How To Save A Car And Home Insurance Package | 2022

Don’t overpay for your car and home insurance

Contents

- 1 Don’t overpay for your car and home insurance

- 2 Car and home insurance bundle: How does it work?

- 3 Who has the best car and home insurance bundle?

- 4 Factors that impact your insurance rates

- 5 What if I already have car and home insurance with separate companies?

- 6 More ways to save on car insurance

- 7 Your next steps

- 8 Can anyone get USAA insurance?

- 9 What are three things you can do to save money on insurance?

- 10 How much can you save when you bundle home and auto?

- 11 Is it a good idea to combine home and auto insurance?

If you own a car and a house, you are already paying for two separate insurance policies – probably with two different companies. This may interest you : $ 906 million in Michigan car insurance rebate checks already issued. Those premiums can add up quickly.

Fortunately, there is a simple way to cut down on insurance costs. By bundling your car and home insurance with the same company, you may be able to reduce your rates by as much as 25 percent. That could be serious cash back in your pocket every month.

If you don’t already bundle your car and home insurance, here’s what you should know.

Car and home insurance bundle: How does it work?

Bundling your car and home insurance policy (or car and renter’s insurance policy) is one of the easiest ways to save money every month. See the article : What should I not tell about car insurance?. This means having multiple insurance policies with the same company, which can help lower your premiums by as much as 25 percent.

Having more than one policy with the same insurer shows loyalty, and insurance companies often reward customers for their loyalty.

Not only can you save money, but bundling also simplifies your finances because you’ll be working with one insurance company for multiple policies.

But while there are advantages to bundling, insurance premiums can increase from year to year. For this reason, it is wise to shop around and compare bundles with other companies from time to time.

Who has the best car and home insurance bundle?

Although many car and home insurance companies offer bundles, there is no single best insurer. One study found that State Farm, Allstate, and USAA tend to offer the biggest bundled discounts. See the article : Is it cheaper to buy car insurance online or over the phone?. But different factors influence your premium, so shopping around is the only way to find the best rate.

Factors that impact your insurance rates

Your level of risk – and the anticipated cost to repair or replace your car – ultimately determines your auto insurance premium. For example, premiums are higher for newer and more luxurious cars. Likewise, younger drivers usually pay more for car insurance compared to older drivers.

In addition, some states charge higher premiums for male drivers. And you may pay more for car insurance if you live in an area with a high level of crime.

Things that can influence your insurance premium include:

The same general principle applies to homeowners insurance: The more at risk your home is for disasters like fire and flood, the more it will cost to insure.

Insurance providers consider these factors when rating customers. The lower your risk score, the less you will pay for your can and homeowners insurance.

What if I already have car and home insurance with separate companies?

There’s a good chance you already have multiple insurance policies with different providers. You may ask: Can I switch in the middle of my policy and bundle with another company?

The short answer is yes. Whether you have car, home or renter’s insurance, you don’t have to wait until your policy expires to get a new one.

But while you can change at any time, canceling cover mid-policy could result in a penalty or fee. This fee is usually 10% of your remaining premium, although some companies do not charge cancellation fees.

Canceling insurance mid-policy may result in a penalty or fee. To avoid a penalty, shop for car and home insurance bundles when at least one of your policies is due for renewal.

To avoid a penalty, shop for car and home insurance bundles when at least one of your policies is due for renewal. Policies usually renew every six months or once a year, and you will receive a renewal letter from your insurance provider in advance. This gives time to shop around and compare rates.

To compare rates, contact your current providers and ask for a quote for bundling your car and home insurance (or other policy). Also, contact some other providers for free quotes.

Once you have bought your new policy, contact your former insurer and cancel your old policy. The cancellation process varies. Some companies allow cancellation by phone, while others require a cancellation form to be faxed or mailed.

More ways to save on car insurance

The average cost for full coverage car insurance averages over $1,000 per year. These policies offer different types of protection, for example:

Your specific coverage levels, your driving history, and your vehicle determine your car insurance rate. However, you can take steps to lower your premium.

1. Shop around

Car insurance rates (as well as home insurance rates) vary from provider to provider. It is therefore important to shop around and compare premiums with different insurers. Ideally, you should have at least three rate quotes.

Price shopping is estimated to save customers hundreds of dollars each year – and the savings could be even greater if you have bad credit or an imperfect driving record, in which case the difference in rates can be more extreme.

When you shop around, make sure that all of your car insurance quotes include the same types and levels of coverage, as well as the same deductible. This will give you the most accurate side-by-side comparison so you know which company is really the cheapest.

2. Ask about discounts

Insurance discounts also vary from one company to another, so ask your agent about their specific offers. To save money, take advantage of as many discounts as possible.

Discounts you may not know about include:

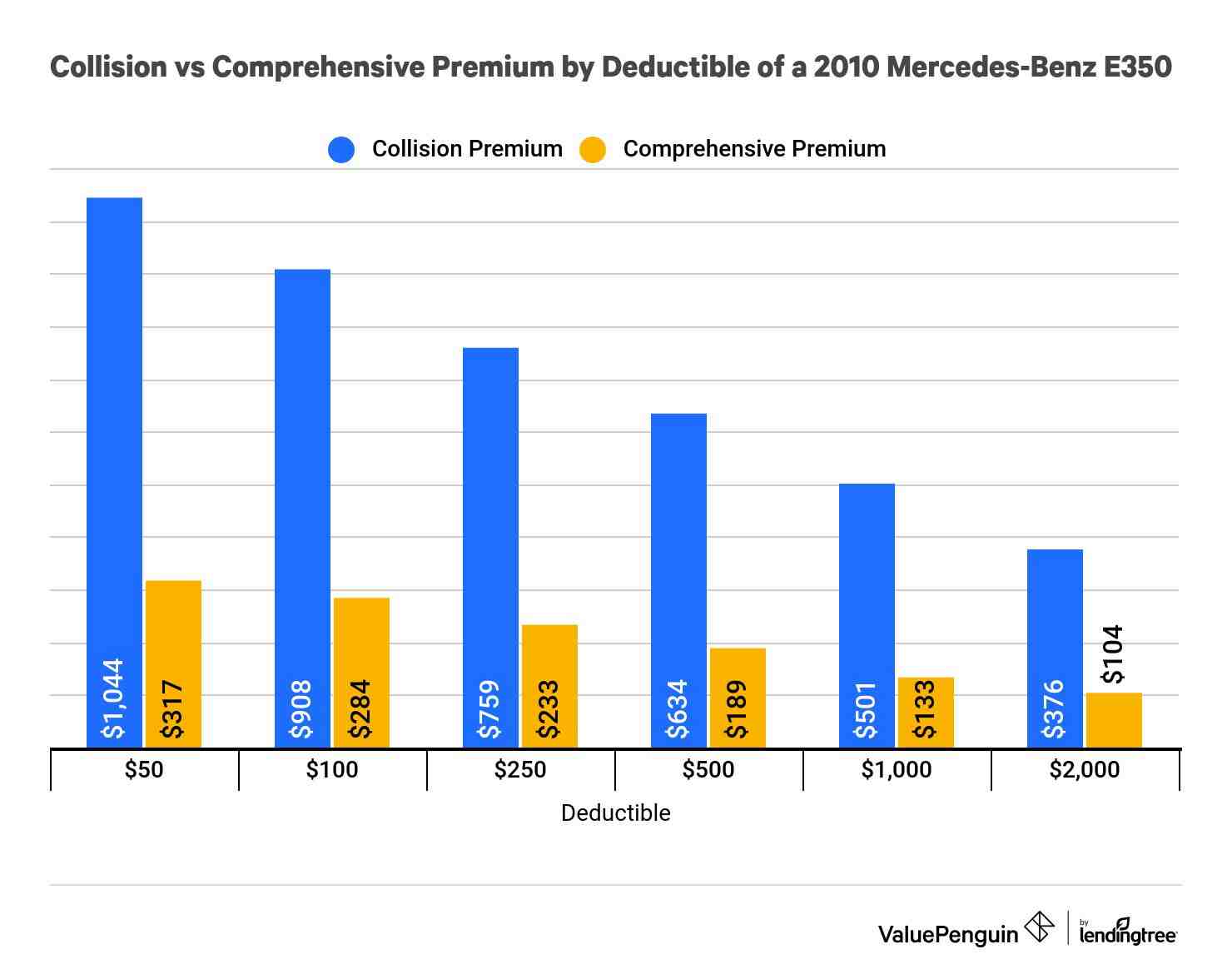

3. Raise your deductible

Your insurance deductible is what you pay out of pocket before your insurance provider pays out on a claim. Average deductibles can range from $500 to $1,000. In general, the lower your deductible, the higher your insurance premium. Therefore, increasing your deductible can significantly reduce your monthly insurance rate.

4. Maintain good credit

Good credit is not only beneficial when applying for loans. It can also lead to lower insurance premiums. Pay your bills on time, dispute errors on your credit report, and pay down credit card balances to help improve your credit score and lower your car and home insurance rates.

Your next steps

Bundling auto and homeowners insurance can save you a bundle, well. So it pays to shop around and see which companies offer the biggest bundle discounts.

If you’re just getting ready to buy a home, it’s the perfect time to compare insurers. You may find a good deal by bundling with your current auto insurance company. Or you might save more by choosing a homeowners insurance company with a lower rate and moving your auto policy to that provider.

Remember that you are free to cancel an insurance policy at any time and if you can find a better rate, it is often worth it.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for a product offered by Full Biker. The views and opinions expressed here are those of the author and do not reflect the policy or position of the Full Biker, its officers, parent, or affiliates.

Can anyone get USAA insurance?

USAA membership is open to active duty, retired and separated veterans with a discharge type of “Honorable.” Who is an eligible family member? Spouses, widows, widowers and ex-spouses (not remarried) of USAA members who joined USAA before or during marriage, and children whose parents joined USAA.

Does anyone qualify for USAA insurance? Eligible Family Wives, widows, widowers and ex-spouses without remarriage of USA members who joined USA before or during marriage and children whose parents joined USA.

Can civilians buy USAA insurance?

Unfortunately, not everyone can buy an insurance policy with the company. USAA sells insurance to active or former members of the military and their families.

Is USAA available to civilians?

Although USAA’s mission is to provide high-quality financial and insurance services to military personnel, membership is not limited to members of the armed forces. In fact, many civilians can benefit from USAA membership as well.

Is USAA insurance Open to the public?

USAA membership is generally open to active duty, retired and separated veterans with a discharge type of “Honorable” and “General Under Honorable Conditions” of the US military and their eligible family members.

Is USAA insurance available to anyone?

USA membership is open to active duty, retired and separated veterans who have a discharge type of “Honorable.” Who is an eligible family member? Spouses, widows, widowers and ex-spouses (not remarried) of USAA members who joined USAA before or during marriage, and children whose parents joined USAA.

Can you get USAA insurance without being in the military?

USAA membership is generally open to active duty, retired and separated veterans with a discharge type of “Honorable” and “General Under Honorable Conditions” of the US military and their eligible family members.

Can civilians join USAA?

Civilians are not eligible for membership, but can purchase life insurance and certain types of investment accounts with USAA.

Why is USAA only for military?

USAA’s mission statement states its focus to serve its niche market, which includes members of the United States military and their immediate families. To that end, the association has always marketed directly to members of the US military.

Can you get USAA without being in the military?

Even if you are not an active military member or a veteran, you may be able to qualify for membership at USA, a financial services company that offers excellent auto loan terms and rates. Find out if a parent or grandparent has been a member, and you may qualify for a USA car loan.

Can a civilian join USAA?

Civilians are not eligible for membership, but can purchase life insurance and certain types of investment accounts with USAA.

Can anyone get a USAA membership?

USA membership is open to active duty, retired and separated veterans who have a discharge type of “Honorable.” Who is an eligible family member? Spouses, widows, widowers and ex-spouses (not remarried) of USAA members who joined USAA before or during marriage, and children whose parents joined USAA.

Is USAA Bank open to non military?

USAA Bank products are only available to military members, honorably served veterans, and their eligible family members. Use of the term “member” or “membership” refers to membership in USAA Membership Services and does not convey any legal rights or ownership in the USA.

Can a non military person join USAA?

Even if you are not an active military member or a veteran, you may be able to qualify for membership at USA, a financial services company that offers excellent auto loan terms and rates. Find out if a parent or grandparent has been a member, and you may qualify for a USA car loan.

What are three things you can do to save money on insurance?

Auto Insurance

- Shop around for your car insurance.

- Compare insurance costs before you buy a car.

- Raise your deductible.

- Reduce optional insurance on your older car.

- Put your insurance and/or stay with the same company.

- Maintain a good credit history.

- Take advantage of low mileage discounts.

- Ask about group insurance.

Can I save money on my car insurance? Increase your deductible You can save money on collision and comprehensive insurance by raising your deductible, the amount the insurance company doesn’t include in paying for repairs. For example, if you have a $500 deductible and your repair bill is $2,000, the insurer will pay $1,500 once you’ve paid the $500.

How much can you save when you bundle home and auto?

How much can bundling save? You can save, on average, 17% or about $730 a year, when you bundle home and auto insurance. That’s based on Insurance.com’s 2021 rate analysis of over 50 car insurance and home insurance companies’ rates for home and auto bundlers.

Does bundling really save money? Yes, bundling usually saves money Companies that offer bundling tend to give a 5-25% discount on each policy. Homeowners insurance usually gets the biggest discount as the value of your home is likely to be much higher than your car.

Is it a good idea to combine home and auto insurance?

If you’ve decided to bundle your car and home insurance, you may save on premiums – at least initially. These savings happen because bundling, by design, only works when you avoid shopping around. Bundling also makes you less likely to shop around or switch providers to get a better price.

Is it cheaper to have home and car insurance together?

With that in mind, many offer discounts when you sign up for multiple policies. The most common – and money-saving – combination is auto and homeowners insurance. According to a study by InsuranceQuotes, the average consumer saves 16.1% on their premiums when bundling these two products.

Can you combine home and car insurance?

Bundling insurance simply means buying your home and car insurance or other insurance from the same company. Bundling insurance policies can have some advantages; most notably, potential savings on your overall insurance costs.

Does it make sense to bundle insurance?

The bundling discount can save you a lot of money every year. This is the main reason most people bundle their insurance policies. How much you can save depends on the company you work with. Some insurers say you could save up to 25% in premiums if you choose to bundle your insurance.

How much can you save by combining home and auto insurance?

With that in mind, many offer discounts when you sign up for multiple policies. The most common – and money-saving – combination is auto and homeowners insurance. According to a study by InsuranceQuotes, the average consumer saves 16.1% on their premiums when bundling these two products.

Is combined car insurance cheaper?

Drivers who insure two cars with the same insurer spend less on premiums than drivers who insure them separately. The average savings for insuring two vehicles with the same company is close to $500 per year.

How much do you save when you bundle with Progressive?

You can save an average of 5% when you bundle home and auto insurance with Progressive (savings applied to your auto policy). You also have the option to combine other policies and save, such as home and motorcycle, auto and boat, or home and RV.

Is bundling with Progressive worth it?

You can save an average of 3% when you bundle renters and auto insurance with Progressive (a discount will be applied to your auto policy). You can also combine many other policies, including renters and motorbikes, boats and renters, and more. You may get additional discounts for each.

How much do you save when you bundle insurance?

Companies that offer bundling tend to give a 5-25% discount on each policy. Homeowners insurance usually gets the biggest discount as the value of your home is likely to be much higher than your car.

How much do you save by paying in full with Progressive?

Full Paid-In Discount – Most customers can save up to 15% if they pay their total premium in one lump sum*.

Is it a good idea to combine home and auto insurance?

If you’ve decided to bundle your car and home insurance, you may save on premiums – at least initially. These savings happen because bundling, by design, only works when you avoid shopping around. Bundling also makes you less likely to shop around or switch providers to get a better price.

Can you combine home and car insurance? Bundling insurance simply means buying your home and car insurance or other insurance from the same company. Bundling insurance policies can have some advantages; most notably, potential savings on your overall insurance costs.

Is it cheaper to have home and car insurance together?

With that in mind, many offer discounts when you sign up for multiple policies. The most common – and money-saving – combination is auto and homeowners insurance. According to a study by InsuranceQuotes, the average consumer saves 16.1% on their premiums when bundling these two products.

Who has the cheapest house and car insurance?

Other than USAA, State Farm is the cheapest company for auto insurance with a bundled condo insurance policy. On average, State Farm charges $92 per month for a car insurance policy with bundled condo insurance.

How much do you save when you bundle insurance?

Companies that offer bundling tend to give a 5-25% discount on each policy. Homeowners insurance usually gets the biggest discount as the value of your home is likely to be much higher than your car.

Is it cheaper to get insurance together?

A couple’s car insurance policy, in the form of one policy with two cars covered, is often a cheaper way to get cover than separate policies because of multi-vehicle discounts and a possible marriage discount. Combining policies for each driver’s car into one policy brings savings of up to 25% in most cases.

Does it make sense to bundle insurance?

The bundling discount can save you a lot of money every year. This is the main reason most people bundle their insurance policies. How much you can save depends on the company you work with. Some insurers say you could save up to 25% in premiums if you choose to bundle your insurance.

Why would bundling different types of insurance be a good idea?

Consolidating all your policies with one insurance company can save you money compared to having a variety of carriers. It’s also important to remember that when one company handles all your insurance policies, that means less time you have to spend sorting and paying for each policy.