Tesla Model Y Car Insurance Cost 2022

Editorial Note: We earn a commission from affiliate links on Forbes Advisor. Commissions do not influence the opinions or evaluations of our editors.

Tesla Model Y car insurance at a glance:

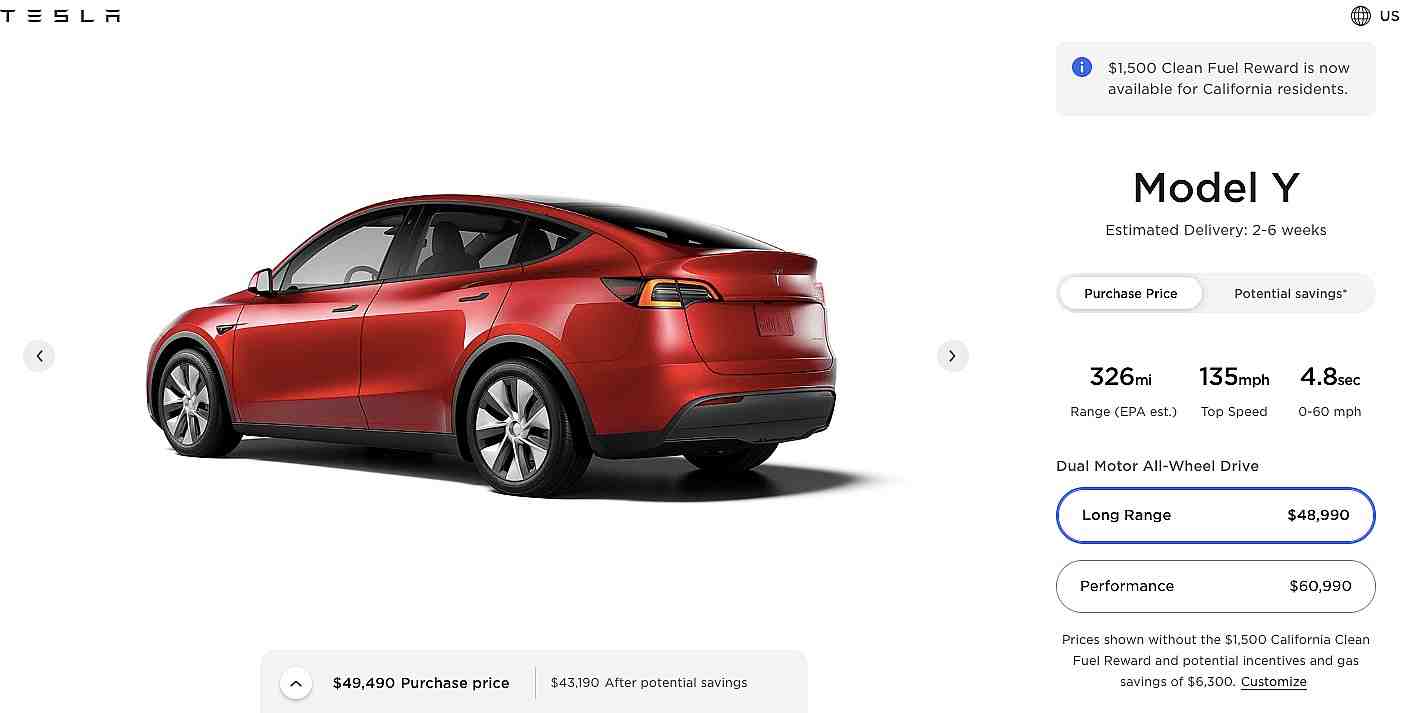

The Forbes Wheels team says Tesla’s Model Y is a compact all-electric crossover with a strong suite of advanced technology and driver entertainment. Unfortunately, the Model Y does not qualify for federal tax credits. But you may be able to find savings when you buy an auto insurance policy. Here we look at the average insurance costs for the Tesla Y model.

Tesla Model Y Insurance Costs by Company

Contents

- 1 Tesla Model Y Insurance Costs by Company

- 2 Tesla Model Y Insurance Costs by State

- 3 Cost of Insurance for a Tesla Model Y Based on Driver Age

- 4 Tesla Model Y Insurance vs. Similar Cars

- 5 How to Save Money on Tesla Model Y Car Insurance

- 6 Best Car Insurance Companies 2022

- 7 Methodology

- 8 How much does it cost to charge a Tesla at a charging station?

- 9 Are electric vehicles more expensive to insure?

- 10 Do Tesla batteries degrade over time?

- 11 Is a Tesla expensive to insure?

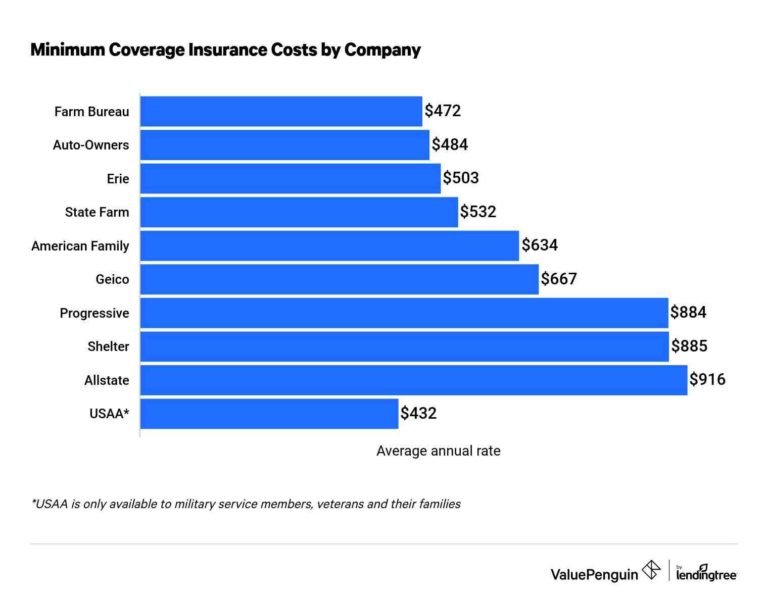

Tesla Model Y owners can save hundreds of dollars a year by comparing car insurance quotes among multiple insurers. Among the major insurance companies we analyzed, Nationwide offers the cheapest car insurance for the Tesla Model Y. This may interest you : What happens if someone scratches your car while parked and left?. USAA was the next cheapest in our analysis. If you don’t qualify for USAA car insurance as a military veteran, member or family member, try quotes from Erie and State Farm.

In addition, Tesla Insurance is available directly from Tesla.

Related: The best car insurance companies

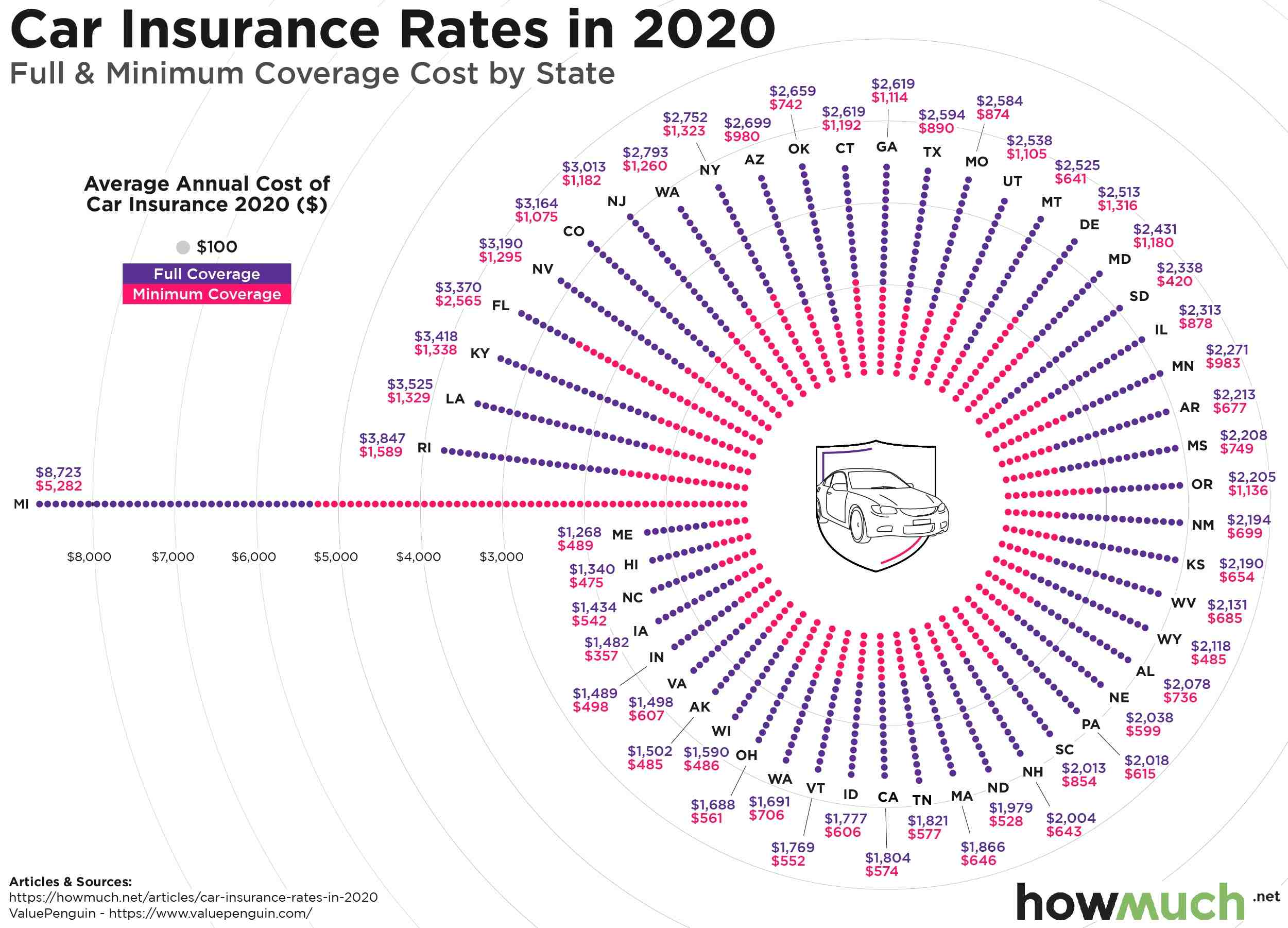

Tesla Model Y Insurance Costs by State

State variations in Tesla Model Y insurance costs are usually driven by past claims, medical expenses, repair costs, state regulations and more. This may interest you : What is Temporary Car Insurance and Do I Need It? | The Ascension. California is the most expensive state for Tesla Model Y car insurance ($4,244 per year). Vermont is the cheapest ($1,616 per year).

Cost of Insurance for a Tesla Model Y Based on Driver Age

The cheapest age to insure a Tesla model Y is 60, according to a rate analysis by Forbes Advisor. Read also : What are the 3 major car insurances?.

Women and men between the ages of 30 and 70 pay about the same amount to insure a Tesla model Y. For example, 40-year-old women pay only $12 less per year than 40-year-old men d age.

The most expensive age to insure a Tesla Model Y is age 20 and under. Gender is also a cost factor for young drivers. A 20-year-old female driver can pay nearly $800 less per year to insure a Model Y compared to a 20-year-old male.

There are several factors that go into determining your car insurance rate. These include your driving record, garage address (where you keep the car), annual mileage, credit based insurance score (lower credit risks pay more), your past claims, the type car, any recent major event in car insurance coverage. and the type and amount of insurance cover chosen.

Related: 9 Factors That Affect Your Car Insurance Rates

Tesla Model Y Insurance vs. Similar Cars

If you’re thinking of buying a Tesla Model Y, you might be thinking of Audi’s e-tron, Ford Mustang Mach-E or Volvo XC40 Recharge. Among those models, the Tesla Model Y is the most expensive to insure, on average.

Related: The most and least green cars to insure

How to Save Money on Tesla Model Y Car Insurance

There are a number of ways you can reduce car insurance costs, for example:

Best Car Insurance Companies 2022

With so many choices for car insurance companies, it can be difficult to know where to start in finding the right car insurance. We’ve evaluated insurers to find the best car insurance companies, so you don’t have to.

Methodology

The rates are based on drivers with a clean record with $100,000 in bodily injury liability coverage per person, $300,000 per accident and $100,000 in property damage liability, uninsured motorist coverage and any other state-required coverage. The rate includes collision and comprehensive coverage as well as a $500 deductible. Rates are from Quarterly Information Services as of June 2022.

Tesla now offers owners enough charge for the first 1000 miles or so (40 kWh) of travel each year for free, but after that they will be charged 20p per kWh.

How much does it cost to charge a Tesla at a charging station?

The Model 3 also has an average supercharger cost of $0.25 per KW. A full recharge to about 250 miles of range costs about $22.00. Typically, a half fare (150 miles of range) would cost about $11.00. The cost varies based on the region of the country and local electricity rates.

How much does it cost to fully charge a Tesla at a charging station? According to EnergySage, the average cost to fully charge a Tesla is $13.96, although you can expect the cost to range from $9.62 to $18.30, depending on the model.

Is it free to charge a Tesla at a charging station?

Now, new Tesla vehicles have to pay a fee per kWh or per minute at Supercharger stations. Tesla vehicles sold with “Free Supercharge for life” do not have to pay anything when charging on the network.

Is charging at Tesla stations free?

If you charge a Tesla supercharger, it usually costs you about $0.25 per KW if you bought a Model S or Model X after January 2017. Supercharging is free for cars bought before January 2017. The average supercharger cost is of $0.25 per KW also applies for Model 3 .

How much does it cost to charge at Tesla station?

Tesla charges an average of $0.28 kWh to use its superchargers. If you are using stations that charge per minute, it is $0.26 for cars that charge less than 60kWh, and it costs $0.13 to charge over 60kWh.

Is it cheaper to charge Tesla at home or station?

In almost all cases, charging your Tesla will save you the most money, since Superchargers tend to bill at a higher rate per kWh than your utility does. Depending on your model, it will cost between $7.65 and $15.29 to fully charge your Tesla at home.

Is charging Tesla at home expensive?

The price of a full charge varies by model and battery capacity, but using the average US price of $0.14 per kWh, Electrek calculates that most models cost between $4 and $5 per 100,000 charges if you charging at home.

Is charging a Tesla at home cheaper than gas?

A full fee will cost a total of $15.29. The cost of the Tesla Model Y is about $11.47 cents, or 4.7 cents per mile. The cost of operating an electric vehicle is much lower than the cost of a conventional gas-powered car, and it can be even cheaper when you clip solar panels on your EV.

How much does charging your Tesla at home raise your electric bill?

Across all Tesla products, the average charging cost per mile is 4.56 cents per mile. So, if you only charge your Tesla at home, you can expect your electric bill to increase by about $50 each month.

Is charging a Tesla cheaper than gas?

It costs an average of $13.96 to charge a Tesla. Depending on the car model, it costs between $9.62 and $18.30. In general, the cost of charging a Tesla is 3.6 times cheaper per mile than the cost of fueling a gas-powered car (4.56 cents per mile compared to about 16.66 cents per mile for gas vehicles).

How much does it cost to charge Tesla?

If you buy a 2021 Standard Range Model 3, you can expect to pay around $7.65 to fully charge the battery. That brings the cost per mile to about $0.03, or $2.91 per 100 miles. To fully charge the 2021 Long Range and Performance models, it would cost $12.54.

Does charging a Tesla increase your electric bill?

Sure, owning an electric car is obviously cheaper in “fuel” than an internal combustion engine (ICE) vehicle, but it’s not free. While you no longer have to worry about the costly fluctuations in petrol/diesel prices, charging an electric car will definitely add to your household energy bill.

How much does it cost to fully charge a Tesla at home?

Moving on to the least expensive Tesla, the 50 kWh battery on the Standard Range Plus Model 3 will cost you about $11.47 to fully charge, while the 82 kWh batteries on the other trims will set you back about $18.82 each . A Standard Range Model Plus 3 comes out to about $0.044 per mile and $4.38 for 100 miles of range.

Are electric vehicles more expensive to insure?

Insuring an electric car may cost more than insuring a conventional gas-powered car. A higher price tag for an electric car and more complex equipment means it may cost more to repair or replace in the event of an accident. That could mean higher rates for policyholders who carry comprehensive and collision coverage.

Do you really save money with electric cars? It costs $1,700 less per year to drive the 120 MPGe Kona for 15,000 miles on electricity than the 30 MPG gas version. That allows you to recoup your costs in eight years. Electric cars are also cheaper, according to AAA, costing $330 less per year. So you could break even in 6.7 years.

Are electric or hybrid cars more expensive to insure?

Since electric cars tend to cost more, they cost more to insure. EVs also cost more to replace if you get into a car accident and it’s your fault, and the insurer pays for the car in full. You may want to shop around for electric vehicles in different price classes to get an idea of what you’ll pay for insurance.

Do hybrid vehicles cost more to insure?

In general, hybrid cars are more expensive to insure compared to a gas version of similar specification. Insurance companies know that people who buy a hybrid are saving on fuel and they also tend to cover more miles. This means higher insurance costs will eat up some of your fuel savings.

Is insurance higher or lower on electric cars?

In general, electric cars are more expensive to insure than conventional vehicles. Because electric vehicles are more expensive to buy and repair, insurance providers charge their drivers more for coverage. That said, the savings you earn on gas and tax incentives could more than make up for the additional cost of your policy.

What is the cheapest electric car to insure?

We analyzed six of the most popular electric cars and found that the Hyundai Kona is the cheapest EV to insure, costing an average of $2,152 per year for a full coverage policy.

How much more expensive is it to insure an electric car?

Key Findings. On average, electric vehicle models cost 15% more to insure than conventional gas-powered vehicles. Of the electric vehicle models with corresponding combustion models, MoneyGeek found premiums 6% to 40% higher. Teslas are among the most expensive electric vehicles to insure.

Which electric car has the lowest maintenance cost?

10 Cheapest New EVs to Maintain

- 8 Peugeot e-208. …

- 7 Fiat 500e 3 1. Via: carphotopress.com. …

- 6 Dacia Spring Electric. Via Google Database/ EV UK. …

- 5 Hyundai Kona Electric. Through Hyundai. …

- 4 Mini Cooper SE. Via: Green Car Reports. …

- 3 Fiat 500e Hatchback (24kWh) Via: EV Database. …

- 2 Hyundai IONIQ 5 SE. Hyundai. …

- 1 Tesla Model 3. Tesla.

Is Tesla expensive to insure?

Tesla cars are expensive to insure because they are expensive to buy and repair. Teslas have very high collision coverage costs due to their high repair and maintenance costs, which are more expensive than other luxury vehicles or EVs. Teslas can only be repaired at Tesla-approved body repair shops.

Do Tesla batteries degrade over time?

We don’t even have to start watching the video to know that the Model 3 has lost some electric range over the years – all batteries degrade over time, but, in many cases, much more slowly and less noticeable than some people would. You believe.

How often does a Tesla battery need to be replaced? According to Elon Musk, Tesla batteries last between 300,000 and 500,000 miles. The average person drives 273 miles a week, so you can expect your Tesla battery to last anywhere from 21 to 35 years, depending on your driving habits. On top of that, Tesla batteries rarely (if ever) need to be replaced.

Will a Tesla battery last 20 years?

Batteries in current Tesla models are estimated to last about 200,000 miles, or 20 years, before the charge capacity begins to drop by more than 20 percent.

Do Tesla batteries only last 10 years?

Tesla is designing vehicles with battery life that will outlast the vehicle itself. Tesla also began offering a minimum 70% battery retention guarantee over a period of 8 years or 100,000 to 120,000 miles.

What is the lifespan of a Tesla battery?

According to Elon Musk on Twitter, Tesla car batteries are technically supposed to last for 300,000 to 500,000 miles, which is 1,500 battery cycles. That’s between 22 and 37 years for the average car driver, who, according to the Department of Transport, drives around 13,500 miles per year.

How much does a Tesla battery degrade over time?

It would mean that its battery capacity is at 91.8%, although the battery degradation is 8.2%. ” Nyland’s other Tesla tests showed similar battery degradation, but at lower mileage and in less time. His 2019 Tesla Model 3 Performance suffered an 8.2% degradation at just 22 months and only 50,000 miles, give or take.

How long do Tesla’s batteries last?

Tesla batteries only wear out over time with use. According to a Tweet by Elon Musk, Tesla batteries should last between 300,000 and 500,000 miles. Based on an average driving distance of 260 miles per week, a new Tesla battery can last anywhere from 22 to 37 years.

How much does it cost to replace a Tesla battery?

How much does it cost to replace a Tesla battery? The cost of Tesla battery replacement varies depending on the labor and parts required. Typically, the most basic battery replacement in a Tesla costs between $13,000 and $14,000. For a Model S premium sedan, it costs about $13,000-$20,000 to replace a Tesla battery.

Is a Tesla expensive to insure?

Tesla cars are expensive to insure because they are expensive to buy and repair. Teslas have very high collision coverage costs due to their high repair and maintenance costs, which are more expensive than other luxury vehicles or EVs. Teslas can only be repaired at Tesla-approved body repair shops.

How much is insurance in France? In France, the average cost of health insurance for one person is 40 EUR (45 USD) per month. Of course, prices also vary depending on the policy: the stronger the policy, the more you will pay for your health insurance. There are many types of health insurance plans.

Do I need extra insurance to drive in France?

From 2 August 2021, drivers will not need a green insurance card to bring their vehicles to France.

Is my UK car insurance valid in France?

If you have valid UK car insurance, you also have the legal minimum cover in any EU country.

What do UK drivers need to drive in France?

To drive in France you must be 18 years of age and have a valid UK driving licence, insurance and vehicle documents. You do not need to carry an additional International Driving Permit (IDP). If you do not own the vehicle you are driving, you should obtain written permission from the registered owner.

What insurance do I need for driving in France?

You must have third party insurance cover (a legal requirement) as a minimum, but it does not cover any costs you incur as a result of an accident. Make sure your policy is fully comprehensive and you have your Certificate of Motor Insurance before you go.

Which country has most expensive car insurance?

Here is a list of the top five countries for expensive car insurance premiums:

- United States.

- Austria.

- Germany.

- United Kingdom.

- Australia.

What car has the most expensive car insurance?

1. Maserati Quattroporte. The Maserati Quattroporte is a luxury sedan that typically costs over $2,500 per six-month policy period to insure, making this car the most expensive vehicle to buy auto insurance in 2021.

Do you need car insurance in France?

Introduction to car insurance in France You must insure all motor vehicles in France with at least third party liability. You will need to do this even for vehicles that are not in use, unless all four wheels are removed. If a vehicle is not insured, fines of up to €3,750 may be charged.

Is insurance mandatory in France?

Under French law it is mandatory to have civil liability insurance (“assurance responsabilité civile”) to cover damage to another person or property. It is generally included with home insurance but you should double check.

What insurance do I need to rent a car in France?

When renting a car in France drivers are required by law to carry unlimited third party liability insurance, and as a result it is automatically included in the price of every car rented.

Does my UK car insurance cover me in France?

If you are driving in most European countries All UK vehicle insurance provides the minimum third party cover for driving in the EU (including Ireland)