How to get the best offer on your car insurance

If you’ve recently had to insure your car, you’ve probably noticed that your premiums have increased compared to last year.

Rising values of used cars and the increased cost of replacement parts have both helped push premiums higher. According to CompareTheMarket, the cost of car insurance was up 14 per cent year-on-year in November 2022, with an average premium of £629 – £76 more than a year earlier.

So if your car insurance needs to be renewed, here we look at the options that can help you get the best deal. One point to note up front is that you should always be honest when insuring your car; You could void your policy if you are not.

Shop around

Contents

- 1 Shop around

- 2 Sort out your policy earlier

- 3 Lower the annual mileage

- 4 Pay the premium in one go if you can

- 5 Think about where you park your car

- 6 Only buy the cover you want

- 7 Look at a telematics policy

- 8 Consider a cheaper-to-insure car

- 9 Which is the best private insurance company?

- 10 Does having a car loan affect insurance?

- 11 Is Progressive insurance really cheaper?

- 12 Which type of insurance is the least expensive and why?

Using insurance comparison sites can bring significant savings. This may interest you : What are the types of car insurance. (PA)

While many of us know that when it comes to renewing or getting auto insurance that we should shop around to find a better deal, many of us choose to avoid the hassle and just have it auto-renew.

It’s worth the time though, as CompareTheMarket says drivers can save an average of £328 by looking elsewhere. There are various insurance comparison websites that make it easy for you to compare policies and find the best deal.

Sort out your policy earlier

If you set reminders at the beginning of the year, you will not miss appointments such as MOT and maintenance. See the article : Report: Florida is ranked 2nd highest for car insurance costs. (PA)

Knowing when your auto insurance needs to be renewed will help you get your insurance sooner for next year. If you do it at the last minute, you will always pay more than if you worked in advance.

Most insurance companies let you take out a policy about four weeks in advance, which is best for lowering your premium. If you change your insurer, don’t forget to tell your existing insurer that you are also terminating the current policy, as it may be set to auto-renew.

Lower the annual mileage

Reducing your annual mileage allowance can help lower premiums. On the same subject : Do men pay more for car insurance?. (PA)

Adjusting your annual car insurance mileage allowance can also make a big difference because the more miles you drive on the road, the more likely it is that a collision or damage will occur.

While reducing mileage by 1,000 is unlikely to make much of a difference, grossly overestimating the number of miles you put in will likely skyrocket costs. If you’re not sure how many miles you’re driving, it’s worth checking your car’s MOT or service history to determine annual mileage. However, make sure it’s representative of what you’re doing. as an underestimate could result in a policy becoming void.

Paying the premium all at once helps reduce costs. (PA)

When you take out an insurance premium, you’ll be asked if you want to pay it all at once or split it into monthly installments.

If you have the funds available paying it off in one go will save you money in the long run as you don’t have to worry about interest charges which can add around £35 depending on the annual policy depending on the insurer and the amount.

Think about where you park your car

Park your car in a safer place to lower premiums. (Kia)

Where your car is typically parked can make a big difference in the premium as it can affect the likelihood of it being vandalized, damaged or stolen. Again, don’t lie about where the car is kept, day or night.

However, if you have an option for a “safer” location, it’s worth making the change. For example, if you have a garage or driveway but don’t use it and instead park on the street, there will be a noticeable cost added to the policy.

Only buy the cover you want

Consider whether you need additional add-ons, e.g. B. breakdown insurance. (RAC/PA)

When purchasing a policy, you will often be asked if you want any extras. This may include legal protection, breakdown protection and key protection, which can help with replacements.

These can quickly push the price to over £100, so it’s worth considering if you really need them. It all depends on your own needs, but it’s worth checking if you don’t already have this. For example, many new cars are sold with multi-year roadside insurance (often the same as the warranty) so you don’t have to buy them again.

Look at a telematics policy

Although black box insurance is often used by new drivers, it is available to all age groups. (PA)

With a telematics policy, often referred to as a black box policy, the insurance company can essentially monitor your driving and adjust charges based on your habits and driving style.

It is often used by younger drivers to reduce costs, although such policies are available to drivers of all ages and levels of experience. It’s a great way to lower premiums, although you have to be aware that your ride will be tracked and poor, fast or erratic driving can result in you paying more. Some policies often have night curfews or penalties.

Consider a cheaper-to-insure car

Choosing a car in a lower insurance group helps lower premiums. (Volkswagen)

If you’ve explored all your options and still can’t get the car insurance on the deal you want, one last point is to look at the car itself. Owning a desirable, high-value, or high-performance vehicle all contributes to higher premium costs.

Although you must consider the cost of changing vehicles, a smaller, less powerful vehicle is almost always cheaper to insure. The easiest way is to look at the insurance group number – from 1 to 50. The lower the number, the cheaper the insurance should be. Before you buy a car, you should always look at the insurance premiums so that you don’t get any nasty surprises.

Paying your insurance premiums annually is almost always the cheapest option. Many companies will give you a full payment discount as it costs the insurance company more if a policyholder pays their premiums monthly as it requires manual processing each month to keep the policy active.

Which is the best private insurance company?

4 Best Health Insurance Companies 2023

- Overall best. Best overall insurance: Kaiser. Best overall insurance: Kaiser.

- Good. Popular health insurance company: BCBS. Popular health insurance company: BCBS.

- Good. Best for self-employed: UHC. Best for self-employed: UHC.

- Cheap. Best for Young Adults: Etna. Best for Young Adults: Etna.

What is the strongest insurance company?

What are the 5 main types of private insurance?

Types of Health Insurance Plans: HMO, PPO, HSA, Service Fee, POS.

What are examples of private insurance?

There are two types of health insurance: Privately funded: primarily through employer-sponsored plans; Examples include Blue Cross and Blue Shield plans, non-Blue business plans, HMOs, and self-funded employer plans.

What are the 4 main types of insurance categories?

However, there are four types of insurance that most financial experts recommend to all of us: life, health, auto, and long-term disability.”

What is the most common type of private insurance?

Preferred Provider Organization (PPO) Plans The Preferred Provider Organization (PPO) plan is the most common insurance coverage plan offered by employers. According to KFF1, 47% of those surveyed with an employer-sponsored plan have a PPO.

Does having a car loan affect insurance?

Does a car loan result in higher premiums for your car insurance? Yes, but not directly. While auto insurers don’t charge you more for an auto loan, you have more coverage requirements, and therefore you end up paying more for auto insurance than if you owned your vehicle directly.

Is car insurance more if you have a loan? Your car insurance won’t charge you more just because you have a car loan. However, your lender will likely require you to take out full-coverage auto insurance, which will increase your insurance rate.

Is insurance higher when you finance?

no Insurers consider many other factors when determining the cost of car insurance, including your age, driving habits, where you live, the make and model of the vehicle, and more. Whether you finance your car or not has no effect on your premium.

Does paying off a car loan decrease insurance?

Auto insurance premiums don’t automatically go down when you pay off your car, but you can likely lower your premium by dropping coverages you no longer need.

Does credit affect car insurance?

A higher credit rating often lowers your auto insurance rate significantly with almost every insurance company and in most states. However, getting a quote will not affect your credit score.

Does insurance look at credit?

If you buy car or home insurance, or if your current policy is about to be renewed, your insurance company may check your credit history. Here are some tips to help you understand how your credit information can be used and how it can affect your insurance premiums.

What is a good credit score for auto insurance?

Then what is good credit to get competitively priced car insurance? A score in the “good” range – between 670 and 739 according to the FICO scoring model – is generally considered the basis for competitive pricing.

Why is car insurance based on credit?

However, credit-based insurance ratings are generally created to help insurance companies understand the likelihood of someone making insurance claims that cost the company more than it earns in premiums. Factors that affect your credit scores can also affect your credit-based insurance scores.

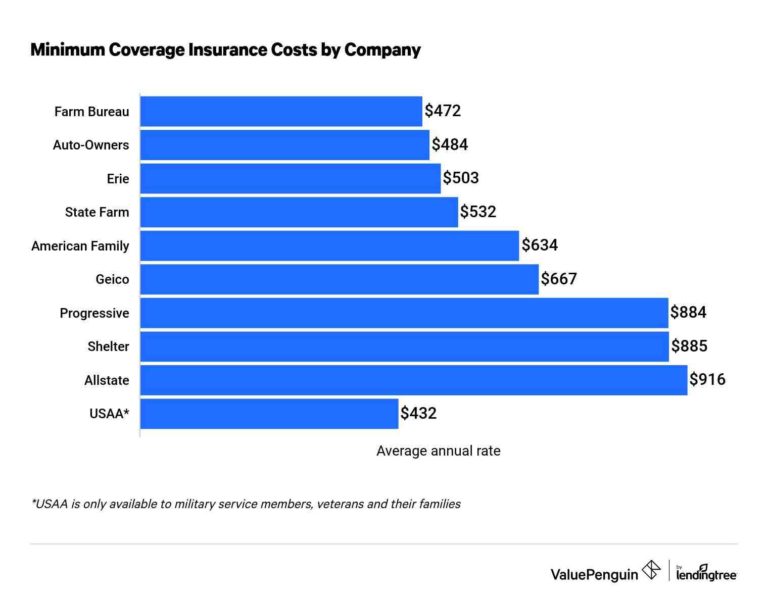

Is Progressive insurance really cheaper?

Is Progressive good car insurance? Progressive’s average auto insurance premiums are only slightly below the national average. But compared to the other insurers in our list of the best auto insurance companies of 2022, Progressive’s average rates are relatively expensive.

Who is cheaper Geico or Progressive? Is Progressive cheaper than Geico? Both Geico and Progressive offer cheap auto insurance to motorists across the country. Geico’s rates tend to be lower overall, but Progressive tends to offer better rates for people with a recent DUI, at-fault accident, or speeding ticket on their driving record.

How are Progressive rates so low?

Progressive is so cheap because it offers a variety of discounts and provides consumers with tools to help them get the best prices possible, such as: B. Progressive’s price comparison tool and their Name Your Price® program.

Does Progressive rates go down after 6 months?

With Progressive you can avoid increasing your auto insurance policy every 6 months as long as you don’t file a claim and have a good driving record.

How does Progressive determine rates?

An insurance score is just one of many factors that Progressive considers when determining rates. Depending on the federal state, we also take into account your driving license, vehicle type, place of residence, gender, age and other factors.

Why does Progressive raise rates after 6 months?

Even drivers with a clean record can see their insurance renewal price increase. As mentioned above, automatic rate increases are sometimes based on factors beyond your control, such as: B. Claims in your zip code. Or if you’ve added a new driver or vehicle to your policy, your rate may also increase at the time of renewal.

Does Progressive price go up after 6 months?

Yes, Progressive increases rates after 6 months in some cases. If you are a new Progressive customer, your auto insurance premium will increase after your first 6 month term if you make a claim or if traffic violations are added to your driving log during that time.

How much do you save by paying in full with Progressive?

Fully Paid Rebate – Most customers can save up to 15% by paying their entire premium at once â¡ .

Who pays the most on progressive taxes?

With a progressive tax, the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers bear a relatively small tax burden.

What is the tax rate in Italy?

The standard rate of Italian corporate income tax (IRES) in 2022 is 24%. In addition, a local tax (IRAP) is levied at a general rate of 3.9%, bringing the effective tax rate to 27.9%.

How much tax do the French pay?

Income tax 2022 for 2021 is calculated based on tax rate brackets (0-45%). Total tax amount: €2,921.95 or 9.74% of the net taxable income. Example : For singles (single household) with a taxable net income of €30,000, without any reduction or deduction.

Which type of insurance is the least expensive and why?

The cheapest type of life insurance, measured in terms of premium payments and insurance costs, will always be term insurance. This is because term life insurance has no cash value and expires before the insured is hypothetically expected to die.

What is the cheapest form of life insurance policy quizlet? Life insurance policies are the most cost-effective way to meet your life insurance needs. The advantages of life insurance are long-term coverage, fixed rates and the savings or present value function.

Why is term life insurance cheap?

Term insurance is typically much cheaper than life insurance because term life insurance has no cash value component and can expire without paying any benefits. Life insurance is a form of permanent life insurance that covers the person for their entire life rather than for a specific period of time.

What is the main advantage of term life insurance?

Having your own term life insurance helps ensure that your family members continue to be insured in the event of death, even if you change employers. If you die during the life of your policy, your beneficiaries receive a tax-free death benefit.

Which is cheaper term or whole life?

Term life insurance is cheaper because it only has a limited term. Your beneficiaries will not receive any money if you live past the end of your term. Life insurance is more expensive because it lasts your entire life and has a cash value that provides a guaranteed return on cash value.

Is it better to have whole life or term life insurance?

If you only need life insurance for a relatively short period of time (e.g. only if you have minor children to raise), the term can be better because the premiums are cheaper. If you need permanent coverage that will last your whole life, probably whole life is preferred.

What is the least expensive health insurance?

Medicaid is the cheapest form of health insurance, but if you don’t qualify, there are many other options available. The Affordable Care Act (ACA) introduced tax subsidies to fund plans through the Health Insurance Marketplace.

Which health insurance has the best benefits?

Kaiser Permanente is the highest rated health insurance company in the United States according to available government data from the National Committee for Quality Assurance (NCQA). Good insurance companies are Blue Cross Blue Shield, UnitedHealthcare, Humana, Aetna and Cigna.

What age has the least expensive health insurance?

The largest increases in health insurance costs occur among adults over age 50 using federal quotas, while those under 21 years of age have the lowest rates.

Which type of life insurance is the least expensive and why?

In general, term life insurance is the cheapest form of life insurance. The cheapest term life insurance depends on several factors, including age, gender, occupation, place of residence, lifestyle, general health, smoking status and length of policy.

Which Is Better life insurance term or whole?

If you only need life insurance for a relatively short period of time (e.g. only if you have minor children to raise), the term can be better because the premiums are cheaper. If you need permanent coverage that will last your whole life, probably whole life is preferred.

Is a whole life policy a good idea?

Life insurance is generally a bad investment unless you need permanent life insurance coverage. If you want lifelong protection, life insurance could be a worthwhile investment if you’ve already maxed out your retirement accounts and have a diversified portfolio.

Can you cash out whole life insurance?

If you have perpetual life insurance, you can have it paid out before you die. There are three main ways to do this. First, you can take out a loan against your policy (repayment is optional).