How does insurance company make money?

How do insurance companies invest their money?

Contents

- 1 How do insurance companies invest their money?

- 2 Why insurance is not a gambling?

- 3 Is insurance an investment?

- 4 Can you get rich selling insurance?

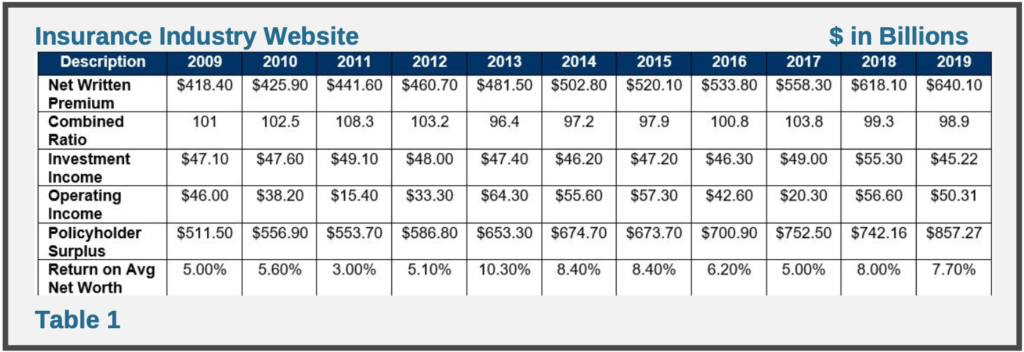

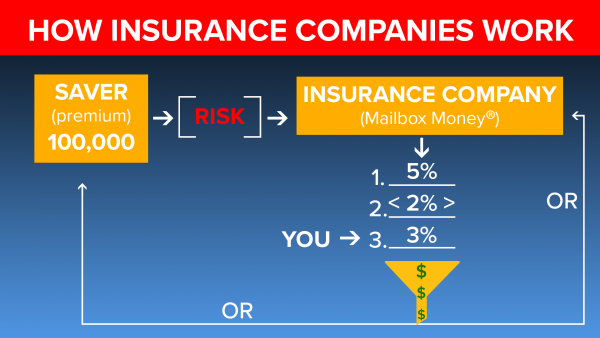

Insurance companies make money in two main ways: collecting premiums for the insured and investing the insurance premium. To see also : Which insurance company has the highest customer satisfaction?.

Where do insurance companies get their money from? Most insurance companies generate revenue in two ways: collecting premiums in return for insurance coverage, and then reinvesting these premiums in other interest-generating assets.

What do insurance companies invest?

Insurance companies tend to invest the most money in bonds, but they also invest in stocks, mortgages and liquid short-term investments. Read also : Do car insurance check your job?.

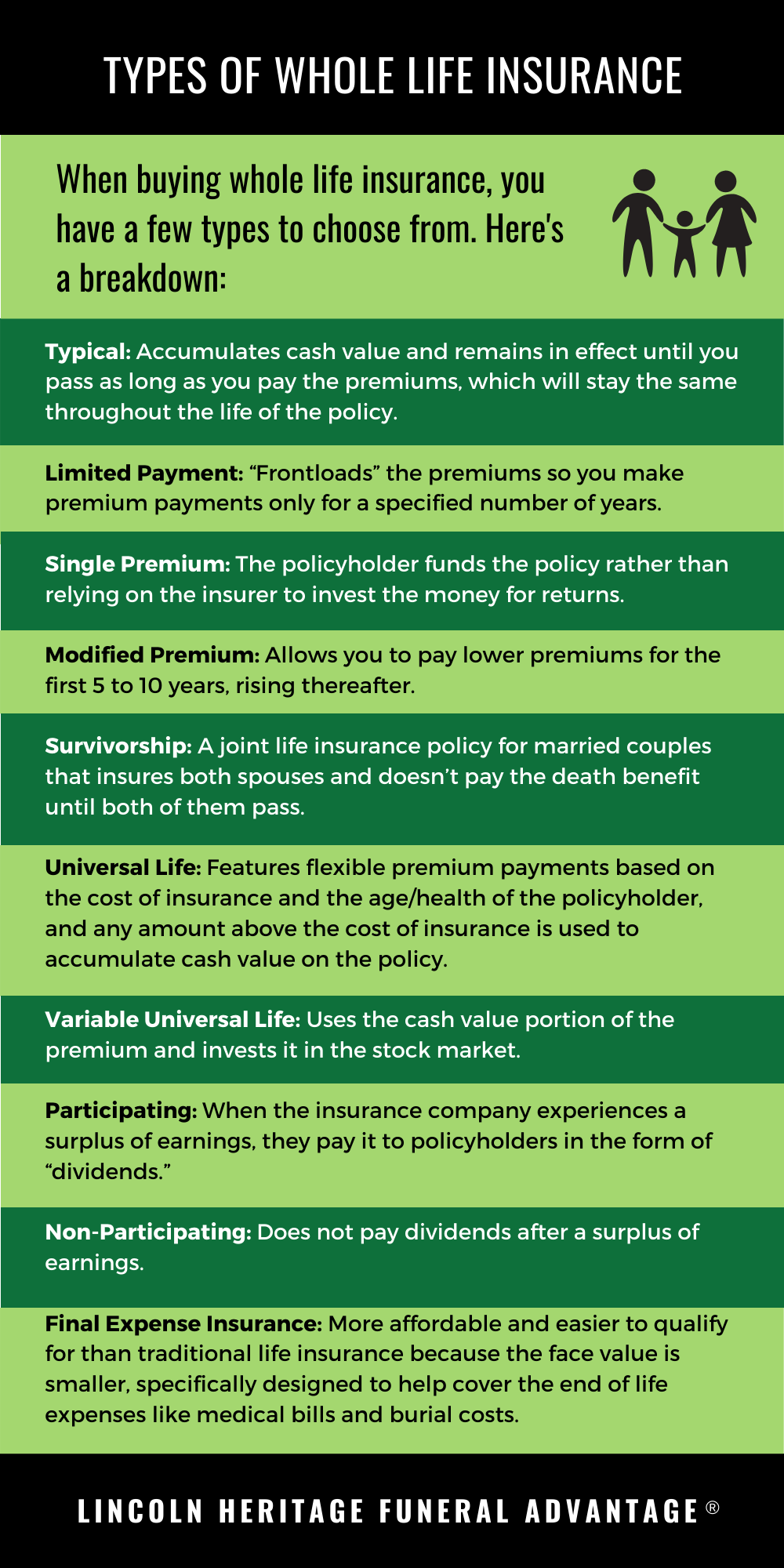

What do Whole life insurance companies invest in?

Life insurance companies invest premiums that they receive from customers. They generally choose assets with features that are tailored to the characteristics of the insurance products they sell. For example, proceeds from a long-term insurance product will be invested in a long-term asset.

Why do insurance companies have investments?

Specifically, U.S. insurers aim to invest in longer-term assets with lower risk. The long duration of their investments is used to pay compensation that is expected far into the future. As a result, US insurers are investing in the long term.

How do insurance company make money?

Most insurance companies generate revenue in two ways: collecting premiums in return for insurance coverage, and then reinvesting these premiums in other interest-generating assets. Like all private companies, insurance companies try to market effectively and minimize administrative costs.

Do insurance companies offer investments?

Specifically, U.S. insurers aim to invest in longer-term assets with lower risk. The long duration of their investments is used to pay compensation that is expected far into the future. To see also : Can you lie about mileage on insurance?. As a result, US insurers are investing in the long term.

How are insurance companies different from investment companies?

As the name suggests, an insurance policy takes care of a financial basis, such as a nest egg for you and your loved ones in the future. An investment allows you to make money with existing excess money.

Life insurance companies invest premiums that they receive from customers. They generally choose assets with features that are tailored to the characteristics of the insurance products they sell. For example, proceeds from a long-term insurance product will be invested in a long-term asset.

Is insurance a kind of investment?

Insurance-cum-investment products offer both â € “life insurance and return on investment. While the benefit of life cover is only available after the insured’s death or disability, the return on investment can be realized during the policy.

How does an insurance company earns a profit?

The most important way an insurance company earns is by ensuring that the premiums received are greater than any claims made against the policy. This is known as underwriting profit. Insurance companies also generate additional investment income by investing in the premiums received.

Do insurance companies typically make a profit?

The profitability of insurance companies depends on the number of premiums they write, the return on their investments, business costs, and how much they have to pay in claims. From Q2 2021, life insurance companies had a net profit margin (NPM) of 4.1% for the last 12 months (TTM).

Why insurance is not a gambling?

Insurance is not gambling due to the presence of insurable interest. Without an insurable interest it would be betting, contract. This principle thus clearly distinguishes the insurance contract from gambling.

Is insurance an investment?

Insurance is not an investment When you invest your money somewhere, you expect something in return. Not so with pure period insurance. If you die, your nominee gets something. If you live, no one gets anything.

Can insurance be a form of investment? Yes, in the right situation and used properly, life insurance can be considered an investment.

Is life insurance a saving or investment?

However, you can think of time-limited life insurance as an investment in the sense that you pay relatively little in premiums in return for the security of knowing that in the event of your death, your beneficiaries will receive a relatively large death benefit.

Is life insurance an asset or investment?

If you have a life insurance policy, you may be wondering if it is an asset or a liability. After all, you might pay a monthly premium for it. The answer is that yes, life insurance is an asset if it accumulates cash value.

Is insurance a type of savings?

When you pay premiums on an insurance policy, this money belongs to the insurance company. If you never suffer a loss, you will get nothing for that investment. In contrast, money you put into a savings plan remains not just your money. It bears interest while it is unused in the account.

Is life insurance a saving?

Although it is not a federally insured bank type of savings account, your life insurance may also include a savings component (but not always). The main types of life insurance include: Term life.

Is insurance the same as investment?

So what to get: Insurance or investment? The answer is simple and boils down to what you need now and what you need in the future. While Investments will take care of your now and immediate future, Insurance will take care of you and your loved ones in the long run.

Why insurance is a form of investment?

Traditional insurance is technically an investment in the sense that you put money away to help you or your family when an unexpected event can set you back financially. Technically, it is an investment in your family’s financial security.

Is an insurance company an investment company?

Investment companies are designed for long-term investment, not short-term trading. Investment companies do not include brokerage firms, insurance companies or banks.

Can insurance be considered as investment?

Why time insurance is not an investment Pure period insurance does not provide any return to the policyholder, either during the term or by surviving the insurance period. In the event of premature death, however, the death benefit is paid to the nominees.

Why insurance is a form of investment?

Traditional insurance is technically an investment in the sense that you put money away to help you or your family when an unexpected event can set you back financially. Technically, it is an investment in your family’s financial security.

How life insurance is a source of investment?

Many reputable insurance companies also offer bonuses that help your investment grow. The returns from life insurance plans can help you achieve your life goals, such as children’s higher education or financial freedom upon retirement. You can also borrow against the cash value of your policy in financial emergencies.

Why insurance is a good investment?

Your insurance investment will take care of your family in any situation and will help compensate for lost household income, pay for the education of your children or even provide financial security to your spouse if something happens to you.

Is insurance a form of investment?

Is insurance an investment? Traditional insurance is technically an investment in the sense that you put money away to help you or your family when an unexpected event can set you back financially. Technically, it is an investment in your family’s financial security.

Can you get rich selling insurance?

Is It Possible To Become A Millionaire By Selling Insurance? A big yes. But like any other job, it takes time to be good at what you do and achieve such income levels. Top agents earn anywhere from $ 100,000 to a million dollars.

Is It Easy To Make Money Selling Insurance? It can be relatively easy to find jobs that sell life insurance policies. Life insurance sales can be added to passive income, as once you sell a policy, you continue to earn a commission on it, provided the policyholder pays their monthly premiums.

Are insurance agents rich?

As of 2019, an insurance agent earned an average salary of $ 50,940, according to the U.S. Bureau of Labor Statistics. In the industry, the lowest 10% earned around 8,000, and the highest 10% earned over $ 125,000. It depends on what employer you work for and what insurance you sell for how much you earn.

Can you make a lot of money as an insurance agent?

The U.S. Bureau of Labor Statistics reports that an insurance agent earned $ 50,940 a year on average in 2019. The lowest 10% in the industry earned more than $ 28,000, and the highest 10% earned over $ 125,000. The way you earn your income differs depending on the company you work for and the type of insurance you sell.

How much do most insurance agents make?

According to the U.S. The Bureau of Labor Statistics earns an insurance agent an average of $ 50,600 a year from 2018. The salary of the position can vary drastically, with the lowest 10% earning less than $ 27,500 and the highest 10% earning more than $ 125,610.

How do insurance agents get rich?

The primary way an insurance broker makes money is from commissions and fees earned on policies sold. These commissions are typically a percentage of the policy’s total annual premium. An insurance premium is the amount a person or business pays for an insurance policy.

How do insurance agents get rich?

The primary way an insurance broker makes money is from commissions and fees earned on policies sold. These commissions are typically a percentage of the policy’s total annual premium. An insurance premium is the amount a person or business pays for an insurance policy.

How profitable is an insurance agency?

Many insurance companies operate with margins as low as 2% to 3%. Smaller margins mean that even the smallest changes in an insurance company’s cost structure or pricing can mean drastic changes in the company’s ability to generate profits and remain solvent.

Can insurance agents make millions?

Insurance agents can make more than a million dollars a year, but most do not because they focus on marketing to people they know and are heavily reliant on referrals. Insurance agents who get online insurance open the door to becoming financially free.

What type of insurance agents make the most money?

Insurance field overview Although there are many types of insurance (ranging from car insurance to health insurance), the most lucrative career in the insurance field is for those who sell life insurance.

What type of insurance can you make the most money selling?

Although there are many types of insurance (ranging from car insurance to health insurance), the most lucrative career in the insurance field is for those who sell life insurance.

Can insurance agents make millions?

Insurance agents can make more than a million dollars a year, but most do not because they focus on marketing to people they know and are heavily reliant on referrals. Insurance agents who get online insurance open the door to becoming financially free.