Oklahoma’s Car Insurance Requirements – InsuranceNewsNet

Oklahoma requires that all residents have at least a minimum amount of liability insurance. If the person has a vehicle loan, the mortgagee may require additional coverage. Oklahoma’s mandatory limits for car insurance are $ 25,000 for death and $ 50,000 for injuries. These restrictions are in addition to any other personal liability restrictions you may have. If your car is worth more than the mandatory limit, you may need to purchase additional insurance. Oklahoma also has restrictions per vehicle. The vehicle limit is the total amount of coverage you can have on your policy regardless of who is driving the vehicle. This limit is $ 40,000 for death and $ 60,000 for injuries. If your vehicle is worth more than the limit per vehicle, you will need to purchase additional insurance.

We interviewed Sarah Routhier, director of Outreach at Expert Insurance Reviews, to learn more about Oklahoma car insurance laws & amp; State the minimum coverage limits and what makes you eligible for them. Suppose you are a resident of Oklahoma and drive a car in another state. In that case, your car insurance in Oklahoma will not cover accidents that happen while driving in that state. Your Oklahoma car insurance will only cover accidents while driving in Oklahoma. Suppose you have been convicted of a traffic offense in motion in the last six months. In that case, your Oklahoma car insurance will not cover accidents that occur while driving in Oklahoma. If you have been declared a common traffic offender in the past

Oklahoma Auto Insurance Requirements Minimums

Contents

If you are a driver in Oklahoma, you must have liability insurance that covers you for any damage you do to other people or their property while driving your car. In addition, you must have comprehensive collision insurance on your vehicle. Your car insurance policy may require additional coverage, such as coverage for uninsured drivers. Your car insurance policy will also state what types of vehicles are covered and coverage limits. Be sure to read your policy carefully to understand what is not covered. To see also : Is AAA car insurance good?. If you have been involved in a car accident, contact your insurance company as soon as possible. This will help you get the maximum compensation for your losses. You should also contact an attorney if you have any questions about your rights or how to proceed with filing a lawsuit. In addition, be sure to obtain written proof of car insurance from the insurer. This documentation can be helpful if there is a dispute over who is responsible for the damage in an accident.

Oklahoma’s Car Insurance Law Requirements

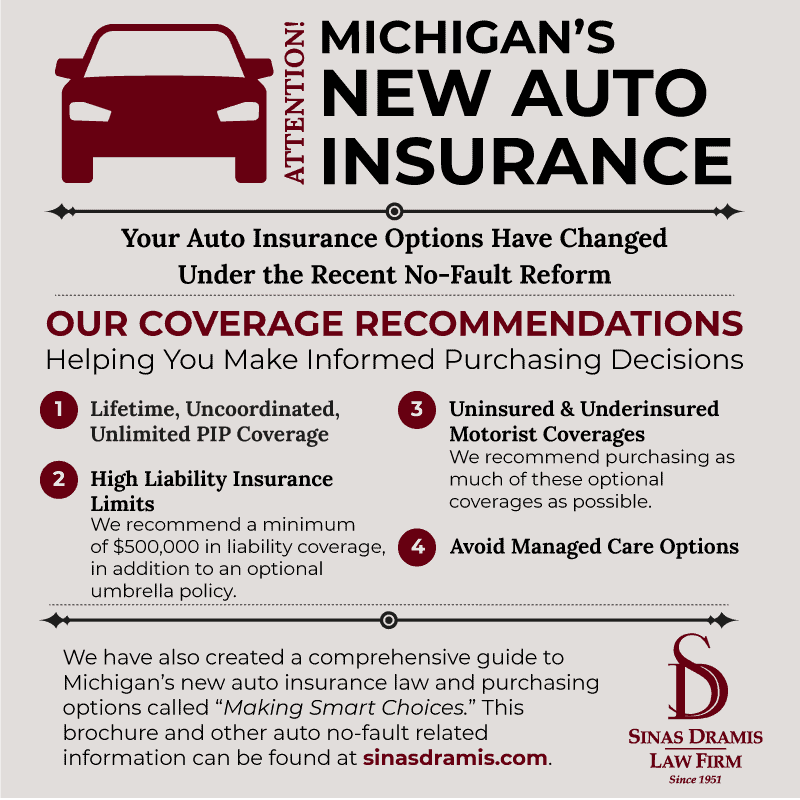

Minimum If you are a driver in Oklahoma, you must have liability insurance that covers you for any damage you cause to other people or their property while driving your car. In Oklahoma, you must have liability insurance that covers you for injuries or property damage to others while driving. In addition, your shelf must also cover all passengers in the car. Information on the minimum requirements for car insurance in Oklahoma can be found on the Oklahoma Department of Insurance website. The minimum liability insurance requirements in Oklahoma are $ 25,000 per person for personal injury, $ 50,000 per accident for total damage, and $ 25,000 per incident for property damage. To see also : Do men pay more for car insurance?. If you have comprehensive coverage or collision coverage, your policy must also cover those damages. For example, suppose you are convicted of a traffic offense that resulted in an accident in which someone was injured or property was damaged. In this case, your liability insurance may not be sufficient to cover the cost of injury or damage. In this situation, you may need to get additional insurance.

If you have questions about whether your existing car insurance policy meets the minimum Oklahoma requirements, contact your insurance company or the Oklahoma Department of Insurance.

How Do Oklahoma’s Car Insurance Law Requirements Affect You?

The Oklahoma Car Insurance Act includes several requirements that you need to know if you want to drive in the state. Read also : Another problem for American motorists: car insurance costs.

Oklahoma’s car insurance law is fairly simple. Still, it’s important to understand all the requirements so you don’t get caught up in an accident you can’t afford to fix.

Tips to Make the Best of Your Costs

When looking for car insurance in Oklahoma, be sure to read the fine print. Here are some tips to make the most of your costs: Buy. There are many different companies in the state and each has different rates and policies. It’s worth checking out a few different companies to see what you can find that fits your needs and budget. Get a good rate. One of the best ways to learn more about Oklahoma Car Insurance Laws & amp; Specify minimum coverage limits and save money on car insurance to get a good rate from ExpertInsuranceReviews.com. Some companies offer discounts for merging policies together or staying with that company for a limited time. Ask your agent about prices before you buy something. Understand your coverage and make sure you understand what coverage you have on your car and what is not covered by your policy. For example, a collision cover will help you pay for damage to your car in the event of an accident.

Conclusion

Oklahoma has pretty standard car insurance laws. All drivers must have liability insurance, which covers personal injuries and material damage to others. Oklahoma has no minimum amount of liability coverage. Instead, you can rely on the Oklahoma Financial Liability Act, which requires your insurance carrier to pay for any damage you cause in an accident after you have exhausted your policy limits. Oklahoma also requires coverage for uninsured drivers (UM). This insurance pays your damages in case the culprit is not insured or underinsured. The minimum UM coverage limit is $ 25,000 per person and $ 50,000 total per accident.