Virginia will require car owners to have insurance by July 1st

Can you be uninsured in Virginia?

Contents

Is it illegal to be uninsured in Virginia? If you are caught driving without insurance in Virginia, you could face a license suspension, a $600 violation fee, a license reinstatement fee, and an SR-22 requirement. The average cost of a minimum coverage auto insurance policy in Virginia is $494 per year.

How long can you be without insurance in VA? You can avoid these serious penalties by purchasing car insurance or paying the $500 UMV fee. On the same subject : What is bodily injury liability insurance? – Forbes Advisor. The fee doesn’t provide financial cover like insurance does, but allows you to drive without insurance for up to 12 months at a time.

Does Virginia require you to have insurance?

Virginia is one of only two states, however, that does not require drivers to have car insurance as long as they pay a fee. But keep in mind that with this route you will not have protection in case of an accident.

Is insurance required in Virginia? Unlike the rest of the United States, Virginia and New Hampshire do not require drivers to have any amount of auto insurance coverage. On the same subject : Why car insurance costs are rising at the fastest rate in 47 years. According to a 2021 study by the Insurance Research Council, nearly 11 percent of Virginia drivers and 6 percent of New Hampshire motorists were uninsured.

Is it legal to not have car insurance in Virginia? “Virginia drivers must purchase a minimum amount of auto insurance coverage for all registered vehicles. You can legally drive without insurance in Virginia, but you must pay an uninsured motor vehicle fee to avoid a penalty.â.

What is the new law in Virginia about car insurance?

Conclusion of Changes to the 2023 Auto Insurance Law Virginia lawmakers passed a law that eliminated credits or “setbacks” on auto insurance claims paid to claimants. This change was made to ensure that policyholders who have been injured in a car accident can use the full amount of their coverage to recover damages.

What insurance is required in Virginia? Liability insurance is required by law in Virginia. Liability pays for bodily injury and property damage to those harmed in an at-fault accident. This coverage can also pay for lost wages and pain and suffering.

Is it illegal in Virginia to not have health insurance?

There is no longer a penalty for not having health insurance.

Is there a federal penalty for not having health insurance? Congress eliminated the federal tax penalty for not having health insurance, effective January 1, 2019. Several states have adopted individual mandates with state tax penalties for not having health insurance. These include California, the District of Columbia, Massachusetts, New Jersey and Rhode Island.

What is the uninsured fee in Virginia?

If the vehicle is uninsured, the owner of the motor vehicle must pay the DMV an uninsured motor vehicle fee of $500 in addition to normal registration fees. Payment of the $500 fee does not provide the driver with any insurance coverage. On the same subject : Illinois auto insurance rates rise with inflation; how to find offers, discounts and quotes for cheap insurance. If involved in an accident, the uninsured driver remains personally liable.

What is the rate of uninsured vehicle in Virginia? Virginia drivers must have the state’s minimum insurance coverage or pay the DMV a $500 uninsured motor vehicle (UMV) fee at each registration renewal.

What is the new law for uninsured motorist in Virginia?

On July 1, 2023, a new law went into effect that changed the way uninsured motorist insurance works in the state of Virginia. Uninsured and underinsured motorist coverage can now be stacked and added to liability insurance coverage.

How does uninsured motorist coverage work in Virginia? Uninsured motorist coverage (UIM) is insurance that will pay for your damages if you are involved in an accident with someone who does not have insurance. This type of coverage is important because it can help protect you financially if you are ever involved in an accident with an uninsured driver.

What happens if an uninsured driver hits you in Virginia? When you purchase auto insurance in VA, you can add uninsured motorist coverage to your policy. If you did, you can file a claim with your own insurance company for damages caused by an uninsured driver or hit-and-run driver (considered uninsured by default) responsible for your accident.

What is the penalty for no insurance in Virginia?

If you are caught driving without any financial responsibility, the penalties could be severe. If you are caught driving without insurance, the state of Virginia can convict you of a Class 3 misdemeanor, charge you a $600 violation fee, and take away your driver’s license, vehicle registration, and the registrations.

What if you get caught driving without insurance in VA? If you are caught driving without car insurance in Virginia, you risk being charged with a class 3 misdemeanor, a suspension of your driver’s license, vehicle registration and license plates. There may also be a fine if you haven’t paid your uninsured motorist fee.

How does uninsured motorist work in Virginia?

In Virginia, all personal auto insurance policies require uninsured and underinsured motorist coverage. However, Virginia is one of the few states that does not require drivers to have auto insurance. An uninsured driver can pay a $500 fee to the DMV for driving without any insurance.

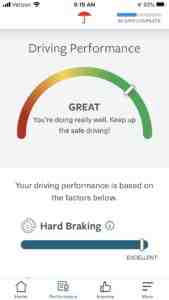

Does uninsured auto claim raise my rates in Virginia? Virginia law does not allow an auto insurance company to increase your premium because of an uninsured motorist claim. The reason for this is simple: because you are not making a claim that you were at fault for!

How does UIM coverage work in Virginia?

Uninsured motorist coverage (UIM) is insurance that will pay for your damages if you are involved in an accident with someone who does not have insurance. This type of coverage is important because it can help protect you financially if you are ever involved in an accident with an uninsured driver.

What is the new law for underinsured motorist coverage in Virginia? On July 1, 2023, a new law went into effect that changed the way uninsured motorist insurance works in the state of Virginia. Uninsured and underinsured motorist coverage can now be stacked and added to liability insurance coverage.

Does UIM stack up in Virginia? In these cases, underinsured motorist coverage can provide a safety net. However, in Virginia, there is also an option to stack underinsured motorist coverage, which can significantly increase the amount of coverage available in the event of an accident.

What is the deductible for uninsured motorist in Virginia?

In Virginia, you must pay a deductible of up to $200 when you use uninsured motorist property damage coverage. Because of this deductible, you should only file a hit-and-run claim if the damage costs more than $200 to repair.

What is the smallest deductible for uninsured motorist coverage? The amount of your UMPD deductible will vary depending on your state. It usually ranges from $100 to $1,000. Note that some states may have a separate deductible for enforcement claims.

What if you find yourself an uninsured driver in Virginia? When you purchase auto insurance in VA, you can add uninsured motorist coverage to your policy. If you did, you can file a claim with your own insurance company for damages caused by an uninsured driver or hit-and-run driver (considered uninsured by default) responsible for your accident.

How does underinsured motorist coverage work in Virginia?

Virginia Underinsured Motorist coverage, abbreviated “UIM,” protects people against negligent drivers who do not have enough auto insurance. If you have more auto insurance than the person who hit you, you have insufficient motorist coverage. Virginia law requires underinsured motorist coverage.

Can you accumulate UIM coverage in Virginia? If you’ve been injured in a car accident, the Virginia legislature just passed a law that allows uninsured motorist coverage to stack with at-fault driver liability coverage, McLean personal injury attorney explains , Jeffrey J. Downey.

What is the statute of limitations on underinsured motorist claims in Virginia?

In most cases, the statute of limitations in Virginia is two years from the date of the auto accident. If a lawsuit is not filed within two years of the car accident, the claim will likely be dismissed. There are exceptions that will extend the limitation period.

What is the truth about underinsured motorist coverage?

Underinsured motorist coverage (UIM) pays medical bills for you and your passengers when a driver without sufficient liability coverage causes an accident. So, if a driver with minimum insurance limits cannot fully pay for the injuries they cause you, UIM coverage will step in to help.

What is the disadvantage of uninsured motorist coverage? The cons of UM/UIM insurance UM/UIM insurance costs money. Still, most drivers pay less than $100 a year for both types of coverage. UM/UIM property damage insurance applies a $250 deductible. An “actual contact” rule applies to coverage for hit-and-run accidents.

Why would a person buy more than the amount of liability coverage they would need? For example, most US states require a minimum limit for liability coverage on an auto insurance policy, but you can choose higher liability limits to better protect your assets if you are responsible for injuries of another person or the damaged property.

What is Section 46.2 707 in Virginia Code?

§ 46.2-707. Therefore, if you have not obtained auto insurance for your motor vehicle and it is registered in Virginia, if you want to avoid committing a class 3 misdemeanor, you must pay the uninsured motor vehicle fee.

What is Virginia Code 46.2 472? Insure the insured or another person against the loss of any liability imposed by law for damages, including damages for care and loss of services, due to bodily injury or death of any person, and injury or destruction of property caused by an accident and arising out of the ownership, use or exploitation of these…

What is Virginia code 46.2 706? (Effective July 1, 2024) Proof of insurance required for motor vehicle registration applicants; insurance verification; suspension of driving licences, registration certificates and license plates for certain offences.

What does paying $500 for an uninsured motor vehicle in Virginia offer? Any person registering an uninsured motor vehicle shall pay a fee of $500 at the time of registration. Payment of this fee allows the owner of a motor vehicle to drive an uninsured motor vehicle; however, payment of this fee does not provide the driver with any insurance coverage.

Is it against the law to not have car insurance in Virginia?

Driving without car insurance is legal in the state of Virginia, but it can come at a high cost. Drivers typically have two options: buy insurance before using their vehicle or pay an uninsured vehicle fee of $500 for driving without coverage.

What is the new law in Virginia regarding auto insurance? Conclusion of Changes to the 2023 Auto Insurance Law Virginia lawmakers passed a law that eliminated credits or “setbacks” on auto insurance claims paid to claimants. This change was made to ensure that policyholders who have been injured in a car accident can use the full amount of their coverage to recover damages.

What insurance is required in Virginia? Liability insurance is required by law in Virginia. Liability pays for bodily injury and property damage to those harmed in an at-fault accident. This coverage can also pay for lost wages and pain and suffering.

Is it illegal to not have car insurance in Virginia?

If you are caught driving without any financial responsibility, the penalties could be severe. If you are caught driving without insurance, the state of Virginia can convict you of a Class 3 misdemeanor, charge you a $600 violation fee, and take away your driver’s license, vehicle registration, and the registrations.

What happens if you don’t pay your car insurance in Virginia? In addition to facing the suspension of all driving and registration privileges, compliance includes paying a $600 violation fee, a $145 reinstatement fee and providing proof of of insurance and financial responsibility (form SR-22) for three years.

What is the VA code for not having insurance? § 46.2-707. (From July 1, 2024) Operation of vehicle without insurance; false proof of insurance; penalty

Is it mandatory to have car insurance in Virginia?

The Commonwealth of Virginia is one of the few states in the United States that does not require motorists to have liability insurance. If you decide not to buy auto insurance, Virginia auto insurance laws say you must pay an additional fee each year, along with your vehicle registration.

Do you have to have VA registration car insurance? The short answer is yes, Virginia requires you to have basic liability insurance to register your vehicle in that state. If it’s helpful, The Zebra can help you get auto insurance quotes from multiple carriers in your state. You can also call us at 888-807-3823 to speak with an agent.

What is the average cost of car insurance in VA? Virginia drivers pay an average of $1,892 per year for full coverage car insurance and $635 per year for minimum coverage.

How long can you go without insurance in VA?

How long can you go without car insurance before you get penalized in Virginia? Until July 2024, most drivers can operate a vehicle without car insurance in Virginia if they pay a $500 uninsured vehicle fee to the Department of Motor Vehicles (DMV). This rate does not offer any insurance.

What if my car insurance expires in Virginia? In this case, the DMV suspends all driver’s licenses and certificates of registration and license plates issued to the owner of the motor vehicle. These items are suspended until the person does the following: Pay a $600 statutory fee (collected by the DMV and deposited into the Uninsured Motorist Fund)

How long can you go without car insurance in the state of Virginia? After July 2024, all Virginia drivers will be required to purchase at least the state’s minimum amount of liability insurance. If you’re pulled over by law enforcement and you can’t prove you have coverage, you’ll have 30 days to respond by providing proof of insurance before you’re subject to penalties.