The car insurance market to see booming growth: Allstate Insurance, Metlife, State Farm Insurance

New Jersey, USA — (SBWIRE) — 7/18/2022. — The latest study published by AMA Research on the global car insurance market estimates the market size, trend and forecast to 2027. The car insurance market study covers significant research data and evidence that will be a practical resource document for managers, analysts, industry experts and others key people who will have a ready access and self-analyzed study that will help in understanding market trends, growth drivers, opportunities and upcoming challenges and about the competition.

Key players in this report include:

AXA (France), Allstate Insurance (United States), Allianz (Germany), Samsung Group (South Korea), PT Astra Aviva Life (United Kingdom), AIG (United States), Berkshire Hathaway (United States), Generali (Italy) , Metlife (United States), PICC (China), State Farm Insurance (United States), Ping An (China), Munich Reinsurance (Germany)

Download Sample Report PDF (Including Full Content, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/11695-global-car-insurance-market-2

Definition:

Auto insurance is also known as car insurance, vehicle insurance or auto insurance. It is vehicle insurance which can include car, truck, bus, motorcycle and other road vehicles. Vehicle insurance offers financial protection against vehicle theft, damage to the vehicle and other factors such as traffic collisions, such as keying, weather or natural disasters, and damage sustained in a collision with immovable objects. Car insurance is expected to become more popular worldwide with increasing awareness among people along with increasing per capita income.

Market trend:

– Increasing preference for different capital investments

Market drivers:

– Increased frequency of traffic accidents due to the increase in road traffic

– Innovative and profitable product launch

Market opportunities:

– Increasing demand from developing countries

– Innovations in insurance schemes

Global car insurance market segments and market data analysis are presented below:

by type (accidental damage insurance, theft insurance, fire insurance, other), application (commercial car, passenger car), distribution channel (insurance broker/agency, online)

The Global Car Insurance Market report highlights information on current and future industry trends, growth patterns as well as offers business strategies to assist stakeholders in making good decisions that can help in ensuring profit trajectory over the forecast years.

Have a query? Make a pre-buy inquiry at https://www.advancemarketanalytics.com/enquiry-before-buy/11695-global-car-insurance-market-2

Media Relations Contact

Contents

- 1 Media Relations Contact

- 2 Who is the biggest insurance company?

- 3 Is Progressive insurance Good?

- 4 What rank is Nationwide Insurance?

- 5 What insurance company has the most policy holders?

Geographically, detailed analysis of consumption, revenue, market share and growth rate of the following regions: On the same subject : Car insurance rates continue to increase-here’s how you can save.

Who is the biggest insurance company?

– Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc. On the same subject : Inflation is likely to force an increase in car insurance rates.)

– North America (United States, Mexico and Canada)

- – South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

- – Europe (Turkey, Spain, Turkey, Netherlands, Denmark, Belgium, Switzerland, Germany, Russia, Great Britain, Italy, France, etc.)

- – Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia and Australia).

- Objectives of the Report

- – To carefully analyze and forecast the car insurance market size by value and volume.

- – -To estimate the market shares of the main car insurance segments

- – -To show the development of the car insurance market in different parts of the world.

- – -Analyze and study micro markets in terms of their contributions to the car insurance market, their prospects and individual growth trends.

What company is the largest insurance company?

– -Offer precise and useful details on the factors influencing the growth of car insurance Read also : Do you need to give up car rental insurance for your trip?.

What is the richest insurance company in the United States?

| – -Provide a detailed assessment of key business strategies employed by leading companies operating in the Auto Insurance market, which includes research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches. | Buy Now Full Car Insurance Market Assessment @ https://www.advancemarketanalytics.com/buy-now?format=1&report=11695 | Main highlights from the Contents: |

|---|---|---|

| Car Insurance Market Study Coverage: | – It includes major manufacturers, growth story of emerging players and major business segments of Auto Insurance market, years considered and objectives of the research. Also, segmentation based on product type, application and technology. | – Executive Summary of Automobile Insurance Market: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends and issues, and macroscopic indicators. |

| – Automotive Insurance Market Production by Regions Automotive Insurance market profile of manufacturers is studied on the basis of SWOT analysis, their products, production, value, financial data and other vital factors. | – Key Points Covered in the Car Insurance Market Report: | – Car Insurance Overview, Definition and Classification Market Drivers and Restraints |

| – Market competition of car insurance manufacturers | – Analysis of the impact of COVID-19 on the car insurance market | – Car Insurance Capacity, Production, Revenue (Value) by Region (2021-2027) |

| – Automobile insurance supply (production), consumption, export, import by region (2021-2027) | – Car Insurance Production, Revenue (Value), Price Trend by Type {Payment Gateway, Merchant Account, Subscription Management,} | – Car Insurance Manufacturers Profiles/Analysis, Car Insurance Manufacturing Cost Analysis, Industry/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing |

Who is the top five insurance company?

– Strategy of key manufacturers/players, standardization of related distributors/traders, regulatory and collaborative initiatives, industry roadmap and value chain market factors analysis.

Who is the top five insurance company?

View full executive summary and table of contents at https://www.advancemarketanalytics.com/reports/11695-global-car-insurance-market-2

What is the most trusted insurance company?

Key questions answered

What are the big 3 insurance companies?

| – How feasible is the car insurance market for long-term investments? | – What factors affect the demand for car insurance in the near future? | – What is the impact analysis of various factors on the growth of the global car insurance market? |

|---|---|---|

| – What are the recent trends on the regional market and how successful are they? | – Thank you for reading this article; you can also get an individual chapter section or region version of the report such as North America, Middle East, Africa, Europe or LATAM, Southeast Asia. | Contact us: |

| Craig Francis (Head of Public Relations and Marketing) | AMA Research & Media LLP | Unit no. 429, Parsonage Road Edison, NJ |

| New Jersey USA – 08837 | For more information on this press release, visit: http://www.sbwire.com/press-releases/car-insurance-market-to-see-booming-growth-allstate-insurance-metlife-state-farm-insurance-1358385 . htm | Nidhi BhawsarPR & Marketing Manager AMA Research & Media LLPPhone: 2063171218Email: click to email Nidhi BhawsarWeb: https://www.advancemarketanalytics.com |

| Prudential Financial was the largest insurance company in the United States in 2019, with total assets of just over US$940 billion. Berkshire Hathaway and Metlife secured second and third place. | Who are the top 10 insurance companies in 2021? Top 10 life insurance companies, based on CSR | TATA AIA Life Insurance Company. … |

Is Progressive insurance Good?

Life insurance Pramerica. …

Exide Life Insurance Company. …

Is Progressive Insurance A Good Choice?

Reliance Life Insurance Company. …

Why is progressive a good company?

Bajaj Allianz Life Insurance Company. …

Who is the target market for Progressive insurance?

Aegon Life Insurance Company. …

How are Progressive rates so low?

ICICI Prudential. …

Does Progressive raise their rates?

Aditya Birla Sun life.

Is Progressive Insurance A Good Deal?

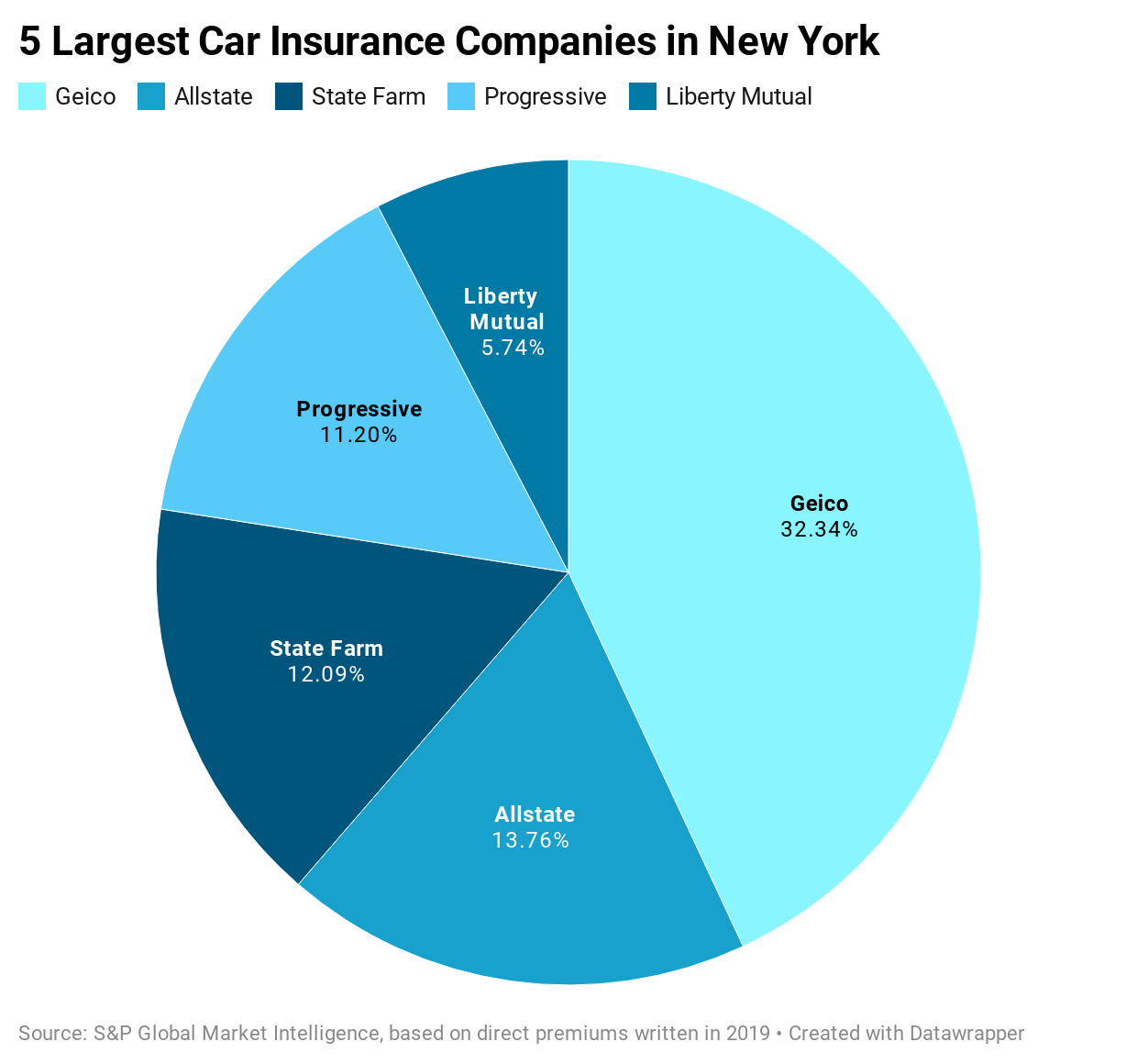

State Farm is the largest insurer on our list, ranking first in 24 states. After State Farm, Progressive is usually the largest insurer, with the largest market share in 15 states. Geico is the largest auto insurance carrier in nine states, followed by Allstate and MAPFRE in one state each.

Will Progressive lower my rate after 6 months?

Ranking

Does Progressive pay its claims?

P/C name of the insurance company

How does Progressive handle claims?

2021 Net Premiums Written ($000)

Is Progressive good at paying claims?

1

How fast does Progressive pay claims?

State Farm Group

What rank is Nationwide Insurance?

69,647,810

2

Is Nationwide a big insurance company?

Berkshire Hathaway Ins

What company owns nationwide insurance?

68,340,644

Is Nationwide insurance company a good company?

3

What is the rating of Nationwide insurance?

Group Progressive Ins

Does Nationwide have good customer service?

46,611,138

Is Nationwide insurance going out of business?

4

Is Nationwide A rated?

Allstate Ins Group

Is Nationwide a good insurer?

38,623,313

How is Nationwide homeowners insurance rated?

The five largest homeowner insurance companies in the US are State Farm, Allstate, USAA, Liberty Mutual and Farmers.

Is Nationwide insurance Reputable?

The five largest homeowner insurance companies in the US are State Farm, Allstate, USAA, Liberty Mutual and Farmers.

Is Nationwide insurance going out of business?

USAA. USAA is the best insurance company in our ratings. According to our 2022 survey, USAA customers report the highest levels of customer satisfaction and are most likely to renew their policies and recommend USAA to other drivers. USAA also has the lowest rates in our study, beating the national average by 35%.

What insurance company has the most policy holders?

Ranking

Name of the insurance company

Which life insurance company has the most assets?

Residence

Who owns the most life insurance?

1

What is the largest life insurance company?

UnitedHealth Group Incorporated (1)

What life insurance company has the most policy holders?

United States

Who owns the biggest insurance companies?

| 2 | Ping An Ins (Group) Co. of China Ltd. | China |

|---|---|---|

| 3 | China Life Insurance (Group) Company | China |

| 4 | Centene Corporation (1) | United States |

| With a long history in the insurance industry and strong financial ratings, Progressive has a solid reputation. Our expert review team gave the insurance company a score of 9.0 out of 10.0 after considering factors such as policy offerings and customer experience. | Is Progressive Insurance Really Cheaper? In our review of Progressive Insurance, we at the Home Media review team found that the company’s full coverage rates are typically around 7% cheaper than the national average for good drivers. We rated Progressive as one of the best car insurance companies and cheapest car insurance companies in 2022. | Progressive was rated #8 on our list of the best car insurance companies in 2022, and many drivers may be able to find better coverage elsewhere. |

| Progressive can be a good choice for many drivers because it offers a wide variety of car insurance coverage options, including usage-based insurance and carpool insurance. Progressive is the third largest provider of auto insurance in the US, according to the National Association of Insurance Commissioners (NAIC). | Progressive is the first brand to use this medium, says Jonathan Beamer, head of marketing strategy and business innovation at Progressive. “We’re targeting young adults with the goal of inspiring people to evaluate their own insurance choices,” says Beamer. “No one should blindly accept their parents’ choice. | Progressive is so cheap because it offers a wide variety of discounts and gives consumers tools to get the best prices possible, like Progressive’s price comparison tool and their Name Your Price® program. |

What company is the largest insurance company?

Progressive won approval for 36 rate increases in 13 states during the month, combining for $511.9 million in added premiums.

What company has the most insurance policies?

Progressive received an overall satisfaction score of 76 out of 100 from its customer group, in a NerdWallet survey conducted online in July 2021. To put that into perspective, the average score among the seven insurers was 79, and the highest score was 83.