Elephant Car Insurance Review 2022 – Forbes Advisor

Editor’s Note: We receive a commission from affiliate links on Forbes Advisor. The commissions do not affect our editorial opinions or ratings.

About Elephant Insurance

Contents

- 1 About Elephant Insurance

- 2 Auto Insurance from Elephant

- 3 Does Elephant Insurance offer Accident Forgiveness?

- 4 Does Elephant Insurance Offer New Car Replacement?

- 5 Does Elephant Offer Gap Insurance?

- 6 Does Elephant Insurance Offer a Diminishing Deductible?

- 7 Does Elephant Insurance Offer SR-22s?

- 8 Does Elephant Offer Usage-Based Insurance?

- 9 Does Elephant Offer Pay-Per-Mile Insurance?

- 10 Elephant’s Auto Insurance Discounts

- 11 Complaints Against Elephant Insurance

- 12 Elephant’s Grade from Collision Repair Professionals

- 13 More Insurance from Elephant

- 14 Elephant Insurance Mobile App

- 15 Elephant’s Charitable Causes

- 16 Best Car Insurance Companies 2022

- 17 What are the 3 major car insurances?

- 18 Who is the top five insurance company?

- 19 Is Churchill owned by Aviva?

- 20 Who is the number 1 auto insurer in the US?

Elephant Insurance came to the car insurance scene in 2009 as a subsidiary of Admiral Group plc. Headquartered in Richmond, Virginia, Elephant insures more than 200,000 vehicles.

Elephant Insurance is available in eight states: See the article : Is Progressive or Geico cheaper?.

The company sells insurance for cars, motorcycles and off-road vehicles. YourMechanic is available to all Elephant customers and connects customers to more than 600 diagnostic, maintenance and repair services at affordable prices.

You can also set up contactless payments and contactless car repairs.

Auto Insurance from Elephant

Elephant sells the same types of car insurance you’ll find at other car insurance companies: See the article : DC car thefts, inflation driving up car insurance rates.

Elephant also sells additional types of coverage, including:

Does Elephant Insurance offer Accident Forgiveness?

Yes, Elephant forgives accidents. To qualify, all drivers on your policy must be accident-free for three years. To see also : Illinois auto insurance rates rise with inflation; how to find offers, discounts and quotes for cheap insurance. After this three-year period, you are eligible for a next-fault accident waiver, meaning your premiums will not increase because of the accident.

Elephant also offers advanced risk forgiveness, which eliminates the three-year waiting period, meaning your risk forgiveness starts immediately. To qualify for the upgrade, none of the drivers on your policy can have an at-fault accident on their records from the past three years.

Does Elephant Insurance Offer New Car Replacement?

No, Giwa does not offer new car replacement insurance. This type of coverage usually reimburses you for a new vehicle of the same value instead of the value of your car only if it is totaled due to a problem covered by your policy (such as a fire or accident).

Does Elephant Offer Gap Insurance?

Elephant sells a “mortgage/lease bond” that is similar to gap insurance. Generally, gap insurance pays the “gap” between what you owe on your car loan or lease and the value of your car if it is totaled due to a problem covered by your policy (such as a car accident).

With an Elephant loan/lease, you will get up to 25% of the value of your car if you are “upside down” on your car loan.

For example, if you owe $20,000 on your total car and its value is down $17,000, you have a $3,000 gap. With an Elephant loan / lease, you are covered up to 25% of $17,000 ($4,250). In this case, taking the loan/lease will be enough to cover the remaining balance of your loan.

Does Elephant Insurance Offer a Diminishing Deductible?

Yes, Elephant offers a reduced rate as an optional policy add-on. If you have collision insurance with at least a $500 deductible, you will see your deductible reduced by $100 for the annual policy and $50 for the six-month policy for each time you are without an accident, up to $500.

Does Elephant Insurance Offer SR-22s?

Yes, Elephant offers SR-22 insurance in Illinois, Indiana, Tennessee, Texas and Virginia.

The SR-22 is a court order that insurance companies file with the state as proof that you meet minimum coverage requirements. A state usually requires drivers with DUI convictions or multiple driving offenses to file an SR-22.

Does Elephant Offer Usage-Based Insurance?

No, Elephant currently does not offer user-based insurance (UBI). UBI uses telematics to track driving behavior such as speed, brake pressure, acceleration and phone usage. Drivers who practice safe driving behavior receive a discount.

Elephant plans to launch its own mobile app, according to the company’s website.

Does Elephant Offer Pay-Per-Mile Insurance?

No, Giwa does not offer pay-per-mile insurance. With pay-per-mile insurance, you’ll usually pay a daily or monthly premium at a rate per mile. It can be a good fit for small traveling drivers.

Elephant’s Auto Insurance Discounts

Elephant offers various car insurance discounts to help you cut your bill, such as:

Complaints Against Elephant Insurance

Giwa has about the average level of complaints compared to other car insurance companies, based on complaints made to state insurance departments across the country. Planners have complained about elephants in 2021 for reasons such as extensions and delayed claims.

Elephant’s Grade from Collision Repair Professionals

In a survey of CRASH Network collision repair experts, Elephant Insurance received a C grade.

The opinions of collision repair experts are useful because they see how insurers compare in the claims process. Auto body experts have an insider’s opinion on the use of minor repairs, whether insurance companies encourage the use of repair methods recommended by car manufacturers, and whether insurers have procedures in place. fast and satisfactory to customers.

More Insurance from Elephant

Other types of insurance policies offered by Elephant include:

Elephant Insurance Mobile App

Elephant insurance allows you to submit claims and photos via mobile. You can also use the app to manage your bills, access your policy documents and change your coverage limits.

Elephant’s Charitable Causes

Elephant launched its Help the Herd program in June 2021. The company has donated more than $300,000 to organizations affected by Covid-19. Help Herd has made two rounds of donations to nearly 50 nonprofit organizations in the states where Giwa works. Each team received between $2,000 and $20,000.

Giwa also supports Project Yellow Light, a scholarship competition that encourages young people to discuss the dangers of distracted driving through short films, radio spots and billboards.

Best Car Insurance Companies 2022

With so many options for car insurance companies, it can be difficult to know where to start getting the right car insurance. We evaluate insurers to find the best car insurance companies, so you don’t have to.

What are the 3 major car insurances?

3 Types of Car Covers Explained

- take responsibility. It protects you if you cause damage to others and/or their property. …

- A collision. It covers your car if you hit another car, person or immovable object (like those darn ornamental rocks cousin Todd has at the end of his driveway). #…

- I take a photo.

What are the different types of car insurance? The six common auto insurance coverage options are: auto liability coverage, uninsured and underinsured coverage, comprehensive coverage, auto coverage, medical coverage and personal injury coverage.

What is the #1 car insurance?

USAA. USAA is the best insurance company in our rating. According to our 2022 survey, USAA customers report the highest level of customer satisfaction and are more likely to renew their policies and recommend USAA to other drivers.

Who is the top five insurance company?

The five largest insurance companies in the United States are State Farm, Allstate, USAA, Liberty Mutual, and Farmers.

Who is the number 1 auto insurer in the US?

State Farm is the number one auto insurance company in the country in terms of market share and written value, behind Geico, Progressive and Allstate.

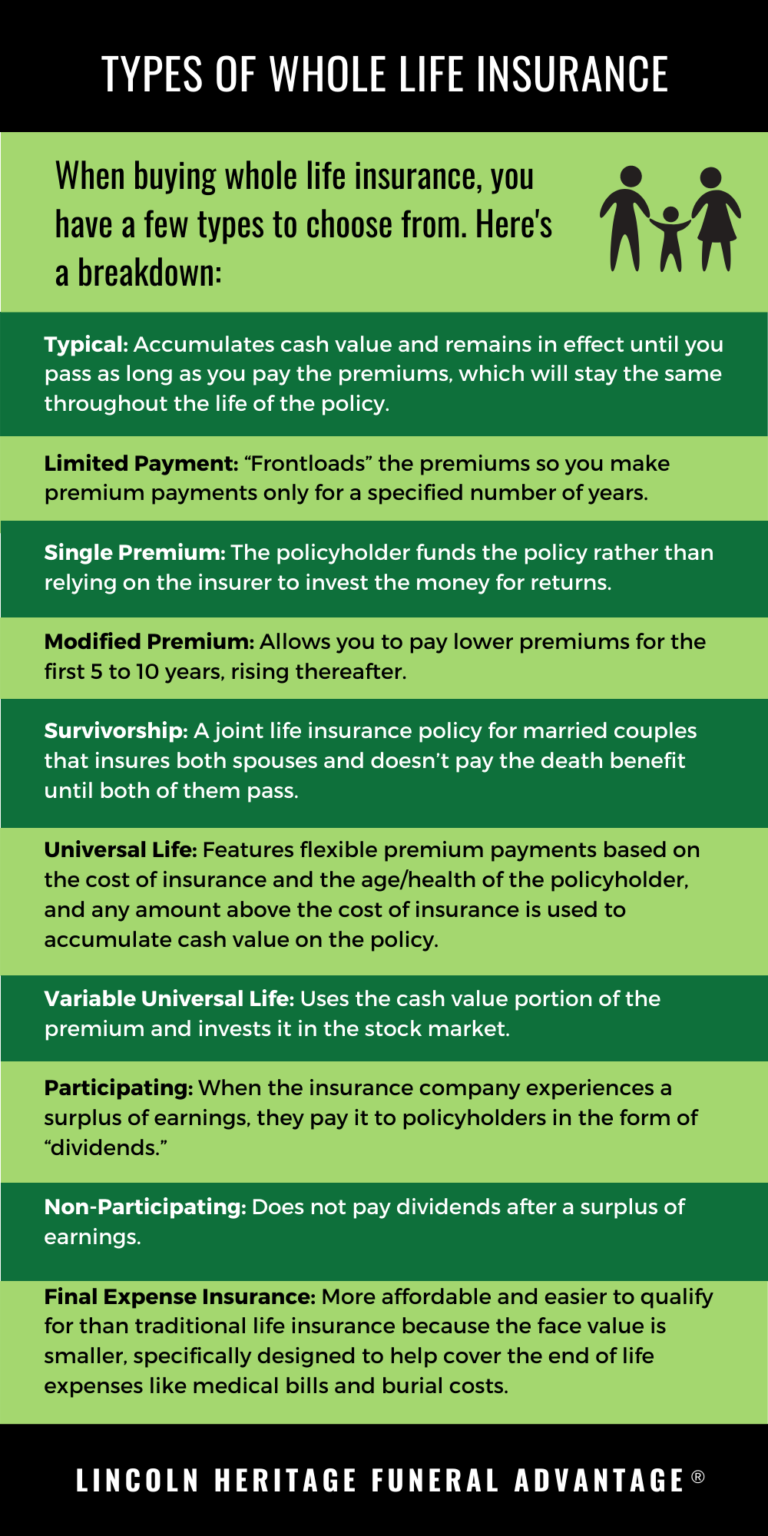

What are the 2 main types of car insurance?

The two main types of auto insurance policies are liability-only and comprehensive coverage. While liability policies only cover bodily injury and property damage, comprehensive coverage includes comprehensive accident and peril insurance in addition to the minimum coverage.

What is basic car insurance called?

Basic car insurance is often known as liability insurance. Requirements vary by state, but basic liability insurance can be divided into two main types of liability insurance: personal injury and property damage.

What is the most common type of car insurance?

Bodily Injury Liability (BI) is the most common type of auto insurance because it is required in almost every state.

Who is the top five insurance company?

The five largest insurance companies in the United States are State Farm, Allstate, USAA, Liberty Mutual, and Farmers.

Who is the biggest insurance company?

Is Churchill owned by Aviva?

In 2003, Royal Bank of Scotland Group acquired Churchill, which made the bank’s insurance fund the second largest insurer in the UK.

Who owns Churchill? We are a UK company and we sell insurance policies over the phone and online. In 2003, Royal Bank of Scotland Group acquired Churchill, which made the bank’s insurance fund the second largest insurer in the UK.

Is Churchill and Direct Line the same company?

Founded in 1989, as one of the country’s first direct to customer auto insurance companies, the company has grown to offer general insurance products. Since February 2012, Churchill has been part of the Direct Line Group; The policy is written by the parent United Kingdom Insurance Limited.

Is Direct Line still owned by RBS?

Direct Line Group 2012 – 2021 Separated from parent group RBS, the Group has achieved the goal of operating as an independent insurance company.

Who underwrites Churchill Insurance?

Churchill motorcycle insurance is written by a panel of insurers and arranged by Devitt Insurance Services Limited. Life insurance is introduced by U K Insurance Business Solutions Limited and issued by Legal & General Assurance Society Limited.

Who underwrites Churchill Insurance?

Churchill motorcycle insurance is written by a panel of insurers and arranged by Devitt Insurance Services Limited. Life insurance is introduced by U K Insurance Business Solutions Limited and issued by Legal & General Assurance Society Limited.

Are Churchill and Privilege the same company?

Who is Privilege Insurance? Privilege is part of the Direct Lines Insurance Group which also owns the Churchill insurance brand. Unlike other Direct Line products, the privilege policy appears on the comparison site.

Is Churchill a Privilege insurance?

Privilege insurance policies are underwritten by U K Insurance Limited (UKI), which owns the Privilege, Direct Line, Churchill and Green Flag brands.

Who is the number 1 auto insurer in the US?

State Farm is the number one auto insurance company in the country in terms of market share and written value, behind Geico, Progressive and Allstate.

Who is the largest auto insurer in America? State Farm is the largest auto insurance company in the United States and has a 16% market share.