How much does losing car insurance cost you?

Although making car insurance payments can sometimes strain your budget, not paying your insurance could cost you more in the long run. First of all, if you are going to drive, almost all states legally require you to carry insurance. And you’ll likely face rising premiums when you eventually get coverage again. The longer you wait, the more your premiums are likely to increase.

Learn more about what happens if your auto insurance lapses, how much your premiums are likely to increase and what you can do to get coverage back.

See how much you can save on auto insurance

What is a lapse in coverage?

Contents

- 1 What is a lapse in coverage?

- 2 What are the consequences of a lapse in coverage?

- 3 How much does a lapse affect insurance rates?

- 4 How to deal with a lapse in coverage

- 5 FAQs

- 6 Bottom line

- 7 When can an insurer refuse to reinstate?

- 8 How do I get around my insurance lapse?

- 9 Can a lapsed insurance policy be reinstated?

- 10 Is it hard to get car insurance after being Cancelled?

A lapse in insurance coverage occurs when you drop or lose coverage for a time. While the exact time period will be defined by your own car insurance company and your state, in general, a lapse of 30 to 60 days in coverage is considered a lapse. On the same subject : 3 years since the Michigan auto insurance reform, has it done what it promised? A look at the data. If you drive without insurance, you may be subject to fines, a driver’s license suspension, or be subject to other penalties.

A lapse in coverage is usually due to non-payment. If you don’t pay your insurance premiums, your insurance company will cancel your policy. Fortunately, insurance companies won’t immediately cancel your policy if you’re a few days late.

Most auto insurance companies offer a grace period for auto insurance. This gives you a few extra days after your payment due date to pay. You may face a late payment fee, however. Be sure to contact your insurer as soon as you realize you’ve missed a payment to make sure your policy is still in place.

What are the consequences of a lapse in coverage?

The only states that do not require auto insurance coverage are New Hampshire and Virginia, and the states that do require it keep tabs on drivers. This may interest you : Solvang Auto Insurance Agent Reports Top Reasons to Buy Business Auto Insurance. Insurance companies work with local departments of motor vehicles (DMV) and report when customers lose their policies.

In case you are not insured, the following can happen:

You are not insured in case of an accident. There is a reason that drivers have a car insurance policy. Car accidents, even minor ones, can be very expensive. Insurance helps eliminate the burden of this cost and could help pay for medical bills and property damage.

You may lose your license. Not having your state’s minimum insurance could cost you your license.

Your insurance rates will likely increase. Insurance companies don’t like it when you have a lapse in your coverage. If and when you reinstate your policy, you will likely end up with a rate increase.

You could get potential jail time. The first time you’re caught without insurance, you may get a fine, but you’re unlikely to face jail time. Repeat offenders may eventually face a short prison sentence, however, depending on their state.

Your vehicle could be repossessed. Drivers with loans or leased vehicles will be able to repossess their vehicles if they fall on insurance coverage. When you take out a loan or lease, lenders require you to maintain insurance – typically comprehensive and collision in addition to liability. If you don’t keep your end of the bargain, your car could be repossessed because you broke a legal agreement.

If you lose your license for not maintaining insurance, the biggest fee you will pay is a license reinstatement fee. The fees range from $50 to a couple of hundred dollars and often collect the more penalties you have. Additionally, you may be required to have an SR-22, which is a statement that says you have your state’s minimum insurance.

How much does a lapse affect insurance rates?

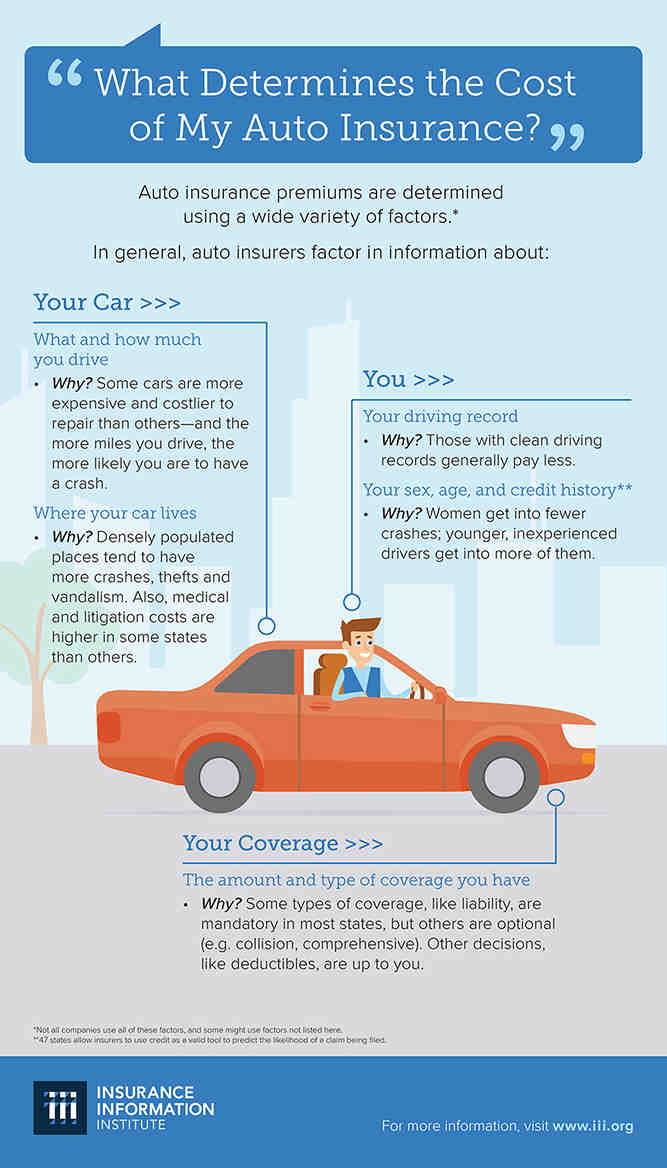

It is difficult to identify an exact amount by which a lapse in coverage will increase your car insurance rates, but you may pay more for insurance once you have returned it. And the longer your lapse, the higher your rate will increase. Read also : Here Are The Cars That Buy The Highest Insurance Rates For 2022. You may be considered a high-risk driver, and some insurance companies may even refuse to insure you.

How to deal with a lapse in coverage

When you realize that you have lost your insurance due to non-payment, you need to act quickly to avoid potential fines, late fees and the potential repossessing of your car.

Here are some steps to help you get your coverage back.

Immediately call your insurer to reinstate coverage

First, call your insurance company. If you have an insurance card, your doctor or agent number should be listed here. Or you can do an internet search for your insurer’s customer service line.

Explain to them that you realize you’ve lost your coverage and want to discuss getting it back. If you have missed a payment, paying it immediately can get you back in the good graces of your insurance company.

Insurance companies are required by state law to provide notice before canceling your policy. If you receive a notice, act quickly to make your payment and avoid dealing with a lapse in coverage.

Only maintain the coverage you can afford

If you no longer have car insurance coverage because you can’t pay your car insurance premiums, there are ways to reduce the monthly cost. Yes, you may pay a little more because you let your policy lapse, but if you drop the most expensive coverage you have, your premium could drop enough to allow you to move forward.

For example, if you own your car and it is not necessary to have collision and comprehensive coverage (also known as comprehensive coverage), consider dropping these. While you won’t have as much coverage, you will still meet the minimum state requirements.

Of course, before making this decision, consider the car you have. If you have a newer car and you have an accident, you will have to pay a lot more out of pocket to repair or replace it than if you drive an old clunker. Again, ask your insurer how you can lower the price of your policy.

You can also increase your deductible or lower your policy limits, but again, these could lead to higher out-of-pocket costs in the event of an accident.

Get quotes for cheaper rates

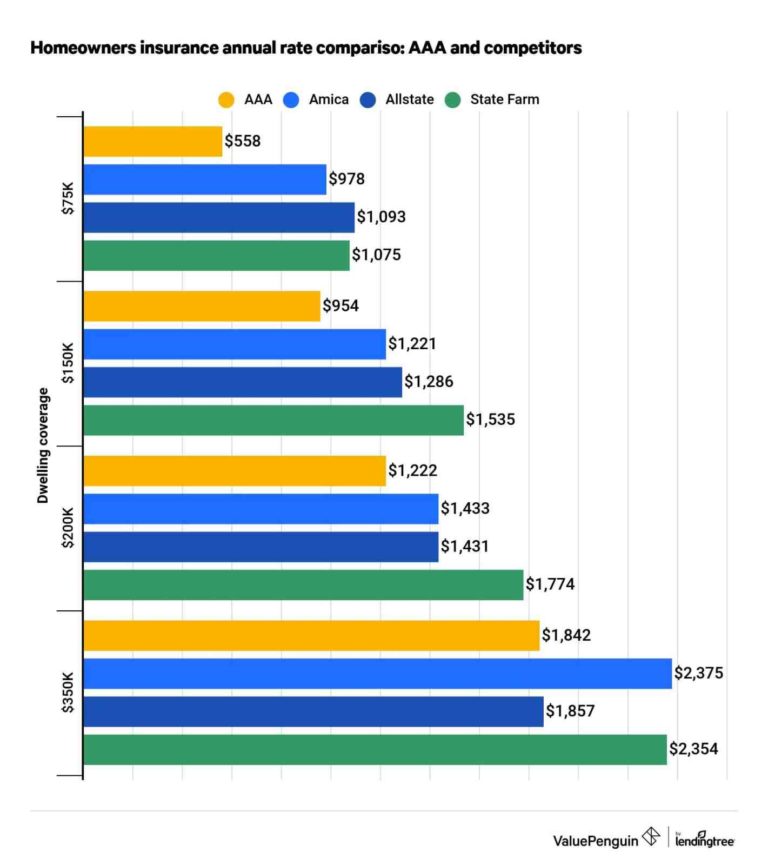

Some insurance companies are stricter than others. If you have found that your insurance company is not willing to work with you on your premium after a lapse in your policy, consider switching to a company that understands and get a new policy.

FAQs

Does an insurance lapse affect credit?

Technically, no, the actual lapse of the insurance does not have an effect on your credit score. However, if you stop paying on your car insurance and those debts are turned over to collection agencies, this could have a negative impact on your score. The collection agencies report these delinquent payments to the credit agencies, who note them on your report for future lenders to see.

How do I get around my insurance lapses?

There is no failure in insurance. Lapses are only after you have not paid for a period of time. Before your policy officially expires, your insurance company is required to contact you to let them know. If you choose to ignore these calls, you need to take the appropriate steps to reinstate your insurance.

Recovering your insurance largely involves contacting your insurance company and paying any late bills.

What is the penalty for not having car insurance?

Leaving your car insurance policy is a pretty big offense in the eyes of the law. Your exact penalty differs depending on the state in which you live. Generally, you have to pay a fine, and your state can suspend your license. If you have multiple offenses, you can end up serving prison time as well.

Bottom line

A lapse in your insurance is likely due to missed payments on your part. The best way to avoid this is to sign up for automatic payments with your insurer, if available, and only insure a policy you can really afford. While it is nice to have as much coverage as possible, if you are going to potentially not pay, it is not worth it.

If you have a lapse in coverage due to a missed payment, you may be able to correct the problem before it affects your rate. Having a short lapse is better (and cheaper) than a longer lapse. If it’s been a while since you’ve had coverage, don’t continue to ignore the problem. Get a few insurance quotes from the best car insurance companies to see who could offer you the best price.

6 Genius Hacks Costco Shoppers Should Know

9 things you should do before the next recession.

Can you retire early? Take this quiz and find out.

9 simple ways to make up to $200 extra/day

This article How much will a lapse in car insurance coverage cost you? originally appeared on FinanceBuzz.

When can an insurer refuse to reinstate?

In the case of the insurer also, can not force for the reinstatement, if the terms of the insurance policy provide another method of compensation.

How many days does an insurance company have to refuse a reinstatement? If the insurer has not notified the insured in writing of its disapproval of the reinstatement request within 45 days from the issuance of the conditional receipt, the policy is automatically reinstated.

What is the reinstatement rule in insurance?

A reinstatement clause is an insurance policy clause that states when the terms of coverage are reset after the insured individual or business files a claim for previous loss or damage. Reinstatement clauses do not generally reset the terms of a policy, but allow the policy to restart coverage for future claims.

What is an example of reinstatement?

Example sentences After his name was cleared, he was reinstated as chairman of the committee. The school board voted to reinstate the school’s uniform policy. the year the death penalty was reinstated.

What is the reinstatement procedure?

Definition. In reinstatement procedures, laboratory animals are trained to self-administer drugs and undergo extinction training, during which lever presses are not reinforced with drugs.

What is a reinstatement on insurance?

Key Takeaways Reinstatement in the insurance industry means that a person’s previously terminated policy can resume if the insured already meets the specific requirements for reinstatement. Typically, insurance companies offer policyholders a grace period for late payments before a policy expires.

Is there a time limit on reinstatement of a lapsed life insurance policy?

How to restore a lapsed policy. Insurers generally allow three to five years to reinstate a policy after it expires, says Ardleigh.

Can a lapsed insurance policy be reinstated?

Most policies can be reinstated within five years of expiration as long as overdue premiums are paid and loans against cash value are satisfied. Most companies require proof of insurability, however, reinstatement of a lapsed policy can be less expensive than purchasing a completely new policy.

What happens if you let your life insurance lapse?

Life insurance policies often have a grace period after a missed payment where the policy is still in force or at least offers a limited benefit. But once the grace periods have passed and the possible cash value is used, an expired policy will end and the life insurance benefits will be gone.

How long after a life insurance policy lapses can it be reinstated?

A life insurance policy can be reinstated within 30 days of a lapse without additional documents, underwriting or health certificates. Insureds often pay a reinstatement premium, which is greater than the original premium.

Can a lapsed insurance policy be reinstated?

Most policies can be reinstated within five years of expiration as long as overdue premiums are paid and loans against cash value are satisfied. Most companies require proof of insurability, however, reinstatement of a lapsed policy can be less expensive than purchasing a completely new policy.

What are the disadvantages of reinstating a lapsed life insurance policy?

The disadvantages of restoring a lapsed policy are: You often have to pay all the missed premiums, which can often add up to a hefty sum. One must also pay a penalty to the insurance company. The insurance company can renegotiate the terms of the original policy to put the insured at a disadvantage.

What happens if an insurance policy lapses?

If the value of the account is not enough to pay for the premiums of the insurer, then the policy will be considered lapsed. Once a policy lapses, the insurer is under no legal obligation to provide the benefits stated in the policy. Term life insurance does not have this benefit because it does not earn cash value.

Can you reactivate a lapsed policy?

Beyond this, if the premium is not paid, the policy is considered lapsed. However, lapsed policies can be revived. A policy can be revived by paying the past premiums, and additional charges as imposed by the insurer. Often, insurers come up with special schemes or campaigns to bring back lapsed policies.

How do I get around my insurance lapse?

You may be able to pay your late payment over the phone and avoid a lapse. Many insurers offer a grace period. Typically, this grace period is a period of time in which your premiums will not increase due to a lapse in coverage. You may want to ask your insurer if you can take advantage of this option.

How long can an insurance policy expire? What is a grace period for car insurance? Your car insurance policy will not be canceled immediately because you miss a payment. Auto insurance companies are required by state law to provide notice before canceling your policy. Depending on the state, you usually have between 10 and 20 days.

What happens if your car insurance lapses in NC?

NCDMV will send a notice of termination of liability insurance to the registered owner of the vehicle, who has 10 days from the date printed on the notice to respond. Failure to respond may result in revocation of the vehicle license plate as well as civil penalties, late fees, interest and collections.

Is there a grace period for car insurance in NC?

Pay your premium in full. Also, pay on or before the due date to avoid the risk of cancellation. There is NO GRACE PERIOD for car insurance. Use a check or money order.

Does North Carolina have a grace for a lapse in insurance coverage?

The North Carolina insurance policy grace period is 2 to 30 days in most cases.

What happens if I have a lapse in car insurance in NC?

Expired coverage An individual who wants to relicense his vehicle after the revocation period is required to pay a civil penalty of $50, $100 or $150, depending on the amount of lapses previously paid in a three-year period.

Can a lapsed insurance policy be reinstated?

Most policies can be reinstated within five years of expiration as long as overdue premiums are paid and loans against cash value are satisfied. Most companies require proof of insurability, however, reinstatement of a lapsed policy can be less expensive than purchasing a completely new policy.

How long do you have to reinstate a lapsed life insurance policy?

A life insurance policy can be reinstated within 30 days of a lapse without additional documents, underwriting or health certificates. Insureds often pay a reinstatement premium, which is greater than the original premium.

Can you reactivate a lapsed policy?

Beyond this, if the premium is not paid, the policy is considered lapsed. However, lapsed policies can be revived. A policy can be revived by paying the past premiums, and additional charges as imposed by the insurer. Often, insurers come up with special schemes or campaigns to bring back lapsed policies.

What happens if an insurance policy lapses?

If the value of the account is not enough to pay for the premiums of the insurer, then the policy will be considered lapsed. Once a policy lapses, the insurer is under no legal obligation to provide the benefits stated in the policy. Term life insurance does not have this benefit because it does not earn cash value.

How do I get around insurance lapse?

What to do if you have a lapse in coverage

- Call your insurance agent. It is better to confirm with your insurer if a lapse has occurred or if it is just from your payment. …

- Many insurers offer a grace period. …

- Establish a new policy. …

- Avoid driving.

What can you do with a lapsed insurance policy?

Life insurance policies often have a grace period after a missed payment where the policy is still in force or at least offers a limited benefit. But once the grace periods have passed and the possible cash value is used, an expired policy will end and the life insurance benefits will be gone.

How long can an insurance policy lapse?

Lapsed insurance policies Insurers are legally required to give policyholders a grace period before the policy lapses. The grace period is usually 30 days. Insurers provide the insured with a period of 30 days to pay for the expiration of the missed premium.

Can a lapsed insurance policy be reinstated?

Most policies can be reinstated within five years of expiration as long as overdue premiums are paid and loans against cash value are satisfied. Most companies require proof of insurability, however, reinstatement of a lapsed policy can be less expensive than purchasing a completely new policy.

Can you reactivate a lapsed policy? Beyond this, if the premium is not paid, the policy is considered lapsed. However, lapsed policies can be revived. A policy can be revived by paying the past premiums, and additional charges as imposed by the insurer. Often, insurers come up with special schemes or campaigns to bring back lapsed policies.

How long do you have to reinstate a lapsed life insurance policy?

A life insurance policy can be reinstated within 30 days of a lapse without additional documents, underwriting or health certificates. Insureds often pay a reinstatement premium, which is greater than the original premium.

How do I reactivate a lapsed life insurance policy?

During the grace period, you can get your life insurance policy back by simply paying the outstanding premium and any associated late fees. Grace periods usually last about 30 days, depending on your policy. In some circumstances, some insurers may extend up to 60 or 90 days.

What happens if my life insurance policy lapses?

What happens if you miss your life insurance payments? If your life insurance policy lapses, you no longer have coverage and your beneficiaries will not receive a payment from the life insurance company when you die.

How many years do you have to reinstate a life insurance policy?

How to restore a lapsed policy. Insurers generally allow three to five years to reinstate a policy after it expires, says Ardleigh.

What happens if an insurance policy lapses?

If the value of the account is not enough to pay for the premiums of the insurer, then the policy will be considered lapsed. Once a policy lapses, the insurer is under no legal obligation to provide the benefits stated in the policy. Term life insurance does not have this benefit because it does not earn cash value.

Can you get money back from a lapsed life insurance policy?

The company will not refund your premiums if you outlive a term policy, unless you have purchased a “return of premium” policy or a rider. Your life insurance company must refund your premiums if it refuses to pay your claim during the two-year period when it can investigate the cause of death.

What happens if your car insurance is Cancelled or you let the policy lapse?

Once your insurance is canceled, the state can revoke or suspend your driver’s license and car registration. For leased or financed cars, lenders generally require collision and comprehensive coverage to protect the vehicle. Without car insurance, the lender can repossess your car.

What are the disadvantages of reinstating a lapsed life insurance policy?

The disadvantages of restoring a lapsed policy are: You often have to pay all the missed premiums, which can often add up to a hefty sum. One must also pay a penalty to the insurance company. The insurance company can renegotiate the terms of the original policy to put the insured at a disadvantage.

What is the advantage of reinstating a policy instead of applying?

The benefit of reinstating an existing policy instead of applying for a new policy is that you will be able to pay less. If your health hasn’t changed, your insurer will honor the original price on your policy, says Ardleigh. If your health has changed, that could affect your rate (or your insurability).

Can lapsed life insurance be reinstated?

During the grace period, you can get your life insurance policy back by simply paying the outstanding premium and any associated late fees. Grace periods usually last about 30 days, depending on your policy. In some circumstances, some insurers may extend up to 60 or 90 days.

What happens when you reinstate your life insurance policy?

In terms of insurance, reinstatement allows a previously terminated policy to resume effective coverage. In the case of non-payment, the insurer may request evidence of eligibility, such as an updated medical examination for life insurance, and the full payment of the outstanding premiums.

Is it hard to get car insurance after being Cancelled?

Depending on why your doctor discontinued coverage, getting car insurance after a canceled policy can be difficult. While some options for insurance are usually available, your premiums are likely to be significantly higher, as you will be considered more risky to cover.

What happens after car insurance is cancelled? You usually have 10 to 20 days between the date of cancellation and the date you are no longer covered. The exact amount of time differs by state. After this, your insurance will officially lapse and you will no longer be able to legally drive your car.

Does canceling car insurance hurt credit?

“Cancelling your auto insurance policy should not impact your credit score. While car insurance companies look at your credit score to determine your rate, they don’t use your credit outside of it. Canceling insurance would be different from canceling a credit card or closing a loan.

What is the best way to cancel car insurance?

The easiest way to cancel your car insurance is to call your insurance company or agent. In many cases, one phone call is enough to cancel your policy or stop renewing your insurance. However, some insurance companies may require you to pay a cancellation fee and sign an insurance cancellation form or letter.

What happens if I just cancel my car insurance?

Once your insurance is canceled, the state can revoke or suspend your driver’s license and car registration. For leased or financed cars, lenders generally require collision and comprehensive coverage to protect the vehicle. Without car insurance, the lender can repossess your car.

Is it worth it to cancel car insurance?

Because gaps in coverage can have a negative impact on your future premium rates, previous car insurance – even for an extended vacation – is probably not worth it. If you plan to be away for a month or longer and your vehicle will not be in use, there may be other ways to save on your premiums without canceling your policy.

How do I get my Cancelled insurance back?

You can renew your auto policy by calling your insurance company or contacting them through their website or mobile app. If you pay the premiums you owe within your insurer’s grace period, your policy will be reinstated and you cannot have a coverage lapse on your record.

What happens if your car insurance gets Cancelled?

Once your insurance is canceled, the state can revoke or suspend your driver’s license and car registration. For leased or financed cars, lenders generally require collision and comprehensive coverage to protect the vehicle. Without car insurance, the lender can repossess your car.

Can you reverse an insurance cancellation?

If you can clarify or reverse the cancellation, such as honoring missed payments, you may be able to recover your policy. Otherwise, you will need to secure new insurance.

How long do you have to declare that you have had insurance Cancelled?

For canceled policies there is no set time limit as for convictions; some insurers may only ask about your insurance history over the previous five years, others may require you to disclose details for a longer period.

Is there a grace period for Cancelled insurance?

After a cancellation for a missed payment, the insurer may increase your rates and your license may be revoked. You’ll usually have a grace period of between one and 30 days, but you shouldn’t count on it to protect yourself.

What happens when your insurance gets Cancelled?

Once your insurance is canceled, the state can revoke or suspend your driver’s license and car registration. For leased or financed cars, lenders generally require collision and comprehensive coverage to protect the vehicle. Without car insurance, the lender can repossess your car.

Can insurers check if you have had a policy Cancelled?

So technically, canceled insurance policies will stay with you indefinitely. During the application process, insurers will sometimes ask you if you’ve ever had a policy canceled in the past.