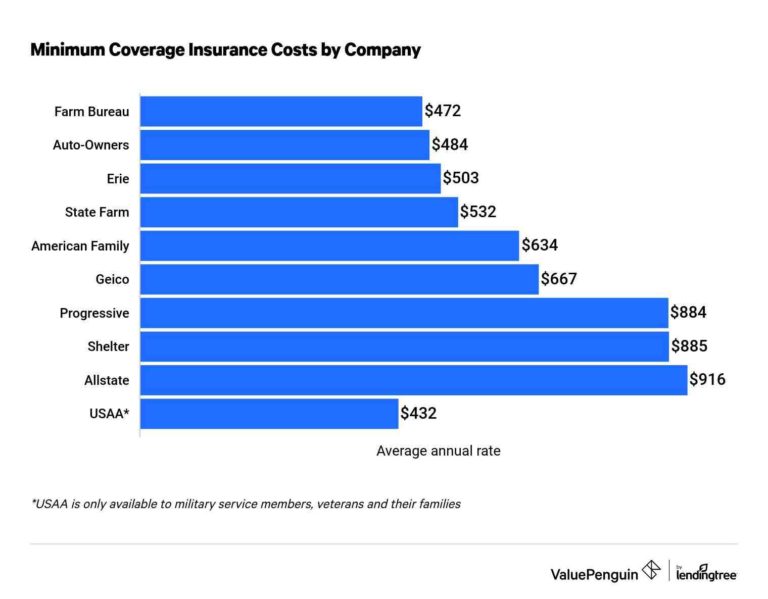

Is it more expensive to insure a new or old car?

Due to their value, repair costs, risk of theft and other factors, insuring a new car can cost more than insuring an older one. If your new vehicle is financed, your lender will likely require you to carry more insurance than the legal minimum, which usually results in higher premiums.

Is it more expensive to insure a new or used car? Insuring a used car is usually cheaper than insuring a new one. Newer cars are more expensive to repair. New vehicles have newer technology, which increases the cost of losses and the amount that insurers set aside to cover claims.

Why is an older car more expensive to insure?

Consider repair and replacement costs: Older vehicles can be more expensive to insure because parts can be more expensive to repair due to hard-to-find parts. Consider how much you will have to spend to fix your older car.

Are older cars more expensive to insure?

An older vehicle is cheaper to insure mainly because older cars are less valuable, so the insurer will not have to pay as much in the event of a total loss. Additionally, once the car drops below a certain value, comprehensive and collision coverage to protect the car itself will actually cost more than they’re worth.

Why is it cheaper to insure a newer car?

While the price of a new vehicle is usually more expensive than the price of a used car, this is not always the case for insurance. State-of-the-art safety features, easier-to-replace parts and other factors often contribute to the low cost of insuring some new cars.

Are newer cars more expensive to insure?

How much does it cost to insure a new car? Newer cars are generally more expensive to insure than older cars, especially if you have comprehensive and collision insurance, as they are worth more and therefore more expensive to replace.

What makes cars more expensive to insure?

The car you drive â The cost of your car is a major factor in the cost of insurance. Other variables include the likelihood of theft, the cost of repairs, the size of the engine and the car’s overall safety record. Cars with high-quality safety equipment can qualify for premium discounts.

Is it cheaper to insure newer or older cars?

An older vehicle is cheaper to insure mainly because older cars are less valuable, so the insurer will not have to pay as much in the event of a total loss. Additionally, once the car drops below a certain value, comprehensive and collision coverage to protect the car itself will actually cost more than they’re worth.

Is it cheaper to insure newer or older cars?

An older vehicle is cheaper to insure mainly because older cars are less valuable, so the insurer will not have to pay as much in the event of a total loss. Additionally, once the car drops below a certain value, comprehensive and collision coverage to protect the car itself will actually cost more than they’re worth.

What is the difference between collision and comprehensive insurance?

Generally, collision insurance comes into play because a driver gets into a car accident. Comprehensive is separate collision coverage. It helps cover different types of losses that are not usually the result of driving the vehicle, such as theft, hail or downed trees.

What does collision insurance cover? Collision coverage helps pay for the repair or replacement of your vehicle if it is damaged or destroyed in an accident with another car, regardless of who is at fault. This is different from liability coverage, which helps pay for damage to another person’s car caused by an accident you caused.

Is it better to have collision or comprehensive?

It is better to have comprehensive insurance than collision insurance if you have to choose between the two. Comprehensive coverage is inexpensive, can be purchased independently, and pays for damage caused by events beyond your control, such as vandalism, theft, natural disasters or animal conflicts.

Is it worth having fully comprehensive insurance?

For the vast majority of drivers, fully comp offers the most affordable car insurance. This is because it offers a higher level of cover than third-party policies. It also means that you won’t have to pay for expensive repairs to your car if you were involved in an accident that was your fault.

Is collision coverage a good idea?

Much like your car, collision coverage becomes less valuable over time because it will never pay out more than the value of the vehicle. If you don’t have a loan or lease that requires it, collision insurance ends up losing its value, costing more than you would have been paid after the collision.

At what point is collision insurance not worth it?

You should drop your collision insurance when your annual premium equals 10% of your car’s value. If your collision insurance costs a total of $100 a year, for example, drop the coverage when your car is worth $1,000 because at that point your insurance payments are too close to the value of your car to be worth it.

What is collision comprehensive coverage?

It comprehensively covers events beyond your control that are not caused by a collision, such as weather, vandalism and theft. Collision coverage is for damage caused by an accident with another vehicle or object.

What is comprehensive deductible vs collision deductible?

The collision deductible applies to losses from a collision that causes damage to your vehicle. For example, collision with a vehicle, hit and run, etc. The comprehensive deductible is called Excluding Collision. Damage to your vehicle that is not caused by a collision.

Is collision and comprehensive the same as full coverage?

Collision coverage covers damage to your vehicle if you hit an object or another car. Comprehensive insurance pays for damage that is not caused by an accident, such as weather or fire damage. It also compensates you for car theft and animal collision damage.

What is the difference between comprehensive and collision deductible?

The collision deductible applies to losses from a collision that causes damage to your vehicle. For example, collision with a vehicle, hit and run, etc. The comprehensive deductible is called Excluding Collision. Damage to your vehicle that is not caused by a collision.

What collision deductible should I get?

Consumer advocates typically recommend a $500 collision deductible unless you have substantial savings. Deductibles are charged per incident, so you’ll pay your deductible each time an accident claim is made.

What is a good deductible for collision and comprehensive?

Comprehensive claims are usually made for less collision damage, so a lower deductible often makes sense. Collision deductibles can sometimes be as high as $100 or $250, but most agents recommend starting with $500 and increasing if you can afford it.