Is comprehensive insurance full coverage?

Compensation for physical damage pays the cost of repairing or replacing your car, less your franchise. A collision covers damage to your car due to an accident with another car or a physical object such as a deer.

What is covered under auto comprehensive?

Contents

- 1 What is covered under auto comprehensive?

- 2 What is included in full coverage?

- 3 Does comprehensive insurance cover personal injury?

- 4 Which one of the following types of coverage would pay for damage to your automobile?

- 4.1 Which of the following types of coverage would pay for damage to your automobile in an accident for which you are at fault?

- 4.1.1 Which type of automobile insurance pays for damage to a covered vehicle caused by hitting an object or being hit during an automobile accident?

- 4.1.2 What type of automobile insurance coverage will pay for the damage?

- 4.1.3 What type of insurance will pay for damage to your car or to replace your car if it is declared to be a total loss?

- 4.2 What are the 3 types of auto insurance?

- 4.3 Which coverage pays for damage to your car when you are at fault quizlet?

- 4.1 Which of the following types of coverage would pay for damage to your automobile in an accident for which you are at fault?

The standard Audi warranty included in all new vehicles covers from bumper to bumper and powertrain for 4 years or 50,000 miles. To see also : 21st Century Car Insurance Review 2022 – Forbes Advisor. This warranty covers defects in workmanship or workmanship under normal use.

What is included in full coverage?

Full car insurance is a term that describes all major parts of car insurance, including personal injury, property damage, uninsured motorcyclists, PIP, crash and comprehensive insurance. You are usually required by law to wear about half of these covers.

What is classified as full coverage? Definition of car insurance with full coverage. Full coverage insurance usually combines collision and comprehensive insurance, which is paid out if your vehicle is damaged, plus liability coverage that covers damage and damage you cause to others. On the same subject : Survey: Most Drivers Don’t Understand Their Car Insurance Coverage. But this extra protection has its costs.

How do you know if you have full coverage?

You know that you have car insurance with full coverage if you have extensive and traffic insurance and any other insurance required by your state or lender. On the same subject : $ 906 million in Michigan car insurance rebate checks already issued. Full coverage is not an official type of insurance, but the term generally describes a policy that protects the policyholder and his car in most situations.

What are the conditions for social security? All people who can afford the French nationality and reside in France in a stable and regular manner, this is a direct addition to 3 months, is obligatorily affiliated to the social security.

He did not do anything to be inscribed in the Social Security. The students restent inscribed on the regime of parental law. Ainsi, il n’y a pas de frais suplémentaires à payer pour bénéficier de la social protection. The death penalty will be celebrated in the day of your life card.

Quelle assurance pour les étudiants Etrangers en France ?

At the end of 2019, all non-European students will be able to join the general government of social security; the students of european continue to be enveloped by their card of european insurance insurance maladie s’ils en onto une.

Is full coverage insurance the same as comprehensive?

The difference between full coverage and comprehensive insurance is that full coverage is car insurance, which includes both comprehensive insurance and collision insurance together with the minimum requirements of the state. Casco insurance covers damage to the car due to things other than accidents, such as theft or fire.

Does comprehensive insurance include?

What is comprehensive car insurance? Casco car insurance covers damage caused to your car, as well as damage that your car can cause to other vehicles and property in the insurance case. It provides broader coverage than third party insurance, which only covers damage to other people’s property.

What is covered with comprehensive?

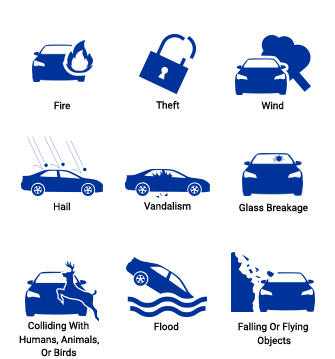

What is comprehensive coverage? Comprehensive coverage helps you cover the cost of damage to your vehicle when you are involved in a non-collision accident. Comprehensive coverage covers losses such as theft, vandalism, hail and animal strikes.

What’s the difference between collision and full coverage?

The main difference between casco and collision insurance is in the scenarios they cover. Collision insurance covers damage to your car if you hit an object or other vehicle, while comprehensive coverage pays for theft or damage due to causes such as bad weather, fire or downed trees.

What does comprehensive on insurance cover?

What is comprehensive coverage? Comprehensive coverage helps you cover the cost of damage to your vehicle when you are involved in a non-collision accident. Comprehensive coverage covers losses such as theft, vandalism, hail and animal strikes.

What are three things that comprehensive insurance would cover?

What does comprehensive insurance cover?

- Contact with animals, such as the impact of a deer.

- Natural disasters, including earthquakes, floods and hurricanes.

- fire.

- Riots and vandalism.

- Theft of a vehicle or theft of certain parts of a vehicle.

- Broken windshields.

- Fallen objects, including branches, stones or hail.

Does comprehensive insurance cover personal injury?

In general, you can expect the most extensive car insurance policies to include: accidental damage to your car or another person’s car. Personal injury to you or injury to other persons involved in the accident.

What types of damage does comprehensive insurance cover? Comprehensive coverage helps you cover the cost of damage to your vehicle when you are involved in a non-collision accident. Comprehensive coverage covers losses such as theft, vandalism, hail and animal strikes.

Is comprehensive coverage the same as physical damage?

If you have a loan for your vehicle or want to fully protect your vehicle, choose physical damage insurance. Collision insurance will provide protection in the event of a collision. Casco insurance will provide protection against almost everything except a collision with another vehicle or object.

What is a physical damage in insurance?

Physical damage insurance refers to a series of insurance coverages designed to protect a vehicle. In general, physical damage includes both collision and full coverage. The first insurance covers damage to your vehicle caused by accidents, including overturning and collisions with other objects.

What does physical damage mean?

Physical damage means any tangible damage to immovable property, whether caused by accident, natural occurrence or any other reason, including damage caused by construction defects, subsidence, movement or landslides, fire, floods, earthquakes, riots, vandalism or any other. Environmental conditions.

What is the difference between collision and comprehensive physical damage?

Quick shot: What is the difference between a comprehensive and a collision? It comprehensively provides coverage for events that are not under your control and are not the result of collisions such as weather, vandalism and theft. Collision protection is for damage resulting from an accident with another vehicle or object.

Which one of the following types of coverage would pay for damage to your automobile?

Collision and comprehensive insurance are two types of car insurance. Both are legally optional and pay the cost of damage to your car, but do so in a variety of situations.

What kind of insurance covers damage to the car in the event of an accident regardless of fault? collision cover pays for damage to your car due to an accident, regardless of fault. It usually involves a deductible, which means you pay the first $ 100, $ 20 or so to repair your car, and the company pays the rest.

Which of the following types of coverage would pay for damage to your automobile in an accident for which you are at fault?

Liability coverage is for accidents for which you are to blame. Liability for personal injury is paid for personal injury you cause to someone else. Liability for property damage pays for property damage you cause to someone else.

Which type of automobile insurance pays for damage to a covered vehicle caused by hitting an object or being hit during an automobile accident?

Running. Anti-collision coverage covers damage to your car resulting from a collision with another car, an object such as a tree or a telephone pole, or overturning (note that collisions with deer are covered in full).

What type of automobile insurance coverage will pay for the damage?

Basically, liability coverage is part of your car insurance policy and helps pay the other driver’s costs if you cause a car accident. However, it does not cover your own. It is important to note that there are two types of liability coverage: personal injury and property damage.

What type of insurance will pay for damage to your car or to replace your car if it is declared to be a total loss?

Comprehensive collision coverage and coverage helps pay for the replacement of the entire vehicle. These two separate covers are usually required on your car insurance policy if you rent or finance your vehicle.

What are the 3 types of auto insurance?

3 types of automatic coverage are explained

- Liability coverage. It protects you if you damage others and / or their belongings. …

- Race coverage. It covers your car if you hit another car, person, or stationary object (like those damn ornamental rocks Cousin Todd has at the end of his driveway). # …

- Comprehensive coverage.

What are the 3 parts of an auto insurance policy?

Most car insurances contain three main parts: personal injury liability insurance, property damage liability insurance and uninsured / underinsured drivers.

What are 4 main types of automobile coverage insurance?

The six common car insurance options are: motor liability insurance, insurance for uninsured and underinsured motorists, comprehensive coverage, collision coverage, health insurance coverage and injury protection.

What are 3 examples of the kinds of auto insurance?

The three types of car insurance that are universally offered are liability insurance, comprehensive insurance and collision insurance. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured / underinsured drivers, but they are not available in all countries.

Which coverage pays for damage to your car when you are at fault quizlet?

Collateral insurance will reimburse the insured for all damage caused to their personal car, which was caused by the fault of the insured driver.

What type of coverage covers repairs to your car after an accident quizlet?

Liability insurance covers you in the event that you are covered by a car accident and it is determined that the accident is the result of your actions. Liability insurance covers the cost of repairing any property damaged in the accident and medical bills due to the damage caused.

What provides coverage for your car when you are at fault?

Car liability insurance helps you financially protect yourself if you are at fault in a car accident. It can help cover the medical bills of an injured person or repair someone’s vehicle. Drivers are required by law to take out liability insurance in most countries.

Which coverage pays for damage to your car when you are at fault group of answer choices?

Motorcycle Uninsured Damage (UMPD): This pays for the damage to your car due to an accident with an uninsured driver who is at fault. The limit is $ 3,500.