TikTok made me buy: Auto insurance issue

ON THIS PAGE

jump to

Contents [hide]

- 1 Key social media and consumer statistics

- 2 TikTok and social media influence on consumers

- 3 Tips for buying car insurance online

- 4 Does social media impact my car insurance?

- 5 Car influencers on TikTok

- 6 How do I know my car insurance type?

- 7 What is the difference between full coverage and comprehensive?

- 8 Does a car black box Track your location?

- 9 Is Rooster money safe?

TikTok made be buy it

Influencer marketing

Sponsored posts

Tips for buying car insurance online

Open site navigation

Protect your personal information

Social media has impacted most lives in some form or way over the last few years. See the article : How To Save A Car And Home Insurance Package | 2022. Whether it’s admiring stunning holiday snaps on Instagram or looking for recipe inspiration on Pinterest, almost everyone in the US comes into contact with one of these platforms at some point.

People may use social media for the fun aspects of life, but there is a growing trend to use social media for more practical things as well. Product recommendations on platforms like Facebook, Instagram and TikTok are now well-known examples of how consumers shop and receive recommendations – even for services like car insurance – from influencers or viewers. Bankrate took a look at how social media affects consumers and what to look out for.

Compare rates

There is little doubt that social media is shaping consumer spending behavior. On the same subject : Does State Farm use credit scores?. With so many users spending hours each day on various social media platforms, it makes sense that there would be such a large opportunity for a consumer to either be influenced or buy something directly on the platform.

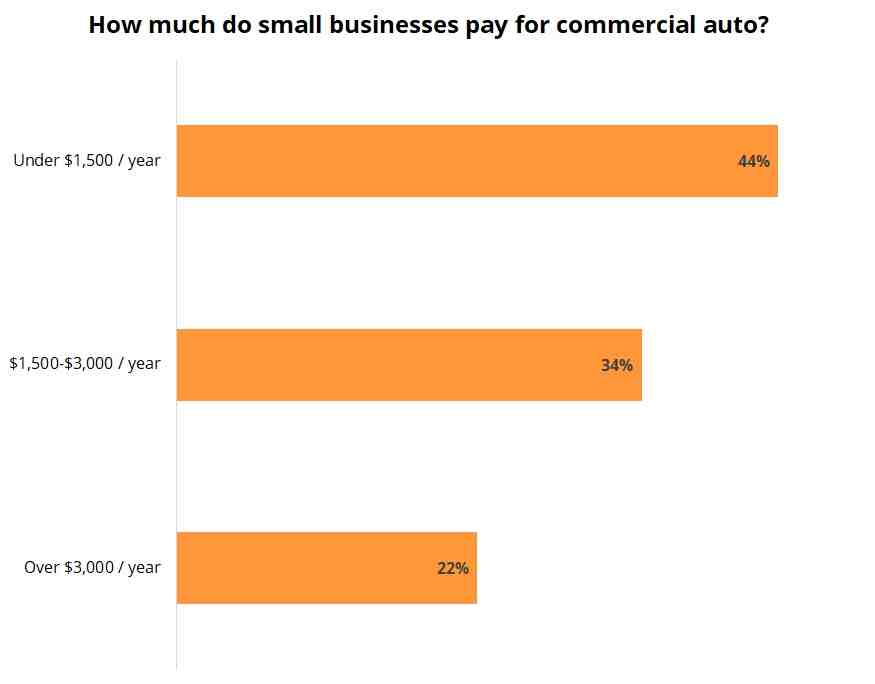

Company reputation

As mentioned above, TikTok users spent over $2.3 billion on the app in 2021. An estimated 76% of consumers have purchased an item they recently saw on social media. This may interest you : Ask Amy: Turning car insurance companies in the middle of a policy, buying the best rates. GenZ consumers tend to shop more on TikTok and Snapchat, but they’re not the only age group making purchases. Gen X and baby boomers are also shopping, although their purchases tend to be more frequent on Pinterest and Facebook.

Customer reviews

Influencer marketing refers to someone who has a built-in audience, e.g. For example, someone who runs a very successful blog or has a large social media presence and uses that platform to monetize products or services. Often you see companies partnering with influencers within a specific niche or industry. “Influencing” can be done either through co-creating content, promoting a specific product, or simply through product placement. When done right, the influencer helps to promote a company’s brand awareness while expanding the product’s audience or potential customers.

Authenticity is one of the most important qualities of influencer marketing. If someone believes the influencer is actually using the product or sees them using the product, it could increase the likelihood that the audience will buy the product.

Getting approved

Advertisers can also partner with influencers through sponsored posts. With a sponsored post, a business pays for an influencer to promote a product or company name with specific content. It is simply paid advertising to expand the reach of the business. This can take the form of sponsoring a blog post, podcast episode, Instagram story or post, or TikTok video.

Filing a claim

With all the marketing hype surrounding influencer marketing, sponsored posts, and TikTok videos, is there a place to advertise and buy auto insurance? It seems that the answer is yes now that more consumers are turning to social media for auto insurance recommendations. Finally, people turn to influencers for advice on other financial topics such as investing and crypto. As entertaining and engaging as TikTok videos (or other social media posts) can be, it’s also important to do your own research before committing to a provider so you know you’re making the best purchase for your own make needs. We’ve put together a few tips to help you protect yourself when buying car insurance online, whether it’s through social media or other websites.

Before you give out any personal information to anyone, you need to make sure you’re getting auto insurance quotes from a reputable website. Look for security guarantees such as an “https” in the web address and the lock symbol in the web browser field. You can also google the company name to make sure the web addresses match before proceeding. You can be expected to provide your zip code, gender, date of birth and address when seeking insurance quotes.

With the growing popularity of social media shopping, this has led to a variety of online scams. The Federal Trade Commission now estimates that social media scams are the most profitable scam method, scamming people out of over $770 million in 2021 alone. Scams can come from bogus investments and fake investment opportunities, online romance scams, and scams that attempt to purchase products through a social media site. You can limit your exposure to these scams by disabling targeted advertising on each platform, limiting the information you post, and never responding to an urgent request from a friend or family member who needs money for an investment.

Car influencers on TikTok

When it comes to car insurance, it is important to regularly compare tariffs and look around. While loyalty to a company can be a good thing, shop around to ensure you’re getting the best coverage options for your budget. You can go online and compare multiple auto insurance companies by providing basic information and finding out what additional discounts or benefits you may be entitled to. So even if your favorite influencer recommends a particular car insurance policy, it may be worth checking other companies for the same coverage before making a purchase.

How do I know my car insurance type?

Don’t just take an influencer’s word for it. As you narrow your search for auto insurance companies, it can be helpful to use insights from other third-party companies to further validate your choice. J.D. Power offers customer satisfaction survey results that may be helpful. You can also view financial information using Standard & Poor or morning top grades for more information on the company’s financial condition.

- Finally, it’s a good practice to read customer reviews from regular folks for any company you’re interested in doing business with. There are a variety of sources where you can find information about customer reviews or complaints for auto insurance companies, such as: B. the NAIC for information on consumer complaints and J.D. Power customer satisfaction surveys.

- As dominant as social media can be in our lives, it’s possible that it’s affecting life outside of your online presence in ways you might not realize. Your social media activity can impact your job, volunteering, or even the cost of your car insurance.

- It is possible for an insurance company to review a social media profile of a person applying for insurance coverage. If you accept the terms and conditions of the insurance provider’s website, you usually consent to them checking your social media activity. This information can be used in the coverage decision-making process.

If you make a claim, a claims adjuster may review your social media profiles to see if there is any information that could potentially negate or affect the claim. Not only could posts be investigated for fraudulent activity, if you posted pictures of your vehicle before an accident, they could be used as part of an investigation.

What are the 4 types of car insurance?

Although data on the effects of intentional social media use while driving is limited, it would definitely qualify as distracted driving. The Centers for Disease Control reports that nine people are killed on the roads every day due to distracted driving. Over 424,000 vehicle accidents in 2019 were directly attributed to distracted driving.

What are the 5 types of car insurance?

While insurers could use social media to uncover fraudulent activity, social media can also help drivers by documenting the aftermath of an accident or showing the condition of your car before an accident.

What is the difference between full coverage and comprehensive?

TikTok is one of the latest platforms to enter the social media scene, but it has certainly found an entrance. The popularity of this platform has given way to a variety of online personalities, some of whom promote topics and information related to financial decisions and cars. Here are some examples of popular influencers who might influence you next and make you say “TikTok made me buy it” on your next car or insurance decision.

Check the car insurance policy details through VAHAN

What is the difference between collision and comprehensive coverage?

Visit VAHAN e-services official website and go to “Know your vehicle details” tab.

Is collision and comprehensive deductible the same?

Enter a mobile phone number to sign in to an account or to create an account.

What is comprehensive coverage good for?

Fill in the details like the registration number of the car and enter the verification code.

Is it better to have collision or comprehensive?

What insurance is there for your car? The five types of auto insurance are third party, collision damage waiver, uninsured/underinsured motorist, and personal injury/health insurance. These are the most common types of auto insurance, although many insurance companies also offer other types of coverage, such as: B. Gap insurance and rent refund.

Is it better to get full coverage on my car?

Six common auto insurance options are: third party motor vehicle insurance, uninsured and underinsured motorist insurance, collision damage waiver, collision insurance, medical payments insurance, and personal injury insurance.

When should I not get full coverage on my car?

The most common types of auto insurance include liability, collision, personal injury, uninsured and underinsured motorists, collision damage waiver, and health insurance payments.

Whats the point of having full coverage?

The difference between collision damage waiver and collision damage waiver is that collision damage waiver is motor vehicle insurance that includes both collision damage waiver and comprehensive insurance in addition to minimum government requirements. Comprehensive insurance covers damage to a car that is not caused by accidents, such as theft or fire.

Is it better to have collision or comprehensive?

Is fully comprehensive insurance worth it? For the vast majority of motorists, full comp offers the cheapest car insurance. This is because it offers a higher level of coverage than third party policies. It also means that you don’t end up paying for expensive repairs to your car if you’re involved in an accident that was your fault.

Is collision coverage a good idea?

Generally, collision insurance comes into play when a driver gets into a car accident. Comprehensive is a separate coverage of Collision. It helps to cover different types of damage not usually related to driving the vehicle, such as: B. Theft, hail or fallen trees.

At what point is collision insurance not worth it?

The Collision Excess applies to losses resulting from impacts that cause damage to your vehicle. For example, a collision with a vehicle, hit-and-run, etc. The comprehensive deductible is referred to as “Other than Collision”. Damage to your vehicle not caused by collision.

Is full coverage better than comprehensive?

Comprehensive coverage helps cover the cost of damage to your vehicle if you are involved in an accident that is not caused by a collision. Comprehensive insurance covers damage such as theft, vandalism, hail and being hit by an animal.

Does a car black box Track your location?

Comprehensive insurance is better than comprehensive insurance if you have to choose between the two. Collision Damage Waiver is inexpensive, can be purchased individually, and pays for damage caused by events outside your control, such as an accident. B. vandalism, theft, natural disasters or collisions with animals.

If you have a new model car, you probably want to keep full coverage even if you bought it without credit. Adequate insurance protects your investment in your vehicle and prevents high expenses in the event of an accident. Some older cars still have a reasonable value.

Do black boxes in cars have GPS?

You should stick with comprehensive insurance until your annual premium meets or exceeds the estimated payout if your car needs repairs or replacement. If your car is five or six years old, the payout for the replacement probably isn’t worth what you pay in premiums.

Does a black box use GPS?

Collision Damage Waiver is one way to ensure your vehicle’s value is protected in the event of an accident. It is an insurance policy that combines Collision Damage Waiver and Collision Damage Waiver to give your vehicle strong coverage in the event of an accident or other damage.

What does a black box record in a car?

Comprehensive insurance is better than comprehensive insurance if you have to choose between the two. Collision Damage Waiver is inexpensive, can be purchased individually, and pays for damage caused by events outside your control, such as an accident. B. vandalism, theft, natural disasters or collisions with animals.

Does a car black box record voice?

Much like your car, collision insurance depreciates over time as it never pays out more than the vehicle’s value. If you don’t have a loan or lease that requires it, collision insurance will eventually lose its value and cost you more than you would pay after an accident.

What data does a car black box record?

You should cancel your collision insurance when your annual premium equals 10% of the value of your car. For example, if your collision insurance costs a total of $100 per year, drop coverage if your car is worth $1,000 because at that point your insurance payments will be too close to your car’s value to be worthwhile.

What can a black box detect?

The difference between collision damage waiver is the difference between the damage caused when a tree fell on your car (risk damage waiver) and the damage caused when you hit a tree (collision). Because collision damage waiver protects you against a wider range of risks, it costs more.

How long does a black box hold information?

Black Box Technology uses GPS tracking to monitor the roads you use and the speed limits, but we would never monitor your location in real-time unless you ask us to. However, GPS can be beneficial in rare cases – for example, if your car is stolen.

Does a car black box record audio?

Does your car track your location? A modern car with Bluetooth, navigation and event data storage knows where you’ve been, who you’ve called, what your texts say and even if you’re buckled up.

Is Rooster money safe?

Information includes vehicle speed, throttle position, airbag deployment times, whether the brakes were applied, whether seat belts were worn, engine RPM, steering angle and more. Manufacturers can also have up to 30 additional data points if they want, excluding, they say, GPS location, video and audio.

A black box is installed in your car. It is placed out of sight so it doesn’t distract you on the go. It collects data using smart technologies like motion sensors and GPS to find out how safe you are driving.

How do I withdraw money from my rooster account?

The black box records your trips and information about your driving style. This includes data on speed, smoothness and usage, all of which contribute to your overall driving style score. The black box also makes it possible to identify your car’s GPS location in the event your car is unfortunate to be stolen.

Does rooster money have a debit card?

Additionally, a car’s black box does not record audio, as in the case of the plane’s CVR. While the car black box does not record as much data as the airplane black box, it is still capable of recording a wealth of data.

How do I close my rooster account?

A black box in a car collects driving information about the vehicle before, during and after an accident. The official name of this device is Event Data Recorder. Data collected includes speed, acceleration, braking, steering and airbag deployment.

Can you transfer money from a rooster account?

With the black box technology, you can look at your previous trips in detail – if there is room for improvement. The app and tag will record your braking, acceleration, cornering, speed and phone usage.

Does rooster cost money?

How long this data is stored also varies from make and model to model. Most store their data for around three to four weeks, based on the number of ignition cycles the car goes through. After that, the data is overwritten by new data.

What is Rooster plus?

Additionally, a car’s black box does not record audio, as in the case of the plane’s CVR. While the car black box does not record as much data as the airplane black box, it is still capable of recording a wealth of data.

Do you have to pay for rooster?

The card is regulated by the Financial Conduct Authority (FCA) and your funds are held securely in a NatWest account. Should anything happen to Rooster Money, your cash will be held in this dedicated account and your money should be returned to you.

Does rooster money have a debit card?

Are rooster cards good? The Rooster Card account offers the most benefits for a child to manage their pocket money and is a great way to give your child financial independence while still having access to their money and control over their spending habits.

Who owns RoosterMoney?

Answer: Unfortunately, you cannot change a removal once it has been made. If you underpaid, you can always make a boost to make up for the extra amount you need!

How do I transfer money on RoosterMoney?

A contactless debit card that helps kids learn about money. Start your 1-month FREE TRIAL today! Go from pocket money tracker to rooster card! With their own contactless debit card, your kids can make informed purchasing decisions online and in stores.

What does rooster money do?

Navigate to: web.roostermoney.com/login. Sign in to your Rooster Money account with your email address and password. Scroll to the bottom of your account page where you will see an option to “Update Plan”. From there you can cancel your account.

What is Natwest RoosterMoney?

Your parent account has its own sort code and account number where you (or your family) can transfer money to your family’s real money accounts. You can also top up the account with a debit card – but to ensure that you don’t miss any credit delivery, we recommend that you set up a regular standing order.