Florida is the second most expensive state for car insurance, study says

TAMPA, Fla. (WFLA) — Florida may be the 12th best state for driving, but that doesn’t mean it isn’t expensive. However, one of the downsides to driving in the Sunshine State is the high cost of car insurance.

According to a new study of coverage rates by ValuePenguin, Florida is the second most expensive state when it comes to the average cost of car insurance in the country. The study looked at both liability coverage and full coverage for drivers across the United States.

Of all 50 states and the District of Columbia, Florida was the second most expensive, with an average cost of $238 per month for full coverage insurance. The study also found that coverage rates were much higher for teenage drivers than for any other age group.

Full coverage car insurance costs your average 16-year-old around $584 per month compared to $143 per month for the average 35-year-old driver.

“Average annual car insurance costs can be significantly reduced between the ages of 18 and 25, as insurers tend to view older drivers as both less risky and less likely to file a claim,” the study said.

In addition, male drivers have the highest monthly rates based on estimates from drivers in their 20s. Women have the least expensive average monthly price. Non-binary drivers fall in the middle. The analysis showed that while women pay $126 per month on average for coverage, men pay $142, and non-binary drivers pay $129. However, not all states have different rates for drivers based on gender identity.

California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania have regulations in place that ensure drivers pay the same rates, all other factors being equal, rather than adjusting costs by gender.

Driving under the influence can also affect your insurance rates. In Florida, if you have a DUI, your insurance can go up as much as 54% per month.

Married Floridians will receive an average 4% discount, according to ValuePenguin. While most states have rebates for married residents, Hawaii, Massachusetts and Montana do not, the study said.

Here are the 10 most expensive states for car insurance, according to the study.

ValuePenguin also analyzed costs based on where Floridians live.

This chart shows the most expensive cities for auto insurance in Tampa Bay, their average monthly cost and how much it differs from the state average.

Is Florida the most expensive car insurance?

Contents

- 1 Is Florida the most expensive car insurance?

- 2 What is the state minimum for car insurance in SC?

- 3 Is State Farm pulling out of Florida?

- 4 Do you need insurance to get a license in SC?

According to a new study of coverage rates by ValuePenguin, Florida is the second most expensive state when it comes to the average cost of car insurance in the country. To see also : Does Progressive pay well on claims?. The study looked at both liability coverage and full coverage for drivers across the United States.

Does Florida have the highest auto insurance rates? Car insurance prices by state: The most expensive and cheapest states for car insurance in 2023. Florida is the state with the most expensive car insurance in 2023, while Ohio is the cheapest. Read our full guide to the most expensive and cheapest states for car insurance.

How much is car insurance in Florida a month?

The average cost of auto insurance in Florida is $91 per month for minimum coverage, or $238 per month for full coverage. Read also : Drivers Are More Open To The Use Of Credit, Education In Car Insurance Quotes.

What is the cheapest vehicle to insure in Florida?

The cheapest car to insure in Florida is a truck because minimum coverage only costs $1,139 per year on average. The cost of insuring a truck is less than the average cost of minimum car insurance coverage in Florida ($1,829 per year).

Is car insurance expensive in FL?

Floridians pay an average of $2,762 per year for full coverage insurance and $997 annually for minimum coverage. Based on proprietary pricing data from Quadrant Information Services, Florida is the third most expensive state in the country for auto insurance, just behind New York and Louisiana.

How much is full coverage in Florida?

According to MoneyGeek, state minimum car insurance in Florida costs an average of $1,123 per year. The average cost of full coverage auto insurance in Florida is $2,208 per year – a significant difference of $1,085.

Does Florida have expensive car insurance?

Car insurance is expensive in Florida. The average auto insurance price in Florida is $1,878 per year – 31. This may interest you : Pro Tip: Don’t forget to search for new auto insurance every year.6% more than the US average. But car insurance rates are dictated by factors other than state lines.

Why is insurance in Florida so expensive?

Florida auto insurance rates are high for several reasons, including the state’s no-fault auto insurance laws, risk exposure due to extreme weather conditions, average driver profile, and number of uninsured drivers.

Does Florida have cheaper car insurance?

Average comprehensive car insurance rates in Florida are $3,183 per year, 58 percent higher than the national average. The average minimum coverage insurance cost in Florida is $1,128 per year, nearly double the national average of $622 per year.

What is the cheapest vehicle to insure in Florida?

The cheapest car to insure in Florida is a truck because minimum coverage only costs $1,139 per year on average. The cost of insuring a truck is less than the average cost of minimum car insurance coverage in Florida ($1,829 per year).

Why are Florida insurance rates so high?

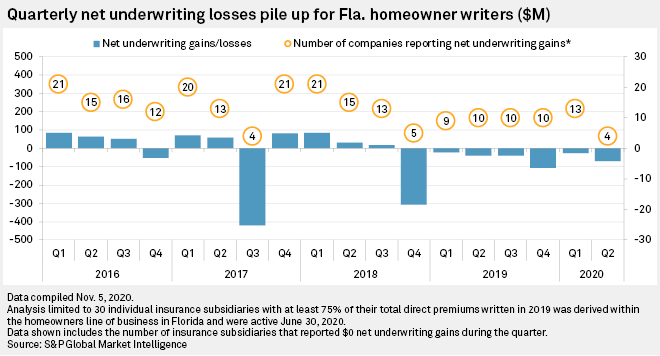

Florida insurers had $1.6 billion in underwriting losses last year. There is much more than just roofing fraud causing rising premiums in 2022. Supply chain disruptions are causing shortages of building materials such as lumber. In turn, it costs more for insurance companies to pay to rebuild homes after a claim has been submitted.

Why is homeowners insurance doubling in Florida?

It’s because of a case problem. Florida has 9 percent of the homeowners insurance in the country, but 79 percent of the lawsuits,” she said. The governor said Thursday that he believes Florida can weather this disaster because the economy is healthy and the state has reserves.

Why did homeowners insurance go up in Florida 2022?

Friedlander notes that the insurance reform bill passed in December 2022 – addresses the two root causes of Florida’s home insurance crisis – litigation abuse and assignment of benefits (AOB) abuse.

What is the state minimum for car insurance in SC?

South Carolina requires you to carry a minimum of $25,000 per person for bodily injury and $50,000 for all people injured in one accident. Bodily injury claims can include medical expenses, lost wages and pain and suffering.

What is the minimum time you can insure a car for? Q. Can I be insured on a car for a day, a week or a month? Yes you can. RAC Temporary car insurance can be bought for as little as 1 hour and up to 30 days at a time. If you need more time, you can always top up this online or take out another policy.

Does insurance follow the car or driver in South Carolina?

Car insurance usually follows the car in South Carolina. The types of auto insurance that come with the car in South Carolina are personal injury liability, personal injury liability, uninsured motorist protection, collision and comprehensive.

Does car insurance follow the car or the driver?

Standard car insurance covers the car, not the driver. If someone other than the car’s owner, or the person named on the policy, borrows the car and is involved in a collision, the insurance will in most cases pay for damages Of course only if the car is driven legally.

Is the registered owner of a car liable for an accident in South Carolina?

While a number of states follow a “no-fault” system for auto accidents, at least when it comes to auto insurance, South Carolina is not one of them. That means anyone who causes a car accident in South Carolina can be held financially responsible for all resulting injuries and property damage.

What happens if someone else is driving my car and gets in an accident in South Carolina?

Does car insurance cover me in a car accident in South Carolina if I borrow someone’s car? Yes it does. There are no limitations on your South Carolina auto accident settlement rights because you borrowed a car. The at-fault driver’s liability insurance pays your car accident settlement.

What is the average cost of car insurance per month in South Carolina?

What is the average cost of car insurance in South Carolina? On average, South Carolina car insurance costs $269 per month and $3,228 per year. Individual rates vary based on driving history, credit history, marital status, gender, age, vehicle type, coverage levels and more.

Is car insurance cheaper in South Carolina?

Is South Carolina Car Insurance Expensive? South Carolina drivers pay an average of $1,139 per year for auto insurance. These prices are cheaper than expensive states like Michigan, but more expensive than other states, like North Carolina or Tennessee.

How much is full coverage car insurance in SC?

In South Carolina, the average cost of auto insurance is $558 per year for minimum state liability coverage, while full coverage is $1,512 annually.

Is South Carolina car insurance expensive?

In South Carolina, you can expect to pay approximately $4,557 per year for full coverage insurance or $1,701 per year for minimum coverage. Auto insurance in South Carolina is more expensive than the national average, which is about $2,000 annually for full coverage and about $700 per year for minimum coverage.

Do you have to have car insurance to get a driver’s license in SC?

When applying for or renewing a South Carolina driver’s license or commercial driver’s license (CDL), you must verify that you are covered by an auto liability policy.

What happens if you don t have car insurance in south carolina?

Your driving licence, license plate and vehicle registration(s) for the vehicle(s) listed on the policy will be suspended. You may have to pay up to $400 to restore your driving and registration privileges.

What is needed to get a driver’s license in SC?

Driver license

- Proof of identity, US citizenship and date of birth.

- Proof of your current physical SC address (For a REAL ID beginner’s permit, driver’s license or ID card, you need two proofs of your current physical SC address)

- Proof of legal name change history (if applicable)

Is car insurance mandatory in South Carolina?

South Carolina law requires you to purchase liability and uninsured motorist coverage to legally drive in the state. Car insurance is divided into two basic coverages: liability and physical damage.

Is State Farm pulling out of Florida?

Which insurance company is pulling out of Florida? All policies from United P&C will be canceled by 31 May 2023, according to an order from the Office of Insurance Regulation.

What five insurance companies are pulling out of Florida?

Companies in liquidation

- AMERICAN CAPITAL ASSURANCE CORPORATION.

- AVATAR PROPERTY AND HARDWARE INSURANCE.

- FEDNAT INSURANCE COMPANY.

- FLORIDA SPECIALTY INSURANCE COMPANY.

- WARRANTY INSURANCE COMPANY.

- GULFSTREAM PROPERTY AND EMERGENCY INSURANCE COMPANY.

- PHYSICIANS UNITED PLAN, INC.

- SOUTHERN FIDELITY INSURANCE COMPANY.

How many Florida insurance companies have gone out of business?

But since then, three Florida insurers have gone bankrupt, affecting 170,000 policies, and others have announced they are pulling out of Florida — a process that involves not renewing policies when they expire.

What insurance companies are pulling out of Florida 2022?

The figure includes Bankers Insurance, Lighthouse Property Insurance, FedNat Insurance, Avatar Property and Casualty, Lexington Insurance and St. Johns Insurance, in addition to the previously mentioned Southern Fidelity, Weston and UPC.

How many insurance companies have left Florida?

The Crisis in Florida’s Insurance Market Since 2017, six property and casualty companies that offered homeowners insurance in Florida have gone out of business.

Is State Farm writing homeowners insurance in Florida?

Nearly five years after it stopped writing new homeowner policies in Florida, State Farm is getting back in the game. State Farm spokeswoman Michal Brower said the insurer has told agents it is writing a “limited” number of new homeowners and leases in the state.

Why did State Farm cancel my homeowners policy?

The condition of your home, multiple claims and not paying your premiums are some of the reasons the insurance company may cancel your homeowner’s policy. A non-renewal is a cancellation that occurs on your renewal date. Insurance companies must give a homeowner 45 days’ notice of termination of home insurance.

Why are home insurance leaving Florida?

Insurance companies had a loss of more than $1 billion in 2020 and again in 2021. Even with premiums rising so much, they are still losing money in Florida because of this. And that’s part of the reason why so many companies decide to leave.

Is State Farm still insuring in Florida?

Florida’s home insurance market is facing a crisis as home insurance companies go bankrupt or pull out of the state. Nine companies have so far exited the market in 2022, but big names like State Farm are still an option.

Why are so many insurance companies leaving Florida?

Insurance companies had a loss of more than $1 billion in 2020 and again in 2021. Even with premiums rising so much, they are still losing money in Florida because of this. And that’s part of the reason why so many companies decide to leave.

Which homeowners insurance pulls out of Florida?

And for the more than 140,000 homeowners, they will soon have to find new insurance. All policies from United P&C will be canceled by 31 May 2023, according to an order from the Office of Insurance Regulation.

Who is the number one insurance company in Florida?

The best car insurance companies balance customer satisfaction, affordability and financial stability. Based on MoneyGeek’s scoring system, the best auto insurance company in Florida is GEICO. It ranked first in affordability, first in financial stability and second in customer satisfaction.

Are insurance companies pulling out of Florida?

An unprecedented number of home insurance companies have pulled out of Florida or gone out of business in 2022. Policyholders often have just 30 days to get new coverage, leaving agents and homeowners scrambling to find a policy.

Do you need insurance to get a license in SC?

Do I need insurance? When applying for or renewing a South Carolina driver’s license or commercial driver’s license (CDL), you must verify that you are covered by an auto liability policy.

Is insurance required in South Carolina? South Carolina law requires you to purchase liability and uninsured motorist coverage to legally drive in the state. Car insurance is divided into two basic coverages: liability and physical damage.

Do I need proof of insurance to register a car in SC?

Vehicle insurance You must provide the name of the insurance company the first time you register your vehicle in this state and each time you renew your vehicle registration. If the SCDMV cannot verify that you have insurance, your license and registration may be suspended.

What documents do I need to register my car in SC?

South Carolina residents can register their vehicle with the South Carolina DMV either by mail or in person. They must be able to provide the vehicle title, proof of insurance, vehicle property tax receipt and payment for registration fees.

Can someone else register my car for me in SC?

The state requires any resident who owns a vehicle to register it with the S.C. Department of Motor Vehicles. In many situations, a dealer can handle this process on behalf of the buyer. Otherwise, the buyer must present identification to apply for registration.

How much does it cost to register a car in SC for the first time?

| Registration fee | Cost |

|---|---|

| Passenger cars | $40 |

| People who are 64 | $38 |

| People who are 65 years of age or older or who have a disability* | $36 |

| Permanent trailer plate | $87 |

What is needed to get a SC driver’s license?

Driver license

- Proof of identity, US citizenship and date of birth.

- Proof of your current physical SC address (For a REAL ID beginner’s permit, driver’s license or ID card, you need two proofs of your current physical SC address)

- Proof of legal name change history (if applicable)

How do I get my driver’s license in South Carolina?

You must visit a local branch of the SCDMV to obtain your SC driver’s license. You must show the following proof of identity: Proof of identity, US citizenship and date of birth (publicly issued birth certificate or valid US passport) Proof of social security number.

Do you have to retake driving test when moving to South Carolina?

Yes, when you move to South Carolina you must pass the written test when you transfer your license out of state. While much of the information on the written test is very similar from state to state, there are some nuances you need to know.

â Proof of social security number – Applicants must provide one of the following (all documents must show social security number): social security number. SSA-1099 – âSurvivor Benefit Formâ. U.S. Military Photo ID Card (active, retired or reservist military status DOD, ID, DD-214).