What Are Car Insurance Premiums? – Forbes Advisor

Editorial Note: We earn a commission from affiliate links on Forbes Advisor. Commissions do not affect the opinions or assessments of our editors.

Your car insurance premium is the money you pay for a car insurance. You can usually pay the car insurance premium in monthly installments, semi-annually or annually, depending on your insurance company.

Here’s what you need to know about car insurance premiums and ways you can save.

Contents [hide]

- 1 How Are Car Insurance Premiums Determined?

- 2 How Much Is a Car Insurance Premium?

- 3 How Can I Lower My Car Insurance Premium?

- 4 What Companies Have the Cheapest Car Insurance Premiums?

- 5 What’s the Difference Between a Car Insurance Quote and a Car Insurance Premium?

- 6 What Is a Car Insurance Premium vs. a Car Insurance Deductible?

- 7 How Often Do I Need to Pay a Car Insurance Premium?

- 8 How Do I Pay a Car Insurance Premium?

- 9 What Happens if I Do Not Pay My Car Insurance Premium?

- 10 What Causes Car Insurance Premiums to Increase?

- 11 Best Car Insurance Companies 2022

- 12 Methodology

- 13 Car Insurance Premium FAQ

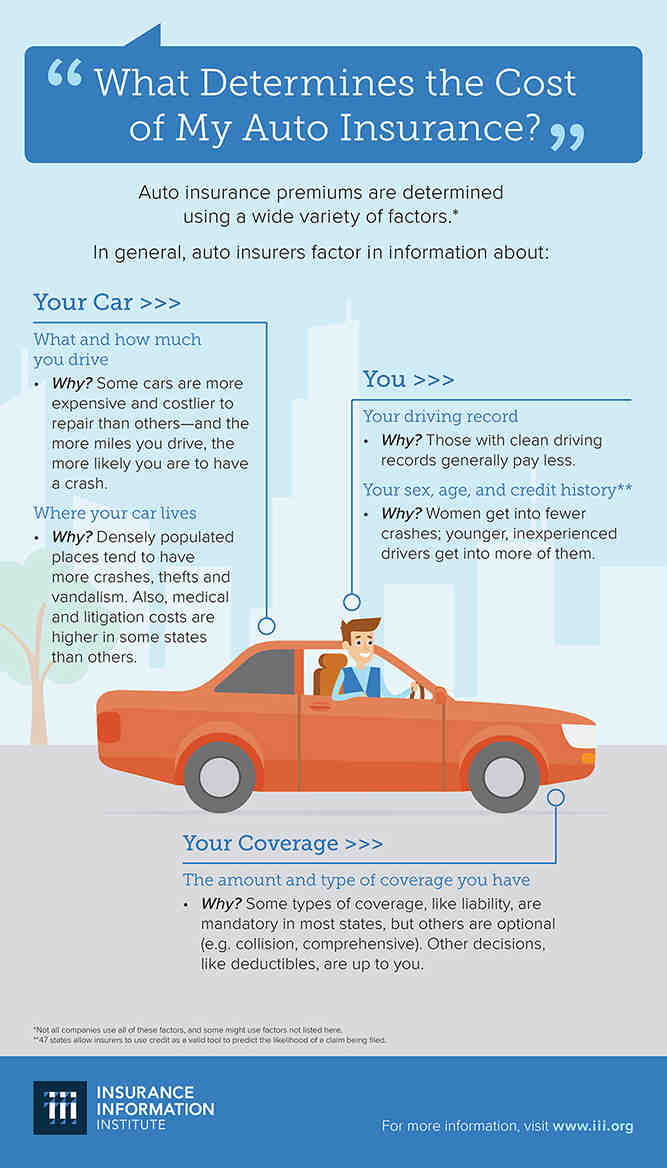

Car insurance companies use several price factors when determining car insurance premiums. On the same subject : Basic car insurance | Lifestyle | washtimesherald.com. Here are the most common factors.

Your driving record

Your driving record is one of the biggest factors that determines your car insurance premium. This may interest you : Who is the number 1 insurance company?. A driving record includes your history of car accidents with faults and moving traffic violations, such as speeding fines.

Drivers with recent accidents and major traffic offenses will pay more for coverage than good drivers. When setting car insurance rates, the insurance company usually considers the last three to five years of your driving record, depending on your state.

Expect the prices of your car insurance to go up after a speeding ticket. A driver with a speeding ticket pays 24% more, or about $ 380 per year, compared to a driver with a clean driving record, according to a Forbes Advisor analysis.

You can also expect the prices of car insurance to increase after an accident if you were wrong. The average increase for property damage accidents is 45%, and 47% for accidents that result in damage, according to a Forbes Advisor analysis.

Your auto insurance coverage selections

The coverage you choose is also an important factor in determining rates for car insurance. The main types of car insurance are liability, collision and extensive and uninsured motorist coverage. This may interest you : $ 906 million in Michigan car insurance rebate checks already issued. Do not save on the coverage you need just to save money. That mistake can cost you in the long run.

For example, the state’s minimum requirements for car insurance are probably not sufficient. If you cause a car accident with multiple injuries, you can quickly clear the police border, which means you get stuck by paying out of pocket for other people’s medical expenses and other bills. Usually you will buy enough liability insurance to cover what you can lose in a lawsuit, such as your savings.

Your car insurance deductible

A car insurance deductible is the amount deducted from an insurance check when you file a claim, such as a collision or comprehensive insurance claim. For example, if your vehicle repair estimate is $ 2000 and you have a deductible of $ 500, you will receive an insurance check for $ 1500.

Generally, the higher your deductible, the less you pay in car insurance premiums. This is because your insurance company will pay less if you file a claim.

There is no car insurance deductible for liability claims against you if you cause an accident.

The type of vehicle you drive

The make and model of your vehicle is another price factor for car insurance. Your insurance company looks at previous claims from similar models to evaluate repair costs, payments for extensive claims and theft.

Related: Most and least expensive cars to insure

Your age and driving experience

Young and inexperienced drivers will pay more for car insurance because they are more likely to end up in a car accident. Car insurance prices for young drivers are starting to fall around the age of 25. You tend to enjoy the best prices in your 40s and 50s, but prices start to creep up again around the age of 65.

Related: How age and gender affect car insurance prices

Where you live

Your zip code is another important price factor. Drivers living in cities usually pay more than drivers in the suburbs due to a higher incidence of car accidents, theft and vandalism. Your insurance company also looks at your region’s weather-related claims (like hail).

Other location-related factors include:

Your credit

Many car insurance companies look at your credit-based insurance score to help determine your rates in states where it is allowed. California, Hawaii, Massachusetts and Michigan prohibit the use of credit to set rates on car insurance.

Other car insurance pricing factors

Car insurance companies also often look at non-driving factors when setting rates, such as:

The use of non-driving factors for car insurance rates is controversial. Some consumer groups have raised concerns that this practice is inherently discriminatory.

Nationally, the average cost of “full coverage car insurance” is $ 1,569 per year, according to a Forbes Advisor analysis of car insurance rates among major insurance companies. Your costs will vary depending on the type of coverage you choose and other cost factors. See the average in your state below.

Here are some steps you can take to reduce your car insurance premium.

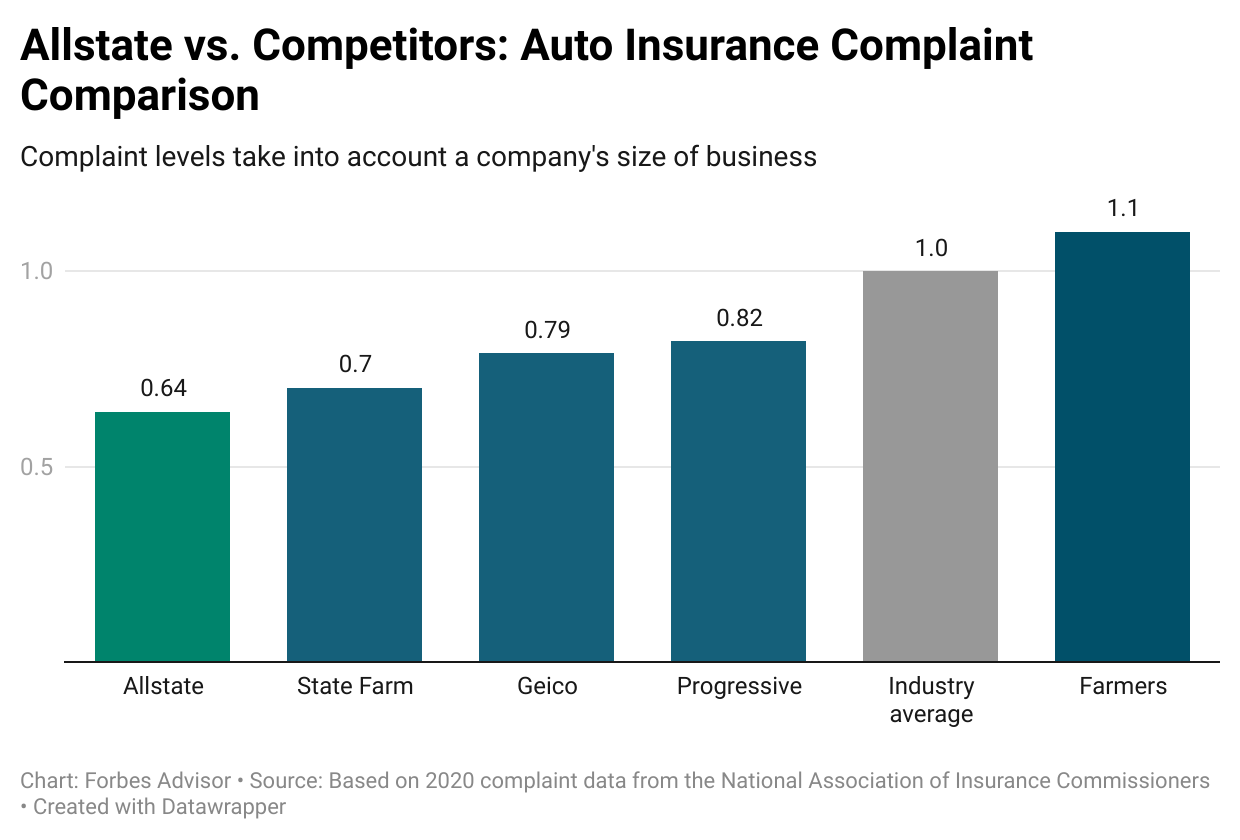

On average, USAA car insurance has the cheapest car insurance, according to a Forbes Advisor analysis of the best cheap car insurance companies. But USAA car insurance is only available to active members of the military, veterans and their families.

If you do not qualify for USAA, our analysis found that Geico, State Farm, Erie and Travelers offer competitive rates based on nationwide averages. It is also a good idea to get quotes from other insurance companies, because the cheapest companies can vary depending on your condition, driving record and other factors.

Average annual rate for good drivers

Average annual rate for drivers with speeding tickets

Compare prices from participating partners via EverQuote’s secure site.

Average annual rate for good drivers

Average annual rate for drivers with speeding tickets

Compare prices from participating partners via EverQuote’s secure site.

Average annual rate for good drivers

Average annual rate for drivers with speeding tickets

Compare prices from participating partners via EverQuote’s secure site.

An offer on car insurance and a car insurance premium are not the same. Here is the main difference:

Your car insurance premium may be higher than what you were originally given online. An insurance company bases your offer on the information you provide, but the final premium can vary for several reasons, for example:

Here is the key difference between a car insurance premium and a deductible

You usually have the option of paying the car insurance premium in monthly installments, semi-annually or annually, depending on your insurance company.

Most car insurance companies offer a full-pay discount. Pay-in-full discounts can often range from 6% to 14%, according to a Forbes Advisor analysis.

You can usually pay a car insurance premium with a credit card, debit card, checking account or savings account. Your insurance company can offer the following payment options:

If you pay the car insurance premium in installments and have the payment automatically deducted, you can usually get a discount on electronic money transfer (EFT) between 3% and 6%.

If you do not pay the car insurance premium, your insurance will eventually be canceled due to non-payment.

Your car insurance company is usually required to send you notice by mail or email before canceling your insurance, depending on the state. You usually have between 10 and 20 days to make a late payment, depending on your state.

If your policy is canceled, you have an insurance waiver, which can cost you even more money when you buy another policy. And if you are caught driving a car without car insurance, you can have major financial and legal consequences.

If you can not afford to pay for car insurance, contact your insurance company as soon as possible. Your insurance company may be willing to extend the deadline or set up a payment plan.

Related: When can your car insurance be canceled?

Your car insurance premium may increase when your insurance is renewed. Here are some common reasons why you may see an increase:

Not all car accidents increase your car insurance premium. For example, if your car was hit while parking or you were driven backwards at a red light, you will not be hit with a rate increase.

Related: Car Accident? Not all types will increase your insurance

Best Car Insurance Companies 2022

With so many choices for car insurance companies, it can be difficult to know where to start to find the right car insurance policy. We have evaluated insurance companies to find the best car insurance companies so you do not need it.

Methodology

To find full company coverage rates, use data from Quadrant Information Services, an insurance data and analytics provider.

The prices are based on a 30-year-old female driver with a clean record who insures a Toyota RAV4 with $ 100,000 in liability coverage per person, $ 300,000 per accident and $ 100,000 in liability for property, uninsured motorist coverage and other coverage required by the state. The price also includes collision and comprehensive with a $ 500 deductible.

How much car insurance do I need?

To find out how much car insurance you need, start with liability insurance. The state minimum is insufficient if you cause a major car accident. If you cause an accident with multiple injuries, medical expenses can quickly exceed the state minimum, and you will be on the hook for any amount above your insurance limits. A good rule of thumb is to buy enough liability insurance to cover assets (such as a house and savings account).

Your state may have other requirements, such as uninsured motorist coverage or personal injury protection. It is a good idea to talk to your insurance agent about appropriate amounts of coverage for your needs.

If you want coverage for your own car repair bills for problems such as car accidents, vandalism, car theft, floods, fires and other types of problems, you will want to add collision insurance and comprehensive insurance. You can also add other optional types of coverage to close any gaps in coverage, including rental insurance or roadside assistance insurance.

If you cancel your car insurance before the end of the term, you can get a refund of the car insurance premium. For example, if you have paid in full for an annual period and you cancel the insurance because you sold your car, the insurance company should reimburse you for the rest of the period. Some insurance companies may charge a cancellation fee.

How does accident forgiveness insurance work?

Some insurance companies offer accident insurance as part of the coverage or as an optional benefit that you can add to your insurance. If you have this coverage and you are at fault in a car accident, your insurance company will “forgive” the accident and the car insurance premium will not increase.

The rules for accident forgiveness vary by insurance company (and may not be available in all states). Accident forgiveness is not unlimited. This usually only applies to one accident per police officer, not per driver at the police station.