How does your address affect your car insurance?

What agency regulates the insurance industry?

Contents

- 1 What agency regulates the insurance industry?

- 2 How much is insurance for a new driver?

- 3 What databases do insurance companies use?

- 4 Is Progressive insurance Good?

Led by Insurance Commissioner Ricardo Lara, the California Department of Insurance is the consumer protection agency for the nation’s largest insurance market and protects all of the state’s consumers through proper regulation of the insurance business. This may interest you : Nigerian Etap gets $ 1.5 million in pre-seed to make buying auto insurance easier.

Is NAIC a regulator? The National Association of Insurance Commissioners (NAIC) is a U.S. standard-setting and regulatory support organization formed and managed by the top insurance authorities from 50 states, the District of Columbia, and five U.S. territories.

Who governs the insurance industry?

Insurance is regulated by the state. This system of regulation stems from the McCarran-Ferguson Act of 1945, which defines state regulations and industry taxes as being in the “public domain” and is clearly prioritized in legislation. This may interest you : Florida car insurance among the most expensive in the United States. federal. Each state has its own set of rules and regulations.

Does the NAIC regulate the insurance industry?

The National Association of Insurance Commissioners (NAIC) provides skills, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers.

Who regulates the insurance industry in the UK?

The Prudential Regulatory Authority (PRA), part of the Bank of England, promotes the safety and well -being of insurers, and the protection of policyholders.

Are insurance companies regulated by the federal government?

Since the McCarran-Ferguson Act of 1945, Congress has given regulation of the “insurance business” in the states. Through congressional legislation, Congress can rescind its submission and establish a federal regulatory directive, similar to what we see in the military industry. bank.

Are insurance companies regulated by the federal government?

Since the McCarran-Ferguson Act of 1945, Congress has given regulation of the “insurance business” in the states. See the article : Does progressive raise rates after 6 months?. Through congressional legislation, Congress can rescind its submission and establish a federal regulatory directive, similar to what we see in the military industry. bank.

Does the federal government influence the insurance industry?

The federal government, through the SEC, has a significant impact on the licensing and registration of securities products, and that impact has increased in the insurance business because many new insurance products have two -dimensional product characteristics. insurance and investment products.

Is insurance is regulated by both the federal and state government?

Insurance, unlike many other financial services, is still regulated by the state. Individual insurance companies are regulated by the state in which they live and are subject to the laws of the other states in which they do business.

Are insurance companies backed by the federal government?

Despite the big AIG government in September 2008, many people are surprised by the fact that the responsibility of protecting consumers from the failure of insurance companies actually falls into the hands. state governments.

Does the NAIC regulate the insurance industry?

The National Association of Insurance Commissioners (NAIC) provides skills, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers.

What is NAIC regulation?

The NAIC Model Laws, Regulations, and Guidelines (available in the library) contain documents published by the National Association of Insurance Commissioners as a proposed set of insurance rules to be adopted by 50 states.

Is the NAIC a regulator?

NAIC is not a regulator; although its members are insurance commissioners (such as the superintendent of insurance) of each of the U.S. states and six territories, the NAIC is a non -governmental organization that is still concerned with insurance matters but not regulated.

Who does the NAIC regulate?

The National Association of Insurance Commissioners (NAIC) is the regulatory body that manages all insurance matters – it sets standards, establishes best practices, and oversees the oversight of the insurance business.

How much is insurance for a new driver?

How much is car insurance for a new driver? Auto insurance for a new driver can start from $ 1,500 per year to $ 3,000 and up. It depends on the cost of the new driver’s car, location, driving records (if any), credit and so on.

How much is insurance for a new driver in the UK? Car insurance for new drivers can be expensive. For young new drivers between the ages of 17-20, annual insurance costs around £ 1,800 and although car insurance for 21-25 years is not expensive, it still costs over £ 1,000. .

Do I need insurance to drive my parents car Ontario?

Can you drive someone else’s car without insurance in Ontario? As long as you are licensed to drive in Ontario, you can use someone else’s car even if you don’t have insurance. You will need to get their explicit permission to operate the vehicle, however. It is not enough to know that they are OK.

How much is insurance in Paris?

How much does car insurance cost in Paris? Car insurance in Paris Kentucky costs an average of $ 2,718 per driver per year, or about $ 226 per month. Compared to the state annual average of $ 2,644, car insurance in Paris is $ 74 higher.

How much is insurance in France?

How Much Does Health Insurance Cost? In France, the average cost of health insurance for an individual is 40 EUR (45 USD) per month. Of course, there are different costs associated with the policy as well: the stronger the policy, the more you pay for your health insurance. There are many types of health insurance.

How much does the French healthcare system cost?

The French health system is one of the most expensive in the world and controlling costs is important for the government and insurers. But French prices remain far higher than the US France spends $ 2,047 per person on health care compared to the US $ 4,095.

How much is the average car insurance in France?

The average annual car insurance coverage in France in 2016 was around ‚¬400, making it the fifth-highest in the EU and more than the total amount of car insurance. EU. All risk premiums are higher, typically in the region of 600â € “900 per year.

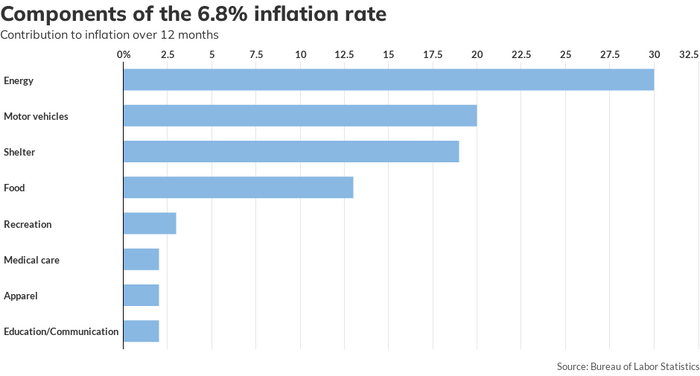

What drives the cost of insurance?

Why is my car insurance so high? The cost of car insurance depends on what you can control – such as where you live, the type of car you drive and how much insurance you buy – and things. you can’t, like your age. Bad credit can greatly increase your costs in many states, as well as accidents or DUI offenses.

What factors affect the cost of insurance?

Some of the factors that can affect your car insurance are your driving habits, your democracy and the insurance, the limits and deductions you choose. These can include things like your age, anti -theft characteristics in your car and your driver’s record.

What makes up the cost of insurance?

You pay for insurance policies that cover your health — and your car, home, life, and other essentials. The amount you pay depends on your age, the type of insurance you want, the amount of insurance you need, your personal information, your ZIP code, etc.

What factors most likely influence the cost of car insurance?

What are the most important factors for car insurance costs?

- Year. Age is a very important factor, especially for young drivers. …

- Travel history. This estimate is correct. …

- Credit score. …

- Years of driving experience. …

- Location. …

- Itupa. …

- Insurance History. …

- annual miles.

What databases do insurance companies use?

Where is my insurance history kept? This claims information service is commonly called the “Index System” and is used by many insurance companies to compile accounts. history of all plaintiffs ’claims.

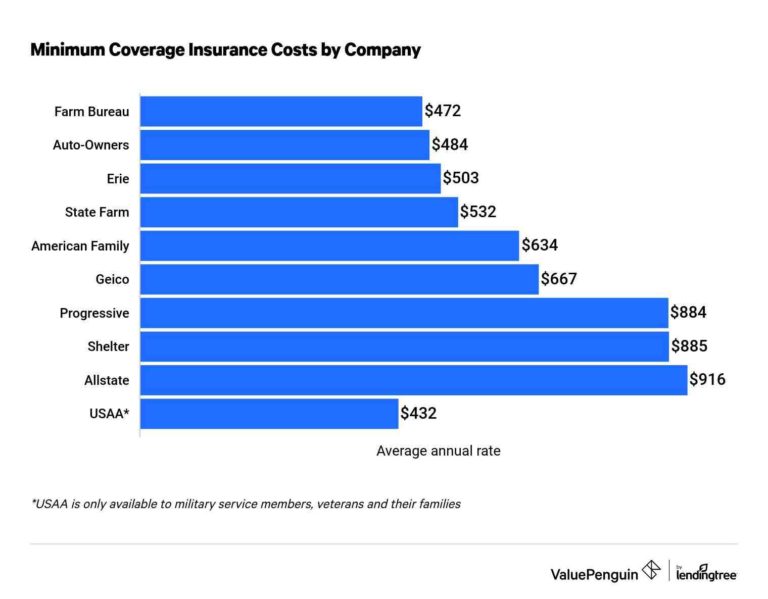

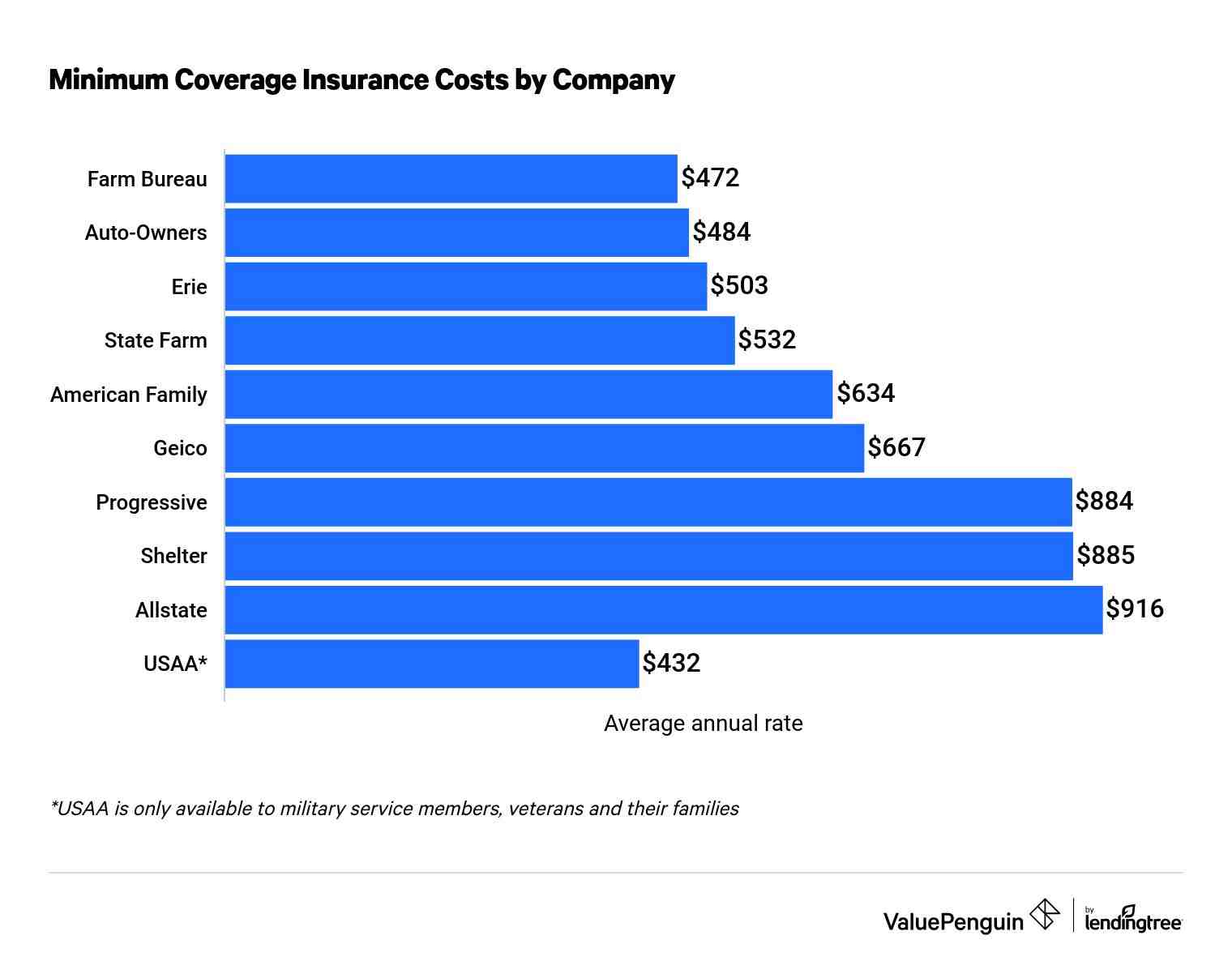

Is Progressive insurance Good?

The growth received a total satisfaction of 76 out of 100 in its customer pool, in a NerdWallet survey conducted online in July 2021. By giving that to in hindsight, the average score in the seven insurances was 79, and the average was 83.