Michigan has dropped to the fourth most expensive state for auto insurance, a new report shows

LANSING, Mich. — Michigan is no longer the most expensive state for auto insurance, according to a new report.

Insure.com released its annual report on auto insurance rates by state, ranking Michigan fourth most expensive in the nation.

Michigan, which was the second most expensive in 2021, is now followed by Florida, Louisiana and Delaware.

Researchers attribute a decrease in the cost of Michigan auto insurance to the 2019 bipartisan auto no-fault reform, which took effect on July 2, 2021.

According to member company data from the Insurance Alliance of Michigan (IAM), more than 200,000 Michigan drivers without prior coverage have purchased auto insurance since the reforms.

IAM says that of those drivers, more than 83,000 had been without car insurance for at least three years.

“Michigan once had a broken, outdated and expensive toll car system. Bipartisan automatic no-fault reforms have eradicated fraud, overcharged medical providers and given consumers choice – while continuing to provide medically necessary care and offering the most personal injury protection coverage. highest in the nation,” said Erin McDonough, executive director. of the Michigan Insurance Alliance.

However, the Michigan Public Health Institute conducted a report between September and October 2021, commissioned by the Brain Injury Association of Michigan, which found that more than 1,500 accident survivors have lost access to care since the no-fault reform. in force.

READ MORE: 1 Year of No-Fault Auto Reform: Crash survivors still struggle to get some care

That report also found that more than 3,000 medical care employees lost their jobs and 96 care companies said they could no longer accept patients with no-fault auto insurance benefits.

Click here for FOX 17’s complete coverage of Michigan No Fault Auto Policies

Follow FOX 17: Facebook – Twitter – Instagram – YouTube

Copyright 2022 Scripps Media, Inc. All rights reserved. This content may not be published, broadcast, rewritten or redistributed.

Sign up to get your weekly dose of good news celebrating the best people and places in the Bluegrass! It’s free and delivered right to your inbox!

Contents

- 1 Sign up to get your weekly dose of good news celebrating the best people and places in the Bluegrass! It’s free and delivered right to your inbox!

- 2 Which state is the cheapest to register a car?

- 3 How much is insurance for a car in Florida?

- 4 Will Michigan auto insurance go down?

- 5 Does auto accident affect credit score?

Uninsured drivers face fines, suspended driver’s licenses and even jail time. To see also : Tips for lowering car insurance prices. If a car accident occurs, they cannot sue, even when they are injured and completely innocent, and they will even have to reimburse the negligent driver to an insurance company.

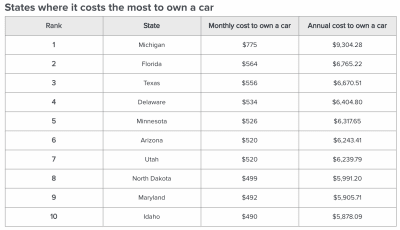

Which state is the cheapest to register a car?

New Hampshire is the cheapest state to own a car overall, with the total costs of buying and owning a car for three years coming in at $1,182 less than the next state cheapest (Missouri at $9,280). New Hampshire is one of four states that levy no sales tax on vehicle purchases. This may interest you : Man accused of stealing the identity of a state representative, opening fraudulent auto insurance policies.

Where is the cheapest state to register a car? Arizona has the lowest registration fee of $8, but the state adds a $32 public safety fee. Below is a table of each state’s registration and title fees.

What is the best state to register a car?

Montana. The research found that Montana is the best state to own a car. See the article : What are the three types of car insurance?. The state has a 0% car sales tax, the highest speed limits in the country of 80 mph, lenient vehicle inspection laws, and it is acceptable to drive on 88% of the roads.

Which state has highest car tax?

Here are the 10 states with the highest car sales tax:

- California (7.25%)

- Indiana (7.00%)

- Rhode Island (7.00%)

- Tennessee (7.00%)

- Utah (6.85%)

- New Jersey (6.63%)

- Georgia (6.60%)

- Arkansas (6.50%)

What is the easiest state to register a vehicle?

One of the most popular places for out-of-state buyers is, in fact, South Dakota. The DMV’s launch process for vehicle registration attracted thousands of car owners to register their wheels in the state.

How much does it cost to register a car in Arkansas?

| 3,000 pounds or less | $17.00 |

|---|---|

| 3,001 â 4,500 pounds | $25.00 |

| 4,500 pounds and above | $30.00 |

How much are car taxes in Arkansas?

Arkansas collects a 6.5% state sales tax rate on all vehicle purchases that cost more than $4,000. Vehicles purchased at a cost of $4,000 or less are not applicable to, and will not be charged, state sales tax.

What is required to register a vehicle in Arkansas?

License, ID, driving record or insurance verification. Title, registration, plate or other vehicle issue.

Which state has least registration fees?

Himachal Pradesh is one of the lowest in India.

Which state in India has lowest car price?

Cheapest States in India to own a car

- Himachal Pradesh. Road tax in Himachal Pradesh is one of the lowest in India, making it the cheapest state to own a car. …

- Punjab. Punjab has a very simple road tax system. …

- Pondicherry (Puducherry) …

- Jharkhand. …

- Gujarat. …

- Chandigarh. …

- Assam. …

- Jammu and Kashmir.

Vehicle registration in Arkansas is determined by the weight of the vehicle. Here’s a look at the current registration price schedule: Cars 3,000 Pounds or Less: $17.00. Cars 3,001 to 4,500 Pounds: $25.00.

How much is insurance for a car in Florida?

According to Bankrate’s analysis of rate data, the average cost of auto insurance in Florida is higher than in many other states. The average cost of minimum coverage car insurance in Florida is $997 per year, and full coverage costs, on average, $2,762 per year.

What is the average cost of car insurance in Florida? According to MoneyGeek, a state minimum auto insurance policy in Florida costs an average of $1,123 per year. The average cost of full coverage auto insurance in Florida is $2,208 per year – a significant difference of $1,085.

How much is car insurance a month in Florida?

The average cost of car insurance in Florida is $1,189 per year, or $99 per month, for minimum liability. Geico has the cheapest minimum coverage auto insurance in Florida.

How much is first time car insurance in Florida?

Car insurance for a new driver in Florida costs between $86 and $283 per month or $1,035 to $3,390 per year.

Is Florida expensive for car insurance?

Auto insurance is expensive in Florida. The average car insurance rate in Florida is $1,878 per year – 31.6% more than the US average. But auto insurance prices are dictated by factors other than state lines.

Who has the cheapest auto insurance in Florida?

| CAR INSURANCE COMPANY | AVERAGE AVERAGE ANNUAL TOTAL COVERAGE PREMIUMS | MONTHLY PREMIUMS TOTAL COVERAGE |

|---|---|---|

| State Farm | $2,055 | $171.25 |

| Geico | $2,103 | $175.25 |

| Allstate | $2,784 | $232.00 |

| Progressive | $2,986 | $248.83 |

How much is first time car insurance in Florida?

Car insurance for a new driver in Florida costs between $86 and $283 per month or $1,035 to $3,390 per year.

How much is car insurance a month for an 18 year old in Florida?

| States | Insurer | Average annual rate |

|---|---|---|

| California | State Farm | $3,528 |

| Florida | Geico | $3,899 |

| Georgia | Georgia Farm Bureau | $3,263 |

| Illinois | State Farm | $3,058 |

Is Florida expensive for car insurance?

Auto insurance is expensive in Florida. The average car insurance rate in Florida is $1,878 per year – 31.6% more than the US average. But auto insurance prices are dictated by factors other than state lines.

Why is insurance in Florida so expensive?

High Risk Drivers Driving Florida Car Insurance Rates Florida requires additional penalties for DUI and high risk drivers, making their rates much more expensive. The higher premiums for high-risk drivers can make many auto insurance rates in Florida so expensive, according to Money Geek.

Does insurance cost more in Florida?

When it comes to car insurance, Florida is one of the most expensive states in the nation. Drivers in the Sunshine State pay an average of $2,364 per year for comprehensive coverage, according to Bankrate’s 2021 study of average annual comprehensive coverage auto insurance rates from Quarterly Information Services.

Will Michigan auto insurance go down?

After the no-fault overhaul went into effect in July 2020, Michigan’s average insurance rates fell 18% by 2021, the largest year-over-year decline in the nation, according to The Zebra report. A report later this month by Bankrate.com places Michigan at No.

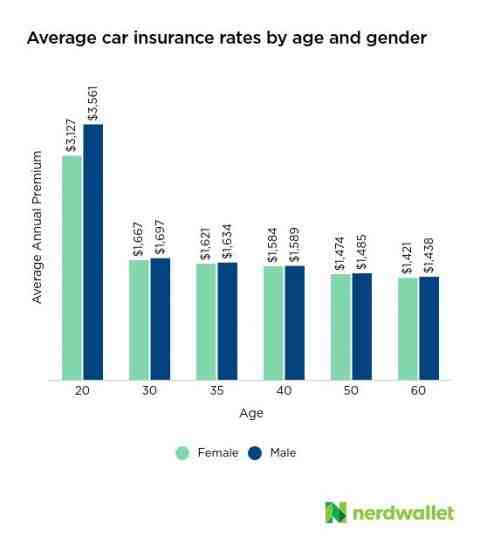

At what age does car insurance go down in Michigan? Your car insurance reduces after you turn 25, but not as much as it does on other birthdays. However, unless you live in a state where insurers cannot factor gender into insurance rates, one significant change occurs at age 25: the difference between what male and female drivers pay for auto insurance.

Why did Michigan car insurance go up?

Many factors contribute to why auto insurance is so expensive in Michigan, including its no-fault status, additional insurance requirements, number of uninsured drivers, insurance fraud rate, claims processing practices and personal injury lawsuits.

What is the change in Michigan auto insurance?

On July 2, 2020, many changes to the current no-fault auto insurance law will go into effect, including giving Michigan drivers a choice in their level of PIP coverage. Under the new plan, drivers will be able to choose up to six options for Personal Injury Protection cover.

Why is my car insurance suddenly so high?

Even drivers with a clean record could see their insurance renewal price increase. As mentioned above, auto rate increases are sometimes based on factors outside of your control, such as demands in your zip code. Or, if you’ve added a new driver or vehicle to your policy, your rate may also increase at renewal time.

Why is insurance going up so much?

Accidents are on the rise, leading to more claims The number of car accidents has increased, leading to more insurance claims. This higher number of claims, along with higher vehicle repair and replacement costs, ultimately drives insurance rates across the industry.

Are car insurance rates going down in Michigan?

Zebra.com, considered the authority on car insurance these days, tells us its 2022 state by state car insurance rankings: The following average annual rates decreased from $3096 in 2019 to $2535 in 2020, a decrease of 18% . But rates increased four percent in 2021 from $2535 to $2639.

Is car insurance in Michigan going down?

Zebra.com, considered the authority on car insurance these days, tells us its 2022 state by state car insurance rankings: The following average annual rates decreased from $3096 in 2019 to $2535 in 2020, a decrease of 18% .

Are car insurances coming down?

Car insurance prices have steadily declined every quarter in 2021, possibly as a result of changing driving habits during the Covid-19 pandemic.

What is the change in Michigan auto insurance?

On July 2, 2020, many changes to the current no-fault auto insurance law will go into effect, including giving Michigan drivers a choice in their level of PIP coverage. Under the new plan, drivers will be able to choose up to six options for Personal Injury Protection cover.

Is Michigan still a no-fault state 2022?

Michigan is a no-fault state, which means drivers are required to have personal injury protection (PIP), also known as no-fault insurance. No-fault insurance covers medical expenses for you and your passengers if you are injured in an accident.

Is Michigan no longer a no-fault state?

NO INSURANCE is required by law in Michigan. All car owners must purchase certain basic covers to obtain license plates. It is against the law to drive your car or allow your car to be driven without no-fault insurance.

What is the new car insurance law in Michigan?

After July 1, 2020, all motor vehicle owners must purchase higher amounts of bodily injury coverage. The new minimum coverage amounts are $250,000 per person and $500,000 per accident.

Is Michigan dropping no-fault insurance?

On May 30, 2019, Governor Whitmer signed historic bipartisan no-fault auto insurance reform legislation (Public Acts 21 and 22 of 2019) to provide insurance coverage options, lower rates for Michigan drivers while maintaining the nation’s highest benefits on base, and strengthen consumers. protections.

Does auto accident affect credit score?

Could an Accident Hurt Your Credit Score? Getting straight to the point: yes. A car accident can do a little damage to your credit score. It’s not uncommon for people to get a worse credit score after an accident and most people have no idea why it happens.

Can insurance hurt your credit? The short answer is no. Car insurance has no direct bearing on your credit, paying your insurance bill late or not at all could result in debt collection reports. Debt collection reports are on your credit report (often for 7-10 years) and can be read by future lenders.

What does crashing your credit mean?

A credit crisis is the breakdown of a financial system caused by a sudden and severe disruption of the normal money movement process that underpins any economy. The shortage of bank money available for lending is just one in a series of cascading events that occur in a credit crisis.

What is crashing your credit?

A credit crunch (also known as a credit crunch, credit tightening or credit crunch) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions necessary to obtain a loan from a bank.

How do you crash someone’s credit?

6 Ways You Can Destroy Someone Else’s Credit

- Not Paying on a Co-Signed Loan. ADVERTISING. …

- Submitting a Debt as an Authorized Credit Card User. …

- Not Paying Your Share of the Rent. …

- Returning Library Books Late (Or Not At All) …

- Bonds on Divided Debts After Bankruptcy. …

- Getting a Ticket in Someone Else’s Car.

How long does it take to fix destroyed credit?

If you’ve had serious trouble, it usually takes about a year or two to repair your credit, according to Weaver. But that depends on your individual situation. For example, FICO research shows that it takes about five to ten years to recover from bankruptcy, depending on your credit score.

Can a car accident mess up or feelings?

Common emotions after a car accident include shock, anger, guilt, denial, anxiety, fear and irritability. Common signs and symptoms of emotional distress include: Fear or anxiety. Crying.

Can a car accident mess you up mentally?

For example, difficulty concentrating is a common and devastating consequence of car accidents. Concentration after a car accident can tank for several reasons; the most serious cause is traumatic brain injury, or TBI. Post-accident TBI can cause confusion, lack of focus and difficulty with simple tasks.

How long after a car accident can you feel effects?

Car accident injuries usually heal themselves immediately, but it may take several days or even weeks for them to appear. In some circumstances, a life-threatening injury may worsen for weeks before a person realizes that the issue stemmed from a recent car accident.

How can a car accident affect you emotionally?

A major car accident can cause PTSD, severe anxiety, depression and debilitating phobias. Studies have shown that the mental trauma of a crash, especially for children, can have symptoms that last up to a year after an auto accident.

Does subrogation affect credit?

Aside from the financial burden of repaying a student loan default, student loan default will also have a negative impact on your credit score.

What happens if you ignore subrogation?

What happens if you don’t pay a foreclosure claim? If you choose not to pay, the insurer will continue to post reimbursement requests. Again, they may file a lawsuit against you. One way to try to avoid the victim’s insurance company is if there is a waiver of subrogation.

What does it mean when a claim is in subrogation?

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver’s insurance company, if the accident was not your fault. A successful subrogation means reimbursement for you and your insurer.

What are the effects of subrogation?

The effect of the override is that the employee is paid only once for those amounts related to medical expenses and loss of wages paid by the employer under workers’ compensation.