State Farm Vs. Geico 2022 Car Insurance – Forbes Advisor

Editor’s Note: We earn a commission through affiliate links on Forbes Advisor. Commissions do not influence the opinions or evaluations of our editors.

State Farm and Geico are two of the largest auto insurance companies in the US and have a lot of experience taking care of customers. They all have a lot to offer, but how does State Farm compare to Geico? Here’s how they stack up against each other.

Which Is Better: State Farm or Geico?

Contents

- 1 Which Is Better: State Farm or Geico?

- 2 State Farm vs. Geico: Which Is Cheaper?

- 3 State Farm vs. Geico Car Insurance: Coverage Comparison

- 4 State Farm vs. Geico Car Insurance: Which has Fewer Complaints?

- 5 State Farm vs. Geico: Collision Repair

- 6 State Farm vs. Geico: Car Insurance Discounts

- 7 Summary: State Farm vs. Geico Car Insurance

- 8 Methodology

- 9 What is the cheapest car insurance called?

- 10 Is State Farm more expensive than AAA?

- 11 Does engine size affect car insurance?

- 12 Will Geico match State Farm?

Geico and State Farm both have strengths and weaknesses that can affect which one is best for you. Read also : 21st Century Car Insurance Review 2022 – Forbes Advisor.

Geico’s main strengths are generally affordable rates and a low number of complaints. Geico’s weakness lies in its leaner range of coverage offerings.

State Farm also has a low number of complaints. State Farm offers reasonable rates, but the average prices are higher than Geico’s for some types of drivers, making that a weak point in this comparison. State Farm is also somewhat lacking when it comes to coverage options.

Both State Farm and Geico fared well in our evaluation of the best auto insurance companies. Geico achieved a top rating of 5 stars over State Farm’s 4.5 stars. Geico received higher marks due to lower auto insurance rates for most types of drivers.

State Farm

Compare rates from participating partners through EverQuote’s secure site. This may interest you : Nigerian Etap gets $ 1.5 million in pre-seed to make buying auto insurance easier.

Geico

Compare rates from participating partners through EverQuote’s secure site. Read also : NJM Auto Insurance Review 2022 – Forbes Advisor.

State Farm vs. Geico: Which Is Cheaper?

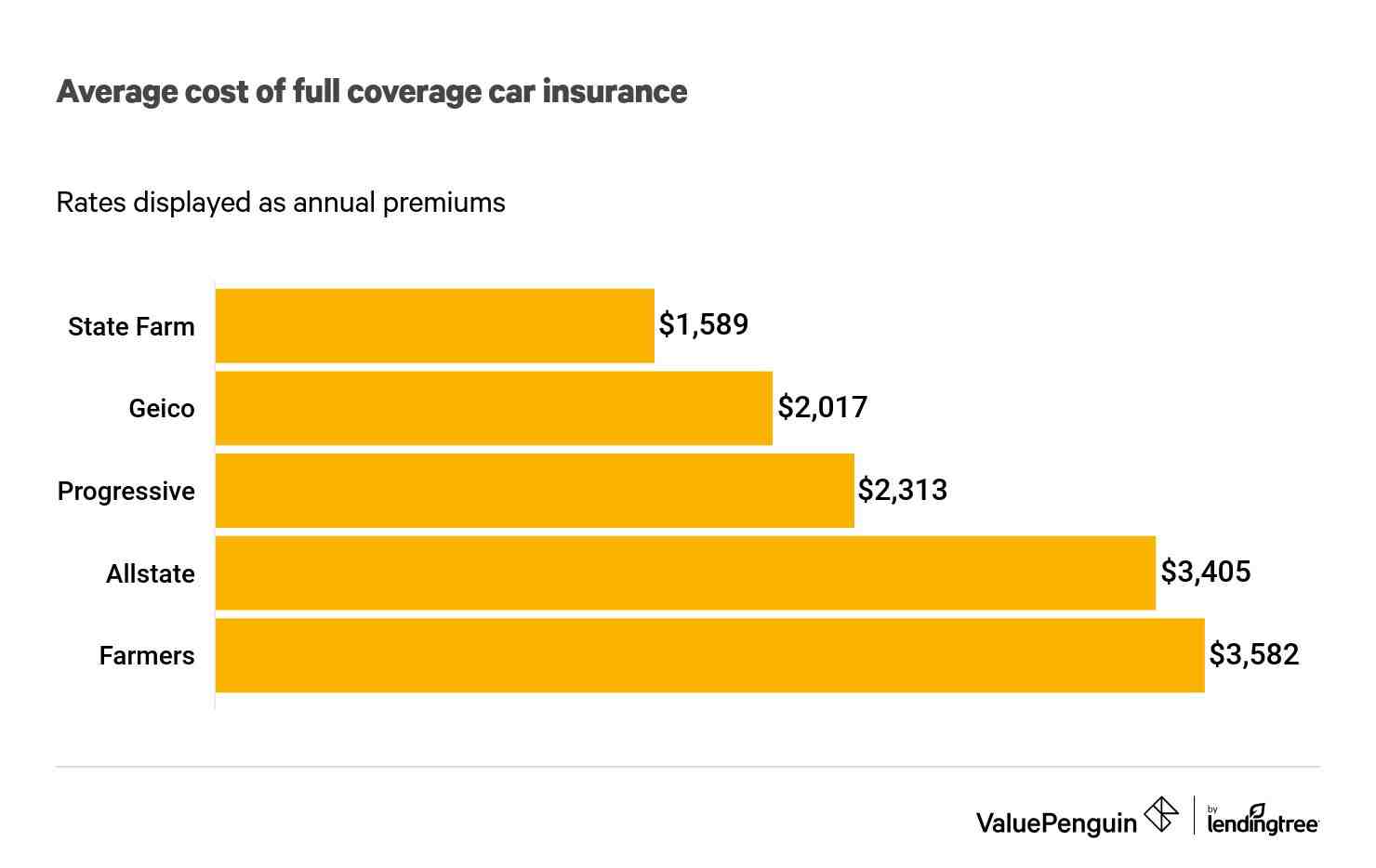

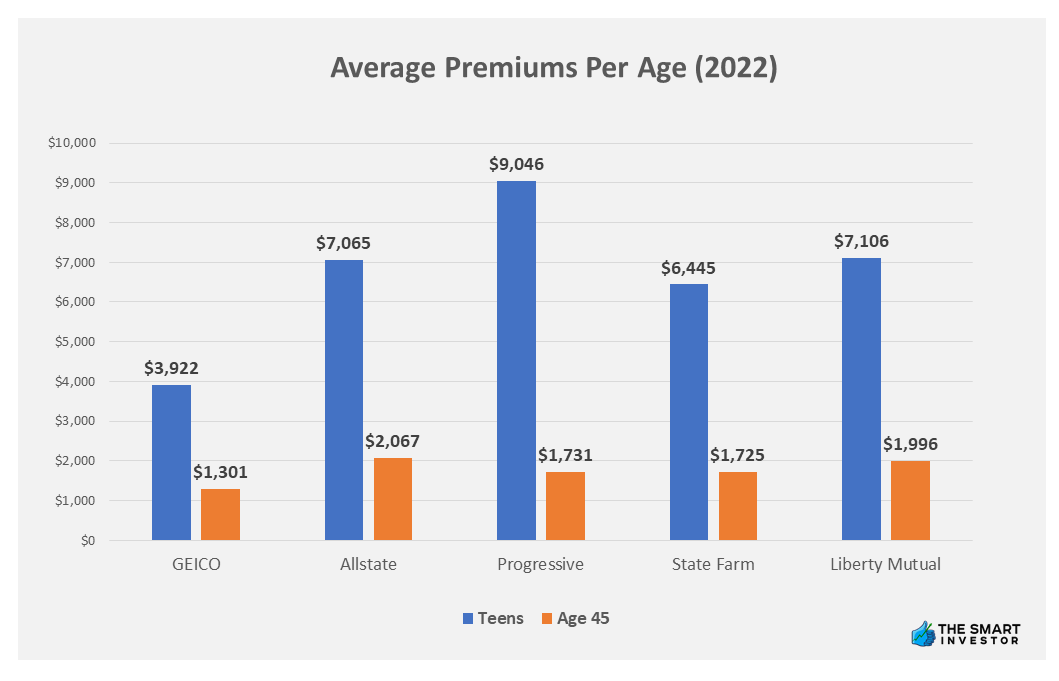

Geico auto insurance beats State Farm auto insurance for cheaper rates for more types of drivers. Geico is cheaper for good drivers as well as for young and older drivers. Geico also beats State Farm with cheaper rates for speeding drivers, but it was close, with just $28 between average quotes.

State Farm is generally the cheaper choice for those with an accident or DUI on their record. Geico’s rates for a driver with a DUI are significantly higher, averaging more than $1,000 per year more than State Farm’s.

State Farm vs. Geico Car Insurance: Coverage Comparison

State Farm and Geico can both provide you with basic policy coverage, such as liability insurance, uninsured and underinsured motorists coverage, and medical payment coverage. They both offer collision avoidance and comprehensive coverage, which is needed if your car is financed or leased.

However, most auto insurance companies today also offer additional coverage and features. When comparing State Farm and Geico, Geico trumps State Farm because it has the most additional coverage types available to drivers. However, both companies lack some common features that other auto insurance companies offer, such as gap insurance.

Both State Farm and Geico have non-owner insurance, SR-22 insurance, and a usage-based program that monitors your driving and can get you a discount. Geico also offers forgiveness for accidents while State Farm does not.

State Farm vs. Geico Car Insurance: Which has Fewer Complaints?

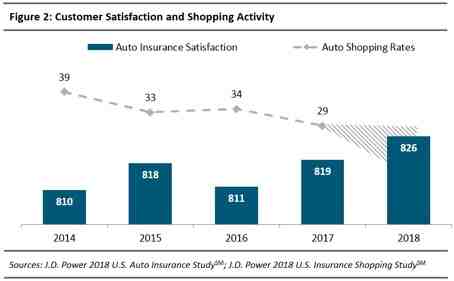

Auto insurance complaints from Geico and State Farm are low compared to the industry average. State Farm has a slightly lower number of complaints compared to Geico, but not enough to make this a factor in a purchase decision.

Complaints about State Farm and Geico car insurance mainly concern claims handling. Geico’s biggest problem is claim delays, and most of State Farm’s complaints relate to unsatisfactory settlement offers.

State Farm vs. Geico: Collision Repair

To get an idea of how State Farm and Geico are handling claims, we looked at the numbers from the CRASH Network. Every year, the CRASH Network surveys bodyshop professionals for their understanding of insurance company claims processes.

In 2022, State Farm and Geico both received a C letter in this report. This figure shows that body repair specialists believe the companies’ claims handling practices are average at best.

State Farm vs. Geico: Car Insurance Discounts

We analyzed State Farm and Geico discounts and found that Geico has even more potential discounts on auto insurance. If you pay in full or set up automatic payments, you can get a discount at Geico, but not at State Farm.

Geico does not have a training discount for new drivers like State Farm, which can be essential if you are a young driver looking to lower your rates. State Farms’ new driver training discount requires drivers under the age of 21 to complete an approved driver training course to receive the discount.

State Farm does not offer discounts for a new vehicle or for airbags, as Geico does.

Discounts are usually applied automatically when the company sees you qualify. However, talking to an insurance agent will ensure that you have received all the discounts available.

Summary: State Farm vs. Geico Car Insurance

Geico and State Farm are fairly evenly matched as auto insurance companies. They both offer cheap rates to certain segments of drivers. Both companies have a low complaint level, an average (C-) rating for body repairs and a limited selection of optional coverages. Both have a decent list of discounts you might qualify for.

In the end, Geico wins by the smallest margin in a head-to-head match. That’s because Geico is cheaper for good drivers, those with minor traffic violations such as a speeding ticket, and drivers young and old. However, State Farm can be better and cheaper for those with an accident or DUI on their record.

Getting an auto insurance quote from each is a must to see who can offer you the best rates for your particular situation.

Methodology

We used rates from Quadrant Information Services, a provider of insurance data and analytics. Average rates, unless otherwise noted, are based on a female driver insuring a Toyota RAV4 with $100,000 per person coverage for personal injury liability, $300,000 per accident and $100,000 for property damage liability, uninsured motorist coverage and any other coverage required by the state. The rate includes collision and extended with a $500 deductible. Rates were analyzed in October 2021.

What is the cheapest car insurance called?

Of the insurance companies available to almost all drivers across the country, State Farm is the cheapest.

Is Geico really the cheapest? Geico has the cheapest auto insurance for most drivers in California. The company charges an average of $390 per year for a minimum liability policy. That is 35% cheaper than the national average.

What is the cheapest car insurance type?

State minimum liability coverage is the cheapest form of auto insurance. A liability-only insurance policy is on average $1,333 cheaper than a full-coverage policy.

Which insurance type is best for car?

What is better car insurance? It is always advisable to purchase comprehensive car insurance as it not only fully protects someone else’s car such as third-party car insurance, but also your own damage to your car as well as any injuries suffered by the owner of the car. the driver.

What is the most basic car insurance?

In general, the six basic auto insurance coverages you need are:

- Liability Coverage for Personal Injury. †

- Liability Coverage for Property Damage. †

- Medical benefits or personal injury cover (PIP). †

- Comprehensive coverage. †

- Collision Coverage. †

- Uninsured/underinsured coverage for motorists.

Who usually has the lowest car insurance?

Geico is the cheapest major auto insurance company in the country, according to NerdWallet’s most recent analysis of minimum coverage rates. Geico’s average annual rate was $354, or about $29 per month.

Who usually has the lowest car insurance?

Geico is the cheapest major auto insurance company in the country, according to NerdWallet’s most recent analysis of minimum coverage rates. Geico’s average annual rate was $354, or about $29 per month.

Who typically has the cheapest insurance?

Of the nine companies in our survey, USAA, Geico, State Farm, Nationwide, Travelers, and American Family have average rates that are cheaper than the overall national average. Progressive, Farmers and Allstate have average rates that are more expensive than the overall national average.

What is the basic car insurance called?

Basic car insurance is often referred to as liability insurance. Requirements vary by state, but basic auto insurance can be broken down into two main types of liability insurance: personal injury and property damage.

What type of insurance is basic?

Starting with the basic form of insurance cover, a policy that provides basic risk cover ONLY covers the insured for said perils. That means there is no cover if an event occurs that is not actually mentioned in the policy. You are on your own for any losses not specifically mentioned.

What is the most basic car insurance?

In general, the six basic auto insurance coverages you need are:

- Liability Coverage for Personal Injury. †

- Liability Coverage for Property Damage. †

- Medical benefits or personal injury cover (PIP). †

- Comprehensive coverage. †

- Collision Coverage. †

- Uninsured/underinsured coverage for motorists.

What are the 2 main types of car insurance?

Six common auto insurance coverage options include: auto liability coverage, uninsured and underinsured motorists coverage, comprehensive coverage, collision coverage, medical payment coverage, and personal injury protection. Depending on where you live, some of these coverages are mandatory and some optional.

Is State Farm more expensive than AAA?

Is State Farm or AAA Cheaper in Your State? State Farm is cheaper than AAA in more states. Because the average cost of auto insurance rates at the state and national levels can vary a lot, compare insurers by state, not just nationally.

Is AAA more expensive? AAA is more expensive, but offers additional benefits as part of their standard coverage and has a better complaint rate.

Who is more expensive State Farm or Allstate?

State Farm is cheaper for adults For adults, State Farm’s average auto insurance rates are significantly lower than Allstate’s and lower than the national average.

What is Allstate ranked?

About Allstate Allstate has a financial rating of A from AM Best, the organization’s second-highest rating. This allows Allstate to easily meet its financial and claims obligations. Allstate also has an A rating from the Better Business Bureau (BBB).

Is Allstate a billion dollar company?

In 2020, Allstate generated revenue of approximately $44.79 billion. Their revenues have been on the rise since 2008, when their revenues reached $29.39 billion. Headquartered in Northbrook, Illinois, Allstate is a publicly traded insurance company.

Is Allstate the most expensive?

Our initial analysis found that for most drivers, Allstate was more expensive on average than State Farm, Geico, Progressive, and Farmers. For other drivers, Allstate remains expensive. Geico remains cheaper for young drivers and policyholders of different backgrounds and coverage limits.

Is State Farm the most expensive insurance?

Is State Farm expensive? According to our rate estimates, State Farm is one of the more affordable providers out there. We found State Farm’s full coverage rates to be about $1,339 per year, making it cheaper on average than providers like Progressive, Nationwide, and Allstate.

Who is the most expensive to insure?

| Vehicle | Average annual premium |

|---|---|

| Dodge Ram 1500 Rebel | $2,015 |

| Lexus RX 350 | $2,105 |

| Nissan Altima 2.0 S | $2,130 |

| Tesla Model 3 Standard Plus | $2,447 |

What is the most expensive car insurance state?

Most Expensive State for Auto Insurance: New York On average, motorists in New York pay $5,936.28 per year for auto insurance. This means that they pay a whopping 92% more than the average for the rest of the country.

Is State Farm or Triple A Better?

Compared to AAA, State Farm has superior financial strength and higher JD Power rankings. State Farm beats AAA’s A.M. Best rating of A with an A , the highest possible ranking of the company.

What are the pros and cons of State Farm?

| State Farm Pros | Disadvantages of state farm |

|---|---|

| Largest car insurer in the country | Not taking on new clients in Massachusetts or Rhode Island |

| Lots of discounts for teens and students | Higher rates than some competitors |

| AM Best .’s superior financial standing | |

| Available in 48 states |

Is Statefarm actually good?

State Farm is a good insurance company – we gave it an overall rating of 4.5/5. The company has cheap auto and home insurance rates and the best renter insurance rates we’ve found. It also achieved above-average scores for customer service and financial strength.

What rank is State Farm?

State Farm is the largest provider of property and casualty insurance and the largest auto insurance company in the United States. State Farm is ranked 36th in the 2019 Fortune 500, ranking US companies by revenue.

Does engine size affect car insurance?

The engine power of your vehicle is one of the factors that insurers use to calculate the cost of your premium. Vehicles with a lower engine power are cheaper to insure than vehicles with a high power. The insurance industry uses a system known as “group rating” to assess likely insurance costs for different vehicle models.

Are larger cars more expensive to insure? Scaling insurance costs Because they are involved in more accidents, they are more expensive to insure. With that rationale, it makes sense that larger vehicles like SUVs would be cheaper to insure.

Does engine size matter for car insurance?

The amount of power from the car’s engine is directly correlated to the insurance quotes you get. A car with fewer cylinders will most likely have lower insurance premiums. However, the number of cylinders is not what they measure; they measure horsepower.

Is it cheaper to insure a car with a fast engine?

High-powered vehicles are generally more expensive to insure than lower-powered vehicles. Different vehicle models can be estimated by the insurance industry through a system called ‘group ratings’.

What is the max engine size for a new driver?

What engine size should a new driver get? engine size – size really only matters when it comes to weight, not so much body size. Richard recommends keeping it between 1200cc and 1500cc if possible, to save both body and engine sizes.

Do bigger engines cost more to insure?

Vehicles with more powerful engines, such as a V8, will cost more to insure than a vehicle with a smaller engine. Providers follow the line of thinking that more powerful vehicles mean the driver is more likely to go faster and therefore collect speeding fines.

Is it cheaper to insure a car with a fast engine?

High-powered vehicles are generally more expensive to insure than lower-powered vehicles. Different vehicle models can be estimated by the insurance industry through a system called ‘group ratings’.

Is insurance higher for fast cars?

Statistics show that smaller, sportier cars at higher speeds are driven by younger, riskier drivers. Because they are involved in more accidents, they are more expensive to insure.

Does a turbo car cost more to insure?

Unfortunately, most auto insurance companies are going to charge you more money to insure a turbocharged car. Some may even refuse to give you a quote. Such vehicles are seen as risky and are more likely to lead to claims because they have more power and speed.

Do bigger engines cost more to insure?

Vehicles with more powerful engines, such as a V8, will cost more to insure than a vehicle with a smaller engine. Providers follow the line of thinking that more powerful vehicles mean the driver is more likely to go faster and therefore collect speeding fines.

Does insurance go up with a bigger engine?

The faster and more powerful your car is, the more likely it is to be involved in an expensive accident. So in general, the bigger your motorcycle, the higher the insurance cost.

What makes your insurance go up the most?

Auto accidents and traffic violations are common explanations for a rising insurance rate, but there are other reasons auto insurance premiums rise, including a change of address, a new vehicle, and claims in your zip code.

Do bigger engines cost more to insure?

Vehicles with more powerful engines, such as a V8, will cost more to insure than a vehicle with a smaller engine. Providers follow the line of thinking that more powerful vehicles mean the driver is more likely to go faster and therefore collect speeding fines.

Will Geico match State Farm?

Overall, we found that Geico and State Farm are equal in average price. However, Geico offers a wider range of discounts that apply to more drivers.